City of London Investment Group PLC Trading Update (3911E)

July 18 2016 - 2:00AM

UK Regulatory

TIDMCLIG

RNS Number : 3911E

City of London Investment Group PLC

18 July 2016

City of London Investment Group PLC

18 July 2016

This announcement contains inside information

CITY OF LONDON INVESTMENT GROUP PLC

("City of London" or "the Group")

TRADING UPDATE

for the year to 30 June 2016

City of London (LSE: CLIG), a leading emerging markets asset

management group, provides a trading update for its financial year

ended 30 June 2016. The numbers that follow are all unaudited.

Funds under management were US$4.0 billion (GBP3.0 billion) at

30 June 2016 (2015: US$4.2 billion or GBP2.7 billion), representing

a 5% decrease in US$ terms and an 11% increase in GBP terms as a

result of the exchange rate moving from 1.57 to 1.33 over the

period. Over the same period, the MSCI Emerging Markets TR Net

Index fell by 12% in US$ terms, resulting in a relative change in

funds under management of +7% versus the benchmark, a product of

both positive investment performance and new and existing client

inflows.

Investment performance in the emerging markets closed-end fund

(CEF) strategy continues to be strong, with results in the first or

second quartile versus manager peers for the year ending 30 June

2016. The current size-weighted average discount (SWAD) across

client portfolios is c. 14%-15%, indicating that there is still

present significant relative value in the strategy. The investment

approach adds value beyond this by exploiting volatility of the

underlying discounts in the CEF universe, from which portfolios are

constructed with their specific SWAD characteristics plus active

country allocation.

The Group's overheads for the year to 30 June 2016 are expected

to be GBP10.7 million (2015: GBP9.4 million) and the current

monthly run-rate is cGBP0.9m.

For the year to 30 June 2016, City of London expects that

pre-tax profits will be approximately GBP8.0 million (2015: GBP8.9

million), and that profits after an anticipated tax charge of

GBP2.0 million (25% of pre-tax profits) will be approximately

GBP5.9 million (2015: profits of GBP6.6 million after a tax charge

of GBP2.3 million, representing 26% of pre-tax profit). Basic and

fully diluted earnings per share are expected to be 23.6p and 23.5p

respectively (2015: 26.4p and 26.0p).

As a result of the fall in Emerging Markets during the financial

year, earnings cover will be reduced this year but given the

Group's strong cash position and optimism with regard to the

future, the Board is recommending a maintained final dividend of

16p per share (2015: 16p). This would bring the total for the year

to 24p (2015: 24p), a dividend cover of 0.98 times earnings per

share (2015: 1.1 times).

The Board confirms the final dividend timetable for the year to

30 June 2016:

-- ex-dividend date: 13 October 2016

-- dividend record date: 14 October 2016

-- payable: 31 October 2016

City of London expects to announce final results alongside

publication of its Accounts for the year to 30 June 2016 on 12

September 2016. The Group's Annual General Meeting will be held on

17 October 2016.

Business Update

-- Virtually all CLIM income is USD based - our fees are sourced from US Institutions

-- Zero FUM effect from BREXIT - zero redemptions FYTD

-- Over 90% of CLIM income on a see through basis is effectively

derived from the Emerging Markets

-- Approximately 40% of Group costs are in GBP

-- Only 2.5% of CLIM assets are UCIT'S - very little fall out from BREXIT

Template

Please see the attached graph which is based on the following

assumptions and includes the estimated cost of a maintained

dividend:

http://www.rns-pdf.londonstockexchange.com/rns/3911E_1-2016-7-17.pdf

Assumptions:

- Starting point Current FuM (end June 2016)

- Net increase in FuM in 2016/2017 (straight-lined to June

2017):

-- emerging market strategies $250m

-- diversification strategies $250m

- Operating margin adjusted monthly for change in product mix

and commission run-off

- Market growth: 0%

- Increase in overhead: 5%

- Corporation tax based on an estimated average rate of 26%

- Exchange rate assumed to be GBP1/$1.35 for entire period

- Number of CLIG Shares in issue (26.9m) less those held by the

ESOP Trust (1.9m) as at 30 June 2016

This can also be found on our website at:

http://www.citlon.co.uk/shareholders/announcements.php

For further information, please visit http://www.citlon.co.uk/

or contact:

Barry Olliff, CEO

City of London Investment Group PLC

Tel: 001 215 313 3774

Martin R Green

Zeus Capital Limited

Financial Adviser & Broker

Tel: +44 (0)20 3829 5000

This release includes forward-looking statements, which may

differ from actual results. Any forward-looking statements are

based on certain factors and assumptions, which may prove

incorrect, and are subject to risks, uncertainties and assumptions

relating to future events, the Group's operations, results of

operations, growth strategy and liquidity.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSFSFAWFMSEIW

(END) Dow Jones Newswires

July 18, 2016 02:00 ET (06:00 GMT)

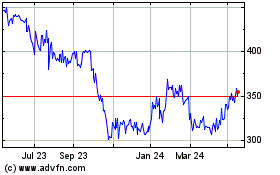

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Oct 2024 to Nov 2024

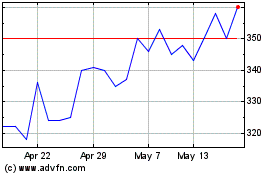

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Nov 2023 to Nov 2024