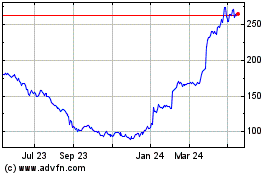

TIDMCMCX

RNS Number : 2375O

CMC Markets Plc

09 June 2022

9 June 2022

CMC MARKETS PLC

("CMC" or the "Company")

Final results for the year ended 31 March 2022

2022 net operating income at top end of guidance. Embarking on

new phase of diversification. Targeting 30% net operating income

growth over three years.

31 March 31 March Change 31 March Change

For the year ended 2022 2021 % 2020 %

Net operating income (GBP

million) 281.9 409.8 (31%) 252.0 12%

Leveraged net trading revenue

(GBP million) 229.6 349.2 (34%) 214.5 7%

Non-leveraged net trading

revenue (GBP million) 48.0 54.8 (12%) 31.8 51%

Other income (GBP million) 4.3 5.8 (25%) 5.7 (24%)

Profit before tax (GBP million) 92.1 224.0 (59%) 98.7 (7%)

Basic earnings per share (pence) 24.8 61.5 (60%) 30.1 (18%)

Dividend per share (pence) 12.4 30.6 (60%) 15.0 (18%)

==================================== ========= ========= ======= ========= =======

Leveraged gross client income

(GBP million) 288.5 335.3 (14%) 240.6 20%

Leveraged client income retention 80% 104% (24%) 89% (9%)

Leveraged active clients (numbers) 64,243 76,591 (16%) 57,202 12%

Leveraged revenue per active

client (GBP) 3,575 4,560 (22%) 3,750 (5%)

------------------------------------ --------- --------- ------- --------- -------

Non-leveraged active clients

(numbers) 246,120 232,053 6% 181,630 36%

------------------------------------ --------- --------- ------- --------- -------

Notes:

- Net operating income represents total revenue net of

introducing partner commissions and levies

- Leveraged net trading revenue represents CFD and spread bet

gross client income net of rebates, levies and risk management

gains or losses

- Non-leveraged net trading revenue represents stockbroking revenue net of rebates

- Leveraged gross client income represents spreads, financing

and commissions charged to clients (client transaction costs)

- Leveraged active clients represent those individual clients

who have traded with or held a CFD or spread bet position with CMC

Markets on at least one occasion during the 12-month period

- Leveraged revenue per active client represents leveraged net

trading revenue from active clients after deducting rebates and

levies

Highlights

-- Net operating income of GBP282 million is at the top end of

guidance and a record performance outside of the pandemic

restrictions.

-- Investment in growth initiatives is expected to result in a

30% increase in net operating income over the next three years.

Benefits to be seen from 2023 and are set to deliver profit before

tax margin expansion from 2024.

-- Operating expenses have increased by 2% to GBP188 million,

primarily due to higher personnel costs to support the ongoing

strategic initiatives, partly offset by lower sales costs.

-- Profit before tax of GBP92 million (2020: GBP224 million).

-- Underlying liquidity remains strong. Regulatory OFR ratio of

489%. Net available liquidity improvement to GBP246 million (2021:

GBP211 million).

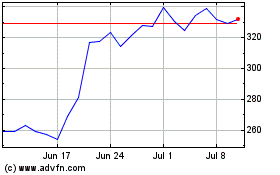

-- The GBP30 million share buyback commenced on 15(th) March. As

of 7(th) June, the Company has repurchased and cancelled 4,603,703

Ordinary Shares with nominal value of 25 pence for an aggregate

purchase amount of GBP12.7 million.

Outlook and dividend

-- Alongside our focus on delivering strong business performance

in 2023 new business expansion is expected to grow net operating

income by 30% over next three years based on the 2022 result and

underlying conditions. The targeted growth is expected to be

broadly linear over that period with benefits expected in 2023.

-- New investments will focus on seven core initiatives aiming

to enhance functionality and capture the broader wallet share as we

evolve our execution services and investment platforms. We will

continue to utilise our technology to enter new markets and expand

our non-leveraged offering. The impact will reduce revenue

volatility and grow pre-tax profit margins from 2024.

-- Our 2023 investment plans are expected to increase operating

costs to approximately GBP205 million excluding variable

remuneration, underpinning the expected 30% growth in underlying

net operating income by 2025 as well as longer-term growth from the

UK non-leveraged business. Over two thirds of the new investment

will be associated with people, product development and marketing.

The rate of spending will be dependent on the Group's ability to

make additional personnel hires.

-- CMC Invest Australia continues to expand and invest in its

market-leading offering, with reinvestment in mobile and a complete

UX redesign. Singapore expansion is on track and planned for

2023.

-- CMC's leveraged B2B offering continues to perform well,

delivering 60% client income growth in 2022 versus 2021. CMC is

expecting future 20% CAGR in B2B client income. B2B expansion

continues to be a major growth pillar.

-- CMC Invest UK: the new UK non-leveraged platform has been

successfully soft launched to staff and will be rolled out to new

clients over coming months.

-- The Board recommends a final dividend of 8.88 pence per share

(FY 2021: 21.43 pence), equating to GBP26 million, resulting in a

total dividend payment for the year of 12.38 pence per share (FY

2021: 30.63 pence).

Lord Cruddas, Chief Executive Officer commented:

"I am delighted to report another year of impressive performance

from both a strategic and financial standpoint. Excluding the

exceptional COVID-19 impacted prior year, which due to market

volatility saw unusually significant trading volumes, this is a

record net operating income result for the Group.

Over the last year we have taken steps to define the strategic

direction and diversification of the Group, building on our

existing technology to launch a new investment platform that will

unlock significant shareholder value and challenge the existing

client transaction fee cost structures.

There is significant opportunity and growth potential in the

self--directing investment platform space, especially in the UK,

not just for improved technology but also transaction costs and

fees. We believe commissions, execution spreads and custodial fees

are too high and too expensive for retail investors. We will

utilise our platform technology, including pricing and execution,

to drive down the transaction costs of investments for retail

clients, just like we did in Australia, where we are the number two

investment platform for retail investors.

The business is evolving. We continue to improve and grow our

existing leveraged business whilst at the same time utilising our

technology to enter new markets and expand our non-leveraged

offering.

I look forward to providing further updates as the strategy

expands over both the short and long-term."

Analyst and Investor Presentation

A presentation will be held for equity analysts and investors

today at 10.00 a.m. (BST), note questions will only be taken over

the conference call line.

A live audio webcast of the presentation will be available via

the following link:

https://webcasts.cmcmarkets.com/results/2022fullyear

Alternatively, you can dial into the presentation by registering

via the following link:

https://webcasts.cmcmarkets.com/results/2022fullyear/vip_connect

Annual Report and Financial Statements

A copy of the Company's Annual Report and Financial Statements

for the year ended 31 March 2022 (the "2022 Annual Report and

Financial Statements") is available within the Investor Relations

section of the Company website

http://www.cmcmarkets.com/group/results/annual-reports

Pursuant to Listing Rule 9.6.1 the Company has submitted a PDF

of the 2022 Annual Report and Financial Statements to the National

Storage Mechanism which will shortly be available for inspection

at: https://data.fca.org.uk/#/nsm/nationalstoragemechanism . A

version in single electronic reporting format will be uploaded in

due course and the Company will make a further announcement when

this is available.

