Custodian REIT plc : Unaudited Net Asset Value as at 31 March 2020 and COVID-19 update (1032169)

April 29 2020 - 2:00AM

UK Regulatory

Custodian REIT plc (CREI)

Custodian REIT plc : Unaudited Net Asset Value as at 31 March 2020 and

COVID-19 update

29-Apr-2020 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

29 April 2020

Custodian REIT plc

("Custodian REIT" or "the Company")

Unaudited Net Asset Value as at 31 March 2020 and COVID-19 update

Custodian REIT (LSE: CREI), the UK commercial real estate investment

company, today reports its unaudited net asset value ("NAV") as at 31 March

2020, highlights for the period from 1 January 2020 to 31 March 2020 ("the

Period") and an update on the impact of the COVID-19 pandemic.

The Company's focus is on managing liquidity to mitigate the risks

associated with COVID-19 disruption and maintaining a level of income for

investors broadly linked to net rental receipts.

Financial highlights

· NAV total return per share1 for the year ended 31 March 2020 ("FY20") of

1.1% (year ended 31 March 2019 ("FY19"): 5.9%), comprising 6.2% income

(FY19: 6.1%) and a 5.1% capital decrease (FY19: 0.2% capital decrease)

· NAV per share of 101.6p (31 December 2019: 104.4p)

· NAV of GBP426.7m (31 December 2019: GBP430.2m)

· FY20 EPRA earnings per share2 7.0p (FY19: 7.3p)

· Dividend per share approved for the Period of 1.6625p payable on 29 May

2020

· FY20 dividends paid and approved of 6.65p (FY19: 6.55p)

· Net gearing3 of 22.4% loan-to-value (31 December 2019: 23.2%) comprising

cash of GBP25m and borrowings of GBP150m

· GBP9.1m of new equity raised during the Period at an average premium of

10.6% to dividend adjusted NAV per share

· Market capitalisation of GBP415.9m (31 December 2019: GBP469.7m)

Portfolio highlights

· Property value of GBP559.8m (31 December 2019: GBP571.2m), subject to a

'material uncertainty' clause in line with prevailing RICS guidance

· GBP12.5m aggregate valuation decrease (2.2% of property portfolio) for the

Period, comprising a GBP2.9m valuation increase from successful asset

management initiatives and GBP15.4m decreases due primarily to the impact of

COVID-19 on retail and alternative sectors

· EPRA occupancy4 95.9% (31 December 2019: 95.6%)

1 NAV per share movement including dividends paid and approved for the

period.

2 Profit after tax excluding net gains on investment property divided by

weighted average number of shares in issue.

3 Gross borrowings less cash (excluding rent deposits) divided by portfolio

valuation.

4 Estimated rental value ("ERV") of let property divided by total portfolio

ERV.

Net asset value

The unaudited NAV of the Company at 31 March 2020 was GBP426.7m, reflecting

approximately 101.6p per share, a decrease of 2.8p (2.7%) since 31 December

2019:

Pence per GBPm

share

NAV at 31 December 2019 104.4 430.2

Issue of equity (net of costs) 0.2 9.0

Valuation movements relating to:

- Asset management activity 0.7 2.9

- Other valuation movements (3.7) (15.4)

Net valuation movement (3.0) (12.5)

Income earned for the Period 2.3 10.0

Expenses and net finance costs for the (0.7) (3.1)

Period

Dividends paid5 (1.6) (6.9)

NAV at 31 March 2020 101.6 426.7

5 Dividends of 1.6625p per share relating to the quarter ended 31 December

2019 were paid on shares in issue throughout the Period.

The NAV attributable to the ordinary shares of the Company is calculated

under International Financial Reporting Standards and incorporates the

independent portfolio valuation as at 31 March 2020, which is subject to a

'material uncertainty' clause in line with RICS guidance, and income for the

Period, but does not include any provision for the approved dividend of

1.6625p per share for the Period to be paid on 29 May 2020.

COVID-19 impact

Commenting on the impact of COVID-19, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's discretionary

investment manager) said:

"The Period started with increased confidence in commercial property

investment following the General Election and reduced uncertainty around

Brexit. Sadly, all talk of confidence has now been eclipsed by the COVID-19

pandemic and the widespread impact on the economy in this country and

globally.

"Our response has been to prioritise protecting cash flow and to secure the

balance sheet. As a result the Company has withdrawn from two acquisitions

of regional offices on which terms had been agreed. In addition, to address

the impact of the statutory protections for commercial tenants introduced by

the UK Government, the Company has agreement in principle from its lenders

to put in place pre-emptive covenant waivers on interest cover6 to provide

the flexibility to collect rent in the most advantageous way for

medium/long-term income security, while supporting tenants and minimising

vacancies.

