Custodian REIT plc (CREI) Custodian REIT plc : Possible offer

for DRUM Income Plus REIT plc 04-Aug-2021 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION

THIS IS AN ANNOUNCEMENT FALLING UNDER RULE 2.4 OF THE CITY CODE

ON TAKEOVERS AND MERGERS (THE "CODE") AND DOES NOT CONSTITUTE AN

ANNOUNCEMENT OF A FIRM INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF

THE CODE AND THERE CAN BE NO CERTAINTY THAT ANY FIRM OFFER WILL BE

MADE

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

For immediate release

4 August 2021

Custodian REIT plc

("Custodian REIT")

Possible offer for DRUM Income Plus REIT plc

Custodian REIT (LSE: CREI), the UK property investment company,

notes the announcement made today by DRUM Income Plus REIT plc

("DRIP") regarding a possible securities exchange offer by

Custodian REIT for the entire issued share capital of DRIP, which

is repeated below:

Drum Income Plus REIT plc ("DRIP" or the "Company")

Possible Offer for the Company

The Board of DRIP announces it is in discussions regarding a

possible securities exchange offer by Custodian REIT plc

("Custodian") for the entire issued and to be issued share capital

of the Company (the "Possible Offer"). There can be no certainty

that any firm offer will be made.

The Possible Offer under consideration and evaluation by

Custodian is a securities exchange offer at a ratio of 0.535

Custodian ordinary shares for each DRIP ordinary share (the

"Exchange Ratio") (subject to the reservations set out below). The

Exchange Ratio would give an implied value for the entire issued

and to be issued share capital of DRIP of approximately £21.6

million (based on a closing price of 105.80 pence per Custodian

share on 3 August 2021, being the latest practicable date prior to

this announcement).

At the value implied by the Exchange Ratio, the Possible Offer

represents a premium of approximately: -- 8.8 per cent. to the bid

market closing price of 52.00 pence per DRIP share on 3 August

2021; and, -- 11.2 per cent. to the volume weighted average price

for DRIP shares of 50.85 pence over the 12 month period ended

on and including 3 August 2021.

Custodian will adjust the Exchange Ratio in the event that: (a)

either Custodian or DRIP announces, declares, makes or pays any one

or more dividends or other distributions on or after the date of

this Announcement and prior to completion of the Possible Offer

(save in relation to the making or payment of any dividend or

distribution that was announced or declared prior to the date of

this Announcement) that is in aggregate in excess of 1.25 pence per

Custodian share or 0.75 pence per DRIP share respectively (the

amount of such excess in each case being the "Excess"), in which

event the adjustment to the Exchange Ratio shall be to take account

of the Excess; and/or (b) at the time of completion of the Possible

Offer, either Custodian or DRIP has announced, declared, made or

paid its regular quarterly dividend of 1.25 pence per Custodian

share and 0.75 pence per DRIP share as applicable, but the other

has not announced, declared, made or paid such dividend (a

"Dividend Discrepancy"), in which case the adjustment to the

Exchange Ratio shall be to take account of the Dividend

Discrepancy.

The Board of DRIP has confirmed to Custodian that the Possible

Offer is at a value the Board of DRIP would be minded to recommend,

should a firm intention to make an offer pursuant to Rule 2.7 of

the Code be announced on the terms contained in the Possible Offer,

and has therefore agreed that Custodian should be provided with

access to due diligence materials.

Custodian has received an irrevocable undertaking from DRIP's

largest shareholder, Seven Investment Management LLP ("7IM") to

support the Possible Offer, should a formal offer be made. The

irrevocable undertaking is in respect of 26,266,690 ordinary

shares, representing approximately 68.76 per cent. of DRIP's issued

ordinary share capital, in respect of which 7IM has investment

management discretion and can procure the exercise of the voting

rights attaching to such shares in favour of a scheme or to accept

an offer. Further details regarding the irrevocable undertaking are

set out in the Appendix.

