TIDMCHAR

RNS Number : 8847Z

Chariot Oil & Gas Ld

23 September 2015

23 September 2015

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

Interim Results

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins

focused oil and gas exploration company, today announces its

unaudited interim results for the six month period ended 30 June

2015.

Highlights during and post period:

Positioning the Portfolio

-- Fully funded for all current commitments with sufficient cash

(US$45.5m) to pursue additional opportunities

-- Licence extension secured in Mauritania - provides time to

carry out additional studies to further de-risk prospects prior to

drilling

-- Fast follower positioning and third party activity continue

to provide information and further understanding of the subsurface

potential, notably in Morocco and Mauritania

-- High margin, deep water assets - remain economically robust even at lower oil prices

Protecting Value

-- Strong cash position with ongoing focus on capital discipline

- demonstrated by a 50% reduction in Board remuneration from May

2015

-- Rejection of AziLat's commercial amendments to the farm-out

agreement protects value of Brazilian acreage and negotiating

position for other assets

De-risking

-- Partnering discussions on-going across the portfolio

-- Woodside election not to increase equity in Morocco frees

Chariot to open acreage to wider market - dataroom open

-- Continued technical evaluation:

o Resource Update in Morocco, Competent Persons Report ("CPR")

on 3D seismic confirms prospectivity with gross mean prospective

resources of 768mmbbls evaluated for JP-1 prospect and several

other prospects with significant follow-on potential

highlighted

o Resource Update of C-19, Mauritania, confirmed four giant

prospects ranging from single target to multi-stacked prospects

o Seabed coring acquisition completed in Morocco and Mauritania

- analysis ongoing

o Environmental Impact Assessment ("EIA") submitted and awaiting

approval prior to initiating 3D seismic programme, Brazil

o 1,700 line km of 2D seismic data acquired offshore Central

Blocks, Namibia, infilling existing grid of data; Pre Stack Time

Migration ("PSTM") received and interpretation underway

o All commitments satisfied in Southern Blocks, Namibia;

processing of 2D data underway with Pre Stack Depth Migration

("PSDM") expected in November 2015

Capitalising on the Business Environment

-- 3D seismic contract signed in Brazil locking in current low cost of acquisition

-- Ongoing evaluation of new venture opportunities to balance

and broaden the portfolio; analysis and discussions continue

Outlook

Morocco & Mauritania:

-- Continue partnering processes with aim of securing a drilling partner on priority prospects

-- Analyse seabed coring results to further understand the

petroleum systems and hydrocarbon migration

Brazil:

-- Continue partnering process with aim of securing a partner for 3D seismic programme

-- Initiate 1,000km(2) of 3D acquisition following EIA approval

Namibia:

-- Evaluate the 2D seismic in region to identify and design the

optimum area for 3D acquisition programmes

-- Continue partnering processes to secure either a drilling

partner on Prospect B or a seismic partner

New Ventures

-- Continue to seek value accretive assets that will diversify

the portfolio to broaden and balance the risk profile

Larry Bottomley, CEO of Chariot commented:

"The current business environment is one that is creating both

challenges and opportunities. Within these market conditions we

have adapted our strategy to look to protect our business whilst

continuing to de-risk and develop our assets, with our underlying

goal still being to create transformational value for

shareholders.

Whilst negotiations, technical evaluations and new venture

analysis take time, we as a team are maintaining our focus with our

clear strategy and objectives. Through our strategic positioning,

strong cash balance and high margin assets we believe Chariot

remains an attractive investment opportunity and we continue to

look to progress the Company towards realising its potential."

Analyst Conference Call and Webcast

A conference call for research analysts will be held at 08.30am

(BST) today. A recording of this conference call will be available

on Chariot's website as soon as possible.

Private Investor Event

Management will also be hosting an event for private investors

at 10.00am (BST) today, further details of which are on the Company

website:

http://www.chariotoilandgas.com/index.php/investors/events-and-financial-calendar/

For further information please

contact:

Chariot Oil & Gas Limited

Larry Bottomley, CEO +44 (0)20 7318 0450

finnCap (Nominated Adviser)

Matt Goode, Christopher Raggett +44 (0)20 7220 0500

GMP Securities Europe (Joint

Broker)

Rob Collins, Emily Morris +44 (0)20 7647 2835

Jefferies International Limited

(Joint Broker)

Chris Zeal, Max Jones +44 (0)20 7029 8000

EMC(2) Advisory (Media Contact)

Natalia Erikssen +44 (0)78 0944 0929

Chief Executive's Review

The past year has seen fundamental changes within the global oil

and gas sector, the impacts of which have been felt and continue to

affect the entire industry. Within this changing environment

Chariot has continued to focus on developing its assets and

delivering on its strategy whilst seeking to both manage risk and

create value over the longer term. It has focused on four key areas

in order to maintain its ability to prosper in current market

conditions.

