Celtic PLC - Statement by Consortium

December 22 1998 - 2:30AM

UK Regulatory

RNS No 3648c

CELTIC PLC

22nd December 1998

Re: Celtic PLC

Statement by the Consortium

Further to the statement released by the board of directors of Celtic PLC

("Celtic" or "the Club") at 5 pm on Friday 18 December, 1998 the consortium

comprising BT Capital Partners Europe and Messrs. Jim McAvoy, Kenny Dalglish,

Jim Kerr and Paul Hewson ("the Consortium") has today released the following

statement:

The Consortium is disappointed by the manner in which Mr. Fergus McCann and

his fellow board members have dealt with its proposals for the future of

Celtic PLC. Prior to the onset of the publicity surrounding its proposal,

the Consortium attempted to conduct discussions with Mr. McCann in private.

These discussions were initiated through a written proposal, the content of

which was intended to serve as a basis for discussion. Mr. McCann required

that any proposals be placed in the hands of his advisors and that ultimately

they be submitted to the Board of Celtic PLC. The Consortium complied at each

stage with Mr. Mc McCann's requests.

At no time did the Consortium or its advisors secure a meeting with the Board

of Celtic PLC to discuss the content of its proposals. The first indication

that its contents were not of interest to the Board came in a letter from the

advisors to the Board, Greig Middleton, received by the Consortium's advisors

at 4.30 pm on Friday 18 December, 1998. As a result of the subsequent press

release issued by Celtic PLC, the Consortium feels it has no choice but to

withdraw the current proposal, which was in any event subject principally to

detailed due diligence of the Club and a recommendation from the Board of

Celtic PLC.

However, the Consortium continues to believe its proposals was in the interest

of Celtic PLC, its supporters and shareholders, and regrets that the Board did

not wish to enter into discussions. The Consortium also recognises that

without the support of Mr. McCann in relation to his majority shareholding,

any formal bid for the Club could not succeed. The Consortium has at all

times expressed Mr.McCann's support to be a pre-condition to a bid for the

entire issued share capital of the Club.

The Consortium would like to make the following specific points in relation to

the Consortium's proposal.

1. The Long Term Interests of Celtic PLC - The Consortium believes that

Celtic PLC requires immediate and substantial investment both in players and

in the development of training facilities if it is to return to the top tier

of European football. The Consortium is not aware of any substantive plan

currently in place to address this requirement. The Consortium's proposal

included the provision of substantial amounts to be available for immediate

investment in both areas.

2. Ownership/Exit - In its proposal, the Consortium recognised the

importance of securing continued supporter involvement, and included

arrangements to cater for this in the structure of its proposal. However, to

remain a top tier football club in today's market requires continued and

significant investment, the best source of which is not necessarily supporter

shareholders alone. As a result, the Consortium views the involvement of a

professional investor with substantial resources as a major strength of the

proposal.

Although the Consortium at all times maintained a willingness and expressed a

desire to discuss appropriate exit mechanics and corporate governance

provisions, this opportunity was never provided by the Board or its advisors.

3. Price and Value - The requirement for detailed due diligence,

particularly in relation to current financial performance, makes a detailed

discussion of price and value inappropriate. However, the Consortium would

like to point out that: (i) its proposal valued the Club in line with the

valuation multiples used by potential purchasers of other publicly traded

football clubs; and (ii) the market value of the ordinary shares does not

appear to take into account the dilution which will occur on conversion of the

preference shares.

4. Gearing - The Consortium's proposal envisaged that the acquisition

would have been in part funded through long-term debt. The Consortium firmly

believed this structure to be both prudent and appropriate. Contrary to press

speculation, there was no intention to fund the operations of the Club through

an overdraft facility, and the proposal would have allowed the Club financial

flexibility to make further investments as required. As well as the debt and

equity capital to have been invested by BT Capital Partners Europe, each of

the individuals in the Consortium had agreed to commit substantial personal

funds to the proposal. Neither BT Capital Partners Europe nor the individuals

would have made this commitment had the proposal not in their opinion been

prudently and appropriately financed.

5. Commercial Development - The Consortium expressed a strong interest

in working with the Club's existing commercial management team to optimise the

daily operations of the Club. In addition, the members of the Consortium

possess considerable commercial expertise and experience. In Kenny Dalglish,

the Consortium would have been able to offer the services and commitment of

one of Europe's leading football experts, and a man uniquely qualified to lead

an effort to return Celtic to the elite tier of European football.

6. Process - The Consortium also notes the Board's comment that BT

Wolfensohn, the financial advisers to the Consortium were asked to consent to

the release of detailed information relating to the proposal, and that this

consent was refused. The Consortium wishes to state for the record that this

request was received from Greig Middleton at 4.30pm and that a response was

required by 4.45pm. When BT Wolfensohn asked for a copy of the proposed

detailed statement by the Board prior to consenting to its release, this

request was refused.

At no time during the period from November 11th, 1998 when the Consortium's

proposal was first made available to Mr. Cann's advisors, to December 19th,

1998 when the Board's statement was released, were any meetings held between

the Consortium and Mr.McCann. At no time during the period from December 3rd,

1998 when the Consortium's proposal was provided to the Board, to December

19th, 1998 were any meetings held between the Consortium and the Board.

The Consortium continues to have an interest in the development of Celtic.

However, in light of the Board and the majority shareholder's stated

unwillingness to deal with the Consortium, the Consortium regrets that it

cannot unilaterally advance its proposal further.

For the further information:

Rollo Head or Ben Padovan

0171 329 0096

Shandwick - London Office

Graeme Jack

0141 333 0557

Shandwick - Glasgow Office

END

MSCFELFUFUAUFDE

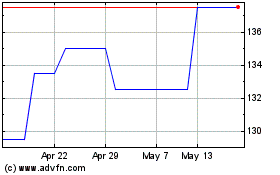

Celtic (LSE:CCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

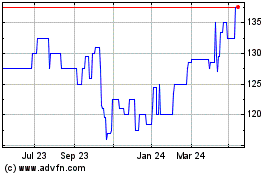

Celtic (LSE:CCP)

Historical Stock Chart

From Jul 2023 to Jul 2024