"It is too early to assess the long-term impact of COVID-19 on the

commercial property market but we believe it may accelerate pre-existing

trends in the use of, and investment in, commercial property. We expect to

see a further deterioration in secondary retail, an increase in demand for

flexible office space (both traditional offices, fitted out and leased

flexibly, as well as serviced offices) and a continuation of the growth of

logistics and distribution. As always, we would expect location to be a key

determinant of the future success of commercial property assets.

"In the near-term, of even more importance than the NAV derived from current

valuations is the absolute focus on rent collection, future cash flow,

ongoing asset management and the affordability of future dividends which are

all underpinned by the Company's low ongoing charges ratio7 of 1.12% and low

cost of debt of 3.0% (circa GBP4.7m interest per annum in aggregate)."

6 Historical rental income received less certain property expenses divided

by interest payable must be greater than 250%.

7 Expenses (excluding operating expenses of rental property recharged to

tenants) divided by average quarterly NAV.

Rent collection

The Investment Manager directly manages the Custodian REIT portfolio,

including rent collection, and continues to hold direct conversations with

tenants regarding the payment of rent. Some of these conversations have led

to positive asset management outcomes, including extending leases in return

for rent concessions, providing short-term cash flow relief for occupiers

and longer term income security for the Company. Importantly, at this stage,

the Company has not waived or cancelled any contractual rent and all

contractual rent remains due.

The Company's rent invoicing profile comprises quarterly in advance (on both

English and Scottish quarter days) and monthly in advance. Following

negotiations regarding the March quarter rent, the Company has agreed that a

number of tenants move from quarterly in advance to monthly in advance rent

payments, or a deferral of the March quarter's rent with a full recovery

over the next 12-18 months. Some tenants have yet to agree a payment profile

but the Investment Manager remains in active discussion with these tenants

to agree payment plans for the balance of outstanding rent.

Given the varied profile of the Company's rental invoicing, the Board

believes reporting rent collected relating to the month of April best

reflects the prevailing level of income generation from the Company's

property portfolio. To date, 74% of rent contractually due relating to the

month of April8 has been collected and 14% has been deferred by agreement

(and is therefore no longer due in April) to be paid either monthly in

arrears or to be recovered through a payment plan over the next 12-18

months.

8 Comprising payments received relating to April 2020 from: Scottish

quarterly invoicing in advance in February 2020, English quarterly invoicing

in advance in March 2020 and monthly invoicing in advance in April 2020.

Asset management

Despite the uncertainty caused by COVID-19, the Investment Manager has

remained focused on active asset management including rent reviews, new

lettings, lease extensions and the retention of tenants beyond their

contractual break clauses during the Period, completing:

· An outstanding rent review with JTF Wholesale on a trade counter in

Warrington, increasing passing rent by 20% to GBP586k, adding GBP0.9m to

valuation;

· A 10 year reversionary lease with five year break option with VP

Packaging on an industrial unit at Venture Park, Kettering, with fixed

rental increases which over time will increase passing rent by more than

20%, increasing valuation by GBP0.5m;

· A five year reversionary lease with Vertiv Infrastructure on an

industrial unit at Priory Business Park, Bedford, extending the lease to

August 2027 and increasing the valuation by GBP0.4m;

· A new 10 year reversionary lease with Arkote on an industrial unit in

Sheffield, extending the lease to February 2034 and increasing the

valuation by GBP0.2m;

· A five year lease renewal with Wienerberger on offices at Cheadle Royal

Business Park with expiry now in March 2025 and rent increasing by 10%,

increasing the valuation by GBP0.2m;

· A five year lease renewal with a 2.5 year tenant only break option with

Poundland on a high street retail unit in Portsmouth, with rent decreasing

by 50% to match the ERV, increasing the valuation by GBP0.2m;

· A five year lease renewal with a 2.5 year tenant only break option with

DHL on an industrial unit at Glasgow Airport, with rent increasing by 17%

and valuation increasing by GBP0.2m;

· A 10 year lease with five year break to Raven Valley on an industrial

unit at Metro Riverside in Gateshead at a passing rent of GBP52k per annum

in line with ERV, increasing the valuation by GBP0.2m; and

· A five year lease renewal with Holland & Barrett on a high street retail

unit in Shrewsbury with passing rent decreasing by 25% to GBP75k per annum

in line with ERV, increasing valuation by GBP0.1m.

These positive asset management outcomes have been offset by Laura Ashley

entering administration, which is expected to result in lost annual

contractual rent of GBP0.23m in total from the Company's Grantham and

Colchester assets.

The portfolio's weighted average unexpired lease term to first break or

expiry ("WAULT") decreased from 5.4 years at 31 December 2019 to 5.3 years

at the Period end, reflecting the natural elapse of time largely offset by

the successful asset management initiatives above.

