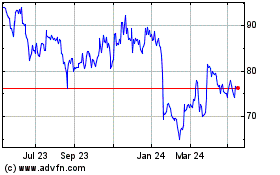

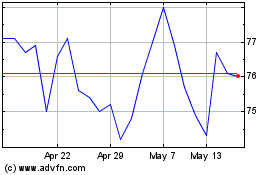

Custodian REIT plc (CREI)

Custodian REIT plc : Interim Results

01-Dec-2020 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

1 December 2020

Custodian REIT plc

("Custodian REIT" or "the Company")

Interim Results

Custodian REIT (LSE: CREI), the UK commercial real estate investment company,

today reports its interim results for the six months ended 30 September 2020

("the Period").

Financial highlights and performance summary

· The COVID-19 pandemic is continuing to impact the property market and our

tenants:

· A GBP27.4m (5.1% of property portfolio) valuation decrease during the Period;

and

· 88% of rent collected relating to the Period, adjusted for contractual rent

deferrals

· EPRA[1] earnings per share[2] for the Period decreased to 2.6p (2019: 3.4p)

due to the reduced level of rent collection

· Basic and diluted earnings per share[3] decreased to -3.8p (2019: 0.2p)

primarily due to property portfolio valuation decreases of GBP27.4m and a GBP2.9m

increase in the doubtful debt provision

· Aggregate dividends per share of 2.0p for the Period (2019: 3.325p), 33%

ahead of the 1.5p minimum announced in April 2020

· Property value of GBP532.3m (31 March 2020: GBP559.8m, 2019: GBP547.2m):

· GBP27.4m aggregate valuation decrease comprising a GBP2.8m property valuation

uplift from successful asset management initiatives and GBP30.2m of valuation

decreases, primarily due to decreases in the estimated rental value ("ERV") of

retail properties, negative investment market sentiment for retail assets and

the impact of the COVID-19 pandemic

· GBP0.9m[4] invested in the acquisition of land for a pre-let development of a

Starbucks drive-through restaurant in Nottingham

· Disposal of an industrial unit in Westerham for GBP2.8m, GBP0.5m (23%) ahead of

the 31 March 2020 valuation, representing a net initial yield of 4.50%

· NAV per share 95.2p (31 March 2020: 101.6p, 2019: 104.3p)

· NAV per share total return[5] of -3.7% (2019: 0.5%) comprising 2.6% income

(2019: 3.1%) and a -6.3% capital change (2019: -2.6 % capital change)

· Loss before tax of GBP16.1m (2019: profit of GBP0.7m)

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2020 30 Sept 2019 31 Mar 2020

Total return

NAV per share total (3.7%) 0.5% 1.1%

return

Share price total (7.7%) 8.7% (5.0%)

return[6]

Capital values

NAV (GBPm) 399.7 428.5 426.7

NAV per share (p) 95.2 104.3 101.6

Share price (p) 88.8 117.6 99.0

Property portfolio value 532.3 547.2 559.8

(GBPm)

Market capitalisation 373.0 483.0 415.9

(GBPm)

(Discount)/premium of (6.7%) 12.8% (2.6%)

share price to NAV per

share

Net gearing[7] 23.4% 20.5% 22.4%

EPRA vacancy rate[8] 7.1% 4.5% 4.1%

The Company presents NAV per share total return, dividend per share, share price

total return, NAV per share, share price, market capitalisation, discount of

share price to NAV per share, net gearing, and certain EPRA Best Practice

Recommendations as alternative performance measures ("APMs") to assist

stakeholders in assessing performance alongside the Company's results on a

statutory basis.

APMs are among the key performance indicators used by the Board to assess the

Company's performance and are used by research analysts covering the Company.

Certain other APMs may not be directly comparable with other companies' adjusted

measures, and APMs are not intended to be a substitute for, or superior to, any

IFRS measures of performance. Supporting calculations for APMs and

reconciliations between APMs and their IFRS equivalents are set out in Note 18.

David Hunter, Chairman of Custodian REIT, said:

"I am very pleased to announce that despite the inevitable disruption to cash

collection caused by the COVID-19 pandemic, the Company's better than expected

cash collection rate has allowed dividends per share of 2.0p to be paid for the

Period, 33% ahead of the minimum level of 1.5p announced in April 2020 before the

full impact of the national lockdown could be ascertained.

"We expect further tenant failures as Government support packages are withdrawn,

the November 2020 English lockdown and subsequent restrictions bite and while

CVAs remain legal, if questionable, practice, but this is likely to be heavily

weighted towards the retail sector and should not diminish the overall appeal of

real estate. In a low return environment we believe that property returns will

look attractive and the search for income and long-term capital security will

bring many investors back to real estate.

"The COVID-19 pandemic has reinforced Custodian REIT's strategy which has always

placed income and financial resilience at the heart of the Company's objectives.

When allied to the appropriate property strategy this focus underpins sustainable

dividends, which in turn support total return, and we remain committed to both

growing the dividend on a sustainable basis and delivering capital value growth

for our shareholders over the long-term."

Further information

Further information regarding the Company can be found at the Company's website

www.custodianreit.com or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240 8740

Imlach / Ian Mattioli MBE

www.custodiancapital.com [1]

Numis Securities Limited

Hugh Jonathan/Nathan Brown Tel: +44 (0)20 7260 1000

www.numiscorp.com

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Custodian REIT plc interim results for the six months ended 30 September 2020

Chairman's statement

The COVID-19 pandemic is continuing to impact the property market and our

tenants, leading to a GBP27.4m property valuation decrease during the Period and

88% of rent being collected, net of contractual deferrals. EPRA earnings per

share decreased to 2.6p (2019: 3.4p) due to a GBP2.9m increase in the doubtful debt

provision, reflecting our prudent assumptions regarding the recovery of overdue

and deferred rents, and a GBP1.9m (4.7%) decrease in the annual rent roll since 31

March 2020 due to tenants exiting at lease expiry (2.4%), cessation of rents

through Company Voluntary Arrangements ("CVAs") and Administrations (2.0%) and

the disposal of an industrial asset (0.3%). Helpfully, rental decreases seen in

the high street retail and other sectors were offset by increases in the

industrial sector.

The recent turmoil in markets has emphasised the importance of having a

well-diversified, income focused property portfolio. I was very pleased to be

able to announce that despite the inevitable disruption to cash collection caused

by the COVID-19 pandemic, the Company's better than expected cash collection rate

has allowed dividends per share of 2.0p to be paid for the Period, 33% ahead of

the minimum level of 1.5p announced in April 2020 before the full impact of the

national lockdown could be ascertained.

This higher dividend reflects the levels of rent collection seen since the onset

of the COVID-19 pandemic and is fully covered by net cash receipts and 130%

covered by EPRA earnings. The Board acknowledges the importance of income for

shareholders, and its objective remains paying dividends at a level broadly

linked to net rental receipts that does not inhibit the flexibility of the

Company's investment strategy.

These have been testing times which have necessitated an exceptional effort from

the Investment Manager, both in the collection of rents and in operating remotely

as a team. I would like to acknowledge the results of their efforts. I also thank

my fellow Board members who have been flexible and supportive during a period

which has required numerous formal and informal additional Board meetings.

Financial and operational resilience

The Company retains its strong financial position to address the extraordinary

circumstances imposed by the COVID-19 pandemic. At 30 September 2020 it had:

· A diverse and high-quality asset and tenant base comprising 161 assets and

200 typically 'institutional grade' tenants across all commercial sectors, with

an occupancy rate of 92.9%;

· GBP26.2m of cash with gross borrowings of GBP150m resulting in low net gearing,

with no short-term refinancing risk and a weighted average debt facility

maturity of seven years;

· Significant headroom on lender covenants at a portfolio level, with net

gearing of 23.4% and a maximum loan to value ("LTV") covenant of 35%; and

· Put in place interest cover covenant[9] waivers on a pre-emptive basis to

mitigate the risk that covenants on individual debt facilities might come under

pressure due to curtailed rent receipts. These waivers have not been required

due to the level of rent collected.

No lender covenants have been breached during the Period. Since the Period end

the Company has charged, or is in the process of charging, five additional

properties valued at GBP21.1m to alleviate short-term LTV covenant compliance

pressure on individual security pools.

