TIDMAD4

RNS Number : 8287S

adept4 plc

28 June 2018

Adept4 plc

("Adept4", the "Group" or the "Company")

Interim Results for the six months ended 31 March 2018

Adept4 plc (AIM: AD4), the AIM quoted provider of IT as a

Service, today announces its unaudited interim results for the six

months ended 31 March 2018.

FINANCIAL HIGHLIGHTS

-- Revenue increased 7% to GBP5.4m (H1 2017: GBP5.0m), of which 69% is recurring

-- Gross profit of GBP3.1m of which 68% comes from recurring

revenues (H1 2017: GBP3.1m), and which represents a gross profit

margin of 57% (H1 2017: 62%)

-- Trading Group EBITDA(1) of GBP0.5m (H1 2017: GBP0.6m)

-- Adjusted Group EBITDA(2) of GBP0.2m (H1 2017: 0.3m)

-- Loss before tax for the period GBP0.8m (H1 2017: GBP0.8m)

after GBP0.5m amortisation of intangible assets and GBP0.3m of

finance costs

-- Cash at bank of GBP2.0m (30 September 2017: GBP2.9m), with

net debt(3) standing at GBP3.0m (30 September 2017: GBP2.0m)

OPERATIONAL HIGHLIGHTS

Progress made against each key objective:

-- Strengthening of senior operational management team, with new

Sales Director identified post period end and due to join business

shortly to drive revenue growth

-- Development of partnership with Microsoft - awarded Gold Cloud Platform Partner status

-- Appointed as exclusive reseller of Nyotron cybersecurity products in the UK market

-- A number of strategic customer wins

Simon Duckworth, Non-Executive Chairman of Adept4,

commented:

"We are satisfied with the progress made in the period against

our stated key objectives and believe we have the building blocks

in place to allow us to focus on driving the operational

performance of the business.

"The appointment of a new Sales Director and a strengthening of

the sales team will be key to us achieving future revenue growth.

Successful execution of our cost rationalisation programme will

ensure we enter the next phase of our development with a cost base

appropriate to a business of our size whilst maintaining the

ability to capitalise on the pipeline of opportunities we have

built.

"There is work to be done to achieve the potential of the

business but we believe we have the right platform in place to move

forward."

(1) Trading Group EBITDA is measured as earnings from continuing

operations before plc costs, interest, taxation, depreciation,

amortisation of intangibles, separately identifiable costs and

income and share based payments

(2) Adjusted Group EBITDA is measured as Trading Group EBITDA

after plc costs

(3) Net debt represents cash and cash equivalents less

short-term and long-term borrowings

All company announcements can be found at www.adept4.co.uk

For further information, please contact:

Adept4 plc

Simon Duckworth, Non-Executive Chairman

Nick Deman, Interim Finance Director 01925 398 255

N+1 Singer

Shaun Dobson / Jen Boorer 020 7496 3000

MXC Capital Markets LLP

Charlotte Stranner 020 7965 8149

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No 596/2014.

CHAIRMAN'S STATEMENT

I am pleased to report the results of the Group for the six

months ended 31 March 2018. As outlined in the 2017 Annual Report,

last year was one of consolidation for the Group, with the

completion of the integration of the three companies previously

acquired into one single operating platform, laying the foundations

for future growth in the IT as a Service sector. We also set out

our key areas of strategic development for 2018 to enable us to

build on those foundations. These key areas of focus primarily

comprised of the strengthening of our senior operational management

team, the development of our partnership with Microsoft,

development of our IT security offering and the transition of

customers' legacy telephone systems to next generation Skype.

I am pleased to report that we have made good progress against

each of these key objectives during the period under review, whilst

also moderately increasing our revenues across all segments of the

business.

There remains work to be done, but we believe we now have the

foundations in place to begin to drive the business forward. As we

transition from a period of development and investment into one of

operational execution, we are now able to recognise certain cost

synergies and have commenced a programme of cost rationalisation,

ensuring that our costs are appropriate for a business of our size

today, whilst maintaining our ability to scale the business as we

convert the pipeline of opportunities we have built.

BOARD CHANGES

In March we announced that Ian Winn, Chief Financial Officer and

M&A director, had stepped down from the Board to pursue other

interests. At the same time, Nick Deman was appointed to the Board

as Interim Finance Director. Nick is a chartered accountant who

recently performed the role of Interim Finance Director at

Thruvision Group plc ("Thruvision") where he managed the balance

sheet and capital restructuring following Thruvision's divestment

of its Video Business as well as overseeing the transitional

arrangements for the finance department. Prior to Thruvision Nick

was Finance Director at Bluefin Solutions Ltd, an international

technology consultancy acquired in July 2015 by Mindtree Limited,

an Indian multinational information technology and outsourcing

company.