Position the Portfolio

At the heart of Chariot's investment case is its high impact

portfolio. Chariot holds large, operated positions in giant

potential frontier and emerging hydrocarbon provinces, which

encompass a number of basins that contain both proven and yet to be

proven plays. To attract investment in such provinces, Governments

offer attractive commercial terms as is the case in all of

Chariot's acreage and, through its careful operatorship and good

relations with its partners and ministries, the Company has

successfully renewed licences and gained extensions where necessary

to ensure that it has the time to fully evaluate its work

programmes prior to entering drilling periods.

As a result of its licence acquisitions and continued efforts to

maintain its strong asset position, the Company has developed a

deep water high margin asset base which offers robust economics

that can be transformational even at low oil prices. The giant

potential identified within each of its licence areas means that,

in the event of a discovery, the breakeven costs are competitive.

Chariot has conducted its own analysis using its Netherland Sewell

and Associates ("NSAI") approved figures and tested its exploration

portfolio against the current oil price and the commerciality

threshold, resulting in a range between an estimated break-even

cost of US$23/bbl to US$43/bbl, similar to other deep water West

African and US plays. These figures were calculated using service

costs from when the oil price was around $100/bbl so would be even

more viable in today's environment. Whilst these are internal

estimates and should be used only as a guide, they provide a

benchmark relative to other exploration assets around the world and

emphasise the relative commercial attractiveness of Chariot's

portfolio.

Protect Value

Balance sheet strength is a current competitive advantage for

the Company and protecting the cash position is paramount in the

current climate. The team continues to focus on its capital

discipline, as evidenced by the significant reduction in the Board

remuneration announced in May 2015, and its aspiration for zero

cost exploration. As operator of the licences, Chariot has

significant control of its investment scale and timing and as a

result of the extensive work programmes completed to date, there

are low or no commitments outstanding.

Protecting the value of the portfolio is an important pillar of

this strategy, hence Chariot's decision not to accept the amended

terms of its agreed farm-out with AziLat in its Brazilian acreage

in May 2015. Whilst Chariot is cognisant of the changes in the

business environment that can make partnering challenging, it is

also careful to ensure that the value of its acreage is reflected

in its agreements and will continue to strive to deliver this.

Partner to Drill

Chariot requires partners to drill for hydrocarbons. The

portfolio of giant potential, high margin assets is attractive to

supermajors, majors and large independents, but the principal

discriminating factor in successfully partnering is the quality of

the technical description and the level of the pre-drill

irreducible risk. As a consequence, reducing risk is a key focus

and the Company continues to apply its de-risking strategy in a

number of ways.

The high quality technical work that continues across all of

Chariot's assets is a fundamental part of this risk description.

Basin analysis, petroleum systems and play fairway description,

extensive proprietary seismic acquisition with state-of-the-art

processing combined with integrated evaluations and interpretation

are all tools the Company utilises to describe prospectivity in the

way that our potential partners would do themselves.

(MORE TO FOLLOW) Dow Jones Newswires

September 23, 2015 02:01 ET (06:01 GMT)

Chariot also looks to benefit from third-party activity within

our selected basins. Drilling in the deep water is high cost and

high risk, and the industry looks to de-risk the prospects as far

as possible to ensure the best chance of success from any

investment. As a fast follower, Chariot has the ability to benefit

from invaluable information provided by third party activity,

without impact on its own balance sheet. For example, successful

drilling offshore Mauritania and Senegal this year has provided

encouraging detail on the regional prospectivity and more drilling

is scheduled to prove up further potential. In both instances,

Chariot has experienced a significant increase in interest from

potential partners following these successes. Third party

information is also incorporated into Chariot's technical work

within each region and helps to further de-risk potential drilling

candidates prior to significant investment.