Net asset value

The NAV of the Company at 30 September 2020 was GBP399.7m, approximately 95.2p per

share, a decrease of 6.4p (6.3%) since 31 March 2020:

Pence per share GBPm

NAV at 31 March 2020 101.6 426.7

Valuation movements relating to:

- Asset management activity 0.7 2.8

- Other valuation movements (7.2) (30.2)

Valuation decrease before acquisition (6.5) (27.4)

costs

Impact of acquisition costs (0.0) (0.1)

Valuation decrease including (6.5) (27.5)

acquisition costs

Profit on disposal of investment 0.1 0.5

property

Net valuation movement (6.4) (27.0)

Revenue 4.8 20.3

Expenses and net finance costs (2.2) (9.3)

Dividends paid[10] during the Period (2.6) (11.0)

NAV at 30 September 2020 95.2 399.7

The valuation decrease before acquisition costs of GBP27.4m was experienced across

all sectors of the portfolio, further detailed in the Investment Manager's

report, due to:

· The impact of COVID-19, with the Company's valuers reflecting historical rent

arrears within valuations and applying an overall increase in yield to assets

let to tenants which have ceased or significantly curtailed trading, in line

with current RICS advice to valuers;

· A reduction in retail ERVs;

· A worsening of investment market sentiment towards commercial property,

especially retail; and

· The impact of Company Voluntary Arrangements ("CVAs") and company

Administrations detailed in the Investment Manager's report.

Borrowings and cash

The Company operates the following debt facilities:

· A GBP35m revolving credit facility ("RCF") with Lloyds Bank plc with interest

of between 1.5% and 1.8% above three-month LIBOR, determined by reference to

the prevailing LTV ratio and expiring on 17 September 2022;

· A GBP20m term loan with Scottish Widows plc with interest fixed at 3.935% and

is repayable on 13 August 2025;

· A GBP45m term loan with Scottish Widows plc with interest fixed at 2.987% and

is repayable on 5 June 2028; and

· A GBP50m term loan with Aviva Real Estate Investors comprising:

a) GBP35m Tranche 1 repayable on 6 April 2032 attracting fixed annual interest

of 3.02%; and

b) GBP15m Tranche 2 repayable on 3 November 2032 attracting fixed annual

interest of 3.26%.

Each facility has a discrete security pool, comprising a number of the Company's

individual properties, over which the relevant lender has security and covenants:

· The maximum LTV of each discrete security pool is between 45% and 50%, with

an overarching covenant on the Company's property portfolio of a maximum 35%

LTV; and

· Historical interest cover, requiring net rental receipts from each discrete

security pool, over the preceding three months, to exceed 250% of the

facility's quarterly interest liability.

The Company complied with all loan covenants during the Period. The Company has

GBP174.1m (33% of the property portfolio) of unencumbered assets which could be

charged to the security pools to enhance the LTV on the individual loans and

since the Period end has charged, or is in the process of charging, five of these

unencumbered properties valued at GBP21.1m.

The weighted average cost of the Company's agreed debt facilities is 2.9% (2019:

3.0%) with a WAM of 7 years (2019: 8 years). 77% (2019: 75%) of the Company's

debt facilities are at a fixed rate of interest, significantly mitigating

interest rate risk.

Dividends

During the Period the Company paid the fourth quarterly interim dividend per

share for the financial year ended 31 March 2020 of 1.6625p, relating to the

quarter ended 31 March 2020, and the first quarterly dividend per share for the

financial year ending 31 March 2021 of 0.95p, relating to the quarter ended 30

June 2020.

In line with the Company's dividend policy the Board approved a quarterly interim

dividend of 1.05p per share for the quarter ended 30 September 2020 which was

paid on 30 November 2020 to shareholders on the register on 6 November 2020.

Investment Manager

Custodian Capital Limited ("the Investment Manager") is appointed under an

investment management agreement ("IMA") to provide asset management, investment

management and administrative services to the Company. The IMA fee structure was

amended in June 2020 as detailed in Note 16.

Board succession and remuneration

Three of the Company's four independent Directors were appointed in 2014. The

Company's succession policy allows for a tenure of longer than nine years, in

line with the 2019 AIC Corporate Governance Code for Investment Companies ("AIC

Code"), but the Board acknowledges the benefits of ongoing Board refreshment. For

this reason expected Director retirement dates are staggered within a nine year

tenure period. Where possible, the Board's policy is to recruit successors well

ahead of the retirement of Directors.

The gender diversity recommendations of the Hampton-Alexander Review are for at

least 33% female representation on FTSE350 company boards. With the appointment

of Hazel Adam during the past year, the female representation on the Board is

20%. The Company is a constituent of the FTSESmallCap Index where no female

representation recommendations apply, but the Board recognises the value and

importance of diversity in the boardroom.

In June 2020 the Remuneration Committee postponed its decision regarding

Directors' annual fees for the year ending 31 March 2021 due to the uncertainty

caused by the COVID-19 pandemic in anticipation of a clearer fiscal outlook later

in the year. In November 2020 the Remuneration Committee determined that there

would be no increase in level of Directors' annual fees for the time being and

subsequent reviews would be undertaken on a quarterly basis whilst uncertainty

caused by the COVID-19 pandemic remained.

Environmental policy

The majority of the Company's investment properties are let on full repairing and

insuring leases, meaning its day-to-day environmental responsibilities are

limited because properties are controlled by their tenants. However, the Board

adopts sustainable principles where possible and the key elements of the

Company's current environmental policy are:

· We want our properties to minimise their impact on the environment and the

Investment Committee of the Investment Manager carefully considers the

historical and current usage and environmental performance of assets before

acquisition;

· An ongoing examination of existing and new tenants' business activities

allows assessment of the risk of pollution occurring, and tenants with

high-risk activities are avoided;

· Sites are visited periodically and any observable environmental issues are

reported to the Investment Committee of the Investment Manager; and

· All leases prepared after the adoption of the policy commit occupiers to

observe any environmental regulations.

During the Period the Company agreed environmental KPIs for the property

portfolio and completed its inaugural submission for the Global Real Estate

Sustainability Benchmark ("GRESB"). The Company's Annual Report for the year

ended 31 March 2020 received a 'most improved' award for its first year complying

with EPRA Sustainability Best Practice Recommendation reporting.

Brexit

The Board is continuing to monitor the potential risks associated with Brexit but

believes the Company is well placed to weather any short-term impact because of

its diverse property portfolio by sector and location with an institutional grade

tenant base and low gearing.

Outlook

The absolute focus on rent collection, financial resilience and maintaining fully

covered dividend payments has occupied the Board's attention throughout the

Period. Indeed, the COVID-19 pandemic has reinforced Custodian REIT's strategy

which, over and above decisions in relation to investment approach, has always

placed income and financial resilience at the heart of the Company's objectives.

When allied to the appropriate property strategy this focus underpins sustainable

dividends, which in turn support long-term total return.

Notwithstanding some ongoing challenges the post-pandemic outlook for real estate

in a low interest, low return environment looks promising. It has been reported

that global institutional investors plan to increase their allocation to real

assets over the next 12 months which should encourage wealth managers and private

clients to re-weight to real estate for its income credentials.

David Hunter

Chairman

30 November 2020

Investment Manager's report

Property market

Investment activity is increasing and appears to be tracking the emerging picture

of forecast occupier demand. There is confidence in the industrial and logistics

market, which represents 47% of the Company's property portfolio value, where

record investment volumes have been matched by record occupational demand for

warehouse space. This occupational demand, driven by the continued growth of

e-commerce and the onshoring of supply chains, combined with low vacancy rates

has led to the continuation of rental growth. Much of the investment capital that

might have been focused on the office or retail sectors has been redirected to

industrial and logistics. We see continued opportunity in this sector as the UK

has yet to build a sufficient logistics network to support the continued growth

in e-commerce.

Despite widespread remote working and the resulting low utilisation of offices

across the country we expect recognition from occupiers of the social and

well-being impact of returning to offices in some meaningful way, post the

COVID-19 pandemic. Office owners must invest in their existing buildings to

create flexible working spaces which may result in greater space requirements per

head but perhaps for fewer office workers. Offices allow space for organisational

productivity, rather than individual productivity which may prove better when

delivered working remotely either from home or from smaller satellite offices.

