Custodian REIT plc : Custodian REIT acquires high-yielding long lease industrial asset (1405493)

July 26 2022 - 2:00AM

UK Regulatory

Custodian REIT plc (CREI) Custodian REIT plc : Custodian REIT

acquires high-yielding long lease industrial asset 26-Jul-2022 /

07:00 GMT/BST Dissemination of a Regulatory Announcement that

contains inside information in accordance with the Market Abuse

Regulation (MAR), transmitted by EQS Group. The issuer is solely

responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

26 July 2022

Custodian REIT plc

("Custodian REIT" or the "Company")

Custodian REIT acquires high-yielding long lease industrial

asset

Custodian REIT (LSE: CREI), the UK property investment company

focused on smaller lot-sizes, is pleased to announce that it has

acquired a 47,882 sq ft industrial facility which is fully let to

Container Components Limited with 20 years remaining on the lease

for GBP3.5 million. The property produces an index linked passing

rent of GBP227,440 per annum, reflecting a net initial yield1 of

6.10%, and is located two miles from junction 29 of the M1 near

Chesterfield, Derbyshire.

The acquisition was funded from the Company's existing debt

facilities, increasing net gearing2 to 23.8% loan to value, which

remains within the Company's target range.

This acquisition increases the industrial weighting within the

Company's highly diversified portfolio of 165 properties to 38%,

with the balance comprising 24% retail warehouse, 16% office, 11%

high street retail and 11% other, all of which are in strong

economic areas across the UK.

Commenting on the acquisition, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's discretionary

investment manager), said: "This well located, modern industrial

asset has been acquired at an entry yield of 6.10% which is

significantly above the market average for industrial assets. The

property also benefits from five-yearly index linked rental

increases which provide long-term inflation-adjusted income. The

acquisition demonstrates our continued ability to source high

quality assets on behalf of our shareholders which offer enhanced

but secure income returns by focussing on smaller sized properties

where there is reduced competition."

1 Reversionary rent divided by purchase price plus assumed

purchasers' costs.

2 Gross borrowings less cash (excluding tenant rental deposits

and retentions) divided by last published property portfolio

valuation.

-Ends-

For further information, please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan/Nathan Brown Tel: +44 (0)20 7260 1000

www.numiscorp.com

FTI Consulting

Richard Sunderland / Ellie Sweeney Tel: +44 (0)20 3727 1000

custodianreit@fticonsulting.com

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, listed

on the main market of the London Stock Exchange. Its portfolio

comprises properties predominantly let to institutional grade

tenants on long leases throughout the UK and is principally

characterised by properties with individual values of less than

GBP10 million at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By targeting smaller lot size properties, the

Company intends to provide investors with an attractive level of

income with the potential for capital growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit www.custodianreit.com and

www.custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

Sequence No.: 177030

EQS News ID: 1405493

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1405493&application_name=news

(END) Dow Jones Newswires

July 26, 2022 02:00 ET (06:00 GMT)

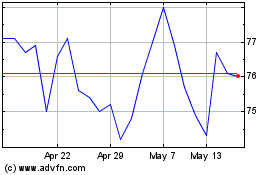

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

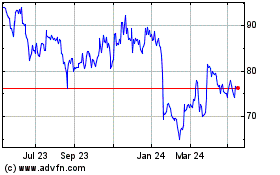

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024