While remaining aware of the current business environment, the

combination of balance sheet strength, low commitments, time on

licences, quality of technical description and reducing pre-drill

risk, in basins that are delivering success, puts Chariot in a

strong position to attract partners. Through partnering at the

seismic and drilling stages, the Company not only secures funds and

reduces the cost of its exploration programme, but it also gains

important independent validation of the assets.

Capitalise on the Business Environment

The lower oil price has had an impact on the industry's cost

base. Capitalising on this trend, Chariot has been able to realise

competitively priced seismic programmes in Namibia and Brazil, and

seabed coring programmes in Morocco and Mauritania. Chariot will

continue to apply capital discipline through rigorous tendering and

contracting procedures to maximise its exploration investments.

Broadening and balancing the risk profile of the portfolio

remains important to maintain a conveyor belt of opportunities, and

the team continues to evaluate a number of new ventures in this

regard. There is a focused mandate for this, with the team looking

to add tangible value by securing assets, at the right valuation,

that fit into the Chariot portfolio.

Whilst the environment is challenging, Chariot sees this as a

time of opportunity for companies that have a robust financial

position and are able to take advantage of these market conditions.

Importantly the team has a track record of delivering on the

strategy, both from previous partnering and its experience in

securing new ventures. Discussions and evaluations continue as the

Company seeks to capitalise on this.

Operational Update

Morocco (Rabat Deep: Operator 50%, Woodside 25%, ONHYM 25%; no

remaining commitments. Loukos, Mohammedia: Operator 75%, ONHYM 25%,

no remaining commitments)

In April 2015, Chariot announced that Woodside had elected not

to take operatorship and fund the drilling of an exploration well

in Rabat Deep in return for an additional 25% equity. Whilst

Woodside retains its 25% interest, Chariot, with its 50% holding

remains operator and is currently marketing a share of its equity

to other interested parties. A dataroom is open and discussions are

ongoing. The market will be updated with progress as and when

appropriate.

Late in the second quarter, the Company completed the evaluation

of the Company's 1,700km(2) 3D dataset over the three operated

licences. NSAI have subsequently completed a CPR confirming

Chariot's view of the materiality of the JP-1 prospect, located in

the Rabat Deep offshore permit, assigning a gross mean prospective

resource of 768mmbbls of oil to this prospect. This 3D data also

highlighted several other prospects ranging between 50 and

289mmbbls within the Jurassic, the Lower Cretaceous in a

shallow-water depositional environment, and within the

Eocene-Oligocene section that offer significant follow-on potential

in the success case. In line with Chariot's continued efforts to

de-risk its assets as far as possible prior to drilling, the

Company, funded by Woodside in the Rabat Deep permit, has completed

a seabed coring programme. The aim of the analysis of these cores

will be to assist in age dating rocks that outcrop at seabed and in

identifying hydrocarbon migration to best locate a well on the JP-1

prospect.

As a fast follower, Chariot has accumulated important

information from wells drilled over the last 18 months in Morocco,

which has served to prove that the Jurassic in the offshore can

have excellent reservoirs and has confirmed the presence of a light

oil charge. However, drilling targeting the Cretaceous in a deep

water depositional environment has yet to demonstrate reservoir

which is illustrative of the benefit of the fast-follower

strategy.

Mauritania (Operator 55%, Cairn 35%, SMHPM 10%.; no remaining

commitments.)

In May 2015, Chariot and its partners announced the successful

extension of the C-19 licence. This provided additional time to

carry out a seabed coring survey which has been acquired. As with

Morocco, once the results are received and analysed, these will

provide the opportunity to gain an improved understanding of the

petroleum systems and hydrocarbon migration to aid in the decision

to enter the next period which takes on a drilling commitment.

The Company has also carried out an independent audit with NSAI

on its Mauritanian acreage, the results of which supported

Chariot's evaluation and highlighted four priority prospects. These

range from the single target PA-1 and MA-1 prospects with gross

mean prospective resources of 431mmbbls and 588mmbbls respectively

and the KT-1 and BFT-1 prospects which are interpreted to comprise

stacked deep water sandstone targets located in a combination of

structural and stratigraphic trapping geometries in the Cretaceous

and overlying Tertiary section. Individual targets in these

prospects are estimated by NSAI to contain a range of gross mean

prospective resources up to 434mmbbls. A dataroom to secure a

drilling partner is currently open and discussions are ongoing. An

update will be provided as appropriate.

Recent third party drilling in both Mauritania and Senegal has

been encouraging for Chariot's C-19 acreage demonstrating excellent

quality Cretaceous reservoirs and a material hydrocarbon charge.