The lettings market has already seen an increase in enquiries for satellite

office locations reflecting this trend which could be positive for Custodian

REIT's portfolio of small regional offices, acknowledging that forecasting office

demand is currently subject to significant uncertainty.

The retail market has borne the brunt of the impact of lockdown with a huge

reduction in footfall and consumers switching to online retailing instead. The

COVID-19 pandemic disruption has accelerated trends that were already embedded in

retailing when online retail already made up almost 20% of all UK retail sales,

namely an oversupply of shops, downward pressure on rents and a rise in the

number of retailers failing.

ONS data indicates online retail sales reached 32.8% in May 2020 during the first

national lockdown compared to 18.8% in May 2019. As lockdown was eased in the

summer, so people returned to the shops and online sales dipped, which is a

positive signal for physical retail. While online sales will remain an important

part of retailers' strategies, the physical shop is not yet dead. This physical

presence is particularly relevant for prime city centre locations where retailers

benefit from high footfall facilitating brand awareness and enabling

'showrooming'. We also believe the physical shop will survive in convenience-led,

out of town locations, especially for goods which are less likely to be bought

online, namely DIY, furniture, homewares, and discount brands. We expect the

Company's strategy of a low weighting to high street retail and a greater focus

on out-of-town retail, let at affordable rents, will position the portfolio well

to pick up as and when consumers can return to the shops with confidence.

Investment volumes have been sufficient for the Company's valuers to remove the

'material uncertainty' caveat from the property portfolio valuation as at 30

September 2020. However, in an attempt to reflect market sentiment in the

valuations a risk factor has still been applied to the collection of deferred

rent or rents arrears due from tenants adversely affected by the COVID-19

pandemic. This rental risk continues to have an impact on NAV but, as deferred

rents continue to be recovered, this risk adjustment applied to rents within

valuations will diminish.

Rent collection

As Investment Manager, Custodian Capital invoices and collects rent directly,

importantly allowing it to hold direct conversations promptly with most tenants

regarding the payment of rent. This direct contact has proved invaluable through

the COVID-19 pandemic disruption, enabling better outcomes for the Company. Many

of these conversations have led to positive asset management outcomes, some of

which are discussed below.

88% of rent relating to the Period net of contractual rent deferrals has been

collected, or 82% before contractual deferrals, as set out below:

Net of Before contractual

contractual rent rent deferrals

deferrals

GBPm

Rental income from 19.4

investment property

(IFRS basis)

Lease incentives (0.9)

Cash rental income 18.5 100%

expected, before

contractual rent

deferrals

Contractual rent (1.5) (8%)

deferrals relating to

the Period

Contractual rent 0.2 1%

deferred falling due

during the Period

Cash rental income 17.2 100%

expected, net of

contractual rent

deferrals

Outstanding rental (2.1) (12%) (11%)

income

Rental income 15.1 88% 82%

collected

88% of the GBP0.2m contractual rent deferred falling due during the Period has been

collected, indicating that the support offered to tenants during the first

national lockdown is now returning a more positive result on overall rent

collections.

Outstanding rental income remains the subject of discussion with various tenants,

although some arrears are potentially at risk of non-recovery from CVAs or

Pre-pack Administrations. We expect the rent recovery rate for the Period to

exceed 90% once tenant discussions are concluded.

To date 92% of rent relating to the quarter ending 31 December 2020 has been

collected, net of contractual deferrals7.

All contractual deferrals offered to date are to be recovered through payment

plans over the next 12-18 months.

The Company's doubtful debt provision has increased by GBP2.9m during the Period to

reflect the risk over collecting outstanding and deferred rent.

7 The proportion of rent collected relating to the quarter ending 31 December

2020 ("FY21 Q3") invoiced rents now due, adjusted for the agreed deferral of 1%

of FY21 Q3 invoiced rents and the rents now due previously deferred from FY21 Q1

and Q2.

Property portfolio performance

At 30 September 2020 the Company's property portfolio comprised 161 assets (31

March 2020: 161 assets), 200 tenants and 265 tenancies with an aggregate net

initial yield[11] ("NIY") of 6.9% (31 March 2020: 6.8%) and weighted average

unexpired lease term to first break or expiry ("WAULT") was 5.1 years (31 March

2020: 5.3 years).

The property portfolio is split between the main commercial property sectors, in

line with the Company's objective to maintain a suitably balanced portfolio, with

a relatively low exposure to office and a relatively high exposure to industrial,

retail warehouse and alternative sectors, often referred to as 'other' in

property market analysis.

The current sector weightings are:

Valuation Weighting Weighting

by by income

income[12 31 March

] 2020

30 Sept

2020 Valuation

movement

30 Sept before

acquisiti

GBPm on costs

GBPm

2020

Sector Valuation

Weighting Weighting

by value by value

30 Sept 31 March

31 March 2020 2020

2020

GBPm

Industrial 250.7 41% 257.3 40% (4.5) 47% 46%

Retail 102.7 21% 109.7 22% (7.4) 19% 20%

warehouse

Other[13] 81.6 17% 87.4 17% (7.1) 15% 16%

High 47.6 11% 52.8 11% (5.3) 9% 9%

street

retail

Office 49.7 10% 52.6 10% (3.1) 10% 9%

Total 532.3 100% 559.8 100% (27.4) 100% 100%

A number of smaller assets in the high street retail sector are earmarked for

disposal which should limit possible future valuation decreases in that sector.

The 31 March 2020 valuation was reported on the basis of 'material valuation

uncertainty' in accordance with RICS valuation standards. This basis did not

invalidate the valuation but, in the circumstances, implied that less certainty

could be attached to the valuation than otherwise would be the case. However, for

30 September 2020 valuations, no 'material valuation uncertainty' clause was

applied for all asset classes in the Company's property portfolio.

Industrial and logistics property remains a very good fit with the Company's

strategy. The demand for smaller lot-sized units is very broad, from

manufacturing, urban logistics, online traders and owner occupiers. This demand,

combined with a restricted supply resulting from limited new development,

supports high residual values (where the vacant possession value is closer to the

investment value than in other sectors) and drives rental growth. Despite a long

period of growth in this sector, we still see opportunity.

Amongst its far-reaching impacts, the COVID-19 pandemic has deepened the

challenges facing the retail sector causing further declines in retail values

across the portfolio, although with a greater percentage decline in high street

locations (-10.1%) than in out-of-town locations (-6.7%). We believe that

out-of-town retail/retail warehousing remains an important asset class for the

Company. We expect that well-located retail warehouse units, let off low rents,

located on retail parks which are considered dominant in their area will continue

to be in demand from retailers. The importance of convenience, free parking, the

capacity to support click and collect and the relatively low cost compared to the

high street should continue to support occupational demand for the Company's

retail warehouse assets.

Regional offices will remain a sector of interest for the Company and we expect

there to be activity post-pandemic in regional office markets. The rise in

working remotely may not be restricted to working from home with a potential

increase in working from regional satellite offices. Locations that offer an

attractive environment to both live and work in and that offer buildings with

high environmental standards and accessibility to a skilled workforce, will be

most desirable. There is latent rental growth in many regional office markets

where supply has been much diminished through redevelopment to alternative uses.

For details of all properties in the portfolio please see

custodianreit.com/property/portfolio [2].

Acquisition

In July 2020 the Company acquired 0.6 acres of land in Nottingham for GBP0.9m to be

developed into a 2,163 sq ft drive-through coffee shop with 34 parking spaces.

Construction, costing GBP0.825m, is being phased over an expected six month build

period. The unit has been pre-let to KBeverage Limited (trading as Starbucks

Coffee) on a 20 year lease with no breaks and five yearly upward only market rent

reviews. On completion of the development passing rent will be GBP115k pa,

reflecting a NIY of 6.67%.

Investment objective

The Company's key objective is to provide shareholders with an attractive

relative level of income by paying dividends fully covered by net rental receipts

with a conservative level of net gearing.

