TIDMCNS

RNS Number : 6359A

Corero Network Security PLC

30 September 2015

30 September 2015

Corero Network Security plc (AIM: CNS)

("Corero" or the "Company")

Interim results for the six month period ended 30 June 2015

Corero Network Security plc (AIM: CNS), the AIM listed network

security company, announces its half yearly report for the six

month period ended 30 June 2015.

Financial Highlights:

-- Revenue $4.0 million (H1 2014: revenue $3.7 million)

-- EBITDA loss* $3.5 million (H1 2014: loss $3.9 million)

-- Loss before tax $5.6 million (H1 2014: loss $5.2 million)

-- Loss per share 4.7 cents (H1 2014: loss per share 5.9 cents)

-- Net cash of $0.5 million at 30 June 2015 (30 June 2014: net cash $5.0 million)

* before depreciation, amortisation and financing costs

Operating Highlights:

-- Flagship SmartWall Threat Defense System ("TDS") order (value

of over $0.5 million) from a US internet service provider

-- Customer wins across the multiple SmartWall TDS target markets

-- SmartWall TDS trials in progress with three of the top 10 US Internet service providers

-- Key sales team appointments adding significant service provider sales experience

-- Partnership with Verisign to deliver hybrid Distributed

Denial of Service ("DDoS") protection solutions

-- New development facility in Edinburgh, Scotland

Post Balance Sheet Event:

-- On 28 August 2015 raised $7.7 million (GBP5.0 million) before

expenses by way of a subscription for 50,000,000 new ordinary

shares at a price of 10p per share

-- New funds to support ongoing SmartWall TDS development and

sales and marketing activities in the US and Europe

-- Directors contributed $3.1 million (GBP2.0 million) to the subscription

Ashley Stephenson, CEO of Corero, commented:

"We are very encouraged by the progress made in the first six

months of the year. We see this trend continuing with additional

new customer orders since the half year.

"We are now engaged in multiple trials with an increasing number

of the world's largest service providers and are encouraged by the

significant market opportunity these companies represent, whilst

recognising the impact of longer sales cycles in this particular

vertical. We believe many of these service providers will see the

value of the Corero approach to DDoS protection.

"Our focus for the second half of 2015 is on converting customer

trials to sales orders and building the pipeline of opportunities

for the SmartWall TDS. The Board remains positive about the outlook

for Corero."

Enquiries:

Corero Network Security plc

Andrew Miller, Chief Financial Tel: 01895 876382

Officer

FinnCap

Stuart Andrews/Carl Holmes (corporate Tel: 020 7220 0500

finance)

Stephen Norcross (corporate

broking)

Redleaf Communications Tel: 020 7382 4747

Rebecca Sanders-Hewett/David cns@redleafpr.com

Ison/Susie Hudson

About Corero Network Security

Corero Network Security, an organisation's First Line of

Defense(R) against Distributed Denial of Service (DDoS) attacks and

cyber threats, provide enterprises and service providers with an

additional layer of security capable of inspecting and analysing

Internet traffic and mitigating attacks. Corero products and

services enhance existing security architecture with a scalable,

flexible and responsive defence against DDoS attacks and cyber

threats before they reach the targeted IT infrastructure, allowing

online services to perform as intended. The latest addition to

Corero First Line of Defense(R) product family includes the Corero

SmartWall(R) Threat Defense System (TDS) allowing for modular,

highly scalable network visibility and DDoS defence for the Large

Enterprise, Datacentre and Hosting Provider, as well as the

Internet Service Provider.

For more information about how Corero solutions are eliminating

the DDoS challenge for organisations across the globe, visit

www.corero.com.

Interim results for the six month period ended 30 June 2015

Overview

The first half of 2015 is the first full six month reporting

period following Corero's decision in Q4 2014 to transition the

business to focus exclusively on the new SmartWall TDS product.