In compliance with The Disclosure Guidance and Transparency

Rules (DTR) 6.3.5, the information in the document below is

extracted from the Company's 2022 Annual Report and Financial

Statements. This material is not a substitute for reading the 2022

Annual Report and Financial Statements in full and any page numbers

and cross references in the extracted information below refer to

page numbers and cross-references in the 2022 Annual Report and

Financial Statements.

Forthcoming announcement dates

Friday 29 July 2022 Q1 2023 trading update

Friday 7 October 2022 H1 2023 pre-close trading update

Enquiries

CMC Markets Plc

James Cartwright, Investor Relations

Euan Marshall, Chief Financial Officer

investor.relations@cmcmarkets.com

Media enquiries

Camarco

Geoffrey Pelham-Lane / Jennifer Renwick Tel: 020 3757 4994

Notes to Editors

CMC Markets plc ("CMC"), whose shares are listed on the London

Stock Exchange under the ticker CMCX (LEI: 213800VB75KAZBFH5U07),

was established in 1989 and is now one of the world's leading

online financial trading businesses. The company serves retail and

institutional clients through regulated offices and branches in 12

countries, with a significant presence in the UK, Australia,

Germany and Singapore. The Group offers an award-winning, online

and mobile trading platform, enabling clients to trade over 10,000

financial instruments across shares, indices, foreign currencies,

commodities and treasuries through contracts for difference

("CFDs") and financial spread bets (in the UK and Ireland only).

Clients can also place financial binary bets through Countdowns

and, in Australia, access stockbroking services. More information

is available at http://www.cmcmarkets.com/group/

Forward Looking Statements

This announcement and Appendix may include statements that are

forward looking in nature. Forward looking statements involve known

and unknown risks, assumptions, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Group to be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements. Except as required by the Listing Rules and

applicable law, the Group undertakes no obligation to update,

revise or change any forward looking statements to reflect events

or developments occurring after the date such statements are

published.

CHAIRMAN'S STATEMENT

Our strategic investments in technology, client service,

professional and institutional clients and income diversification

through new products, have led to a strong financial performance in

2022. This performance, along with the launch of the CMC Invest

platform in the UK, provides the Group with a strong base from

which we can continue to focus on innovation and agile and

responsive technology development.

The Board's clear vision of the Group's strategy of income

diversification through adapting and building on our superior

technology is starting to crystallise. The benefits of the Group's

strategy are becoming more apparent. Through engagement with

clients and the expertise of our staff, the Group is continuing to

develop clear opportunities for significant growth within all of

our markets.

Throughout all parts of the product development process, we

engage with clients to provide input into improvements that can be

made to our products and propositions. In addition, we have made

significant progress on initiatives to improve staff engagement.

The combination of engaged clients and employees results in a

robust and agile business focusing on medium to long-term value

generation, which supports our purpose, values and strategy.

Results and dividend

Net operating income fell 31% to GBP281.9 million; however, when

excluding the exceptional COVID-19 affected 2021, the Group

generated an increase in net operating income of 12% on 2020. This

is a strong result for the Group, as it represents a record year

outside of 2021.

The strong net operating income performance has generated

profits after tax of GBP72.0 million. The Board recommends a final

dividend of 8.88 pence per share which results in a total dividend

payment of 50% of profits after tax.

Board and governance

As discussed in the 2021 Annual Report and Financial Statements,

the Board conducted an internal governance review in 2021,

resulting in the appointment of external advisers, Independent

Audit, in January 2021. This review was concluded within 2022,

resulting in very positive changes to the information the Board

receives, improvements in the scope of the Nomination Committee

including greater involvement in people strategy, and improvements

in ownership and presentation of the Group's risk information. More

information on the changes can be found on pages 66, 74 and 76 in

the 2022 Annual Report and Financial Statements.

We are sorry to lose Clare Salmon, who is not putting herself up

for re-election this year, but also welcome Susanne Chishti, who

brings a diverse view of developments and trends in the wider

consumer technology environment. We are also seeking, via agents, a

further Non-Executive Director to cover the gap left by Clare's

departure, further details of which can be found on page 76 of the

Nomination Committee report in the 2022 Annual Report and Financial

Statements.

People and stakeholders

Our staff are our greatest asset and their work on delivering

against our strategic initiatives has driven the strong performance

across all business lines, along with delivering new products and

features to communicated timescales. On behalf of the Board, I

would like to thank them all for their considerable

contribution.

In addition, our staff have shown incredible resilience and

flexibility when faced with travel and work restrictions caused by

the COVID-19 pandemic, and have continued to do so throughout this

year. No staff were furloughed and the Group did not request any

government COVID-19 assistance. More details of what we have been

doing are presented in the Sustainability section of the 2022

Annual Report and Financial Statements.

Financial Reporting Council

During the year to 31 March 2022 the Board received

correspondence from the Financial Reporting Council ("FRC")

concerning a potential unlawful dividend payment in respect of the

payment of the 2021 interim dividend. On further investigation by

the Company it was concluded that similar questions had arisen in

some prior years. Details of this and the rectification process for

addressing these issues are set out on page 101 in the Directors'

Report in the Annual Report and Financial Statements. The Company

has made certain changes to internal processes to ensure that these

irregularities do not arise again.

Outlook

Our focus on improving and building on our existing technology

underpins our strategy of exploiting our existing leveraged

technology with both new and improved products and expanding into

new geographies in our non-leveraged business.

The strengths and robustness of our technology have been

demonstrated through the white-label agreement for Australia and

New Zealand Banking Group Limited ("ANZ"), culminating in the

announcement of the acquisition of its Share Investing clients.

The strategy also forms the foundation for the launch of our new

UK non-leveraged investment platform in April 2022. The new

platform is being rolled out to the market over the coming year and

augurs well for the Group's future. Our clear focus on revenue

diversification will continue throughout the coming year as will

our assessment of how best to address the realisation of future

value for the two broadly different businesses, namely leveraged

and non-leveraged, both underpinned by our technology.

James Richards

Chairman

8 June 2022

CEO REPORT

We continue to expand and diversify the business into new asset

classes including the launch of a new investment platform in the UK

and the development of a new investment platform in Singapore.

This follows the success of our investment platform in Australia

with the migration of over 500,000 investing client accounts

through partnerships (B2B) and the acquisition of the ANZ Bank

investing business.

We have ambitious plans to continue this expansion in various

other countries and I look forward to updating investors as the

strategy expands over the short and long term.

Investing for the future

Over the last year we have taken steps to define the strategic

direction and diversification of the Group, building on our

existing technology to launch new investment platforms that will

unlock significant shareholder value and challenge the existing

client transaction fee cost structures.

There is significant opportunity and growth potential in the

self -- directed investment platform space, especially in the UK,

not just for improved technology and client experience but also

transaction costs and fees.

We believe commissions, execution spreads and custodial fees are

too high and too expensive for retail investors. We will utilise

our platform technology, including pricing and execution, to drive

down the transaction costs of investments for retail clients, just

like we did in Australia, where we are the number two investment

platform for retail investors.

CMC is a pioneer of platform technology and boasts over 25 years

of experience in providing technology-backed solutions for B2C and

B2B clients and partners. This gives us scale, leverage and the

ability to drive down transaction costs, as well as the ability to

launch new platforms and enter new markets quickly.

For example, our new UK investment platform, CMC Invest, was

launched ahead of time and on budget. It was launched to our UK

staff in April 2022 and will be available to the broader market

over the coming summer months.