Nick has been appointed on an interim basis as we continue to

undertake a process to find a permanent successor.

OPERATIONAL REVIEW

During the period, we have further strengthened the management

team responsible for the day to day operations of the business. We

have brought in a Director of Operations from a large metropolitan

police authority and a Chief Technology Officer from Microsoft.

These appointments, together with our existing executives, provide

us with an effective team to guide the business through its next

phase of development. It has taken time to identify a suitable

candidate for the key role of Sales Director and this is affecting

our sales performance in the short term. We have now identified a

suitable candidate for the role and look forward to them joining

the business in the near future.

We have continued the development of our technical skills, our

competencies and our engagement with our key vendor partners. We

have been awarded Microsoft's coveted 'Gold Cloud Platform' partner

status; a certification that validates our high level of competency

in cloud technologies, identity management, systems management,

virtualization, storage and networking. In addition, we have

completed, with Microsoft, an end to end review of our managed

services capability; the purpose of this review is to demonstrate

our suitability to qualify for entry into the Microsoft Managed

Service Partner (MSP) program. MSP status is only open to a limited

number of companies and provides the Microsoft indirect sales team

with trusted partners to fulfil Microsoft sales enquiries. We

envisage that if we are successful in securing a place on this

programme, this will become a source of significant opportunity for

the Company.

In relation to our security proposition, we have been awarded

exclusivity to sell the Nyotron security portfolio in the UK.

Nyotron's next generation cybersecurity solution distinguishes

between legitimate operating system behaviour of IT users versus

threatening activities carried out by attackers. This provides

real-time protection from any attack without foreknowledge of the

exploit. We are now able to dramatically improve the security of

our customers by bundling Nyotron products within our managed

service proposition. We have already seen significant interest for

this next generation product and we are working on several large

opportunities across a number of territories.

Our customers' adoption of Skype and Anywhere365 (the

replacement for legacy telephony platforms) has increased, with

sales across a number of market sectors demonstrating the reach and

appetite for next generation contact centre technology. We continue

to develop our technical skills and service capability to meet

demand as we increase our customer penetration and pipeline

development.

Our customer service engagement model has further developed with

the introduction of a technical account manager (TAM) as a trusted

advisor and strategist for all major clients on all matters of a

technical nature. This approach is providing high levels of

customer satisfaction and is proving to generate new opportunities

and additional revenue.

During the period, we have had success in securing new sales

across each of our market segments. Some of the highlights

include:

-- Global provider of Customer Contact Centres - GBP0.3m application development

-- Real estate and business centre provider - GBP0.3m, 5-year telephony managed service

-- First two Nyotron next generation security orders - minimum GBP0.2m, multi-year contracts

Within our sales pipeline, we are clearly starting to see an

increase in our customers' appetite to understand how they can

embrace digital transformation, i.e. how they can utilise cloud

technology to drive business agility, improve time to market,

understand and predict client behaviour and make better use of

their business data. We are seeing a steady increase in these early

discussions on how to approach such a significant change in their

business and how Adept4 can assist in doing so.

As part of digital transformation, customers typically see a

change in the profile of their IT spend with an increase in upfront

professional services to make the journey from "traditional to

cloud" but then a reduction in infrastructure hardware and monthly

recurring spend as they have less infrastructure for us to support.

This is manifesting itself in a reduction in recurring spend which

is likely to reduce revenue growth in the short term but we expect

the impact of this to lessen as we add new customers as well as

continuing to assist existing customers with their digital

transformation.

We are also seeing this reduction in recurring spend being

replaced by our customers' willingness to adopt new services as

part of their digital transformation program including technology

areas such application redevelopment, BOT technology and Artificial

Intelligence alongside Big Data and analytics. We believe we are

well placed to benefit from these opportunities and replace any

potential loss of recurring revenue, and as such we are already

seeing an increase in pipeline and orders won in our software

development division which can provide many of these new services.

We have agreed a partnership with a "nearshore" development

provider to assist with our own software development capabilities

in a cost efficient and scalable manner.

We continue to monitor our cost base closely to ensure that it

is always appropriate for our current and near-term future

operations. As we transition from a period of development and

investment into one of operational execution, we have commenced a

programme of cost rationalisation which we believe can be effected

without impacting the operational performance of the business.