Highlights in the first half of 2015 include:

-- Flagship SmartWall TDS order (value of over $0.5 million) from a US service provider

o Solution comprises multiple Corero SmartWall TDS products

deployed at three regional locations with supporting SecureWatch

Analytics services for a 12-month period

o The Corero solution provides real-time DDoS protection and

analytics covering all Internet traffic arriving in the provider's

network

-- Customer wins across the multiple SmartWall TDS target markets

o Service providers, hosting providers and on-line

enterprises

-- SmartWall TDS trials in progress with three of the top 10 US Internet service providers

o Service providers are increasingly seeing the value of the

Corero approach to solving DDoS challenges through 'always on',

automatic threat protection and visibility

-- Key sales team appointments adding significant service provider sales experience

o Scott Prouty appointed Senior Vice President of Sales, North

America

o Prior to joining Corero, Prouty served as Vice President of

Service Provider Sales, North America for RedSeal Networks where he

led the sales and go-to-market strategy for building the company's

service provider customer base, which included some of the largest

service providers in North America

o Previously, at Arbor Networks, he held the position of Vice

President Sales, Americas and as founder of the sales organisation,

led the company to rapid growth

-- Partnership with Verisign to deliver hybrid DDoS protection solutions

o For Verisign and Corero customers, this integration combines

on-premises technology from Corero to defeat sub-saturating DDoS

attacks alongside cloud-based DDoS Protection Service from Verisign

for high volume and complex application layer attacks that exceed

the customer's network and resource capacity

o Together, these solutions are designed to provide

Internet-dependent organisations with scalable DDoS protection

capabilities

-- New development facility in Edinburgh, Scotland

o Adds significant security, virtualisation and software-defined

networking (SDN) expertise

o The new lab is operational and is fully integrated with the

Company's US based facility in Hudson, MA

Since the half-year, Corero has secured its largest SmartWall

TDS order to date; a $0.7m sale to a US regional service

provider.

Financial Summary

In the six months to 30 June 2015, Corero reported revenues of

$4.0 million (H1 2014: $3.7 million) and an EBITDA loss of $3.5

million (H1 2014: loss $3.9 million). The EBITDA loss is net of

capitalised R&D of $1.1 million relating to incremental feature

development of the SmartWall TDS product, a reduction over H1 2014

capitalised R&D of $2.2 million following the completion of the

initial SmartWall TDS product development in June 2014. Operating

costs net of capitalised R&D were $5.9 million (H1 2014: $6.3

million) and below the prior year reflecting the lower headcount in

the period. This was as a result of the skills rebalancing in the

second half of 2014 as the development efforts were focused on

enhancements to the SmartWall TDS DDoS defence capability following

general availability release of the SmartWall TDS in mid-2014.

The loss before taxation was $5.6 million (H1 2014: loss $5.2

million) including amortisation of capitalised R&D of $1.1

million (H1 2014: $0.2 million) reflecting a full six month's

amortisation following the first sale of the new SmartWall TDS

product in June 2014. The reported loss per share was 4.7 cents (H1

2014: 5.9 cents).

Corero had cash of $1.1 million at 30 June 2015 (2014: $5.4

million) and net cash of $0.5 million (2014: net cash of $5.0

million). The net reduction in cash from operating activities in

the 6 months ended 30 June 2015 was $4.1 million (H1 2014: net

reduction $2.1 million).

Post Balance Sheet Event

On 28 August 2015, the Company raised $7.7 million (GBP5.0

million) (before expenses), of which the Directors contributed $3.1

million (GBP2.0 million). The fundraising was completed by way of a

subscription for 50,000,000 new ordinary shares at a price of 10p

per share, to support SmartWall TDS sales and marketing activities

in North America and Europe, and the further development of the

SmartWall TDS product.

Market Opportunity

Corero is continuing to see a shift in enterprises looking to

their service providers for delivery of protection against DDoS

attacks. The Company's SmartWall TDS products enable it to address

the growing service provider demand for DDoS protection

solutions.

Despite longer sales cycles in the large service provider

market, the opportunity in this segment is larger than Corero had

originally anticipated. Demand is being driven by the immediate

need for next generation technology solutions to deliver DDoS and

cyber threat protection services to service provider customer bases

and also to protect the growing Cloud services infrastructure from

the impact of DDoS and cyber threats. Corero believes traction in

this market segment would be transformational for the success of

the Company.

Outlook

Based upon the growing level of interest and increasing number

of significant proof of concept trials, and the significant

customer win since the half-year, the outlook for the SmartWall TDS

product offering is very encouraging.

The Board remains confident in the Company's prospects and look

forward to updating the market on its continued progress.