Financial resilience

The Company retains its strong financial position to address the

extraordinary circumstances imposed by COVID-19, having:

· A diverse and high-quality asset and tenant base comprising 161 assets

and over 250 typically 'institutional grade' tenants across all commercial

sectors, with an occupancy rate of 95.9%;

· GBP25m of cash-in-hand with gross borrowings of GBP150m resulting in low net

gearing, with no short-term refinancing risk and a weighted average debt

facility maturity of seven years; and

· Significant headroom on lender covenants at a portfolio level, with

Company net gearing of 22.4% compared to a maximum loan to value ("LTV")

covenant of 35%.

The Company operates the following loan facilities:

· A GBP50m revolving credit facility ("RCF") with Lloyds Bank plc ("Lloyds")

expiring on 17 September 2022 with interest of between 1.5% and 1.8% above

three-month LIBOR, determined by reference to the prevailing LTV ratio of

a discrete security pool. The RCF is currently GBP35m drawn;

· A GBP20m term loan with Scottish Widows plc ("SWIP") repayable on 13

August 2025 with interest fixed at 3.935%;

· A GBP45m term loan with SWIP repayable on 5 June 2028 with interest fixed

at 2.987%; and

· A GBP50m term loan with Aviva Investors Real Estate Finance ("Aviva")

comprising:

a) A GBP35m tranche repayable on 6 April 2032 with fixed annual interest

of 3.02%; and

b) A GBP15m tranche repayable on 3 November 2032 with fixed annual

interest of 3.26%.

Each facility has a discrete security pool, comprising a number of the

Company's individual properties, over which the relevant lender has security

and covenants:

· The maximum LTV of the discrete security pool is between 45% and 50%,

with an overarching covenant on the Company's property portfolio of a

maximum 35% LTV; and

· Historical interest cover, requiring net rental receipts from each

discrete security pool, over the preceding three months, to exceed 250% of

the facility's quarterly interest liability.

The Company has GBP184.8m (33% of the property portfolio) of unencumbered

assets which could be charged to the security pools to enhance the LTV on

the individual loans.

At a portfolio level, the aggregate interest cover on borrowings was more

than 600% for the quarter ended 31 March 2020. However, interest cover

covenants on individual facilities may come under some short-term pressure

due to anticipated curtailed rental receipts. To mitigate this risk, the

Company has agreement in principle from its lenders to put in place

pre-emptive covenant waivers on interest cover for the next two quarters in

return for depositing amounts equivalent to interest payable for that period

into charged accounts.

Portfolio analysis

At 31 March 2020 the Company's property portfolio comprised 161 assets with

a net initial yield9 ("NIY") of 6.8% (31 December 2019: 6.6%). The portfolio

is split between the main commercial property sectors, in line with the

Company's objective to maintain a suitably balanced investment portfolio.

Sector weightings are shown below:

Valuation Period Weighting Weighting

valuat by by

ion income10 income10

moveme 31 Mar 31 Dec

31 Mar Weighting nt Period 2020 2019

2020 by value valuat

31 Mar ion

2020 moveme

GBPm nt

GBPm

Sector

Industrial 257.3 46% 3.1 1.2% 40% 40%

Retail 109.7 20% (5.9) (5.1%) 22% 21%

warehouse

Other11 87.4 16% (4.7) (5.1%) 17% 17%

High 52.8 9% (4.7) (8.2%) 11% 12%

street

retail

Office 52.6 9% (0.3) (0.6%) 10% 10%

Total 559.8 100% (12.5) (2.2%) 100% 100%

9 Passing rent divided by property valuation plus purchaser's costs.

10 Current passing rent plus ERV of vacant properties.

11 Includes car showrooms, petrol filling stations, children's day

nurseries, restaurants, gymnasiums, hotels and healthcare units.

During the Period we have experienced a net decline in the portfolio

valuation that broadly reflects the market trends in the differing sectors.

Industrial and logistics values have marginally strengthened by 1.2%, office

values have been broadly flat and we have seen a decline in retail values

with a greater percentage decline in high street locations (8.2%) compared

to out of town retail warehousing (5.1%). This is perhaps a reflection of

the stock selection in the Custodian REIT portfolio where retail warehouse

occupiers are predominantly value retailers and homewares/DIY, many of whom

have remained open for trading during the lockdown, even if at restricted

levels. Furthermore, the average rent across the retail warehouse portfolio

is only GBP14.31 per square foot, which represents an affordable rent for most

occupiers.

The valuation is reported on the basis of 'material valuation uncertainty'

as per the current RICS valuation standards. This does not invalidate the

valuation but, in the current extraordinary circumstances, implies that less

certainty can be attached to the valuation than otherwise would be the case.

There is a body of market evidence to support the valuations in the usual

way but, in addition, the valuers have reflected market sentiment in their

reported numbers.