Alongside this, we are undertaking a review of our customer base to

ensure that we are maximising our efficiencies and

profitability.

FINANCIAL SUMMARY

The financial results for the six months ended 31 March 2018,

reflect a period of further change, consolidation and investment as

we continue to pursue our strategy of delivering IT as a Service to

SMEs and public sector customers in the UK.

Continued revenue growth was demonstrated across all business

segments, delivering revenue of GBP5.4m in the six-month period to

31 March 2018 (H1 2017: GBP5.0m), representing year-on-year growth

of 7%. Our professional services segment, although the smallest

revenue contributor, delivered the largest percentage increase in

this period mainly due to the transformation projects performed for

some of our key customers (as can be seen in note 3.1). As

explained above, transformation projects can result in reduced

ongoing monthly recurring fees for our customers, offset by an

increase in one-off professional services revenues and other

revenues.

Given the timing of the transformation projects undertaken in

the period, overall, recurring revenues increased modestly by

GBP0.1m to GBP3.7m in the six-month period to 31 March 2018, (H1

2017: GBP3.6m) representing 69% (2017: 71%) of all revenues in the

period. This revenue stream relates to our regular contracted and

service-based revenues, recurring on a monthly, quarterly or annual

basis.

Gross profit for this current half-year was GBP3.1m (H1 2017:

GBP3.1m). Gross profit margin achieved for the period was 57% (H1

2017: 62%). The gross profit margin achieved in H1 2017 was higher

due to the increased proportion of recurring revenues and reduced

expenditure on third-party vendor services in that period, with the

result for the current period in line with the 58% achieved in the

second half of 2017.

Other operating costs, excluding plc costs, during the current

period increased by GBP0.1m to GBP2.6m (H1 2017: GBP2.5m) primarily

as a result of our continued investment in the management team. As

a consequence, our Trading Group EBITDA, representing the

underlying profits from the trading business, excluding plc costs,

was lower at GBP0.5m for the period (H1 2017: GBP0.6m).

Plc costs during the period were GBP0.3m (H1 2017: GBP0.3m),

whilst non-cash items charged to the income statement in respect of

amortisation of intangible assets, depreciation and share-based

payments totalled GBP0.6m (H1 2017: GBP0.6m). In addition, we

incurred GBP0.1m (H1 2017: GBP0.03m) of separately identifiable

costs relating to professional and legal fees and restructuring

costs.

After net interest costs of GBP0.3m (H1 2107: GBP0.5m) and a tax

credit of GBP0.1m (H1 2017: GBP0.1m), the loss after tax for the

period was GBP0.8m (H1 2017: GBP0.7m).

Cash balances at 31 March 2018 were GBP2.0m (30 September 2017:

GBP2.9m), an outflow of GBP0.9m in the six months. The cash

movement can be summarised as follows:

-- Cash flows from trading operations were neutral arising from

trading EBITDA of GBP0.5m offset by an increase of GBP0.5m in trade

debtors and accrued income;

-- Cash utilised on plc and separately identifiable costs of GBP0.4m;

-- Loan interest paid of GBP0.2m;

-- Investment in fixed assets of GBP0.1m;

-- Cash items relating to discontinued operations of GBP0.1m.

The increase in our trade receivables balance of GBP0.5m

includes GBP0.3m of accrued income relating to large customer

transformation projects and other professional services projects in

progress at 31 March 2018. These projects were worked on during the

months leading up to 31 March 2018, but were subsequently completed

and invoiced in full during April and May 2018. In addition, trade

debtors increased by GBP0.2m in the period as a result of some

large public sector and education sector invoices raised in March

2018 and collected during April and May 2018.

In respect of payments relating to discontinued operations, we

settled a dispute with Chess ICT Limited ("Chess") in October 2017

by payment of GBP0.1m, relating to the recovery of an asset

included in the sale of the trade and assets of Pinnacle CDT

Limited to Chess in May 2016. This cost was provided for in the

Group's financial statements for the year ended 30 September 2017.

A further GBP0.1m will be paid in September 2018 if no further

recovery of the asset is made. We expect to make some recovery

against this and therefore no further provision has been made.

Net debt was GBP3.0m (H2 2017: GBP2.0m). This includes the

deferred consideration of GBP1.0m payable to the sellers of Adept4

Managed IT Limited ("MIT") on 2 January 2018. There is currently an

ongoing legal dispute with the vendors of MIT which has resulted

in, amongst other matters, a delay in the payment of the deferred

consideration. We continue to recognise the full amount of the

deferred consideration due to the early stage of this dispute.