Consolidated Interim Statement of Comprehensive Income

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:02 ET (06:02 GMT)

for the six month period ended 30 June 2015

Unaudited six months ended 30 Unaudited six months ended 30 Audited year ended 31

June June December

2015 2014 2014

$'000 $'000 $'000

Revenue 4,032 3,672 7,477

Cost of sales (1,674) (1,226) (3,372)

------------------------------ ------------------------------ ----------------------

Gross profit 2,358 2,446 4,105

------------------------------ ------------------------------ ------------------------------ ----------------------

Operating expenses before

highlighted item (5,856) (6,338) (11,250)

Depreciation and

amortisation of intangible

assets (2,116) (1,313) (3,272)

------------------------------ ------------------------------ ------------------------------ ----------------------

Operating expenses (7,972) (7,651) (14,522)

Operating loss (5,614) (5,205) (10,417)

Finance income 8 11 22

Finance costs (13) (17) (24)

------------------------------ ------------------------------ ----------------------

Loss before taxation (5,619) (5,211) (10,419)

Taxation 191 186 358

------------------------------ ------------------------------ ----------------------

Loss for the period (5,428) (5,025) (10,061)

Other comprehensive

(expense)/income

Difference on translation of

UK functional currency

entities (109) 233 (479)

Total comprehensive expense

for the period (5,537) (4,792) (10,540)

------------------------------ ------------------------------ ----------------------

Total loss for the period

attributable to:

Equity holders of the parent (5,428) (5,025) (10,061)

Total (5,428) (5,025) (10,061)

------------------------------ ------------------------------ ----------------------

Total comprehensive expense

for the period attributable

to:

Equity holders of the parent (5,537) (4,792) (10,540)

Total (5,537) (4,792) (10,540)

------------------------------ ------------------------------ ----------------------

Basic and diluted loss

per share

31 December

30 June 30 June 2014

2015 2014

Cents Cents Cents

Basic and diluted loss

per share (4.7) (5.9) (11.5)

-------- ---------- ------------

Consolidated Interim Statement of Financial Position

as at 30 June 2015

Unaudited six months ended Unaudited six months ended Audited year ended 31

30 June 30 June December

2015 2014 2014

$'000 $'000 $'000

Assets

Non-current assets

Goodwill 17,983 17,983 17,983

Acquired intangible assets 938 2,071 1,548

Capitalised development

expenditure 8,553 8,066 8,624

Property, plant and

equipment 1,072 1,333 1,175

28,546 29,453 29,330

Current assets

Inventories 466 518 749

Trade and other receivables 2,420 2,247 2,811

Cash and cash equivalents 1,128 5,386 6,036

---------------------------- ---------------------------- ----------------------------

4,014 8,151 9,596

Liabilities

Current Liabilities

Trade and other payables (2,291) (2,118) (2,362)

Borrowings (653) (406) (20)

Deferred income (3,460) (3,087) (4,055)

(6,404) (5,611) (6,437)

Net current

(liabilities)/assets (2,390) 2,540 3,159

Non-current liabilities

Deferred income (965) (2,110) (1,570)

Deferred taxation (276) (639) (467)

---------------------------- ---------------------------- ----------------------------

(1,241) (2,749) (2,037)

---------------------------- ---------------------------- ----------------------------

Net assets 24,915 29,244 30,452

---------------------------- ---------------------------- ----------------------------

Equity

Ordinary share capital 1,804 1,333 1,804

Capital redemption reserve 7,051 - -

Deferred share capital* - 7,051 7,051

Share premium 50,000 43,507 50,000

Share options reserve 285 293 285

Translation reserve 605 1,426 714

Retained earnings (34,830) (24,366) (29,402)

---------------------------- ---------------------------- ----------------------------

Total equity 24,915 29,244 30,452

---------------------------- ---------------------------- ----------------------------

*On 17 June 2015 the Company purchased the entire deferred share

capital of 1,518,900 GBP2.99 shares for a consideration of 1p. The

deferred shares were subsequently cancelled on 22 June 2015.