These discoveries also confirm the potential for giant-scale

accumulations in this part of the Atlantic margin. Further third

party drilling due in late 2015 will continue to contribute to the

description of the petroleum systems in this region and inform

Chariot's understanding of the prospectivity.

Brazil (Operator 100%; 800km(2) 3D seismic commitment)

Chariot's Brazilian acreage sits in the Barreirinhas basin which

was conjugate to the prolific petroleum systems of Cote d'Ivoire

and Ghana during the opening of the Atlantic. As a consequence,

this basin experienced significant industry interest and

competition in Round 11 with other industry players paying over

US$300 million in signature bonuses and committing to 8,000km(2) of

3D seismic data and 9 deep water wells, one adjacent to Chariot's

acreage. Chariot secured its four blocks with a US$2 million

signature bonus for an 800km(2) 3D seismic option and no well in

the first period of exploration.

With Chariot's acreage, the team has identified sufficient

burial of the Cenomanian-Turonian source rock for hydrocarbon

generation, and the prospectivity is supported by seismic

indicating deep water turbidite sands, fan entry points as well as

a large roll-over structure.

Following the unsolicited approach and the resulting farm-out

agreement with AziLat, the Company announced in May 2015 that this

agreement had been terminated, owing to AziLat's request to amend

the original commercial terms. Given the substantial prospectivity

identified within this acreage and in order to protect the ongoing

value of its assets, Chariot considered the proposed amendments

unacceptable.

Since this time, the team has continued to re-process and is

currently interpreting further legacy 2D seismic datasets. Using

this, the Company will continue to seek a partner to participate in

its 3D seismic campaign, however, given the Company's strong

funding position it will look to pursue its commitment once the

submitted EIA has been approved, regardless of partner

participation. In order to capitalise on current market conditions,

the Company has signed a seismic contract to secure good terms and

is prepared to commence the survey as soon as state permissions are

granted. It appears that all the operators in the Barreirinhas

basin are experiencing delays in this approvals process, which

suggests there is a possibility that the 3D seismic programme may

be delayed into 2016.

Namibia

Central Blocks (Operator 65%, AziNam 20%; NAMCOR 10%; Ignitus

5%; 1500km(2) 3D commitment)

Chariot has repositioned its Namibian acreage to provide the

optionality to seek seismic or well partners. Several major oil

companies have entered the country on seismic options allowing them

to act as fast followers and, for this reason, Chariot has

positioned itself in the Central Blocks to provide the optionality

to interested parties that may seek further technical development

on the licence prior to drilling.

From its fast follower positioning, Chariot has been able to

utilise information released from third party drilling which

described an excellent source as oil prone, mature and generating a

light, sweet oil. This source rock can be directly correlated into

Chariot's Central Blocks where it is buried to the same depths and

should have experienced the same hydrocarbon maturation.

(MORE TO FOLLOW) Dow Jones Newswires

September 23, 2015 02:01 ET (06:01 GMT)

Within the 3,500km(2) of 3D seismic within the Central Blocks,

Prospect B, an upper-slope fan with gross mean prospective

resources of 469mmbbls, is drill ready. The upper-slope fans

identified within the 3D seismic extend westwards and drape over a

regional-scale outboard high. In March 2015, Chariot completed

1,700 line kilometres of 2D seismic acquisition over this high to

infill previous grid data to better determine where it focuses its

3D seismic commitment, due to be carried out in 2016. This

acquisition aims to develop structural traps to complement the

stratigraphic prospects already identified to build an attractive

portfolio of targets with demonstrable follow-on potential in the

success case.

Using its positioning, Chariot has the flexibility to seek a

partner to share in its seismic commitment or to drill its priority

prospect. This flexibility is key to Chariot's ability to adapt to

circumstances in the current environment which has been reflected

in its indicative timelines. The Company has been actively

scrutinising potential opportunities in the market and has hosted

several discussions throughout 2015 with interested parties. Of

these was the potential opportunity to accelerate a well into 2015,

however this opportunity did not mature. Chariot will continue to

focus on the partnering process in order to de-risk its Namibian

acreage as far as possible prior to drilling and updates in this

regard will be provided as appropriate.