In addition, as detailed in the Group financial statements for

the year ended 30 September 2017, the performance criteria for

achievement of the earn-out relating to the acquisition of MIT were

not achieved and therefore the full value of the contingent

consideration accrued (of GBP1.1m) was written back. Although the

vendors of MIT have not yet accepted this position, our assessment

remains unchanged and therefore no contingent liability has been

recognised. Once we have clarity on all these matters, we will

undertake a full impairment review of our intangible assets to

ensure that all amounts recognised in the accounts are

appropriately stated.

We have identified a number of opportunities to unlock cost

savings in the trading business which will reduce our overhead base

going forward. Our focus continues to be on developing and growing

our trading business to generate a cash surplus sufficient to

support the costs of the plc and loan interest payments and

increase our cash reserves.

OUTLOOK

We are satisfied with the progress made in the period against

our stated key objectives and believe we have the building blocks

in place to allow us to focus on driving the operational

performance of the business.

The appointment of a new Sales Director and a further

strengthening of the sales team will be key to us achieving future

revenue growth. Successful execution of our cost rationalisation

programme will ensure we enter the next phase of our development

with a cost base appropriate to a business of our size whilst

maintaining the ability to capitalise on the pipeline of

opportunities we have built.

There is work to be done to achieve the potential of the

business but we believe we have the right platform in place to move

forward.

Simon Duckworth

Non-Executive Chairman

27 June 2018

INDEPENT REVIEW REPORT TO ADEPT4 PLC ("the Company")

Introduction

We have been engaged by the Company to review the interim

condensed financial statements for the six months ended 31 March

2018 which comprise the consolidated income statement, the

consolidated statement of financial position, consolidated

statement of changes in equity, consolidated statement of cash

flows and the related explanatory notes.

We have read the other information contained in the interim

results announcement and considered whether it contains any

apparent misstatements or material inconsistencies with the

financial information in the condensed set of financial

statements.

This report is made solely to the Company in accordance with the

terms of our engagement to assist the Company in meeting the

requirements of the AIM Rule 18. Our review has been undertaken so

that we might state to the Company those matters we are required to

state to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company for our review work, for this

report or for the conclusions we have reached.

Directors' responsibilities

The interim results announcement is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the interim results announcement in accordance with

AIM Rule 18.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with IFRS as adopted by the

European Union. It is the responsibility of the directors to ensure

that the condensed set of financial statements included in this

interim results announcement have been prepared on a basis

consistent with that which will be adopted in the Group's annual

financial statements.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the interim results

announcement based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" issued by the Financial Reporting Council for use in the

United Kingdom. A review of interim financial information consists

of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim results announcement for the six months ended 31

March 2018 is not prepared, in all material respects, in accordance

with the requirements of the AIM Rules for Companies.

Nexia Smith & Williamson 25 Moorgate

Statutory Auditor London

Chartered Accountants EC2R 6AY

27 June 2018

CONSOLIDATED INCOME STATEMENT

for the six-month period ended 31 March 2018

6 months 6 months Year to

to to

31 March 31 March 30 September

2018 2017 2017

Note GBP000 GBP000 GBP000

---------------------------------------- ----- --------- ---------------------- -------------

Revenue 3 5,392 5,028 10,301

Cost of sales (2,323) (1,914) (4,137)

---------------------------------------- ----- --------- ---------------------- -------------

Gross profit 3 3,069 3,114 6,164

Other operating expenses excluding

plc costs (2,616) (2,479) (5,005)

Trading Group EBITDA 453 635 1,159

Plc costs (267) (288) (570)

---------------------------------------- ----- --------- ---------------------- -------------

Other operating expenses (2,883) (2,767) (5,575)

---------------------------------------- ----- --------- ---------------------- -------------

Profit from continuing operations

before amortisation, depreciation,

share based payment costs and

separately identifiable costs 3 186 347 589

Amortisation of intangible assets 7 (470) (437) (880)

Depreciation (39) (76) (162)

Separately identifiable costs

and expenses 4 (137) (26) 626

Share based payments (60) (66) (162)

---------------------------------------- ----- --------- ---------------------- -------------

Operating (loss)/profit from

continuing operations (520) (258) 11

Interest receivable 1 - -

Interest payable (330) (531) (842)

---------------------------------------- ----- --------- ---------------------- -------------

Net finance expense (329) (531) (842)

---------------------------------------- ----- --------- ---------------------- -------------

Loss before tax from continuing

operations (849) (789) (831)

Taxation 5 84 87 248

---------------------------------------- ----- --------- ---------------------- -------------