It will include physical shares, multi-currency accounts, tax

wrapper products and third-party funds, cryptocurrencies and, in

due course, a full B2B offering.

In addition, we continue to look at expanding our non-leveraged

geographical diversification and we have recently announced we plan

to launch a new investment platform in Singapore within the next

year, as well as considering two other jurisdictions for launch in

2024.

As part of CMC's strategy, we announced the acquisition of

Australia and New Zealand Banking Group Limited's ("ANZ's") Share

Investing client base during the year. The transaction involved the

acquisition of approximately 500,000 ANZ Share Investing clients,

with total assets in excess of AUD$43 billion.

The CMC platform will offer ANZ clients a wide range of

additional benefits; these include access to enhanced

market-leading mobile apps and complementary education tools and

resources, as well as lower brokerage commissions across four major

international markets and the local Australian market.

The Group continues to progress the transition of clients, which

is expected to complete in the next 12 months.

Because of the growing diversification of the Group the Board

has begun an evaluation of the merits of a managed separation of

its leveraged and non-leveraged divisions to unlock further

shareholder value. This process is being led by the Chairman and

the Board and they will update investors later in the year.

Financial performance

As expected, against an extremely strong prior period, revenues

across our leveraged retail (B2C) businesses declined, compared to

the COVID-19 period.

In our non-leveraged business, revenues remained less volatile.

Client income retention remained strong, and the stockbroking

business continued to see growth in active clients and contributed

a material level of revenue and profitability for the Group.

Overall, Group net operating income decreased 31% versus the

prior period, to GBP281.9 million, but increased 12% versus 2020

(GBP252.0 million).

The Group's cost base excluding variable remuneration increased

by 3% to GBP173.1 million during the year, mainly as a result of

the significant investments in people and technology and increased

marketing spend to attract new clients.

Variable remuneration decreased by GBP1.7 million to GBP14.5

million following the record performance and associated

remuneration last year. Overall, total costs increased by 2% to

GBP189.8 million.

Against an exceptional prior year comparator, profit before tax

at GBP92.1 million was GBP131.9 million lower than the previous

year, and GBP6.6 million lower than 2020. Our dividend policy

remains unchanged, at 50% of profit after tax, therefore resulting

in a proposed final dividend per share of 8.88 pence.

The underlying fundamentals of the business remain well

supported; we continue to target and retain higher value,

sophisticated clients and we have seen levels of client money,

which are an indicator of future trading potential, remain close to

the record levels seen in the prior year. Stockbroking active

clients increased 6% to 246,120. Of this increase, stockbroking B2C

clients increased 21% to 56,205, with B2B increasing by 2% to

189,915.

The balance sheet continues to reflect the strong financial

position of the Group. At the end of the year, the Group's net

available liquidity was GBP245.9 million and the regulatory OFR

ratio was 489%.

Regulatory change

The Australian Securities and Investments Commission ("ASIC")

implemented measures relating to CFDs on 29 March 2021. After the

introduction of these new measures, regulatory conditions are now

more harmonised globally and we can continue to focus on growing

our business in an industry where regulatory arbitrage is reduced.

As anticipated, the changes reduced the notional value of retail

client trading in Australia and, combined with lower market

volatility, resulted in less active client trading than in the

prior period. In April 2022, ASIC extended its product intervention

order, imposing conditions on the issue and distribution of CFDs

for a further five years to 23 May 2027, thereby improving

regulatory visibility.

People & sustainability

Our people are crucial to our success, and I continue to be

impressed by their hard work and dedication. We have a very strong

team across all our business units and on behalf of the Board I

would like to thank all of our people for their commitment,

especially through the COVID-19 pandemic.

How we as a business and our people interact with each other,

the environment and society is important. CMC recognises that the

Group has a duty to help improve the prospects and living

environment of the local community. Sustainability and social

awareness are part of our core values and culture. I'm proud of the

launch of our "Our Tomorrow: taking a positive position" strategy,

detailing the five core pillars of what we stand for at CMC from a

sustainability perspective.

Clients

Our clients are at the heart of everything we do as we continue

to develop our platforms, innovate and invest to ensure that our

user experience is industry leading as we drive client retention

and lifetime value. On top of our continued focus on our leveraged

clients, I am pleased to welcome approximately 500,000 new clients

to our Australian stockbroking business as they transition from ANZ

Share Invest and look forward to offering them new functionality

and an enhanced experience.

I also look forward to welcoming new clients to our UK

non-leveraged wealth platform, where we will strive to partner with

new investors over the longer term to help them achieve prosperity

at every stage of their lives.

Share buyback programme

On 15 March 2022, the Company commenced a share buyback

programme of up to GBP30 million. The Board's decision to undertake

the buyback was underpinned by the Company's robust capital

position and having considered the capital and liquidity

requirements for ongoing investment in the business. This buyback

programme forms part of a normal balanced approach to shareholder

returns alongside the current dividend policy. The share buyback

programme is progressing well and remains on track to be completed

no later than 30 June 2023.

Dividend

The Board recommends a final dividend payment of GBP25.8

million. This is 8.88 pence per share (2021: 21.43 pence),

resulting in a total dividend payment for the year of 12.38 pence

per share (2021: 30.63 pence). This represents a payment of 50% of

profit after tax, in line with policy. The Board believes that this

is an appropriate payment for the year after considering both the

Group's capital and liquidity position and forecast requirements in

the year ahead to support business growth.

Outlook

We continue to see a lot of uncertainty, not just in the

financial markets, but across all sectors and industries. If recent

years have taught us anything it is that we must be prepared for

the unexpected and the extraordinary.

Our platforms have demonstrated that in periods of extreme

volatility, they are able to continue servicing clients robustly,

enabling us to gain trust and a reputation of stability. The

investments made in our infrastructure have served us well and will

continue to do so, providing a solid foundation upon which we can

look to take advantage of future opportunities.

This year's performance reflects the ongoing success of our B2B

technology partnerships and focus across our leveraged and non --

leveraged businesses.

With a large addressable market, in terms of both client numbers

and AuA, there is a huge opportunity for us to grow with a more

predictable and stable revenue stream.

This business continues to change as we look to utilise our

technology to enter new markets and new geographies and expand our

non-leveraged offering. I look forward to updating investors as the

strategy expands over both the short and long term.

Lord Cruddas

Chief Executive Officer

8 June 2022

Financial review

2022 saw a significant decrease in market activity, particularly

during H1, from the exceptional levels seen during 2021. Whilst

this has resulted in lower net operating income for the Group, we

are in a stronger position when comparing to pre -- pandemic

performance. This has been driven primarily by the material

increase in sustained monthly active leveraged and non -- leveraged

clients when compared to 2020.

Decreased market volatility, and the resulting lower client

trading activity across both the leveraged and non-leveraged

businesses, combined with lower client income retention compared to

the exceptional levels seen in 2021, resulted in 2022 net operating

income of GBP281.9 million. This, combined with a moderate increase

in operating expenses from investment in technology and product,

resulted in a statutory profit before tax of GBP92.1 million (2021:

GBP224.0 million). Whilst net operating income and profit before

tax have reduced from 2021, the performance of the Group in 2022

was strong compared to pre-COVID-19 levels and is a record net

operating income year when excluding the COVID-19 influenced 2021

results. The overall health of the Group remains exceptionally

strong, with the step-change in active client numbers achieved in

2021 continuing in both our leveraged and non-leveraged businesses

throughout the year, combined with client AuM and AuA reaching

record highs, providing a solid base of future profitability and

growth for the Group.