Southern Blocks (Operator 85%; NAMCOR 10%; Quiver 5%; no

remaining commitments)

The Company has satisfied all work commitments in the Southern

acreage, and following the receipt of PSDM data in November 2015

will be developing an integrated interpretation with the Company's

proprietary datasets. This evaluation will provide essential

insight to determine the best positioning for a 3D seismic

campaign. A dataroom to secure a partner for the 3D seismic survey

will be opened following this evaluation.

An additional three wells are reported to be drilled within the

next 12 months offshore Namibia which will bring further

understanding to the plays that the Company has identified and is

pursuing in both the Central and Southern areas.

Financial Results

The Group is debt free and held a cash balance of US$45.5

million at 30 June 2015 (US$37.5 million at 30 June 2014; US$53.5

million at 31 December 2014).

The Group incurred a loss of US$4.4 million for the six months

ended 30 June 2015 (30 June 2014: US$36.1 million). The decrease in

the loss between the two periods is primarily due to an impairment

charge of US$33.6 million for the Northern Blocks offshore Namibia

reflected in the 2014 period.

Other administrative expenses of US$2.5 million are lower than

last year (30 June 2014: US$3.0 million) mainly due to the 50%

reduction in Board remuneration from May 2015 combined with other

cost savings. Share-based payments charges of US$0.6 million are

lower than the US$0.9 million incurred for the six months ended 30

June 2014 due to the vesting of historic awards of employee

deferred shares.

Net cash outflow from operating activities before changes in

working capital of US$2.3 million is lower than the US$2.8 million

for the six months ended 30 June 2014 due to cost savings in other

administrative expenses.

Capitalised exploration costs in the period of US$6.3 million

(30 June 2014: US$13.9 million) were funded by existing cash,

working capital movements and farm-in proceeds.

Outlook

Whilst the current climate remains tough and we continue to see

the sector tighten, Chariot believes it is in a strong position and

remains focused on the business in hand. Market conditions have

made partnering more challenging, but whilst the number of

attendees in data rooms is lower, there are new entrants and

discussions are underway with interested parties. Plans for further

seismic and ongoing geological & geophysical work continue as

the Company looks to progress and de-risk its assets and generate

prospects for drilling.

Chariot has adapted its strategy in order to ensure that it is

able to both survive in and capitalise on the current business

environment, and will continue to protect, progress and de-risk the

portfolio as it looks to build the business and achieve

transformational growth over the longer term. Management views this

as an opportunity to leverage its cash position and expertise in

order to broaden the portfolio and risk profile. This is aimed at

generating a sustainable business model whilst progressing towards

drilling. The team is dedicated to delivering on its strategy and

looks forward to reporting on its ongoing work and progress.

Larry Bottomley

Chief Executive Officer

22 September 2015

Chariot Oil & Gas Limited

Independent review report to Chariot Oil & Gas Limited

Introduction

We have been engaged by the company to review the set of

financial statements in the half-yearly financial report for the

six months ended 30 June 2015 which comprises the consolidated

statement of comprehensive income, the consolidated statement of

changes in equity, the consolidated statement of financial

position, the consolidated cash flow statement and the related

notes.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

Our responsibility

Our responsibility is to express to the company a conclusion on

the set of financial statements in the half-yearly financial report

based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with the International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing and consequently does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the set of financial statements in the

half-yearly financial report for the six months ended 30 June 2015

is not prepared, in all material respects, in accordance with the

rules of the London Stock Exchange for companies trading securities

on AIM.

BDO LLP

Chartered Accountants

London

United Kingdom

22 September 2015

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Chariot Oil & Gas Limited

Consolidated statement of comprehensive income for the six

months ended 30 June 2015

Six months Six months Year ended

ended 30 ended 31 December

June 2015 30 2014

June 2014

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Share based payments (607) (854) (1,746)

Impairment of exploration

asset 4 - (33,629) (33,629)

Other administrative

expenses (2,483) (2,991) (6,053)

------------------------------ ------- -------------- -------------- ---------------

Total operating expenses (3,090) (37,474) (41,428)

------------------------------ ------- -------------- -------------- ---------------

Loss from operations (3,090) (37,474) (41,428)

Finance income 704 1,574 1,546

Finance expense (1,849) - (1,580)

------------------------------ ------- -------------- -------------- ---------------

Loss for the period

before taxation (4,235) (35,900) (41,462)

Tax expense (154) (180) (311)

------------------------------ ------- -------------- -------------- ---------------