Loss for the period from continuing

operations (765) (702) (583)

---------------------------------------- ----- --------- ---------------------- -------------

Discontinued operations

Loss for the period from discontinued - (100) -

operations

---------------------------------------- ----- --------- ---------------------- -------------

Loss for the period (765) (802) (583)

---------------------------------------- ----- --------- ---------------------- -------------

Loss per share (pence)

Basic and fully diluted - continuing

operations 6 (0.34) (0.31) (0.26)

Basic and fully diluted - discontinued

operations 6 - (0.04) -

Basic and fully diluted 6 (0.34) (0.35) (0.26)

Notes 1 to 10 form part of the analysis of the interim

condensed financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 March 2018

At 30

At 31 At 31 March September

March

2018 2017 2017

Note GBP000 GBP000 GBP000

--------------------------------- ----- --------- ------------ ----------

Non-current assets

Intangible assets 7 11,369 12,307 11,804

Property, plant and equipment 214 288 228

Total non-current assets 11,583 12,595 12,032

--------------------------------- ----- --------- ------------ ----------

Current assets

Inventories 102 69 66

Trade and other receivables 2,822 2,284 2,349

Cash and cash equivalents 2,037 3,888 2,905

--------------------------------- ----- ------------ ----------

Total current assets 4,961 6,241 5,320

--------------------------------- ----- --------- ------------ ----------

Total assets 16,544 18,836 17,352

--------------------------------- ----- --------- ------------ ----------

Liabilities

Short-term borrowings 9 (1,035) (2,341) (1,012)

Trade and other payables (1,137) (1,448) (1,203)

Other taxes and social security

costs (554) (783) (490)

Accruals and other payables (1,426) (1,480) (1,590)

--------------------------------- ----- --------- ------------ ----------

Total current liabilities (4,152) (6,052) (4,295)

--------------------------------- ----- --------- ------------ ----------

Non-current liabilities

Long-term borrowings 9 (4,038) (3,795) (3,914)

Deferred tax liability 8 (1,332) (1,577) (1,416)

--------------------------------- ----- --------- ------------ ----------

Total liabilities (9,522) (11,424) (9,625)

--------------------------------- ----- --------- ------------ ----------

Net assets 7,022 7,412 7,727

--------------------------------- ----- --------- ------------ ----------

Equity

Share capital 2,271 2,271 2,271

Share premium account 11,337 11,337 11,337

Capital redemption reserve 6,489 6,489 6,489

Merger reserve 1,997 1,997 1,997

Other reserve 1,661 1,505 1,601

Retained earnings (16,733) (16,187) (15,968)

--------------------------------- ----- --------- ------------ ----------

Total equity 7,022 7,412 7,727

--------------------------------- ----- --------- ------------ ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six-month period ended 31 March 2018

Capital

Share Share redemption Merger Other Retained

capital premium reserve reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- ------------

At 1 October

2016 2,271 11,337 6,489 1,997 1,439 (15,385) 8,148

Loss and total

comprehensive

loss for the

period - - - - - (802) (802)

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- ------------

Transactions

with owners

Share-based

payments - - - - 66 - 66

Total

transactions

with owners - - - - 66 - 66

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- ------------

Total

movements - - - - 66 (802) (736)

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- ------------

Equity at 31

March

2017 2,271 11,337 6,489 1,997 1,505 (16,187) 7,412

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- ------------

Capital

Share Share redemption Merger Other Retained

capital premium reserve reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------- --------- --------- ------------ --------- --------- ---------- --------

At 1 April 2017 2,271 11,337 6,489 1,997 1,505 (16,187) 7,412

Loss and total

comprehensive

loss for the

period - - - - - 219 219

-------------------- --------- --------- ------------ --------- --------- ---------- --------

Transactions with

owners

Share-based

payments - - - - 96 - 96

Total transactions

with owners - - - - 96 - 96

-------------------- --------- --------- ------------ --------- --------- ---------- --------

Total movements - - - - 96 219 315

-------------------- --------- --------- ------------ --------- --------- ---------- --------

Equity at 30

September

2017 2,271 11,337 6,489 1,997 1,601 (15,968) 7,727

-------------------- --------- --------- ------------ --------- --------- ---------- --------

Capital

Share Share redemption Merger Other Retained

capital premium reserve reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- --------- --------- ------------ --------- --------- ---------- ----------

At 1 October 2017 2,271 11,337 6,489 1,997 1,601 (15,968) 7,727

Loss and total

comprehensive

loss for the

period - - - - - (765) (765)