Consolidated Interim Statement of Cash Flows

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:02 ET (06:02 GMT)

for the six month period ended 30 June 2015

Unaudited six months ended Unaudited six months ended Audited year ended 31

30 June 30 June December

2015 2014 2014

Cash flows from operating

activities $'000 $'000 $'000

Loss for the period (5,428) (5,025) (10,061)

Adjustments for:

Amortisation of acquired

intangible assets 613 612 1,229

Amortisation of capitalised

development expenditure 1,140 228 1,118

Depreciation 363 473 925

Finance income (8) (11) (22)

Finance expense 13 17 24

Taxation (191) (186) (358)

Share based payment credit - - (8)

Decrease/(increase) in

inventories 283 (189) (334)

Decrease in trade and other

receivables 391 1,483 893

(Decrease)/increase in

payables (1,271) 504 1,234

---------------------------- ---------------------------- ----------------------------

Net cash from operating

activities (4,095) (2,094) (5,360)

Cash flows from investing

activities

Purchase of intangible

assets (3) (48) (142)

Capitalised development

expenditure (1,069) (2,173) (3,621)

Purchase of property, plant

and equipment (260) (463) (844)

Net cash used in investing

activities (1,332) (2,684) (4,607)

Cash flows from financing

activities

Net proceeds from issue of

ordinary share capital - - 6,964

Finance income 8 11 22

Finance expense (13) (17) (24)

Receipt/(repayment) of

credit facility 633 149 (236)

---------------------------- ---------------------------- ----------------------------

Net cash from financing

activities 628 143 6,726

Effects of exchange rates on

cash and cash equivalents (109) 246 (498)

Net decrease in cash and

cash equivalents (4,908) (4,389) (3,739)

Cash and cash equivalents at

1 January 6,036 9,775 9,775

---------------------------- ---------------------------- ----------------------------

Cash and cash equivalents at

balance sheet dates 1,128 5,386 6,036

---------------------------- ---------------------------- ----------------------------

Consolidated Interim Statement of Changes in Equity

for the six month period ended 30 June 2015

2002 Total

attributable

Capital Share Share to equity

Share redemption premium options Translation Retained holders of

capital reserve account reserve reserve earnings the parent

$'000 $'000 $'000 $'000 $'000 $'000 $'000

1 January 2014 8,384 - 43,507 293 1,193 (19,341) 34,036

Loss for the period - - - - - (5,025) (5,025)

Other comprehensive income - - - - 233 - 233

-------- ----------- -------- -------- ------------ --------- -------------

Total comprehensive expense for the period - - - - 233 (5,025) (4,792)

30 June 2014 8,384 - 43,507 293 1,426 (24,366) 29,244

Loss for the period - - - - (5,036) (5,036)

Other comprehensive income - - - - (712) - (712)

Total comprehensive expense for the period - - - - (712) (5,036) (5,748)

Contributions by and distributions to owners

Share based payments - - - (8) - - (8)

Issue of share capital 471 - 6,493 - - - 6,964

Total contributions by and distributions to owners 471 - 6,493 (8) - - 6,956

31 December 2014 8,855 - 50,000 285 714 (29,402) 30,452

Loss for the period - - - - - (5,428) (5,428)

Other comprehensive income - - - - (109) - (109)

-------- ----------- -------- -------- ------------ --------- -------------

Total comprehensive expense for the period - - - - (109) (5,428) (5,537)

-------- ----------- -------- -------- ------------ --------- -------------

Contributions by and distributions to owners

Buy back of deferred shares (7,051) - - - - - (7,051)

Creation of capital redemption reserve* - 7,051 - - - - 7,051

-------- ----------- -------- -------- ------------ --------- -------------

Total contributions by and distributions to owners (7,051) 7,051 - - - - -

-------- ----------- -------- -------- ------------ --------- -------------

30 June 2015 1,804 7,051 50,000 285 605 (34,830) 24,915

-------- ----------- -------- -------- ------------ --------- -------------

* the capital redemption reserve arose as result of the

Company's purchase of the entire deferred share capital of

1,518,900 GBP2.99 shares for a consideration of 1p on 17 June 2015

and subsequent cancellation on 22 June 2015.

Notes to the interim financial statements

1. General information and basis of preparation

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:02 ET (06:02 GMT)

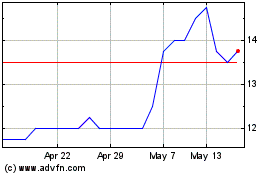

Corero Network Security (LSE:CNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

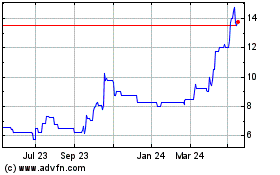

Corero Network Security (LSE:CNS)

Historical Stock Chart

From Jul 2023 to Jul 2024