The Board remains committed to a strategy principally focused on regional

properties with individual values of less than GBP10m at acquisition with a

weighting towards regional industrial and logistics. Diversification of property

type, tenant, location and lease expiry profile continues to be at the centre of

the strategy together with maximising cash flow by taking a flexible approach to

tenants' requirements and retaining tenants wherever possible.

Property portfolio risk

The property portfolio's security of income is enhanced by 19.1% of income

benefitting from either fixed or indexed rent reviews.

Short-term contractual income at risk is a relatively low proportion of the

property portfolio's total income, with 31% (2019: 35%) expiring in the next

three years and 8% within one year (2019: 15%).

The Company's Annual Report for the year ended 31 March 2020 set out the

principal risks and uncertainties facing the Company at that time. We do not

anticipate any changes to those risk and uncertainties over the remainder of the

financial year, but highlight the following risks:

COVID-19 pandemic

The impact of the COVID-19 pandemic has been pervasive across the globe, and we

believe it will continue to have a significant impact on rental receipts, tenant

stability, property valuations, government legislation and availability of

finance and compliance with financial covenants for at least the remainder of the

financial year ending 31 March 2021. We believe it is still too early to fully

comprehend the short-term impact and longer-term ramifications of the COVID-19

pandemic. The Board has met frequently via video-conference during the Period to

ensure the Company reacts promptly to a dynamic situation, including guiding and

challenging our response and approving decisions quickly when required.

Brexit

The Board is continuing to monitor the potential risks associated with Brexit.

Discussions are ongoing and the final outcome regarding the UK's future trading

relationship with the EU remains unclear, making it too early to understand fully

the impact Brexit will have on the Company's business. The main potential

negative impact of Brexit is a deterioration of the macro-economic environment,

potentially leading to further political uncertainty and volatility in interest

rates, but it could also impact the investment and occupier markets, our ability

to execute the Company's investment strategy and its income sustainability in the

long-term. However, we believe the Company is well placed to weather any

short-term impact of Brexit because of its diverse portfolio by sector and

location with an institutional grade tenant base and low gearing.

Environmental

The Board is aware of the increasing focus from external stakeholders on the

Company's environmental credentials and the increasing level of disclosure

requirements regarding the Company's environmental impact. We continue to work

with specialist environmental consultants to ensure compliance with new

requirements and identify cost-effective opportunities to improve the Company's

environmental performance. The Board recently approved a suite of environmental

KPIs on which the Investment Manager will report to ensure the Company's ongoing

environmental impact is considered in the decision making process.

Asset management

Our continued focus on asset management including rent reviews, new lettings,

lease extensions and the retention of tenants beyond their contractual break

clauses resulted in a GBP2.8m valuation increase in the Period. Key asset

management initiatives completed during the Period include:

· Completing a twenty-year lease extension with Bannatyne Fitness on a leisure

scheme in Perth, extending lease expiry to August 2046 and incorporating five

yearly RPI linked rent reviews, which increased valuation by GBP1.5m;

· Unconditionally exchanging an agreement for lease with MCC Labels in Daventry

on a new ten-year lease without break commencing in Spring 2021 after the

current tenant vacates in December 2020, at a rent of GBP295k pa, which increased

valuation by GBP0.8m;

· Completing a five-year lease extension with DHL on an industrial unit at

Speke, Liverpool, subject to a tenant-only break in year three, maintaining

annual passing rent at GBP119k which increased valuation by GBP0.2m;

· Completing a five-year lease extension with Erskine Murray at an office

building in Leicester, extending the lease expiry from December 2020 to

December 2025 at an increased annual rental of GBP72.5k (previously GBP66.5k) which

increased valuation by GBP0.1m;

· Completing a deed of variation with Urban Outfitters in Southampton to push

the October 2021 tenant only break option back to April 2024, increasing the

term certain to 3.5 years, which increased valuation by GBP0.1m;

· Settling an open market rent review with Synergy Health at an industrial unit

in Sheffield, increasing the annual rent from GBP142k to GBP158k which increased

valuation by GBP0.1m;

· Unconditionally exchanging an agreement for lease with MKM in Lincoln on a

new 10 year reversionary lease on a trade counter unit, extending expiry from

June 2022 to June 2032 without break and maintaining annual passing rent at

GBP192k with 12 months' rent free, with no impact on valuation;

· Re-gearing with The Works in Portsmouth which removed a tenant only break

option in October 2021, extending the term certain to October 2026, with no

impact on valuation;

· Completing a lease renewal with The White Company in Nottingham for a five

year lease with 2.5 year tenant only break option at a reduced rent of GBP65k pa

(previously GBP140k), in line with current ERV, with no impact on valuation;

· Completing a short-term turnover-based lease with mutual breaks to retain

Game in Portsmouth following expiry of its existing lease whilst we re-market

the premises, with no impact on valuation; and

· Completing a five-year lease renewal with Sports Direct on a retail park in

Weymouth at a rebased annual rent of GBP90k (previously GBP118k), subject to a 5%

turnover top-up clause and featuring rolling mutual break options after 36

months, with no impact on valuation.

Since the Period end the following initiatives have been completed:

· Exchanging an agreement for lease with Tim Hortons Fast Food Restaurants on a

drive-through restaurant in Perth (formerly a Frankie & Benny's) for a term of

15 years, with a tenant only break option in year 10, at an annual rent of

GBP90k; and

· Completing a 10 year reversionary lease without break with DX Networks at an

industrial unit in Nuneaton, pushing the lease expiry out from March 2022 to

March 2032 subject to a day one rent review where we expect to secure an

increase in the GBP267k pa passing rent.

These positive asset management outcomes have been tempered by the impact of the

following business failures, which have resulted in GBP801k (2.0% of rent roll) of

lost annual rent with a further GBP1,008k (2.5% of rent roll) at risk:

Lost contractual annual rent since 31 March 2020

Annual rent

GBP000

Location Tenant Sector Event

Colchester Laura Ashley Retail 229 In

and Grantham warehouse Administ

ration,

tenant

exited

both

units

during

the

Period

Perth* The Restaurant Restaurant 100 CVA -

Group rent

reduced

to 0%

for 12

months

before

closure.

Grantham and Poundstretcher Retail 221 CVA -

Evesham warehouse tenant

remains

in

occupati

on rent

free

whilst

units

are

remarket

ed

Portishead Travelodge Hotel 83 CVA -

rent

reduced

to 25%

of

passing

rent in

2020 and

70% in

2021

Leicester, Pizza Hut Restaurant 168 CVA -

Watford and base

Crewe rent

reduced

by an

average

of 66%

of

passing

rent

plus an

8% of

turnover

top-up

801

*An agreement for a 15 year lease has been exchanged on the Perth asset with Tim

Hortons Fast Food Restaurants with rent of GBP90k per annum.

Contractual annual rent at risk at 30 September 2020

Swindon Go Outdoors Retail 325 Pre-pack

warehouse Administration -

new tenant in

occupation under

licence,

negotiating

revised lease

terms

Carlisle and JB Global Retail 390 Pre-pack

(t/a Oak warehouse Administration -

Furniture Oak Furniture Land

Land) now occupying

Plymouth under licence

whilst new terms

are negotiated

Torquay Las Iguanas Restaurant 110 In Administration

- tenant remains

in occupation

under licence,

negotiating

revised lease

terms

Shrewsbury Edinburgh High street 93 Administration

Woollen Mill retail

Torquay Le Bistrot Restaurant 90 Pre-pack

Pierre Administration -

new tenant in

occupation under

licence,

negotiating new

lease terms

1,00

8

All tenants in properties with rent at risk remain in occupation and continue to

trade, with negotiations for new lease terms either agreed and in solicitors

hands or under negotiation, demonstrating occupier demand remains in the market

for well-located assets.

Outlook

As we see increasing confidence in the collection of contractually deferred rents

and once landlords can formally pursue non-payers, positive sentiment towards the

income credentials of commercial real estate investment is likely to return. In a

low return environment, where dividends are under pressure across all investment

markets, we believe that property returns will look attractive and the search for

income and long-term capital security will bring many investors back to real

estate. We expect further tenant failures as Government support packages are

withdrawn, the November 2020 English lockdown and subsequent restrictions bite

and while CVAs remain legal, if questionable, practice, but this is likely to be

heavily weighted towards the retail sector and should not diminish the overall

appeal of real estate.