Loss for the period

and total comprehensive

(MORE TO FOLLOW) Dow Jones Newswires

September 23, 2015 02:01 ET (06:01 GMT)

loss for the period

attributable to equity

owners of the parent (4,389) (36,080) (41,773)

------------------------------ ------- -------------- -------------- ---------------

Loss per ordinary share 3 US$(0.02) US$(0.18) US$(0.19)

attributable to the

equity holders of the

parent - basic and diluted

------------------------------ ------- -------------- -------------- ---------------

Chariot Oil & Gas Limited

Consolidated statement of changes in equity for the six months

ended 30 June 2015

Share Total

based Foreign attributable

Share Share Contributed payment exchange Retained to equity

capital premium equity reserve reserve deficit holders of

the parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

---------------- ------------ ------------ -------------- ------------ ------------ ------------ --------------

For the six

months ended

30 June 2015

(unaudited)

As at 1

January 2015 4,779 338,348 796 4,514 (1,241) (185,145) 162,051

Loss and total

comprehensive

loss for the

period - - - - - (4,389) (4,389)

Share based

payments - - - 607 - - 607

As at 30 June

2015 4,779 338,348 796 5,121 (1,241) (189,534) 158,269

---------------- ------------ ------------ -------------- ------------ ------------ ------------ --------------

For the six

months ended

30 June 2014

(unaudited)

As at 1

January 2014 3,776 324,577 796 3,874 (1,241) (143,372) 188,410

Loss and total

comprehensive

loss for the

period - - - - - (36,080) (36,080)

Share based

payments - - - 854 - - 854

Transfer of

reserves due

to issue of

LTIPS 6 266 - (272) - - -

As at 30 June

2014 3,782 324,843 796 4,456 (1,241) (179,452) 153,184

---------------- ------------ ------------ -------------- ------------ ------------ ------------ --------------

For the year ended 31 December 2014

(audited)

As at 1 January 2014 3,776 324,577 796 3,874 (1,241) (143,372) 188,410

Loss and total comprehensive loss for the

year - - - - - (41,773) (41,773)

Issue of capital 972 13,605 - - - - 14,577

Issue costs - (909) - - - - (909)

Share based payments - - - 1,746 - - 1,746

Transfer of reserves due to issue of LTIPS 31 1,075 - (1,106) - - -

As at 31 December 2014 4,779 338,348 796 4,514 (1,241) (185,145) 162,051

-------------------------------------------- ------- --------- ----- --------- --------- ----------- ----------

Chariot Oil & Gas Limited

Consolidated statement of financial position as at 30 June

2015

30 June 30 June 31 December

2015 2014 2014

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Non-current assets

Exploration and appraisal

costs 4 106,067 108,509 101,251

Property, plant and

equipment 204 508 342

------------------------------ ------- ----------- ----------- -------------

Total non-current assets 106,271 109,017 101,593

------------------------------ ------- ----------- ----------- -------------

Current assets

Trade and other receivables 1,432 1,492 1,681

Inventory 7,462 7,761 7,427

Cash and cash equivalents 5 45,521 37,510 53,482

------------------------------ ------- ----------- ----------- -------------

Total current assets 54,415 46,763 62,590

------------------------------ ------- ----------- ----------- -------------

Total assets 160,686 155,780 164,183

------------------------------ ------- ----------- ----------- -------------

Current liabilities

Trade and other payables 2,417 2,596 2,132

Total current liabilities 2,417 2,596 2,132

------------------------------ ------- ----------- ----------- -------------

Total liabilities 2,417 2,596 2,132

------------------------------ ------- ----------- ----------- -------------

Net assets 158,269 153,184 162,051

------------------------------ ------- ----------- ----------- -------------

Capital and reserves

attributable to equity

holders of the parent

Share capital 6 4,779 3,782 4,779

Share premium 338,348 324,843 338,348

Contributed equity 796 796 796

Share based payment

reserve 5,121 4,456 4,514

Foreign exchange reserve (1,241) (1,241) (1,241)

Retained deficit (189,534) (179,452) (185,145)

------------------------------ ------- ----------- ----------- -------------

Total equity 158,269 153,184 162,051

------------------------------ ------- ----------- ----------- -------------

Chariot Oil & Gas Limited

Consolidated cash flow statement for the six months ended 30

June 2015

Six months Six months Year ended

ended ended 31 December

30 30 June 2014

June 2015 2014

US$000 US$000 US$000

Unaudited Unaudited Audited

------------------------------------ -------------- -------------- ---------------