The Company operates a geographically diversified property portfolio across

the UK, seeking to ensure that no one region represents an overweight

position. The geographic analysis of the Company's portfolio at 31 March

2020 was as follows:

Weighting Period Weighting Weighting

by value valuat by by

31 Mar ion income10 income10

2020 moveme 31 Mar 31 Dec

Valuation nt 2020 2019

31 Mar GBPm Period

2020 valuat

ion

moveme

nt

GBPm

Location

West 119.5 21% (3.6) (2.8%) 20% 20%

Midlands

North-West 92.6 17% (1.2) (1.3%) 17% 17%

South-East 72.9 13% (2.6) (3.5%) 13% 13%

East 67.1 12% (2.0) (2.9%) 13% 14%

Midlands

South-West 65.7 12% (2.4) (3.5%) 11% 10%

North-East 53.7 10% 0.3 0.6% 10% 10%

Scotland 47.7 8% (0.4) (0.8%) 8% 8%

Eastern 33.9 6% (0.1) (0.2%) 6% 6%

Wales 6.7 1% (0.5) (6.8%) 2% 2%

Total 559.8 100% (12.5) (2.2%) 100% 100%

For details of all properties in the portfolio please see

www.custodianreit.com/property-portfolio [1].

Equity

The Company issued 8.0m new ordinary shares of 1p each ("the New Shares")

during the Period raising GBP9.1m. The New Shares were issued at a premium of

10.6% to the unaudited NAV per share at 31 December 2019, adjusted to

exclude the dividend paid on 28 February 2020.

Dividends

The Board intends to make the fourth quarterly interim dividend payment

relating to the Period of 1.6625p per share on 29 May 2020, reflecting the

normal collection of rent for the quarter ended 31 March 2020, and

consequently meeting its target of paying an annual dividend per share for

the financial year of 6.65p (2019: 6.55p).

However, as explained earlier, we are experiencing an inevitable disruption

to cash collection in the current quarter, due to the COVID-19 pandemic, as

a number of tenants seek to defer rental payments to protect their own cash

flows. As a result, the current level of dividend is not expected to be

fully supported by net rental receipts while the COVID-19 pandemic is

impacting rent collections.

Acknowledging the importance of income for shareholders, the Company intends

to pay the next two quarterly dividends at a minimum of 0.75p per share12,

regardless of rent collection rates. Should rent collections in June and

September quarters allow, more generous dividends may be possible. Over the

course of the financial year, as deferred rents are collected, the Board

hopes it will be possible to restore the dividend to a sustainable long-term

level akin to previous years.

12 This is a target only and not a profit forecast. There can be no

assurance that the target can or will be met and it should not be taken as

an indication of the Company's expected or actual future results.

Accordingly, shareholders or potential investors in the Company should not

place any reliance on this target in deciding whether or not to invest in

the Company or assume that the Company will make any distributions at all

and should decide for themselves whether or not the target dividend yield is

reasonable or achievable.

- Ends -

Further information:

Further information regarding the Company can be found at the Company's

website www.custodianreit.com [2] or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240 8740

Imlach / Ian Mattioli MBE

www.custodiancapital.com [3]

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numis.com/funds

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, which listed on the

main market of the London Stock Exchange on 26 March 2014. Its portfolio

comprises properties predominantly let to institutional grade tenants on

long leases throughout the UK and is principally characterised by properties

with individual values of less than GBP10m at acquisition.

The Company offers investors the opportunity to access a diversified

portfolio of UK commercial real estate through a closed-ended fund. By

targeting sub GBP10m lot-size, regional properties, the Company intends to

provide investors with an attractive level of income with the potential for

capital growth.

Custodian Capital Limited is the discretionary investment manager of the

Company.

For more information visit www.custodianreit.com [2] and

www.custodiancapital.com [3].

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

Sequence No.: 60972

EQS News ID: 1032169

End of Announcement EQS News Service

1: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=be531edfb7113375e33d32944df93de5&application_id=1032169&site_id=vwd&application_name=news

2: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=44eae66ce326b2005a19503bbab5faed&application_id=1032169&site_id=vwd&application_name=news

3: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=c24dec6d0ea6c746569ddd52de0eca8d&application_id=1032169&site_id=vwd&application_name=news

(END) Dow Jones Newswires

April 29, 2020 02:00 ET (06:00 GMT)

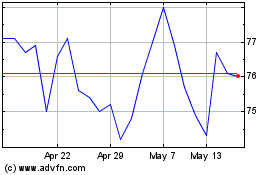

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

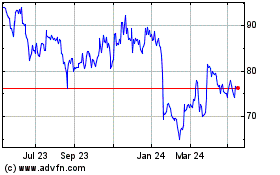

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024