The cohort of clients onboarded during the pandemic displays

similar characteristics, including quality and tenure, to those of

prior client cohorts, giving the Group confidence of retaining this

ongoing stronger and larger client base into the medium term. This,

in conjunction with the agreed acquisition of ANZ Bank Share

Investing clients in the Australian non-leveraged business, the

launch of our CMC Invest platform in the UK and the ongoing focus

on improving our institutional product offering, sees the Group

exiting the year with significant prospects for diversified

growth.

Whilst total capital resources decreased to GBP311.5 million

(2021: GBP323.1 million) as a result of the increase in intangible

assets and proposed capital distributions to shareholders, the

Group OFR ratio remains strong at 489%. Our total available

liquidity increased to GBP469.0 million (2021: GBP456.1 million)

primarily due to cash generated from operations. This healthy

capital and liquidity position is reflected in the launch of the

GBP30 million share buyback programme in March 2022. The buyback

programme should be considered as part of a normal balanced

approach to shareholder returns alongside the current dividend

policy, which is unchanged.

The ambitious digital transformation and technology investment

plan we embarked upon during 2021 has made significant progress

throughout 2022 with more frequent product enhancements along with

the new CMC Invest platform launched in the UK in April 2022. Our

non-leveraged business presents a significant growth opportunity

for the Group, and we will continue to invest in the product and

platform, both in the UK and in other geographies, over the coming

years. In addition, there are still significant areas of

opportunity for optimisation and enhancement within the leveraged

business, particularly for our institutional business, and

investment will continue in technology and product throughout

2023.

Summary income statement

GBPm 2022 2021 Change Change %

Net operating income 281.9 409.8 (127.9) (31%)

Operating expenses (187.6) (184.0) (3.6) (2%)

================================ ======== ======== ======== =========

Operating profit 94.3 225.8 (131.5) (58%)

Finance costs (2.2) (1.8) (0.4) (24%)

================================ ======== ======== ======== =========

Profit before taxation 92.1 224.0 (131.9) (59%)

================================ ======== ======== ======== =========

PBT margin (1) 32 .7% 54 .7% (22.0%) -

================================ ======== ======== ======== =========

Profit after tax 72.0 178.1 (106.1) ( 60%)

================================ ======== ======== ======== =========

Pence 2022 2021 Change Change %

Basic EPS 24.8 61.5 (36.7) (60%)

Ordinary dividend per share(2) 12.4 30.6 (18.3) (60%)

================================ ======== ======== ======== =========

(1) Statutory profit before tax as a percentage of net operating

income.

(2) Ordinary dividends paid/proposed relating to the financial

year, based on issued share capital as at 31 March of each

financial year.

Summary

Net operating income for the year decreased by GBP127.9 million

(31%) to GBP281.9 million, with a decrease in market volatility,

particularly in H1, compared to exceptional levels seen in 2021

resulting in lower client trading activity and lower client income

retention throughout the period. This lower volatility and trading

activity impacted both the leveraged and non-leveraged businesses.

The net operating income represents a record for the Group when

excluding the COVID-19 impacted 2021.

Total operating expenses have increased by GBP3.6 million (2%)

to GBP187.6 million, with the main driver being investments in our

strategic initiatives resulting in higher personnel, professional

fees and technology costs. These increases have been partially

offset by lower sales-related costs.

Profit before tax decreased to GBP92.1 million from GBP224.0

million and PBT margin decreased to 32.7% from 54.7%, reflecting

the high level of operational gearing in the business.

Net operating income overview

GBPm 2022 2021 Change %

Leveraged net trading revenue 229.6 349.2 (34%)

Non-leveraged net trading revenue (excl. interest income) 48.0 54.8 (12%)

=========================================================== ====== ====== =========

Net trading revenue(1) 277.6 404.0 (31%)

Interest income 0.8 0.7 12%

Other operating income 3.5 5.1 (30%)

=========================================================== ====== ====== =========

Net operating income 281.9 409.8 (31%)

=========================================================== ====== ====== =========

(1) CFD and spread bet gross client income net of rebates,

levies and risk management gains or losses and stockbroking revenue

net of rebates.

Leveraged net trading revenue decreased by GBP119.6 million

(34%) driven by decreases in both gross client income and client

income retention. The reduction in gross client income was a result

of the significant volatility in the market in 2021 resulting in

exceptionally high client trading activity, with the majority of

2022 returning to more normalised levels. Client income retention

was lower during the period at 80% (2021: 104%) as a result of a

change in the mix of asset classes traded by clients and lower

natural hedging of flow within indices. This resulted in revenue

per active client ("RPC") decreasing by GBP985 (22%) to

GBP3,575.

Leveraged active client numbers decreased by 16% in comparison

to 2021; however, monthly active clients remain significantly above

pre -- COVID-19 levels, demonstrating the structural shift in the

Group's client base.

Non-leveraged net trading revenue was 12% lower at GBP48.0

million (2021: GBP54.8 million), with decreased client trading

activity during the less volatile market environment offset by an

active client base which was 6% larger than 2021 and 36% higher

than 2020.

B2B and B2C net trading revenue

2022 2021 Change %

GBPm B2C B2B Total B2C B2B Total B2C B2B Total

Leveraged net

trading revenue 185.5 44.1 229.6 307.3 41.9 349.2 (40%) 5% (34%)

Non-leveraged

net trading revenue 9.6 38.4 48.0 10.4 44.4 54.8 (8%) (14%) (12%)

======================= ===== ==== ===== ===== ==== ===== ===== ===== =====

Net trading revenue 195.1 82.5 277.6 317.7 86.3 404.0 (39%) (4%) (31%)

======================= ===== ==== ===== ===== ==== ===== ===== ===== =====

The lower trading activity across the Group was reflected within

both our B2C and B2B businesses, with year-on-year decreases in net

trading revenue of 34% and 12% respectively. Whilst the leveraged

B2C business saw the largest fall in revenue of 40%, the

non-leveraged business experienced a comparatively lower fall of 8%

and the leveraged B2B business revenue grew 5%, demonstrating the

progress the Group continues to make in its strategic

direction.

Regional performance overview: leveraged

2022 2021 Change %

Net Gross Active RPC Net Gross Active RPC Net Gross Active RPCRPC

trading client Clients GBP trading client Clients GBP trading client Clients

revenue income revenue income revenue income(1)

GBPm GBPm(1) GBPm GBPm(1)

UK 78.8 107.1 16,264 4,848 122.0 123.2 20,077 6,078 (35%) (13%) (19%) (20%)

Europe 43.7 51.1 15,747 2,778 64.8 53.7 20,280 3,197 (33%) (5%) (22%) (13%)

======== ======== ======== ======== ====== ======== ======== ======== ====== ======== ========== ======== =======

UK &

Europe 122.5 158.2 32,011 3,827 186.8 176.9 40,357 4,630 (34%) (11%) (21%) (17%)

APAC

&

Canada 107.1 130.3 32,232 3,322 162.4 158.4 36,234 4,481 (34%) (18%) (11%) (26%)

======== ======== ======== ======== ====== ======== ======== ======== ====== ======== ========== ======== =======

Total 229.6 288.5 64,243 3,575 349.2 335.3 76,591 4,560 (34%) (14%) (16%) (22%)

======== ======== ======== ======== ====== ======== ======== ======== ====== ======== ========== ======== =======

(1) Spreads, financing and commissions on CFD client trades.