Operating activities

Loss for the period before

taxation (4,235) (35,900) (41,462)

Adjustments for:

Finance income (704) (1,574) (1,546)

Finance expense 1,849 - 1,580

Depreciation 153 164 334

Share based payments 607 854 1,746

Impairment of exploration

asset - 33,629 33,629

------------------------------------ -------------- -------------- ---------------

Net cash outflow from operating

activities before changes

in working capital (2,330) (2,827) (5,719)

Decrease/(increase) in trade

and other receivables 70 166 (197)

(Decrease)/increase in trade

and other payables (622) (23) 162

Increase in inventories (19) (527) (92)

------------------------------------ -------------- -------------- ---------------

Cash outflow from operating

activities (2,901) (3,211) (5,846)

Tax payment (164) (1,989) (2,078)

------------------------------------ -------------- -------------- ---------------

Net cash outflow from operating

activities (3,065) (5,200) (7,924)

------------------------------------ -------------- -------------- ---------------

Investing activities

Finance income 708 753 1,578

Payments in respect of property,

plant and equipment (15) (59) (63)

Farm-in proceeds 1,731 - 10,265

Payments in respect of intangible

assets (5,471) (15,489) (19,146)

(MORE TO FOLLOW) Dow Jones Newswires

September 23, 2015 02:01 ET (06:01 GMT)

Net cash outflow used in

investing activities (3,047) (14,795) (7,366)

------------------------------------ -------------- -------------- ---------------

Financing activities

Issue of ordinary share

capital - - 14,577

Issue costs - - (909)

Net cash outflow used in

financing activities - - 13,668

------------------------------------ -------------- -------------- ---------------

Net decrease in cash and

cash equivalents in the

period (6,112) (19,995) (1,622)

Cash and cash equivalents

at start of the period 53,482 56,684 56,684

Effect of foreign exchange

rate changes on cash and

cash equivalent (1,849) 821 (1,580)

Cash and cash equivalents

at end of the period 45,521 37,510 53,482

------------------------------------ -------------- -------------- ---------------

Chariot Oil & Gas Limited

Notes to the Interim Financial Statements for the six months

ended 30 June 2015

1. Accounting policies

Basis of preparation

The interim financial statements have been prepared using

policies based on International Financial Reporting Standards (IFRS

and IFRIC interpretations) issued by the International Accounting

Standards Board (IASB) as adopted for use in the EU.

The interim financial information has been prepared using the

accounting policies which were applied in the Group's statutory

financial statements for the year ended 31 December 2014. The Group

has not adopted IAS 34: Interim Financial Reporting in the

preparation of the interim financial statements.

There has been no impact on the Group of any new standards,

amendments or interpretations that have become effective in the

period. The Group has not early adopted any new standards,

amendments or interpretations.

2. Financial reporting period

The interim financial information for the period 1 January 2015

to 30 June 2015 is unaudited but was the subject of an independent

review carried out by the Company's auditors, BDO LLP. The

financial statements also incorporate the unaudited figures for the

interim period 1 January 2014 to 30 June 2014 and the audited

figures for the year ended 31 December 2014.

The financial information contained in this interim report does

not constitute statutory accounts as defined by sections 243-245 of

the Companies (Guernsey) Law 2008.

The figures for the year ended 31 December 2014 are not the

Group's full statutory accounts for that year. The auditors' report

on those accounts was unqualified, did not contain references to

matters to which the auditors drew attention by way of emphasis and

did not contain a statement under section 263 (3) of the Companies

(Guernsey) Law 2008.

3. Loss per share

The calculation of the basic earnings per share is based on the

loss attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

Six months Six months Year ended

ended ended 30 31 December

30 June June 2014 2014

2015

-------------------------- ------------- ------------- --------------

Loss for the period

US$000 (4,389) (36,080) (41,773)

-------------------------- ------------- ------------- --------------

Weighted average number

of shares 262,294,113 202,043,615 222,449,858

-------------------------- ------------- ------------- --------------

Loss per share, basic US$(0.02) US$(0.18) US$(0.19)

and diluted*

-------------------------- ------------- ------------- --------------

*Inclusion of the potential ordinary shares would result in a

decrease in the loss per share and, as such, is considered to be

anti-dilutive. Consequently a separate diluted loss per share has

not been presented.

