TIDMCLA

RNS Number : 4551C

Capital Lease Aviation PLC

16 October 2015

Capital Lease Aviation PLC

("CLA" or the "Company")

Proposed cancellation of Admission to AIM

Notice of Annual General Meeting

Capital Lease Aviation Plc (LSE: CLA) announces that it will,

today, be sending a Circular to Shareholders together with a notice

convening an AGM to seek Shareholder's approval to cancel the

admission of the Company's Ordinary Shares to trading on AIM.

Introduction

The Company announces it is proposing to seek shareholder

consent to cancel the admission of the Company's Ordinary Shares to

trading on AIM.

In addition, the Company is seeking shareholder consent to

execute market purchases of its Ordinary Shares and it may seek to

make market purchases (if Shareholder consent is forthcoming) in

the period following the AGM and prior to the Delisting, to the

extent that there are Shareholders selling shares on market.

This announcement sets out the background to and reasons for the

Proposal, additional information on the implications of the

Proposal for the Company and its Shareholders, and why your Board

believes the Proposal to be in the best interests of Shareholders

as a whole. Having disclosed their interests in the Company and

their intentions with regard to their individual holdings, the

Directors also unanimously recommend the Proposal.

In addition to the Proposal, the AGM will include the ordinary

business to be dealt with at the Company's annual general

meeting.

The Delisting

Reasons for the Delisting

During the course of the last 18 months, Avation has increased

its holding in the Company from approximately 62 per cent. to

approximately 97 per cent.. Following the increase in Avation's

holding, liquidity in the Company's Ordinary Shares has been

significantly reduced. The Company has considered maintaining the

listing in order to facilitate further transactions, although it

has become clear that, considering the costs of maintaining the

listing and the limited free float, it would be more beneficial to

shareholders to proceed with the Delisting.

In addition, the Company's AIM nominated adviser, WH Ireland,

has advised the board that in light of the points listed above, it

would be appropriate for the Company to consider a Delisting.

Accordingly, the Board has taken the decision to delist from AIM

in an orderly manner by seeking a shareholder vote in this

regard.

Effects of Delisting

The principal effect of the Proposal and the Delisting is that

Shareholders will no longer be able to buy and sell shares in the

Company through a public stock market and so liquidity in the

Company's shares will be extremely limited. Upon the Delisting

becoming effective, Ordinary Shares shall cease to be available in

uncertificated form and, following a short period after the

Delisting, shall be withdrawn from CREST. Holders of Ordinary

Shares in uncertificated form will then hold those shares in

certificated form, for which they will be sent share certificates

within 7 days of the CREST facility being withdrawn.

In addition, the Company will no longer be required to retain a

nominated adviser and broker, announce material events to

shareholders, comply with corporate governance requirements or to

comply with the AIM Rules. The Company will continue to be subject

to the Act, which mandates shareholder approval for certain

matters.

Following the Delisting, if there are still Shareholders in the

Company (in addition to Avation), the Company will use its

reasonable endeavours to match any Shareholders who wish to sell

their holdings with potential buyers. Whilst there can be no

guarantee that Shareholders will be able to sell their Ordinary

Shares in this manner, any Shareholder seeking to do so should

contact the Company in writing at its registered office.

Summary

Your Board has accordingly concluded that it is in the best

interests of Shareholders as a whole that the Delisting be

approved.

Under the AIM Rules, the Delisting can only be effected by the

Company after securing a special resolution of Shareholders in a

general meeting, whereby at least 75 per cent. of votes cast are in

favour of such a resolution. A period of at least five Business

Days following the Shareholder approval of the Delisting is

required before the Delisting may be put into effect.

In addition, Rule 41 of the AIM Rules requires an AIM company

that wishes the London Stock Exchange to cancel the admission of

its shares to trading on AIM to notify such intended cancellation

and separately inform the London Stock Exchange of its preferred

cancellation date at least twenty Business Days prior to such date.

In accordance with AIM Rule 41, the Directors have notified AIM of

the Company's intention to cancel the Company's admission of the

Shares to trading on AIM.

Resolution 1 contained in the Notice seeks Shareholder approval

for the Delisting. The Company has received irrevocable

undertakings from Shareholders holding 92,483,395 Ordinary Shares,

representing approximately 96.7 per cent. of the current voting

rights in the Company, to vote in favour of the Delisting. Assuming

that Shareholders approve this resolution, it is proposed that the

Delisting will take place by 24 November 2015 at the earliest.