Over the last eight months the market's focus has been on income (and therefore

EPRA earnings per share) rather than NAV and we expect this focus to continue

whilst disruption to contractual rent collections remains. We believe that EPRA

earnings per share is a more important metric than NAV per share in demonstrating

the Company's ability to deliver long-term sustainable dividends. As a result our

focus has understandably been, and will remain, centred on rent collection.

We remain confident that the Company's strategy of targeting income with

conservative net gearing in a well-diversified regional property portfolio will

continue to deliver the long-term returns demanded by our shareholders.

Richard Shepherd-Cross

for and on behalf of Custodian Capital Limited

Investment Manager

30 November 2020

Property portfolio

Location Tenant % Portfolio

Income[14]

Industrial

Winsford H&M 1.5%

Warrington JTF Wholesale 1.4%

Ashby Teleperformance 1.3%

Burton ATL Transport 1.2%

Salford Restore 1.1%

Bedford Elma Electronics and 1.0%

Vertiv Infrastructure

Hilton Daher Aerospace 0.9%

Stone Revlon International 0.9%

Eurocentral Next 0.9%

Tamworth ICT Express 0.8%

Doncaster Silgan Closures 0.8%

Kettering Multi-let 0.8%

Normanton Yesss Electrical 0.8%

Biggleswade Turpin Distribution 0.8%

Warrington Procurri Europe and 0.7%

Synertec

Daventry Cummins 0.7%

Gateshead Multi-let 0.7%

Edinburgh Menzies Distribution 0.7%

Cannock HellermannTyton 0.7%

Milton Keynes Massmould 0.7%

Plymouth Sherwin-Williams 0.7%

West Bromwich OT Group Limited 0.7%

Gateshead - Team Worthington Armstrong 0.7%

Valley

Bellshill Yodel Delivery Network 0.6%

Nuneaton DX Network Service 0.6%

Milton Keynes Saint-Gobain Building 0.6%

Distribution

Avonmouth Superdrug 0.6%

Bedford Heywood Williams 0.6%

Components

Bristol BSS Group 0.6%

Glasgow Menzies Distribution 0.6%

Weybridge Menzies Distribution 0.6%

Coventry Royal Mail 0.5%

Aberdeen Menzies Distribution 0.5%

Hamilton Ichor Systems 0.5%

Stevenage Morrison Utility Services 0.5%

Livingston A Share & Sons (t/a SCS) 0.5%

Manchester Unilin Distribution 0.5%

Oldbury Sytner 0.5%

Aberdeen DHL Supply Chain 0.5%

Christchurch Interserve Project 0.5%

Services

Cambuslang Brenntag 0.5%

Warrington Dinex Exhausts 0.4%

Warwick Semcon 0.4%

Norwich Menzies Distribution 0.4%

Leeds Sovereign Air Movement 0.4%

and Tricel Composites

Coalville MTS Logistics 0.4%

Erdington West Midlands Ambulance 0.4%

Service NHS Trust

Langley Mill Warburton 0.4%

Ipswich Menzies Distribution 0.4%

Irlam Northern Commercials 0.4%

Sheffield Parkway Synergy Health 0.4%

Castleford Bunzl 0.4%

Liverpool, Speke Powder Systems 0.3%

Swansea Menzies Distribution 0.3%

Stockton on Tees Menzies Distribution 0.3%

Sheffield Arkote 0.3%

Sheffield ITM Power and River 0.3%

Island

Kettering Sealed Air 0.3%

Atherstone North Warwickshire 0.3%

Borough Council

Liverpool, Speke DHL International 0.3%

Huntingdon PHS 0.3%

Glasgow DHL Global Forwarding 0.3%

Normanton Acorn Web Offset 0.2%

Kilmarnock Royal Mail Group 0.2%

Vacant 2.8%

40.9%

Location Tenant % Portfolio

Income

Retail Warehouse

Evesham Multi-let 2.1%

Carlisle Multi-let 2.0%

Weymouth B&Q, Halfords and 1.8%

Sports Direct

Winnersh Pets at Home and Wickes 1.3%

Burton CDS (t/a The Range) and 1.3%

Wickes

Swindon B&M and Go Outdoors and 1.2%

InstaVolt

Leicester Matalan 1.2%

Plymouth A Share & Sons (t/a 1.1%

SCS) and JB Global (t/a

Oak Furniture Land)

Banbury B&Q 1.1%

Ashton-under-Lyne B&M 1.0%

Plymouth - Transit Way B&M, Magnet and 0.9%

InstaVolt

Gloucester Magnet, Smyths Toys and 0.9%

InstaVolt

Sheldon Multi-let 0.9%

Leighton Buzzard Homebase 0.8%

Galashiels B&Q 0.6%

Leicester Magnet 0.6%

Torpoint Sainsburys 0.5%

Portishead Majestic Wine, TJ 0.5%

Morris (t/a

HomeBargains) and

InstaVolt

Grantham Carpetright, 0.4%

Poundstretcher and

InstaVolt

Vacant 1.1%

21.3%

Location Tenant % Portfolio Income

Other

Stockport Benham (Specialist Cars) (t/a 1.7%

Williams BMW and Mini)

Liverpool Liverpool Community Health NHS 1.0%

Trust

Perth Bannatyne Fitness, Scotco 1.0%

Eastern (t/a KFC) and The

Restaurant Group (t/a Frankie &

Benny's)

Lincoln Total Fitness 0.9%

Stoke Nuffield Health 0.8%

Derby VW Group 0.8%

Crewe Multi-let 0.8%

Stafford VW Group 0.7%

Torquay Multi-let 0.7%

Gillingham Co-Operative 0.6%

York Pendragon 0.6%

Portishead Travelodge 0.5%

Salisbury Parkwood Health & Fitness 0.5%

Shrewsbury VW Group 0.5%

Lincoln MKM Buildings Supplies 0.5%

Gateshead MTOR and Raven Valley 0.4%

Crewe Multi-let 0.4%

Loughborough Listers Group 0.4%

Redhill Honda Motor Europe 0.3%

Bath Chokdee (t/a Giggling Squid) 0.3%

Shrewsbury Azzurri Restaurants (t/a ASK) 0.3%

and Sam's Club (t/a House of the

Rising Sun)

Castleford MKM Buildings Supplies 0.3%

High Wycombe Stonegate Pub Co 0.3%

Maypole Starbucks 0.3%

Shrewsbury TJ Vickers & Sons 0.3%

Carlisle The Gym Group 0.3%

Leicester Pizza Hut 0.2%

Watford Pizza Hut 0.2%

Plymouth McDonald's 0.2%

Portishead JD Wetherspoon 0.2%

King's Lynn Loungers 0.1%

Stratford Universal Church of the Kingdom 0.1%

of God

Chesham Bright Horizons 0.1%

Knutsford Knutsford Day Nursery 0.1%

Vacant 0.6%

17.0%

Location Tenant % Portfolio Income

High street retail

Shrewsbury Multi-let 1.0%

Worcester Superdrug 0.9%

Cardiff Multi-let 0.9%

Portsmouth Multi-let 0.7%

Southampton URBN 0.5%

Guildford Reiss 0.5%

Colchester H Samuel, Leeds Building 0.4%

Society and Lush

Llandudno WH Smith 0.4%

Birmingham Multi-let 0.3%

Chester Felldale Retail (t/a 0.3%

Lakeland) and Signet (t/a

Ernest Jones)

Norwich Specsavers 0.3%

Weston-super-Mare Superdrug 0.3%

Edinburgh Phase Eight 0.3%

Chester Aslan Jewellery (t/a 0.3%

Gasia) & Der Touristik

Portsmouth The Works 0.2%

Southsea Portsmouth City Council 0.2%

Stratford Foxtons 0.2%

Taunton Wilko Retail 0.2%

Bury St Edmunds The Works 0.2%

Colchester Kruidvat Real Estate (t/a 0.2%

Savers)

St Albans Crepeaffaire 0.2%

Cirencester Brook Taverner & The 0.2%

Danish Wardrobe Co (t/a

Noa Noa)