Leveraged

UK and Europe

Gross client income fell by GBP18.7 million (11%) and RPC

decreased by GBP803 (17%), with active clients decreasing by

21%.

UK

The number of active clients in the region decreased by 19% to

16,264 (2021: 20,077), in turn driving a gross client income

reduction of 13% against the prior year to GBP107.1 million (2021:

GBP123.2 million). The decreases were predominantly driven by the

B2C business.

Europe

Europe comprises offices in Austria, Germany, Norway, Poland and

Spain. Gross client income decreased 5% to GBP51.1 million (2021:

GBP53.7 million), driven by reduced client trading in the less

volatile market environment. RPC also fell by 13% to GBP2,778

(2021: GBP3,197). The number of active clients decreased 22% to

15,747 (2021: 20,280).

APAC & Canada

Our APAC & Canada business services clients from our Sydney,

Auckland, Singapore, Toronto and Shanghai offices along with other

regions where we have no physical presence. Gross client income

decreased by 18% to GBP130.3 million (2021: GBP158.4 million),

primarily driven by decreased active clients and lower market

activity throughout the year. Active clients were down 11% to

32,232 (2021: 36,234). Performance in the region was impacted by

the regulatory intervention by ASIC in Australia at the start of

the year, as well as the wider decrease in market volatility.

Non-leveraged

The non-leveraged Australian business delivered a very strong

top line performance, continuing the momentum from a record year in

2021. While revenue fell 12% to GBP48.0 million (2021: GBP54.8

million) due to more normalised market conditions, the underlying

key health metrics of the business continue to achieve new heights.

The business finished 2022 with record AuA, up 16% to AUD$80.2

billion (2021: AUD$69.4 billion), while active clients continued to

increase, up 6% to 246,120 (2021: 232,053).

Interest income

Global interest rates remained at historically low levels

despite moderate increases in Q4 2022, with interest income

remaining broadly flat, up 12% to GBP0.8 million (2021: GBP0.7

million). The majority of the Group's interest income is earned

through our segregated client deposits in our UK, Australia, New

Zealand and stockbroking subsidiaries.

Expenses

Total costs increased by GBP4.0 million (2%) to GBP189.8

million.

GBPm 2022 2021 Change %

---------------------------------------- ----- ----- --------

Net staff costs - fixed (excluding

variable remuneration) 70.4 62.5 (13%)

IT costs 28.7 26.2 (10%)

Marketing costs 24.5 24.6 -

Sales-related costs 2.8 5.8 51%

Premises costs 3.3 3.8 12%

Legal and professional fees 8.6 7.2 (18%)

Regulatory fees 5.6 5.0 (11%)

Depreciation and amortisation 12.9 11.2 (15%)

Irrecoverable sales tax 2.8 6.5 57%

Other 13.5 15.0 10%

======================================== ===== ===== ========

Operating expenses excluding variable

remuneration 173.1 167.8 (3%)

Variable remuneration 14.5 16.2 10%

======================================== ===== ===== ========

Operating expenses including variable

remuneration 187.6 184.0 (2%)

Interest 2.2 1.8 (24%)

======================================== ===== ===== ========

Total costs 189.8 185.8 (2%)

======================================== ===== ===== ========

Net staff costs

Net staff costs including variable remuneration increased GBP6.2

million (8%) to GBP84.9 million following significant investment

across the business, particularly within technology, marketing and

product functions, to support the delivery of strategic projects.

Variable remuneration decreased due to the Group performance

resulting in lower performance-related pay.

GBPm 2022 2021 Change %

Gross staff costs excluding variable remuneration 74.0 64.4 (15%)

Performance related pay 12.1 13.7 12%

Share-based payments 2.4 2.5 3%

=================================================== ====== ====== =========

Total employee costs 88.5 80.6 (10%)

Contract staff costs 3.9 3.2 (20%)

Net capitalisation (7.5) (5.1) 46%

=================================================== ====== ====== =========

Net staff costs 84.9 78.7 (8%)

=================================================== ====== ====== =========

Depreciation and amortisation costs

Depreciation and amortisation have increased by GBP1.7 million

(15%) to GBP12.9 million, primarily due to the depreciation of

additional office space in London and the amortisation of staff

development costs which were capitalised at the end of the previous

financial year.

Irrecoverable sales tax

Irrecoverable sales tax costs decreased GBP3.7 million (57%) to

GBP2.8 million as a result of a one-off tax recovery and ongoing

lower irrecoverable VAT in the UK.

Other expenses

Sales-related costs decreased by GBP3.0 million (51%), primarily

driven by the release of provisions made in the prior year for

client compensation.

Legal and professional fees increased GBP1.4 million (18%),

primarily driven by external consultants who have been engaged to

advise on the delivery of various strategic projects during the

year.

Premises costs decreased GBP0.5 million (12%) due to the rental

of temporary additional office space within London in 2021. This

was replaced with permanent space at the start of the financial

year to accommodate growth in headcount.

Other costs decreased due to a number of factors, with the main

drivers being lower bad debt and higher FX gains on balance sheet

revaluation, offset by higher bank charges.

Taxation

The effective tax rate for 2022 was 21.9%, up from the 2021

effective tax rate, which was 20.5%. The effective tax rate has

increased in the period due as a result of a higher proportion of

the Group's taxable profits earned outside of the UK, and so taxed

at a higher corporate tax rate than the UK's 19%, notably Australia

at 30%.

Profit after tax for the year

The decrease in profit after tax for the year of GBP106.1

million (60%) was due to lower net operating income and the

operational gearing in the business.

Dividend

Dividends of GBP72.6 million were paid during the year (2021:

GBP62.1 million), with GBP62.4 million relating to a final dividend

for the prior year paid in September 2021, and a GBP10.2 million

interim dividend paid in December 2021 relating to current year

performance. The Group has proposed a final ordinary dividend of

8.88 pence per share (2021: 21.43 pence per share).

Non-Statutory Summary Group Balance Sheet

GBPm -Statutory Summary Group Balance Sheet 2022 2021

Intangible assets 30.4 10. 3

Property, plant and equipment 13.0 14. 8

Net lease liability (2.3 ) (4.0)

--------------------------------------------- ------- -------

Fixed Assets 41.1 21.1

Cash and cash equivalents 176.6 118. 9

Amount due from brokers 196.1 253. 9

Financial investments 27.9 28. 1

Other assets 13.4 -

Net derivative financial instruments - 0. 2

Title transfer funds (44.1) (30.7)

--------------------------------------------- ------- -------

Own Funds 369.9 370.4

Working Capital (43.0) 2.6

Tax (payable) / receivable (0.4) 1.7

Deferred tax net asset 2. 7 4.7

--------------------------------------------- ------- -------

Net Assets 370.3 400.5

============================================= ======= =======

The table above is a non-statutory view of the Group Balance

Sheet and line names do not necessarily have their statutory

meanings. A reconciliation to the primary statements can be found

on page 164 in the 2022 Annual Report and Financial Statements.

Fixed assets

Intangible assets increased by GBP20.1 million to GBP30.4

million (2021: GBP10.3 million) as a result of the transaction with

ANZ Bank to transition approximately 500,000 Share Investing

clients to CMC (AUD$25 million) in addition to the capitalisation

of internal resource dedicated to the development of new products

and functionality in 2022.