------------------- --------- --------- ------------ --------- --------- ---------- ----------

Transactions with

owners

Share-based

payments - - - - 60 - 60

Total transactions

with owners - - - - 60 - 60

------------------- --------- --------- ------------ --------- --------- ---------- ----------

Total movements - - - - 60 (765) (705)

------------------- --------- --------- ------------ --------- --------- ---------- ----------

Equity at 31 March

2018 2,271 11,337 6,489 1,997 1,661 (16,733) 7,022

------------------- --------- --------- ------------ --------- --------- ---------- ----------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the six-month period ended 31 March 2018

6 months 6 months Year to

to to

31 March 31 March 30 September

2018 2017 2017

Note GBP000 GBP000 GBP000

---------------------------------------- ----- --------- -------------------- -------------

Cash flows from continuing operating

activities

Cash (used) / generated by operations 10 (514) 43 (52)

Taxation - (45) (383)

---------------------------------------- ----- --------- -------------------- -------------

Net cash used in operating activities (514) (2) (435)

---------------------------------------- ----- --------- -------------------- -------------

Cash flows from investing activities

Purchase of property, plant and

equipment (75) (109) (248)

Interest received 1 - -

Net cash used in investing activities (74) (109) (248)

---------------------------------------- ----- --------- -------------------- -------------

Cash flows from financing activities

Receipt of finance lease 56 - 16

Payment of finance lease liabilities (18) (27) (30)

Interest paid (218) (202) (404)

---------------------------------------- ----- --------- -------------------- -------------

Net cash used in financing activities (180) (229) (418)

---------------------------------------- ----- --------- -------------------- -------------

Cash flow from discontinued operations (100) (38) (260)

---------------------------------------- ----- --------- -------------------- -------------

Net decrease in cash (868) (378) (1,361)

Cash at bank and in hand at beginning

of period 2,905 4,266 4,266

---------------------------------------- ----- --------- -------------------- -------------

Cash at bank and in hand at end

of period 2,037 3,888 2,905

---------------------------------------- ----- --------- -------------------- -------------

NOTES TO THE FINANCIAL INFORMATION

for the six-month period ended 31 March 2018

1. General Information

Adept4 plc is a company incorporated in the United Kingdom under

the Companies Act 2006. The principal activity of the group is the

provision of IT as a Service ("ITaaS") to small and medium sized

businesses in the United Kingdom. The interim condensed financial

statements are presented in pounds sterling because that is the

currency of the primary economic environment in which each of the

Group's subsidiaries operates.

The address of its registered office is 5 Fleet Place, London,

EC4M 7RD and its principal places of business are Leeds and

Warrington. The company is quoted on AIM, the market of that name

operated by the London Stock Exchange, under ticker symbol

AD4.L

These interim condensed financial statements contain inside

information.

2. Basis of preparation

The annual financial statements of the group are prepared in

accordance with IFRS as adopted by the European Union. The interim

financial information in this report has been prepared using

accounting policies consistent with IFRS as adopted by the European

Union. IFRS is subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and the IFRS

Interpretations Committee and there is an ongoing process of review

and endorsement by the European Commission. The financial

information has been prepared on the basis of IFRS that the

Directors expect to be adopted by the European Union and applicable

at 30 September 2018.

Financial information contained in this document does not

constitute statutory accounts within the meaning of section of 434

of the Companies Act 2006 ("the Act"). The statutory accounts for

the year ended 30 September 2017 have been filed with the Registrar

of Companies. The report of the auditors on those statutory

accounts was unqualified, did not draw attention to any matters by

way of emphasis and did not contain a statement under section

498(2) or (3) of the Act. The financial information for the six

months ended 31 March 2018 and 31 March 2017 is unaudited.

The accounting policies applied by the Group in these interim

condensed financial statements are the same as those applied by the

Group in the consolidated financial statements for the year ended

30 September 2017. In accordance with IFRS 3, prior period balances

as at 31 March 2017 and 30 September 2017 have been retrospectively

adjusted in order to reflect adjustments to provisional fair values

noted within the measurement periods arising from pre-acquisition

tax charges for the acquired entities.

After reviewing budgets, forecasts and cash projections for the

next twelve months and beyond, the Directors believe that the Group

have adequate resources to continue operations for the foreseeable

future and for this reason they have adopted a going concern basis

in preparing the interim condensed financial statements. The

interim condensed financial statements were approved by the Board

of Directors on 27 June 2018.