Nottingham The White Company 0.2%

Southsea Superdrug 0.1%

Bury St Edmunds Savers 0.1%

Scarborough Waterstones 0.1%

Chester Ciel (Concessions) (t/a 0.1%

Chesca)

Cheltenham Done Brothers (Cash 0.1%

Betting) (t/a Betfred)

Bedford Waterstones 0.1%

Vacant 1.0%

10.5%

Location Tenant % Portfolio Income

Office

West Malling Regus (Maidstone West 1.5%

Malling)

Sheffield Secretary of State for 0.9%

Communities and Local

Government

Birmingham Multi-let 0.8%

Castle Donnington National Grid 0.8%

Leeds First Title (t/a Enact 0.8%

Conveyancing)

Cheadle Wienerberger 0.8%

Leeds First Title (t/a Enact 0.7%

Conveyancing)

Leicester Countryside Properties and 0.6%

Erskine Murray

Derby Edwards Geldards 0.6%

Solihull Lyons Davidson 0.5%

Leicester Regus 0.4%

Glasgow Multi-let 0.3%

Vacant 1.6%

10.3%

Condensed consolidated statement of comprehensive income

For the six months ended 30 September 2020

Unaudited Unaudited Audited

6 months 6 months 12 months

to 30 Sept to 30 Sept to 31 Mar

2020 2019

2020

Note GBP000 GBP000 GBP000

Revenue 4 20,286 20,495 40,903

Investment (1,653) (1,762) (3,517)

management fee

Operating expenses

of rental property (881)

(892) (838)

· rechargeable to

tenants

10 (3,781) (928) (1,883)

· directly

incurred

Professional fees (195) (191) (445)

Directors' fees (115) (94) (200)

Administrative (310) (317) (619)

expenses

Expenses (6,946) (4,130) (7,545)

Operating profit

before financing

and revaluation of

investment property

13,340 16,365 33,358

Unrealised losses

on revaluation of

investment

property:

- relating to gross

property

revaluations

9 (27,388) (12,919) (25,850)

9 (69) (222) (599)

· relating to

acquisition costs

Net valuation (27,457) (13,141) (26,449)

decrease

Profit/(loss) on 485 (79) (101)

disposal of

investment property

Net losses on (26,972) (13,220) (26,550)

investment property

Operating (13,632) 3,145 6,808

(loss)/profit

before financing

Finance income 5 27 10 36

Finance costs 6 (2,471) (2,428) (4,721)

Net finance costs (2,444) (2,418) (4,685)

(Loss)/profit (16,076) 727 2,123

before tax

Income tax 7 - - -

(Loss)/profit and

total comprehensive

(expense)/income

for the Period, net

of tax (16,076) 727 2,123

Attributable to:

Owners of the (16,076) 727 2,123

Company

Earnings per

ordinary share:

Basic and diluted 3 (3.8) 0.2 0.5

(p)

EPRA (p) 3 2.6 3.4 7.0

The loss for the Period arises from the Company's continuing operations.

Condensed consolidated statement of financial position

As at 30 September 2020

Registered number: 08863271

Unaudited Unaudited Audited

30 Sept 30 Sept 31 Mar

2020 2019 2020

Note GBP000 GBP000 GBP000

Non-current assets

Investment property 9 532,250 547,179 559,817

Total non-current assets 532,250 547,179 559,817

Current assets

Trade and other receivables 10 7,754 4,940 5,297

Cash and cash equivalents 12 26,205 41,659 25,399

Total current assets 33,959 46,599 30,696

Total assets 566,209 593,778 590,513

Equity

Issued capital 14 4,201 4,107 4,201

Share premium 250,469 240,023 250,469

Retained earnings 145,032 184,381 172,082

Total equity attributable to

equity holders of the Company

399,702 428,511 426,752

Non-current liabilities

Borrowings 13 148,493 150,696 148,323

Other payables 575 576 576

Total non-current liabilities 149,068 151,272 148,899

Current liabilities

Trade and other payables 11 10,653 7,009 7,794

Deferred income 6,786 6,986 7,068

Total current liabilities 17,439 13,995 14,862

Total liabilities 166,507 165,267 163,761

Total equity and liabilities 566,209 593,778 590,513

These interim financial statements of Custodian REIT plc were approved and

authorised for issue by the Board of Directors on 30 November 2020 and are signed

on its behalf by:

David Hunter

Director

Condensed consolidated statement of cash flows

For the six months ended 30 September 2020

Unaudited Unaudited Audited

6 months 6 months 12 months

to 30 Sept to 30 Sept to 31 Mar

2020 2019

2020

Note GBP000 GBP000 GBP000

Operating activities

(Loss)/profit for the (16,076) 727 2,123

Period

Net finance costs 5,6 2,444 2,418 4,685

Net revaluation loss 9 27,457 13,141 26,449

(Profit)/loss on (485) 79 101

disposal of investment

property

Impact of lease 9 (877) (749) (1,402)

incentives

Amortisation 4 4 7

Income tax 7 - - -

Cash flows from 12,467 15,620

operating activities

before changes in

working capital and

provisions 31,963

Increase in trade and (2,457) (1,266) (1,623)

other receivables

Increase/(decrease) in 2,576 (165)

trade and other 702

payables

Cash generated from 12,586 14,189 31,042

operations

Interest and other 6 (2,301) (2,280) (4,435)

finance charges

10,285 11,909

Net cash flows from

operating activities 26,607

Investing activities

Purchase of investment (900) - (24,048)

property

Capital expenditure (348) (1,933) (2,804)

and development

Acquisition costs (69) (222) (599)

Proceeds from the 2,800 15,383 15,383

disposal of investment

property

Costs of disposal of (15) (137) (159)

investment property

Interest received and 5 27 10 36

similar income

Net cash flows 1,495 13,101 (12,191)

from/(used in)

investing activities

Financing activities

Proceeds from the - 14,655 25,300

issue of share capital

Costs of the issue of - (187) (292)

share capital

New borrowings 13 - 13,500 11,000

New borrowings 13 - (484) (495)

origination costs

Dividends paid 8 (10,974) (13,307) (27,002)

Net cash flows (used (10,974) 14,177 8,511

in)/from financing

activities

806 39,187

Net increase in cash

and cash equivalents 22,927

Cash and cash 25,399 2,472

equivalents at start 2,472

of the Period

Cash and cash 26,205 41,659

equivalents at end of 25,399

the Period

Condensed consolidated statements of changes in equity

For the six months ended 30 September 2020

Issued Share Retained Total

capital premium earnings equity

Note GBP000 GBP000 GBP000 GBP000

As at 31 March 2020 4,201 250,469 172,082 426,752

(audited)

Loss and total

comprehensive expense for

Period

- - (16,076) (16,076)

Transactions with owners

of the Company,

recognised directly in

equity

Dividends 8 - - (10,974) (10,974)

As at 30 September 2020

(unaudited)

4,201 250,469 145,032 399,702

For the six months ended 30 September 2019

Issued Share Retained Total

capital premium earnings equity

Note GBP000 GBP000 GBP000 GBP000

As at 31 March 2019 3,982 225,680 196,961 426,623

(audited)

Profit and total

comprehensive income for

Period

- - 727 727

Transactions with owners

of the Company,

recognised directly in

equity

Dividends 8 - - (13,307) (13,307)

Issue of share capital 14 125 14,343 - 14,468

As at 30 September 2019

(unaudited)

4,107 240,023 184,381 428,511

Notes to the interim financial statements for the period ended 30 September 2020

1) Corporate information

The Company is a public limited company incorporated and domiciled in England and

Wales, whose shares are publicly traded on the London Stock Exchange plc's main

market for listed securities. The interim financial statements have been prepared

on a historical cost basis, except for the revaluation of investment property,

and are presented in pounds sterling with all values rounded to the nearest

thousand pounds (GBP000), except when otherwise indicated. The interim financial

statements were authorised for issue in accordance with a resolution of the

Directors on 30 November 2020.