Net lease liability decreased by GBP1.7 million during the year

due to the net length of lease contracts being lower at the end of

2022 than the prior year.

Own funds

Amounts due from brokers relate to cash held at brokers either

for initial margin or balances in excess of this for cash

management purposes. The reduced client trading exposures

throughout the year, particularly in equities, resulted in

decreases in holdings at brokers for hedging purposes.

Cash and cash equivalents have increased during the year as a

result of the Group's operating performance, in addition to the

Group holding less cash at our brokers for margining purposes

resulting in associated increases in own cash.

Financial investments mainly relate to eligible assets held by

the Group as core liquid assets used to meet Group regulatory

liquidity requirements.

Title transfer funds increased by GBP13.4 million, reflecting

the high levels of account funding by a small population of mainly

institutional clients.

Working capital

The decrease year on year is primarily as a result of the

increased market volatility in Q4 of the prior year, which

significantly increased the value of the stockbroking receivables

yet to settle at the prior year end.

Tax payable

Tax moved to a payable position due to underpayments in

Australia.

Deferred tax net asset

Deferred net tax assets decreased as a result of accelerated

research and development tax deductions in the UK and

Australia.

Impact of climate risk

We have assessed the impact of climate risk on our balance sheet

and have concluded that there is no material impact on the

Financial Statements for the year ended 31 March 2022.

Regulatory capital resources

For the year under review, the Group was supervised on a

consolidated basis by the FCA. The Group maintained a capital

surplus over the regulatory requirement at all times.

For the period to 31 December 2021, the Group and its UK

regulated subsidiaries were subject to CRD IV, comprising the

Capital Requirements Directive ("CRD") and the Capital Requirements

Regulation ("CRR").

From 1 January 2022 the Group and its UK regulated subsidiaries

became subject to the Investment Firm Prudential Regime ("IFPR") as

transposed into the FCA's MIFIDPRU handbook. A new legislative

package, the Investment Firm Regulation and Directive ("IFR/IFD"),

was also introduced in Europe that became directly applicable to

Member States from 26 June 2021. Both regimes have been designed to

be more tailored towards investment firms and have led to changes

in the treatment of capital, remuneration requirements, governance

and transparency provisions. The UK played an instrumental role in

the introduction of IFR/IFD and the IFPR has been designed to

achieve similar outcomes, albeit tailored where necessary to

reflect the structure of the UK market and how it operates.

The Group and its UK regulated subsidiaries fall into scope of

the IFPR, with the Group's German subsidiary, CMC Markets Germany

GmbH, subject to the provisions of IFR/IFD.

On a like for like basis, the Group's total capital resources

decreased to GBP311.5 million (2021: GBP323.1 million) with

retained earnings for the year being partly offset by the interim

and proposed final dividend distribution. In accordance with the

IFPR all deferred tax assets must now be fully deducted from core

equity Tier 1 capital.

At 31 March 2022 the Group had a total OFR ratio of 489% in

comparison to a capital ratio of 20.5% in 2021 (as calculated under

the CRR). The change in capital treatment under the IFPR has

resulted in revisions to the calculation of capital requirements

and monitoring metrics. In essence, the Group has a surplus of

nearly 5 times the regulatory minimum in comparison to 2021 when it

was just over 2.5 times the regulatory minimum in accordance with

the CRR rules. This is attributable to changes in methodology but

also a decrease in market risk exposure.

The following table summarises the Group's capital adequacy

position at the year end. The Group's approach to capital

management is described in note 30 in the 2022 Annual Report and

Financial Statements.

GBPm 2022 2021

Core equity Tier 1 capital ("CET1 capital")(1) 344.5 339. 8

Less: intangibles and deferred tax assets(2) (33.0) (16.7)

=================================================== ======= =======

Total capital resources after relevant deductions 311.5 323.1

=================================================== ======= =======

Own funds requirements ("OFR")(3) 63.6 84.2

=================================================== ======= =======

Total OFR ratio (%)(4) 489% 384%

=================================================== ======= =======

(1) Total audited capital resources as at the end of the

financial year of GBP370.4 million, less proposed dividends.

(2) In accordance with the IFPR, all deferred tax assets must be

fully deducted from CET1 capital.

(3) The minimum capital requirement in accordance with MIFIDPRU

4.3.

(4) The OFR ratio represents CET1 capital as a percentage of OFR

.

Liquidity

The Group has access to the following sources of liquidity that

make up total available liquidity:

-- Own funds: The primary source of liquidity for the Group. It

represents the funds that the business has generated historically,

including any unrealised gains/losses on open hedging positions.

All cash held on behalf of segregated clients is excluded. Own

funds consist mainly of cash and cash equivalents. They also

include investments in UK government securities, of which the

majority are held to meet the Group's regulatory liquidity

requirements.

-- Title transfer funds ("TTFs"): This represents funds received

from professional clients and eligible counterparties (as defined

in the FCA Handbook) that are held under a title transfer

collateral agreement ("TTCA"), a means by which a professional

client or eligible counterparty may agree that full ownership of

such funds is unconditionally transferred to the Group. The Group

does not require clients to sign a TTCA in order to be treated as a

professional client and as a result their funds remain segregated.

The Group considers these funds as an ancillary source of liquidity

and places no reliance on them for its stability.

-- Available committed facility (off-balance sheet liquidity):

The Group has access to a facility of up to GBP55.0 million (2021:

GBP55.0 million) in order to fund any potential fluctuations in

margins required to be posted at brokers to support the risk

management strategy. The facility consists of a one-year term

facility of GBP27.5 million (2021: GBP27.5 million) and a

three-year term facility of GBP27.5 million (2021: GBP27.5

million). The maximum amount of the facility available at any one

time is dependent upon the initial margin requirements at brokers

and margin received from clients. There was no drawdown on the

facility at 31 March 2022 (2021: GBPnil).

The Group's use of total available liquidity resources consists

of:

-- Blocked cash: Amounts held to meet the requirements of local

regulators and exchanges, in addition to amounts held at overseas

subsidiaries in excess of local segregated client requirements to

meet potential future client requirements. Cash committed to the

purchase of shares within the current buyback programme is also

classified as blocked cash. This was GBP28.0 million at 31 March

2022 (2021: GBPnil).

-- Initial margin requirement at broker: The total GBP

equivalent initial margin required by prime brokers to cover the

Group's hedge derivative and cryptocurrency positions.

Own funds have decreased slightly to GBP369.9 million (2021:

GBP370.4 million). Own funds include short-term financial

investments, amounts due from brokers and amounts

receivable/payable on the Group's derivative financial instruments.

For more details refer to note 29 in the 2022 Annual Report and

Financial Statements.

GBPm 2022 2021

Own funds 369.9 370.4

Title transfer funds 44.1 30.7

Available committed facility 55.0 55.0

============================================ ======== ========

Total available liquidity 469.0 456.1

Less: blocked cash (103.1) (75.4)

Less: initial margin requirement at broker (120.0) (170.1)

============================================ ======== ========

Net available liquidity 245.9 210.6

============================================ ======== ========

Of which: held as liquid asset requirement 27.9 28.1

============================================ ======== ========

Client money

Total segregated client money held by the Group for leveraged

clients was GBP546.6 million at 31 March 2021 (2021: GBP549.4

million).

Client money represents the capacity for our clients to trade

and offers an underlying indication of the health of our client

base.