There were no new financial reporting standards adopted in the

six months ended 31 March 2018. The following standards and

interpretations have not been early adopted by the Group and will

be adopted in future accounting periods:

-- International Financial Reporting Standard (IFRS) 15 Revenue

from Contracts with Customers (effective for annual financial

statement periods beginning on or after 1 January 2018);

-- International Financial Reporting Standard (IFRS) 9 Financial

Instruments (effective for annual financial statement periods

beginning on or after 1 January 2018); and

-- International Financial Reporting Standard (IFRS) 16 Leases

(effective for annual financial statement periods beginning on or

after 1 January 2019)

We have been assessing the likely impact from adopting the

standards as reported in the consolidated financial statements for

the year ended 30 September 2017 and will continue to do so.

3. Segment Reporting

Following the re-organisation of the business during early 2016

the operating segments of the business were redefined to reflect

the holistic nature of IT as a Service. Three segments were

identified which are defined below;

-- Product - comprises the resale of solutions (hardware and software) from leading vendors

-- Recurring Services - comprises the provision of continuing IT

services which have an ongoing billing and support element

-- Professional Services - comprises the provision of highly

skilled resource to consult, design, install, configure and

integrate IT technologies

All revenues for continuing operations relate to the UK.

3.1 Analysis of revenue 6 months 6 months Year to

to to

31 March 31 March 30 September

2018 2017 2017

GBP000 GBP000 GBP000

-------------------------------- --------- --------- -------------

By operating segment

Product 1,210 1,115 2,232

Recurring services 3,741 3,594 7,316

Professional services 441 319 753

--------------------------------- --------- --------- -------------

Total revenue 5,392 5,028 10,301

--------------------------------- --------- --------- -------------

3.2 Analysis of gross profit

By operating segment

Product 551 516 1,000

Recurring services 2,082 2,288 4,414

Professional services 436 310 750

---------

Total gross profit 3,069 3,114 6,164

--------------------------------- --------- --------- -------------

3.3 Analysis of Adjusted Group

EBITDA

Gross profit 3,069 3,114 6,164

Other operating expenses,

not including plc costs (2,616) (2,479) (5,005)

--------------------------------- --------- --------- -------------

Trading Group EBITDA 453 635 1,159

Other operating expenses,

plc costs (267) (288) (570)

--------------------------------- --------- --------- -------------

Adjusted Group EBITDA 186 347 589

--------------------------------- --------- --------- -------------

4. Separately identifiable costs and expenses

During the period, the Group incurred the following separately

identifiable costs and expenses which are material by their size or

incidence:

6 months 6 months Year to

to to 30 September

31 March 31 March 2017

2018 2017 GBP000

GBP000 GBP000

----------------------------------------- ---------- ---------- --------------

Write back of contingent consideration - - 1,122

Termination payment for former Chairman - - (75)

Provision for dispute with Chess

ICT Limited - - (100)

Impairment of goodwill - - (200)

Professional and legal fees relating

to acquisitions (90) - -

Restructuring costs (47) (26) (121)

----------------------------------------- ---------- ---------- --------------

Separately identifiable (costs) and

expenses (137) (26) 626

----------------------------------------- ---------- ---------- --------------

5. Taxation

6 months to 6 months Year to

to

31 March 31 March 30 September

2018 2017 2017

GBP000 GBP000 GBP000

----------------------------------- ------------ --------- -------------

Current tax

UK corporation tax for the period - - -

on continuing operations

Deferred tax

Deferred tax on intangible assets

from continuing operations (84) (87) (248)

Total taxation credit for the

period (84) (87) (248)

----------------------------------- ------------ --------- -------------

6. Loss per share

6 months 6 months Year to

to to

31 March 31 March 30 September

2018 2017 2017

p/share p/share p/share

---------------------------------------- ------------ ------------ -------------

Basic and fully diluted - continuing

operations (0.34) (0.31) (0.26)

Basic and fully diluted - discontinued - (0.04) -

operations

Basic and fully diluted (0.34) (0.35) (0.26)

---------------------------------------- ------------ ------------ -------------

GBP000 GBP000 GBP000

---------------------------------------- ------------ ------------ -------------

Loss on continuing operations (765) (702) (583)

Loss on discontinued operations - (100) -

Loss attributable to ordinary

shareholders (765) (802) (583)

---------------------------------------- ------------ ------------ -------------

Weighted average number of shares

in issue:

Basic and fully diluted 227,065,100 227,065,100 227,065,097

---------------------------------------- ------------ ------------ -------------

7. Intangible assets

IT, billing

and

website Customer

Goodwill systems Brand lists Total

GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------- -------------- ----------------- ------- --------- --------