The Board will consider making market purchases of Ordinary

Shares in the period following the AGM up until the Delisting if

there are Shareholders who are not able or willing to continue to

own shares in the Company following the Delisting and who are

offering Ordinary Shares for sale on market.

Purchases of Own Shares

The Board recognises that not all Shareholders will be able or

willing to continue to own shares in the Company following the

Delisting. At the Company's last AGM, authority was given to the

Directors to make market purchases of the Company's shares.

However, the authority only permitted such purchases at a price of

20.5 pence per Ordinary Share (being both the maximum and the

minimum price authorised for market purchases). The market price of

the Company's Ordinary Shares as at 15 October 2015 (being the

latest practicable date before publication of this announcement)

was 23.5 pence. The Company recently paid a 2 pence dividend per

ordinary share.

The Board is, subject to Shareholder consent at the AGM,

considering continuing to make on market purchases of Ordinary

Shares at 20.5 pence per Ordinary Share in the period following the

AGM up to the time of Delisting.

Once the Delisting has been effected, there will be no external

trading facility or matched bargain service in place for remaining

Shareholders to trade Ordinary Shares. Shareholders wishing to

effect transactions in Ordinary Shares post the Delisting will be

able to do so by contacting the Company Secretary directly with

their details and proposed trades. The Company Secretary will then

attempt to match trades based on the information received from

Shareholders.

All Shareholders are advised to consult their professional

advisers about their own tax position if they wish to effect market

sales of their Ordinary Shares.

Re-registration as a private limited company

The Proposal does not include a resolution to re-register the

Company as a private limited company. However, the Board may

determine in the future that this is appropriate, as it would

reduce the costs and complexity of operating the Company. A

re-registration as a private company would, in particular, allow

subject to shareholder approval, the Company to effect returns of

capital to Shareholders without the need to apply to a court of

law.

Takeover Code

The Takeover Code is issued and administered by the Takeover

Panel. The Takeover Code currently applies to the Company and will

continue to apply to the Company notwithstanding the Delisting. If

the Company is successfully re-registered as a private company, the

Takeover Code will cease only to apply to the Company on the expiry

of the 10-year period from the date of the Reregistration or, if

earlier, the date on which the Company is dissolved.

The Takeover Code and the Takeover Panel operate principally to

ensure that shareholders are treated fairly and are not denied an

opportunity to decide on the merits of a takeover and that

shareholders of the same class are afforded equivalent treatment by

an offeror. The Takeover Code also provides an orderly framework

within which takeovers are conducted. In addition, it is designed

to promote, in conjunction with other regulatory regimes, the

integrity of the financial markets

The Takeover Code is based upon a number of General Principles

which are essentially statements of standards of commercial

behaviour. General Principle One states that all holders of

securities of an offeree company of the same class must be afforded

equivalent treatment and if a person acquires control of a company,

the other holders of securities must be protected. This is

reinforced by Rule 9 of the Takeover Code which requires a person,

together with persons acting in concert with him, who acquires

shares carrying voting rights which amount to 30 per cent. or more

of the voting rights to make a general offer. A general offer will

also be required where a person who, together with persons acting

in concert with him, holds not less than 30 per cent. but not more

than 50 per cent. of the voting rights, acquires additional shares

which increase his percentage of the voting rights. Unless the

Takeover Panel consents, the offer must be made to all other

shareholders, be in cash (or have a cash alternative) and cannot be

conditional on anything other than the securing of acceptances

which will result in the offeror and persons acting in concert with

him holding shares carrying more than 50 per cent. of the voting

rights.

(MORE TO FOLLOW) Dow Jones Newswires

October 16, 2015 02:00 ET (06:00 GMT)

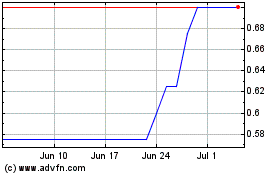

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jun 2024 to Jul 2024

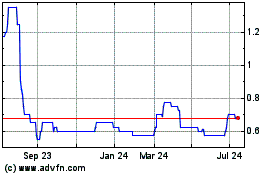

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jul 2023 to Jul 2024