Client money governance

The Group segregates all money held by it on behalf of clients

excluding a small number of large clients which have entered a TTCA

with the firm. This is in accordance with or exceeding applicable

client money regulations in countries in which it operates. The

majority of client money requirements fall under the Client Assets

Sourcebook ("CASS") rules of the FCA in the UK, BaFin in Germany

and ASIC in Australia. All segregated client funds are held in

dedicated client money bank accounts with major banks that meet

strict internal criteria and are held separately from the Group's

own money.

The Group has comprehensive client money processes and

procedures in place to ensure client money is identified and

protected at the earliest possible point after receipt as well as

governance structures which ensure such activities are effective in

protecting client money. The Group's governance structure is

explained further on pages 60 to 68 of the 2022 Annual Report and

Financial Statements.

Euan Marshall

Chief Financial Officer

8 June 2022

PRINCIPAL RISKS

The Group's business activities naturally expose it to

strategic, financial and operational risks inherent in the nature

of the business it undertakes and the financial, market and

regulatory environments in which it operates. The Group recognises

the importance of understanding and managing these risks and that

it cannot place a cap or limit on all of the risks to which it is

exposed. However, effective risk management ensures that risks are

managed to an acceptable level. The Board, through its Group Risk

Committee, is ultimately responsible for the implementation of an

appropriate risk strategy, which has been achieved using an

integrated Risk Management Framework. The main areas covered by the

Risk Management Framework are:

-- identifying, evaluating and monitoring of the principal risks

to which the Group is exposed;

-- setting the risk appetite of the Board in order to achieve its strategic objectives; and

-- establishing and maintaining governance, policies, systems

and controls to ensure the Group is operating within the stated

risk appetite.

The Board has put in place a governance structure which is

appropriate for the operations of an online retail financial

services group and is aligned to the delivery of the Group's

strategic objectives including its diversification into

non-leveraged businesses. The structure is regularly reviewed and

monitored and any changes are subject to Board approval.

Furthermore, management regularly considers updates to the

processes and procedures to embed good corporate governance

throughout the Group. As part of the Group Risk Management

Framework, the business is subject to independent assurance by

internal audit (third line of defence). The use of independent

compliance monitoring, risk reviews (second line of defence) and

risk and control self-assessments (first line of defence) provides

additional support to the integrated assurance programme and

ensures that the Group is effectively identifying, managing and

reporting its risks. The Group continues to make enhancements to

its Risk Management Framework and governance to provide a more

structured approach to identifying and managing the risks to which

it is exposed to ensure the Group's risk management is commensurate

to its current operations alongside its aspirations and

diversification. The Board annually undertakes a robust assessment

of the principal risks facing the Group.

The Group has always had an understanding of the importance of

the importance of ESG, evidenced by governance review conducted by

Independent Audit in respect to Governance and, in turn, the Group

is in the process of evolving its framework to a more pure adoption

of Enterprise Risk Management framework to support the

diversification of its business whilst maintaining its level of

oversight and control.

Top and emerging risks are those that would threaten the Group's

business model, future performance, solvency or liquidity. They

form either a subset of one or multiple principal risks, their

management is set out in note 30 to the Financial Statements and

they are:

-- COVID-19 : The primary risk faced was from a resilience

perspective; the Group has put significant measures in place which

have proven to be robust and continues to actively monitor the

situation.

-- Climate change risk: A summary of the process undertaken to

assess the risks of climate change on the Group is detailed within

pages 40 to 43 of the 2022 Annual Report and Financial Statements,

with the conclusion that they are not material.

-- People risk: changing expectations regarding the office

working environment and flexible working in combination with skills

shortages have given rise to heightened staff acquisition and

retention risk. Numerous measures have been put in place during the

year to continue to attract and retain talent including changes to

policies and remuneration reviews. The risk continues to be

heightened.

-- Market risk management: The Group's risk management is

constantly reviewed to ensure it is optimised and as efficient as

possible. For more information on market risk management and

mitigation see page 53 of the 2022 Annual Report and Financial

Statements.

Further information on the structure and workings of the Board

and Management Committees is included in the Corporate governance

report on pages 60 to 68 of the 2022 Annual Report and Financial

Statements.

Principal Risk Risk Description Management and mitigation

Business and Acquisitions The risk that

strategic risks and disposals mergers, * Robust corporate governance structure including

risk acquisitions, strong challenge from independent Non-Executive

disposals or Directors.

other partnership

arrangements made

by the * Vigorous and independent due diligence process.

Group do not

achieve the

stated strategic * Aligning and managing the businesses with Group

objectives or strategy as soon as possible after acquisition.

that they give

rise to ongoing

or

previously

unidentified

liabilities.

================ ================== ==============================================================

Strategic / The risk of an

business model adverse impact * Strong governance framework established including

risk resulting from three independent Non-Executive Directors and the

the Group's Chairman sitting on the Board.

strategic

decision making

as well * Robust governance, challenge and oversight from

as failure to independent Non-Executive Directors.

exploit strengths

or take

opportunities. It * Managing the Group in line with the agreed strategy,

is a risk which policies and risk appetite.

may cause damage

or loss,

financial or

otherwise, to the

Group as a whole.

================ ================== ==============================================================

Preparedness The risk that

for regulatory changes to the * Active dialogue with regulators and industry bodies.

change risk regulatory

framework the

Group operates in * Monitoring of market and regulator sentiment towards

impact the the product offering.

Group's

performance.

Such changes * Monitoring by and advice from compliance department

could result in on impact of actual and possible regulatory change.

the Group's

product offering

becoming less * A business model and proprietary technology that are

profitable, more responsive to changes in regulatory requirements.

difficult

to offer to

clients, or an

outright ban on

the product

offering in one

or more of the

countries

where the Group

operates.

================ ================== ==============================================================

Reputational The risk of

risk damage to the * The Group is conservative in its approach to

Group's brand or reputational risk and operates robust controls to

standing with ensure significant risks to its brand and standing

shareholders, are appropriately mitigated.

regulators,

existing

and potential * Examples include:

clients, the

industry and the

public at large. * proactive engagement with the Group's regulators and

active participation with trade and industry bodies;

and positive development of media relations with

strictly controlled media contact; and

* systems and controls to ensure we continue to offer a

good service to clients and quick and effective

response to address any potential issues.

================ ================ ================== ==============================================================

Financial risks Credit and The risk of Client counterparty risk

counterparty losses arising The Group's management of client counterparty risk is

risk from a significantly aided by the automated

counterparty liquidation functionality. This is where the client positions

failing to meet are reduced should the total

its obligations equity of the account fall below a pre-defined percentage of

as they fall the required margin for the portfolio

due. held.

Other platform functionality mitigates risk further:

* tiered margin requires clients to hold more

collateral against bigger or higher risk positions;

* mobile phone access allowing clients to manage their

portfolios on the move;

* guaranteed stop loss orders allow clients to remove

their chance of debt from their position(s); and

* position limits can be implemented on an instrument

and client level. The instrument level enables the

Group to control the total exposure the Group takes

on in a single instrument. At a client level this

ensures that the client can only reach a pre-defined

size in any one instrument.

In relevant jurisdictions, CMC offers negative balance

protection to retail clients limiting

the liability of a retail investor to the funds held in their

trading account.

However, after mitigations, there is a residual risk that the

Group could incur losses relating

to clients (excluding negative balance protection accounts)

moving into debit balances if

there is a market gap.

