Custodian REIT PLC Purchase of Property (6487P)

February 22 2016 - 2:00AM

UK Regulatory

TIDMCREI

RNS Number : 6487P

Custodian REIT PLC

22 February 2016

22 February 2016

Custodian REIT plc

("Custodian REIT" or the "Company")

Purchase of Property

Custodian REIT (LSE: CREI), the UK property investment company,

is pleased to announce a further property purchase.

The Company has acquired a 34,955 sq ft retail warehouse in

Banbury, located one mile from junction 11 of the M40 and within

walking distance of the town centre and railway station. Nearby

occupiers include Wickes, Halfords, Homebase, Dunelm Mill, Topps

Tiles and Staples.

The property is let to B&Q Plc on a lease expiring on 24

March 2022 with a current passing rent of GBP478,842 per annum,

reflecting a net initial yield of 6.94%.

The agreed purchase price of GBP6.525 million was funded from

the Company's existing debt facilities, resulting in net borrowings

increasing to 20.1% loan to value.

Commenting on the acquisition, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's discretionary

investment manager), said:

"We are delighted to have secured this property let to B&Q

which has been in occupation for 29 years. The unit is prominently

located in an established bulky goods retail warehouse pitch, near

the Banbury Cross Retail Park. The development of a proposed 42,000

sq ft Waitrose on land opposite will further strengthen the

location."

-Ends-

For further information, please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240

Imlach / Ian Mattioli 8740

www.custodiancapital.com

Numis Securities Limited

Nathan Brown / Hugh Jonathan Tel: +44 (0)20 7260 1000

www.numiscorp.com

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, which

listed on the main market of the London Stock Exchange on 26 March

2014. Its portfolio comprises properties predominantly let to

institutional grade tenants on long leases throughout the UK and is

characterised by small lot sizes, with individual property values

of less than GBP7.5 million at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By targeting smaller lot size properties, the

Company intends to provide investors with an attractive level of

income with the potential for capital growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit www.custodianreit.com and

www.custodiancapital.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQGGUMGPUPQGQB

(END) Dow Jones Newswires

February 22, 2016 02:00 ET (07:00 GMT)

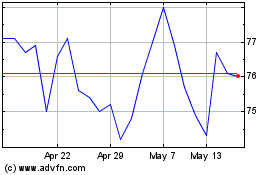

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

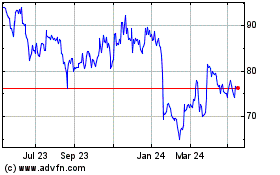

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024