2) Basis of preparation and accounting policies

1) Basis of preparation

The interim financial statements have been prepared in accordance with IAS 34

Interim Financial Reporting. The interim financial statements do not include all

the information and disclosures required in the annual financial statements. The

Annual Report for the year ending 31 March 2021 will be prepared in accordance

with International Financial Reporting Standards adopted by the International

Accounting Standards Board ("IASB") and interpretations issued by the

International Financial Reporting Interpretations Committee ("IFRIC") of the IASB

(together "IFRS") as adopted by the European Union, and in accordance with the

requirements of the Companies Act applicable to companies reporting under IFRS.

The information relating to the Period is unaudited and does not constitute

statutory financial statements within the meaning of section 434 of the Companies

Act 2006. A copy of the statutory financial statements for the year ended 31

March 2020 has been delivered to the Registrar of Companies. The auditor's report

on those financial statements was not qualified, did not include a reference to

any matters to which the auditor drew attention by way of emphasis without

qualifying the report and did not contain statements under section 498(2) or (3)

of the Companies Act 2006.

The interim financial statements have been reviewed by the auditor and its report

to the Company is included within these interim financial statements.

Certain statements in this report are forward looking statements. By their

nature, forward looking statements involve a number of risks, uncertainties or

assumptions that could cause actual results or events to differ materially from

those expressed or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as representation that

such trends or activities will continue in the future. Accordingly, undue

reliance should not be placed on forward looking statements.

2) Significant accounting policies

The principal accounting policies adopted by the Company and applied to these

interim financial statements are consistent with those policies applied to the

Company's Annual Report and financial statements.

3) Key sources of judgements and estimation uncertainty

Preparation of the interim financial statements requires the Company to make

judgements and estimates and apply assumptions that affect the reported amount of

revenues, expenses, assets and liabilities.

The areas where a higher degree of judgement or complexity arises are discussed

below:

Valuation of investment property - Investment property is valued at the reporting

date at fair value. In making its judgement over the valuation of properties, the

Company considers valuations performed by the independent valuers in determining

the fair value of its investment properties. The valuers make reference to market

evidence of transaction prices for similar properties. The valuations are based

upon assumptions including future rental income, anticipated maintenance costs

and appropriate discount rates. In response to the COVID-19 pandemic, 31 March

2020 valuations were subject to a 'material uncertainty' clause in line with

prevailing RICS guidance, which has not been applied to 30 September 2020

valuations. In response to the COVID-19 pandemic, the Company's valuers used

historical rent arrears to indicate the potential for further short-term

disruptions in tenants' trading and rental payments as well as reflecting changes

to market rents and yields. This approach means for certain assets occupied by

tenants currently not trading or with trade significantly curtailed, the

Company's valuers assumed a prospective three-six-month rental void and applied a

yield increase of 25-75bps to valuations.

The areas where a higher degree of estimation uncertainty arises significant to

the interim financial statements are discussed below:

Impairment of trade receivables - As a result of the COVID-19 pandemic the

Company's assessment of expected credit losses is inherently subjective due to

the forward-looking nature of the assumptions made, most notably around the

assessment over the likelihood of tenants having the ability to pay rent as

demanded, as well as the likelihood of rent deferrals and lease incentives being

offered to tenants as a result of the pandemic. The expected credit loss which

has been recognised is therefore subject to a degree of uncertainty which may not

prove to be accurate given the uncertainty caused by COVID-19. Details of the

changes made to the assessment of expected credit losses are set out in Note 10.

4) Going concern

Under Provision 30 of the UK Corporate Governance Code 2018 ("the Code"), the

Board needs to report whether the business is a going concern and identify any

material uncertainties to the Company's ability to continue to do so. The levels

of rent collection since the onset of the COVID-19 pandemic have been ahead of

base case forecasts made in June 2020 to support the going concern assessment for

the year ended 31 March 2020. However, in considering the Code's requirements,

the Investment Manager has continued to forecast prudently in particular

regarding cash flows and borrowing facilities. This twelve month forecast

indicates that:

· The Company has surplus cash to continue in operation and meet its

liabilities as they fall due;

· Interest cover covenants on borrowings are complied with;

· LTV covenants are not breached; and

· REIT tests are complied with.

This assessment was subject to sensitivity analysis, which involved flexing a

number of key assumptions and judgements included in the financial projections to

understand what circumstances would result in potential breaches of financial

covenants or the Company not being able to meet its liabilities as they fall due:

· The anticipated level of rents deferred due to the impact of the COVID-19

pandemic;

· Tenant default;

· Length of potential void period following lease break or expiry;

· Acquisition NIY, disposals, anticipated capital expenditure and the timing of

deployment of cash;

· Interest rate changes; and

· Property portfolio valuation movements.

Sensitivity analysis considered the following areas:

Covenant compliance

The Company operates four loan facilities which are summarised in Note 13. At 30

September 2020 the Company has:

· Significant headroom on lender covenants at a portfolio level, with Company

net gearing of 23.4% and a maximum LTV covenant of 35% and GBP174.1m (32% of the

property portfolio) unencumbered by the Company's borrowings; and

· Covenant waivers with certain of its lenders for the December quarter-end and

expects further covenant waivers to be made available if needed based on

discussions with each lender.

Since the Period end the Company has charged, or is in the process of charging,

five additional properties valued at GBP21.1m to alleviate short-term LTV covenant

compliance pressure on individual security pools. On charging these additional

assets each security pool will have at least 17% headroom on valuations before

LTV covenants are breached, leaving GBP153.0m of unencumbered properties available

to charge if required.

Reverse stress testing has been undertaken to understand what circumstances would

result in potential breaches of financial covenants. While the assumptions

applied in these scenarios are possible, they do not represent the Board's view

of the likely outturn, but the results help inform the Directors' going concern

assessment. The testing indicated that at a portfolio level:

· Following expiry of interest cover covenant waivers, the rate of loss or

deferral of contractual rent would need to deteriorate by a further 44% from

the levels included in the Company's forecasts to breach interest cover

covenants; and

· Property valuations would have to decrease by 29% from the 30 September 2020

position to risk breaching the overall 35% LTV covenant.

The Board notes that the September 2020 IPF Forecasts for UK Commercial Property

Investment survey suggests an average 5.0% reduction in rents during 2020 and a

1.9% decrease in 2021, with capital value decreases forecast of between 4.0% and

16.0% in 2020 and a 1.8% decrease in 2021. The Board believes that the valuation

of the Company's property portfolio will prove resilient due to its higher

weighting to industrial assets and overall diverse and high-quality asset and

tenant base comprising 161 assets and circa 200 typically 'institutional grade'

tenants across all commercial sectors.

Liquidity

At 30 September 2020 the Company has:

· GBP26.2m of cash with gross borrowings of GBP150m resulting in low net gearing,

with no short-term refinancing risk and a weighted average debt facility

maturity of seven years;

· An annual contractual rent roll of GBP39.2m, with interest costs on drawn loan

facilities of only c. GBP4.4m per annum; and

· Received 92% of rents due relating to the October - December 2020 quarter.

The Company has sufficient cash to settle its expense and interest liabilities

for a period of at least 12 months, even assuming no further rent is collected.

Liquidity is therefore not considered a key area of sensitivity for the going

concern assessment.

The Board has considered the scenario used in covenant compliance reverse stress

testing, where the rate of loss or deferral of contractual rent deteriorates by a

further 44% from the levels included in the Company's prudent forecast, with

dividends paid at the minimum required by the REIT regime. In this scenario all

financial covenants and the REIT tests are complied with and the Company has

surplus cash to settle its liabilities.

As detailed in Note 13, the Company's GBP35m RCF expires in September 2022 but can

be extended by a further two years at the lender's discretion. The Board

anticipates lender support in agreeing to the available extensions, and would

seek to refinance the RCF with another lender or dispose of sufficient properties

to repay it in September 2022 in the unlikely event of lender support being

withdrawn.

The Company's financial resilience is described in the Chairman's statement.

Having due regard to these matters and after making appropriate enquiries, the

Directors have reasonable expectation that the Company has adequate resources to

continue in operational existence for a period of at least 12 months from the

date of signing of these condensed consolidated financial statements and,

therefore, the Board continues to adopt the going concern basis in their

preparation.