Custodian believes that on successful completion of the Possible

Offer, if made, DRIP shareholders would benefit from, inter alia,

gaining exposure to a larger portfolio with more diversity by

sector and geography with a property strategy consistent with that

of DRIP, and a holding in a significantly larger company offering

accessible liquidity and lower ongoing charges as a percentage of

net asset value. In addition, DRIP shareholders would hold shares

in a company that has predominantly traded on a premium to net

asset value since IPO and has managed to grow through the issuance

of new shares, whilst current Custodian shareholders would benefit

from exposure to DRIP's portfolio with low purchaser's costs.

In accordance with Rule 2.6(a) of the Code, Custodian is

required, by not later than 5.00 pm on 1 September 2021, either to

announce a firm intention to make an offer for the Company in

accordance with Rule 2.7 of the Code or to announce that it does

not intend to make an offer for the Company, in which case the

announcement will be treated as a statement to which Rule 2.8 of

the Code applies. This deadline can be extended only with the

consent of the Panel on Takeovers and Mergers ("Takeover Panel") in

accordance with Rule 2.6(c) of the Code.

As a consequence of this announcement, an offer period has now

commenced in respect of DRIP in accordance with the rules of the

Code and the attention of shareholders is drawn to the disclosure

requirements of Rule 8 of the Code, which are summarised below.

This announcement has been made with the consent of Custodian

and 7IM.

For the purposes of Rule 2.5(a) of the Code, Custodian has

reserved the right to make an offer on less favourable terms than

those set out in this announcement: a. with the agreement or

recommendation of the Board of DRIP; and/or b. if a third party

announces a possible or firm intention to make an offer for DRIP on

terms less favourable than the

value implied by the Exchange Ratio; and/or c. following an

announcement by DRIP of a whitewash transaction pursuant to the

Code.

A further announcement regarding the Possible Offer will be made

in due course as appropriate.

Enquires:

DRIP Hugh Little, Chairman DRIP.REIT@jtcgroup.com

Dickson Minto W.S. (Sponsor and Rule 3 Adviser to DRIP)

Douglas Armstrong +44 (0) 20 7649 6823

Custodian

Richard Shepherd-Cross / Ed Moore/ Ian Mattioli MBE +44 (0) 116

240 8740

Numis Securities Ltd (Financial Adviser and Broker to

Custodian)

Hugh Jonathan / Stuart Ord +44 (0) 20 7260 1000

Camarco (Communications adviser to Custodian)

+44 (0) 20 3757 4984

Ed Gascoigne-Pees

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No.596/2014 as it forms part of

the domestic law of the United Kingdom by virtue of the European

Union (Withdrawal) Act 2018. Upon the publication of this

announcement via a Regulatory Information Service, this inside

information is now considered to be in the public domain.

Disclaimer

Dickson Minto W.S., which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom, is acting

exclusively for DRIP and for no one else in connection with the

Possible Offer and will not be responsible to anyone other than

DRIP for providing the protections afforded to its clients or for

providing advice in connection with the Possible Offer referred to

in this announcement.

Numis Securities Ltd, which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom, is acting

exclusively for Custodian and for no one else in connection with

the Possible Offer and will not be responsible to anyone other than

Custodian for providing the protections afforded to its clients or

for providing advice in connection with the Possible Offer referred

to in this announcement.

The release, publication or distribution of this announcement in

jurisdictions outside the United Kingdom may be restricted by laws

of the relevant jurisdictions and therefore persons into whose

possession this announcement comes should inform themselves about,

and observe, any such restrictions. Any failure to comply with such

restrictions may constitute a violation of the securities law of

any such jurisdiction.

This announcement is for information purposes only, and is not

intended to and does not constitute, or form part of, an offer,

invitation or the solicitation of an offer to purchase, otherwise

acquire, subscribe for, sell or otherwise dispose of any

securities, or the solicitation of any vote or approval in any

jurisdiction.

Disclosure requirements of the Code

(MORE TO FOLLOW) Dow Jones Newswires

August 04, 2021 02:00 ET (06:00 GMT)

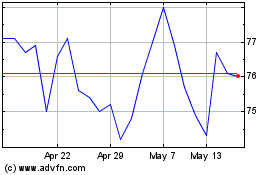

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

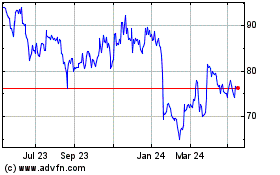

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024