Cost

At 1 October 2016 4,312 - 1,157 7,580 13,049

Adjustments to provisional

fair values 108 - - - 108

At 31 March 2017 4,420 - 1,157 7,580 13,157

Additions - 113 - - 113

Adjustments to provisional

fair values 27 - - - 27

---------------------------- -------------- ----------------- ------- --------- --------

At 30 September 2017 4,447 113 1,157 7,580 13,297

Additions - 35 - - 35

---------------------------- -------------- ----------------- ------- --------- --------

At 31 March 2018 4,447 148 1,157 7,580 13,332

---------------------------- -------------- ----------------- ------- --------- --------

Amortisation

At 1 October 2016 - - (35) (378) (413)

Charge for the period - - (31) (406) (437)

At 31 March 2017 - - (66) (784) (850)

Impairment charge (200) - - - (200)

Charge for the period - (7) (84) (352) (443)

At 30 September 2017 (200) (7) (150) (1,136) (1,493)

Charge for the period - (10) (60) (400) (470)

At 31 March 2018 (200) (17) (210) (1,536) (1,963)

---------------------------- -------------- ----------------- ------- --------- --------

Net Book Value

At 31 March 2017 4,420 - 1,091 6,796 12,307

At 30 September 2017 4,247 106 1,007 6,444 11,804

At 31 March 2018 4,247 131 947 6,044 11,369

---------------------------- -------------- ----------------- ------- --------- --------

* Note: In accordance with IFRS 3, prior period balances as at

31 March 2017 and 30 September 2017 have been retrospectively

adjusted in order to reflect adjustments to provisional fair values

noted within the measurement periods arising from pre-acquisition

tax charges for the acquired entities.

8. Deferred tax 6 months 6 months Year to

to to 30 September

31 March 31 March 2017

2018 2017

GBP000 GBP000 GBP000

----------------------------------- ---------- ---------- --------------

Provision brought forward 1,416 1,664 1,664

Credits to income statement - on

intangibles (84) (87) (166)

Credits to income statement - for

change in future tax rates - - (82)

Provision carried forward 1,332 1,577 1,416

------------------------------------ ---------- ---------- --------------

9. Borrowings 6 months 6 months Year to

to 31 March to 31 30

2018 March September

2017 2017

GBP000 GBP000 GBP000

-------------------------------------------- ------------- --------- --------------------

Short-term borrowings

Finance lease 43 37 12

Deferred consideration for Accent Telecom - 223 -

North Limited

Deferred consideration for Adept4 Managed

IT Limited 992 1,000 1,000

Contingent consideration for Adept4 - 1,500 -

Managed IT Limited

Fair Value adjustment relating to deferred

and contingent consideration - (419) -

Total short-term borrowings 1,035 2,341 1,012

-------------------------------------------- ------------- --------- --------------------

Long-term borrowings

Finance lease 61 23 42

BGF loan notes repayable to BGF between

2021 and 2023 5,000 5,000 5,000

Fair value adjustment relating to BGF

loan notes (1,023) (1,228) (1,128)

-------------------------------------------- ------------- --------- --------------------

Total long-term borrowings 4,038 3,795 3,914

-------------------------------------------- ------------- --------- --------------------

10. Cashflow from operating activities 6 months 6 months Year to

to to 30

31 March 31 March September

2018 2017 2017

GBP000 GBP000 GBP000

------------------------------------------- --------- --------- -----------

Loss before tax from continuing

operations (849) (789) (831)

Adjustments for:

Depreciation 39 76 162

Amortisation 470 437 880

Share option charge 60 66 162

Interest expense 329 531 842

Increase in trade and other receivables (473) (716) (781)

Increase in inventories (35) (47) (44)

(Decrease) / increase in trade payables,

accruals and other creditors (55) 485 (442)

-------------------------------------------- --------- --------- -----------

Net cash (outflow)/inflow from continuing

operations (514) 43 (52)

-------------------------------------------- --------- --------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BDLLLVQFFBBF

(END) Dow Jones Newswires

June 28, 2018 02:00 ET (06:00 GMT)

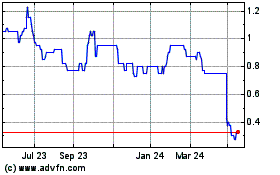

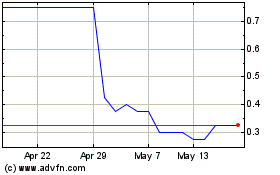

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Jul 2023 to Jul 2024