Trading Statement

September 29 2000 - 3:00AM

UK Regulatory

RNS Number:7456R

Claims Direct PLC

29 September 2000

CLAIMS DIRECT PLC ("CLAIMS DIRECT")

TRADING STATEMENT

Claims Direct, the UK market leader in personal injury

compensation, which floated on the London Stock Exchange in

July, is today announcing a trading update prior to its half

year end. The interim results for the six months ended 30

September 2000 will be announced on Wednesday 29 November

2000.

At the time of flotation the company was experiencing a "run

rate" of cases per month of approximately 4,000. The

company is therefore delighted to announce that the current

"run rate" has increased to approximately 5,000 per month.

Accordingly the half-year results are likely to be

significantly ahead of expectations at the time of

flotation.

The company is also pleased to confirm that it has reached

agreement with a number of potential litigants (a small

number of former or current franchisees of the Company), the

details of whose allegations were included in the company's

flotation Prospectus. The net cost to the company is

expected to be less than #100,000, being the cost of

compensation payments made, associated costs, less the

benefit to the company of progressing cases previously

handled by these franchisees. The board is confident that

similar satisfactory agreements will be reached with the

remaining complainants.

The acquisition of the vetting division of Poole & Co was

completed as planned on 1 September 2000 and the company is

now deriving the extra income stream from that operation.

Chief Executive, Colin Poole, commented

"The period during and since the flotation has been one of

high activity and I am delighted to report that the

company's case load has continued to grow over that time,

despite the obvious distractions of the IPO."

"The company is continuing to expand its core business while

exploring new product lines and other investment

opportunities. We are performing ahead of expectations and

look forward to announcing a successful maiden set of

interim results in November."

For further information, please contact:

Claims Direct plc

Colin Poole, Chief Executive 01952 284838

Paul Doona, Finance Director 01952 284938

Web Site www.claimsdirect.com

Golin/Harris Ludgate 0207 253 2252

Reg Hoare/Victoria Martin

Notes to Editors

Claims Direct manages compensation claims for individuals

who have suffered a personal injury and wish to recover

damages from a third party. The service covers the entire

process of recovering damages taking each claimant from

initial enquiry, through expert legal and medical

assessments, to the goal of compensation.

The company generates the majority of its cases from

advertisements on national television. Individuals who call

Claims Direct are put in touch with a Claims Manager who

assists the individual in completing a detailed

questionnaire relating to the proposed claim. The

questionnaire is then reviewed by a vetting solicitor to

assess the likelihood of success. If the chance of success

is considered to be above 50 per cent the claim is passed on

to an independent, qualified solicitor who formally accepts

the case. The solicitor then represents the client

throughout the duration of the case until its conclusion

gathering medical evidence and seeking barristers' opinions

where appropriate.

Claims Direct operates on a "no win, no fee" basis. The

primary product offered by Claims Direct is the Claims

Direct Protect post-event insurance policy. Under this

policy, which the claimant purchases with a loan arranged by

the Company, the claimant is insured against the costs of

the process if the claim fails.

The Company was launched in 1995 and last year handled

28,917 new cases. In the year ended 31 March 2000 it

reported revenues of #40m, with profit before tax of #10.1m.

In July 2000 the Company floated on the London Stock

Exchange raising #50 million of new money by way of a

placing with institutional and other investors at 180p,

valuing the company at #338 million.

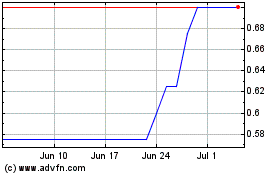

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jun 2024 to Jul 2024

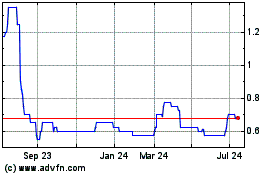

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jul 2023 to Jul 2024