5) Segmental reporting

An operating segment is a distinguishable component of the Company that engages

in business activities from which it may earn revenues and incur expenses, whose

operating results are regularly reviewed by the Company's chief operating

decision maker to make decisions about the allocation of resources and assessment

of performance and about which discrete financial information is available. As

the chief operating decision maker reviews financial information for, and makes

decisions about, the Company's investment property as a portfolio, the Directors

have identified a single operating segment, that of investment in commercial

properties.

6) Principal risks and uncertainties

The Company's assets consist of direct investments in UK commercial property. Its

principal risks are therefore related to the UK commercial property market in

general, the particular circumstances of the properties in which it is invested

and their tenants. Principal risks faced by the Company are:

· COVID-19 pandemic response;

· Loss of revenue;

· Decrease in property portfolio valuations;

· Reduced availability or increased costs of debt and complying with loan

covenants;

· Inadequate performance, controls or systems operated by the Investment

Manager;

· Regulatory or legal changes; and

· Business interruption from cyber or terrorist attack.

These risks, and the way in which they are mitigated and managed, are described

in more detail under the heading 'Principal risks and uncertainties' within the

Company's Annual Report for the year ended 31 March 2020. The Company's principal

risks and uncertainties have not changed materially since the date of that report

but the following emerging risks are discussed in more detail in the Investment

Manager's report which may change materially during the remaining six months of

the Company's financial year and will be detailed within the Company's Annual

Report for the year ending 31 March 2021:

· COVID-19 pandemic;

· Brexit; and

· Environmental.

3) Earnings per ordinary share

Basic earnings per share ("EPS") amounts are calculated by dividing net profit

for the Period attributable to ordinary equity holders of the Company by the

weighted average number of ordinary shares outstanding during the Period.

Diluted EPS amounts are calculated by dividing the net profit attributable to

ordinary equity holders of the Company by the weighted average number of ordinary

shares outstanding during the Period plus the weighted average number of ordinary

shares that would be issued on the conversion of all the dilutive potential

ordinary shares into ordinary shares. There are no dilutive instruments.

The following reflects the income and share data used in the basic and diluted

earnings per share computations:

Unaudited 6 months Unaudited 6 months Audited

to 30 Sept 2020 to 30 Sept 2019 12 months

to 31 Mar

2020

Net (16,076) 727

(loss)/profit

and diluted net

(loss)/profit

attributable to

equity holders 2,123

of the Company

(GBP000)

Net losses on 26,972 13,220 26,550

investment

property (GBP000)

EPRA net profit 10,896 13,947

attributable to

equity holders

of the Company

(GBP000) 28,673

Weighted average

number of

ordinary shares:

Issued ordinary 420,053 398,203

shares at start

of the Period

(thousands)

398,203

- 6,978

Effect of shares

issued during 11,508

the Period

(thousands)

Basic and

diluted weighted

average number

of shares

(thousands) 420,053 405,181 409,711

Basic and (3.8) 0.2 0.5

diluted EPS (p)

2.6 3.4

EPRA EPS (p) 7.0

4) Revenue

Unaudited 6 months Unaudited Audited

to 30 Sept 6 months 12 months

2020

to 30 Sept 2019 to 31 Mar

GBP000

GBP000 2020

GBP000

Rental income 19,394 19,657 40,022

from investment

property

Income from 892 838 881

recharges to

tenants

20,286 20,495 40,903

5) Finance income

Unaudited 6 months Unaudited 6 months Audited

to 30 Sept 2020 to 30 Sept 2019 12 months

GBP000 GBP000 to 31 Mar

2020

GBP000

Bank interest 27 10 36

27 10 36

6) Finance costs

Unaudited 6 Unaudited 6 Audited

months months

12 months

to 30 Sept 2020 to 30 Sept 2019

to 31 Mar

GBP000 GBP000

2020

GBP000

Amortisation of 170 148 286

arrangement fees on

debt facilities

Other finance costs 96 147 200

Bank interest 2,205 2,133 4,235

2,471 2,428 4,721

7) Income tax

The effective tax rate for the Period is lower than the standard rate of

corporation tax in the UK during the Period of 19.0%. The differences are

explained below:

Unaudited 6 Unaudited Audited

months 6 months

12

to 30 Sept 2020 to 30 Sept 2019 months

GBP000 GBP000 to 31

Mar

2020

GBP000

(Loss)/profit before (16,076) 727 2,123

income tax

Tax (benefit)/charge

on profit at a

standard rate of

19.0% (30 September

2019: 19.0%, 31 March (3,054) 138 403

2020: 19.0%)

Effects of:

REIT tax exempt 3,054 (138) (403)

rental

losses/(profits)

Income tax expense - - -

for the Period

Effective income tax 0.0% 0.0% 0.0%

rate

The Company operates as a Real Estate Investment Trust and hence profits and

gains from the property investment business are normally exempt from corporation

tax.

8) Dividends

Unaudited Unaudited 6 months Audited

6 months to 30 Sept 2019 12 months

to 30 Sept GBP000 to 31 Mar

2020 2020

GBP000 GBP000

Interim equity dividends

paid on ordinary shares

relating to the quarters

ended:

31 March 2019: 1.6375p - 6,521 6,521

30 June 2019: 1.6625p - 6,786 6,786

30 September 2019: - - 6,828

1.6625p

31 December 2019: - - 6,867

1.6625p

31 March 2020: 1.6625p 6,983 - -

30 June 2020: 0.95p 3,991 - -

10,974 13,307 27,002

All dividends paid are classified as property income distributions.

The Directors approved an interim dividend relating to the quarter ended 30

September 2020 of 1.05p per ordinary share in October 2020 which has not been

included as a liability in these interim financial statements. This interim

dividend was paid on 30 November 2020 to shareholders on the register at the

close of business on 6 November 2020.

9) Investment property

GBP000

At 31 March 2020 559,817

Impact of lease incentives 877

Additions 969

Capital expenditure 348

Disposals (2,300)

Amortisation of right-of-use asset (4)

Valuation decrease before acquisition costs (27,388)

Acquisition costs (69)

Valuation decrease including acquisition costs (27,457)

As at 30 September 2020 532,250

GBP000

At 31 March 2019 572,745

Impact of lease incentives 749

Capitalised costs relating to post Period-end 222

acquisitions

Capital expenditure 1,933

Disposals (15,325)

Amortisation of right-of-use asset (4)

Valuation decrease before acquisition costs (12,919)

Acquisition costs (222)

Valuation decrease including acquisition costs (13,141)

As at 30 September 2019 547,179

Included in investment property is GBP610k relating to right-of-use long-leasehold

assets.

The investment property is stated at the Directors' estimate of its 30 September

2020 fair value. Lambert Smith Hampton Group Limited ("LSH") and Knight Frank LLP

("KF"), professionally qualified independent valuers, valued the properties as at

30 September 2020 in accordance with the Appraisal and Valuation Standards

published by the Royal Institution of Chartered Surveyors. LSH and KF have recent

experience in the relevant location and category of the properties being valued.

The 31 March 2020 valuations for all properties were subject to a 'material

uncertainty' clause in line with prevailing RICS guidance. This clause has not

been applied to 30 September 2020 valuations.

Investment property has been valued using the investment method which involves

applying a yield to rental income streams. Inputs include yield, current rent and

ERV. For the Period end valuation, the equivalent yields used ranged from 4.7% to

12.0%. Valuation reports are based on both information provided by the Company

e.g. current rents and lease terms which are derived from the Company's financial

and property management systems are subject to the Company's overall control

environment, and assumptions applied by the valuers e.g. ERVs and yields. These

assumptions are based on market observation and the valuers professional

judgement. In estimating the fair value of the property, the highest and best use

of the properties is their current use. In response to the COVID-19 pandemic, the

Company's valuers used historical rent arrears to indicate the potential for

further short-term disruptions in tenants' trading and rental payments as well as

reflecting changes to market rents and yields. This approach means for certain

assets occupied by tenants currently not trading or with trade significantly

curtailed, the Company's valuers assumed a prospective three to six-month rental

void and applied a yield increase of 25-75bps to valuations.

10) Trade and other receivables

Unaudited as at Unaudited as at Audited

30 Sept 2020 30 Sept 2019 as at 31 Mar

2020

GBP000 GBP000

GBP000