Financial institution credit risk

Risk management is carried out by a central liquidity risk

management ("LRM") team under the

Counterparty Concentration Risk Policy.

Mitigation is achieved by:

* monitoring concentration levels to counterparties and

reporting these internally/externally on a

monthly/quarterly basis; and

* monitoring the credit ratings and credit default swap

("CDS") spreads of counterparties and reporting

internally on a weekly basis.

---------------- ================ ================== ==============================================================

Insurance risk The risk that an

insurance claim * Use of a reputable insurance broker who ensures cover

by the Group is is placed with financially secure insurers.

declined (in full

or in part) or

there is * Comprehensive levels of cover maintained.

insufficient

insurance

coverage. * Rigorous claim management procedures are in place

with the broker.

The Board's appetite for uninsured risk is low and as a

result the Group has put in place

established comprehensive levels of insurance cover.

---------------- ================ ================== ==============================================================

Tax and The risk that

financial financial, * Robust process of checking and oversight in place to

reporting risk statutory or ensure accuracy.

regulatory

reports including

VAT and similar * Knowledgeable and experienced staff undertake and

taxes are overview the relevant processes.

submitted late,

incomplete or are

inaccurate.

================ ================== ==============================================================

Liquidity risk The risk that

there is * Risk management is carried out by a central LRM team

insufficient under policies approved by the Board and in line with

available the FCA's Investment Firms Prudential Regime ("IFPR")

liquidity to meet regime. The Group utilises a combination of liquidity

the liabilities forecasting and stress testing to identify any

of the Group potential liquidity risks under both normal and

as they fall due. stressed conditions. The forecasting and stress

testing fully incorporates the impact of all

liquidity regulations in force in each jurisdiction

that the Group operates in and any other impediments

to the free movement of liquidity around the Group

Risk is mitigated by:

* the provision of timely daily, weekly and monthly

liquidity reporting and real-time broker margin

requirements to enable strong management and control

of liquidity resources;

* maintaining regulatory and Board-approved buffers;

* managing liquidity to a series of Board-approved

metrics and Key Risk Indicators;

* a committed bank facility of up to GBP55 million

(2021: GBP55 million) to meet short-term liquidity

obligations to broker counterparties in the event

that the Group does not have sufficient access to its

own cash; and

* a formal Contingency Funding Plan ("CFP") is in place

that is designed to aid senior management to assess

and prioritise actions in a liquidity stress

scenario.

For further information see note 30 to the 2022 Annual Report

and Financial Statements.

---------------- ================ ================== ==============================================================

Market risk The risk that the

value of our * Trading risk management monitors and manages the

residual exposures it inherits from clients on a real-time

portfolio will basis and in accordance with Board-approved appetite.

decrease due to

changes in market

risk * The Group predominantly acts as a market maker in

factors. The linear, highly liquid financial instruments in which

three standard it can easily reduce market risk exposure through its

market risk prime broker ("PB") arrangements. This significantly

factors are price reduces the Group's revenue sensitivity to individual

moves, interest asset classes and instruments.

rates and foreign

exchange rates.

* Financial risk management runs stress scenarios on

the residual portfolio, comprising a number of single

and combined Company-specific and market-wide events

in order to assess potential financial and capital

adequacy impacts to ensure the Group can withstand

severe moves in the risk drivers it is exposed to.

For further information see note 30 to the 2022 Annual Report

and Financial Statements.

================ ================ ================== ==============================================================

Operational Business change The risk that

risks risk business change * Governance process in place for all business change

projects are programmes with Executive and Board oversight and

ineffective, fail scrutiny.

to deliver stated

objectives,

or result in * Key users engaged in development and testing of all

resources being key change programmes.

stretched to the

detriment of

business-as-usual * Significant post-implementation support, monitoring

activities. and review procedures in place for all change

programmes.

* Strategic benefits and delivery of change agenda

communicated to employees.

---------------- ================ ================== ==============================================================

Business The risk that a

continuity and business * Multiple data centres and systems to ensure core

disaster continuity event business activities and processes are resilient to

recovery risk or system failure individual failures.

results in a

reduced ability

or * Remote access systems to enable staff to work from

inability to home or other locations in the event of a disaster

perform core recovery or business continuity requirement.

business

activities or

processes. * Periodic testing of business continuity processes and

disaster recovery.

* Robust incident management processes and policies to

ensure prompt response to significant systems

failures or interruptions.

---------------- ================ ================== ==============================================================

Financial crime The risk that the Adherence with applicable laws and regulations regarding

risk Group is not anti-money laundering ("AML"), counter

committed to terrorism financing ("CTF"), sanctions and anti-bribery &

combatting corruption is mandatory and fundamental

financial crime to our AML/CTF framework. We have strict and transparent

and ensuring that standards and we continuously strengthen

our our processes to ensure compliance with applicable laws and

platform and regulations. CMC Markets reserves

products are not the right to reject any client, payment, or business that is

used for the not consistent with our risk

purpose of money appetite. This risk is further mitigated by:

laundering, * establishing and maintaining a risk-based approach

sanctions evasion towards assessing and managing the money laundering

or terrorism and terrorist financing risks to the Group;

financing.

* establishing and maintaining risk-based know your

customer ("KYC") procedures, including enhanced due

diligence ("EDD") for those customers presenting

higher risk, such as politically exposed persons

("PEPs");

* establishing and maintaining risk-based systems for

surveillance and procedures to monitor ongoing

customer activity;

* procedures for reporting suspicious activity

internally and to the relevant law enforcement

authorities or regulators as appropriate;

* maintenance of appropriate records for the minimum

prescribed record keeping periods;

* training and awareness for all employees;

* provision of appropriate MI and reporting to senior

management of the Group's compliance with the

requirements; and

* oversight of Group entities for financial crime in

line with the Group AML/CTF Oversight Framework.

================ ================== ==============================================================

Information and The risk of

data security unauthorised * Dedicated information security and data protection

risk access to, or expertise within the Group.

external

disclosure of,

client or Company * Technical and procedural controls implemented to

information, minimise the occurrence or impact of information

including those security and data protection breaches.

caused by cyber

attacks.

* Access to information and systems only provided on a

"need-to-know" and "least privilege" basis consistent

with the user's role and also requires the

appropriate authorisation.

* Regular system access reviews implemented across the

business.

---------------- ================ ================== ==============================================================

Information The risk of loss

technology and of technology * Continuous investment in increased functionality,

infrastructure services due to capacity and responsiveness of systems and

risk loss of data, infrastructure, including investment in software that

system or data monitors and assists in the detection and prevention

centre or failure of cyber attacks.

of a third party

to restore

services in a * Software design methodologies, project management and

timely manner. testing regimes to minimise implementation and

operational risks.

* Constant monitoring of systems performance and, in

the event of any operational issues, changes to

processes are implemented to mitigate future

concerns.

* Operation of resilient data centres to support each

platform (two in the UK to support Next Generation

and two in Australia to support Stockbroking).

* Systems and data centres designed for high

availability and data integrity enabling continuous

service to clients in the event of individual

component failure or larger system failures.

* Dedicated Support and Infrastructure teams to manage

key production systems. Segregation of duties between

Development and Production Support teams where

possible to limit development access to production

systems.

---------------- ================ ================== ==============================================================

Legal The risk that

(commercial / disputes * Compliance with legal and regulatory requirements