4. Exploration and appraisal costs

Six months ended 30 June Six months ended 30 June 2014 Year

2015 ended 31 December 2014

-------------------------- ------------------------------ ------------------------------- -------------------------

US$000 US$000 US$000

-------------------------- ------------------------------ ------------------------------- -------------------------

Balance brought forward 101,251 128,284 128,284

-------------------------- ------------------------------ ------------------------------- -------------------------

Additions 6,256 13,854 17,287

-------------------------- ------------------------------ ------------------------------- -------------------------

Farm-in proceeds (1,440) - (10,691)

-------------------------- ------------------------------ ------------------------------- -------------------------

Impairment - (33,629) (33,629)

-------------------------- ------------------------------ ------------------------------- -------------------------

Net book value 106,067 108,509 101,251

-------------------------- ------------------------------ ------------------------------- -------------------------

As at 30 June 2015 the net book values of the five cost pools

are Central Blocks offshore Namibia US$44.3m (31 December 2014:

US$43.0m), Southern Blocks offshore Namibia US$49.5m (31 December

2014: US$47.3m), Mauritania US$4.4m (31 December 2014: US$3.9m),

Morocco US$3.4m (31 December 2014: US$3.2m) and Brazil US$4.5m (31

December 2014: US$3.9m).

Farm-in proceeds are in relation to the farm-out of 25% of the

Rabat Deep Offshore permits I-IV, Morocco, to a wholly owned

subsidiary of Woodside Petroleum Limited, which completed on 23

December 2014.

Continued portfolio review leading to no application for a

licence renewal of 1811A&B resulted in the licence lapsing on

26 October 2014, causing a provision of US$33.6 million against the

carrying value of Northern Blocks, Namibia.

5. Cash and cash equivalents

As at 30 June 2015 the cash balance of US$45.5m (31 December

2014: US$53.5m) contains the following cash deposits that are

secured against bank guarantees given in respect of exploration

work to be carried out:

30 June 2015 30 June 2014 31 December 2014

------------------------- -------------- -------------- ------------------

US$000 US$000 US$000

------------------------- -------------- -------------- ------------------

Brazilian licences 9,093 12,958 10,745

------------------------- -------------- -------------- ------------------

Mauritanian licence 611 500 500

------------------------- -------------- -------------- ------------------

Moroccan licences 1,400 1,900 1,900

------------------------- -------------- -------------- ------------------

Namibian 2714B licence 300 300 300

------------------------- -------------- -------------- ------------------

11,404 15,658 13,445

------------------------- -------------- -------------- ------------------

The funds are freely transferrable but alternative collateral

would need to be put in place to replace the cash security.

The cash balance of US$45.5 million (31 December 2014: US$53.5

million) does not include US$1.4 million (31 December 2014: US$1.4

million) held in a Brazilian Real denominated escrow bank account

relating to a farm-out agreement with a wholly owned subsidiary of

AziLat Limted which was terminated on 19 May 2015. At 30 June 2015

the Group did not control or benefit from this escrow cash and the

funds were returned to AziLat limited after the reporting

period.

6. Share capital

Allotted, called up and fully paid

----------- ------------------------------------------------------------------------------------

At 30 At 30 At 30 At 30 At 31 At 31

June 2015 June June June December December

2015 2014 2014 2014 2014

----------- --------------- --------- --------------- --------- --------------- -----------

Number US$000 Number US$000 Number US$000

----------- --------------- --------- --------------- --------- --------------- -----------

Ordinary

shares

of 1p

each 262,294,113 4,779 202,174,664 3,782 262,294,113 4,779

----------- --------------- --------- --------------- --------- --------------- -----------

No ordinary shares issued were during the six month period to 30

June 2015.

(MORE TO FOLLOW) Dow Jones Newswires

September 23, 2015 02:01 ET (06:01 GMT)

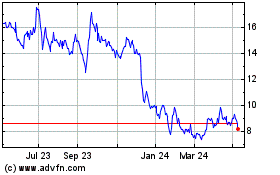

Chariot (LSE:CHAR)

Historical Stock Chart

From May 2024 to Jun 2024

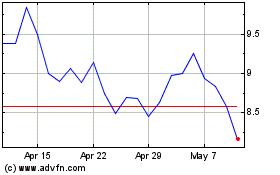

Chariot (LSE:CHAR)

Historical Stock Chart

From Jun 2023 to Jun 2024