Celtic PLC - Final Results

August 12 1997 - 3:30AM

UK Regulatory

RNS No 5777h

CELTIC PLC

12th August 1997

PRELIMINARY ANNOUNCEMENT

CELTIC PLC

CHAIRMAN'S STATEMENT

The financial results in this 1997 Annual Report have met or

exceeded your Board's objectives in all areas, and are a

credit to our hard working management and staff, and to the

loyalty of our customers and supporters.

Although the season began with a strengthened player squad,

which also benefited from further investment during the year,

success on the playing field proved elusive. Our First

Team's performance over the year did not reach the hoped for

level, and the loss of key matches resulted in no domestic

trophies and a lack of progress in Europe.

I can assure both shareholders and supporters, however, that

the substantial profit earned this year will be reinvested to

improve the success of the Club on the field, and the process

of strengthening our playing resources will continue. In

turn, football success will come hand in hand with our success

as a business.

Attendance at Celtic First Team matches rose by 37% to a total

of 1,692,558, the majority at Celtic Park where occupancy

averaged 92%. Our policy of continuing to invest in a high

capacity stadium and improvements to the First Team playing

squad is being justified. The addition of 4 new players last

season, and 6 more since then, will, I am sure, improve our

prospects for success in the near future.

As Celtic grows and aspires to compete at a higher level, both

domestically and in Europe, I am convinced that the recent

change in the way our football activities are managed, is a

major step forward. With Jock Brown as General Manager of

football operations and Wim Jansen as our Head Coach, along

with a well qualified support staff, we believe we have the

right structure and the right people.

Solid progress has also been made in all areas of Celtic's

business:

- season tickets remain at the highest level of any British

club with a large number of waiting list members

- retail sales grew by 35% and an improved shirt sponsorship

deal has been secured covering the next 3 years

- the South East stand now accommodates all administrative,

commercial and football staff in centralised modern offices,

while dining and meetings capacity has been increased in the

South Stand.

- a Celtic Museum and Visitor Centre is now under

construction, along with a retail megastore, with openings

set for November

- Celtic Pools enjoyed a record year and consolidated its

position as the most successful fund raiser of any British

club.

Our determination to return Celtic to the status of a top-

level European club brings great pressure and challenges which

I welcome because I know they can be met. In common with

most major clubs, we must grow our revenue rapidly to meet the

rising costs of player acquisitions and salaries. But we are

hindered by the quality and structure of the Scottish domestic

game and its limited market. This quality will improve only

through a more productive structure for the full time

professional clubs.

Within the year we intend to start work on the next phase of

the rebuilding of Celtic Park. It will be of a scale and

quality worthy of Celtic's stature and the strength of our

support. During the current year we also intend to start

work on an upgraded Training Centre in order to develop the

star Celtic players of the future.

Please refer to the report on Celtic Charity Fund on page 20.

In thanking all those who support Celtic in many ways, I want

to commend in particular all who worked on the Fund's projects

and who made donations.

Celtic's leadership of the Youth Against Bigotry programme,

adopted in 100 Glasgow schools, was recently endorsed by the

Scottish Minister for Education and Industry to become a

project nationally. The Club's campaign also received the

Scottish Equality Award from the European Commission.

Celtic's business success will help deliver its football

success and its long term security, but its stature as a

caring institution with an unrivalled history gives us the

greatest satisfaction and pride.

Date 11 August 1997 Fergus McCann

GROUP PROFIT AND LOSS ACCOUNT

YEAR ENDED 30 JUNE 1997

1997 1996

#000 #000

TURNOVER 22,189 16,005

OPERATING EXPENSES (16,290) (13,270)

_______ _______

PROFIT FROM OPERATIONS 5,899 2,735

AMORTISATION OF INTANGIBLE FIXED ASSETS (3,302) (1,624)

NET GAIN ON SALE OF INTANGIBLE FIXED ASSETS 2,606 58

WRITE DOWN OF INTANGIBLE FIXED ASSETS - (2,178)

_______ _______

OPERATING PROFIT (LOSS) 5,203 (1,009)

INTEREST RECEIVABLE AND

SIMILAR INCOME 27 91

INTEREST PAYABLE AND

SIMILAR CHARGES (78) (95)

____ ____

PROFIT/(LOSS) ON ORDINARY ACTIVITIES

BEFORE TAXATION 5,152 (1,013)

TAX ON ORDINARY ACTIVITIES - -

_______ _______

PROFIT/(LOSS) FOR THE YEAR 5,152 (1,013)

PREFERENCE DIVIDEND (533) -

_______ _______

RETAINED PROFIT/(LOSS) FOR THE YEAR 4,619 (1,013)

--------------------

EARNINGS/(LOSS) PER ORDINARY SHARE #15.93 (#3.49)

FULLY DILUTED EARNINGS/(LOSS) PER SHARE #10.83 (#2.24)

All amounts relate to continuing operations.

There were no gains or losses recognised in 1997 other than

the profit for the year.

GROUP BALANCE SHEET

30 JUNE 1997

1997 1996

#000 #000 #000 #000

FIXED ASSETS

Tangible assets 32,606 30,935

Intangible assets 8,958 8,152

_______ _______

41,564 39,087

CURRENT ASSETS

Stocks 126 212

Debtors 3,367 1,281

Cash at bank and in hand 3,478 67

_______ _______

6,971 1,560

--------- ---------

CREDITORS - Amounts falling

due within one year (6,223) (3,808)

Income deferred less

than one year (6,000) (4,979)

_______ _______

(12,223) (8,787)

--------- ---------

NET CURRENT LIABILITIES (5,252) (7,227)

_______ _______

TOTAL ASSETS LESS

CURRENT LIABILITIES 36,312 31,860

CREDITORS - Amounts falling due

after more than one year (305) (472)

_______ _______

NET ASSETS 36,007 31,388

--------- ---------

CAPITAL AND RESERVES

Called up share capital

(includes non-equity) 11,390 11,390

Share premium 17,361 17,361

Profit and loss account 7,256 2,637

_______ _______

SHAREHOLDERS' FUNDS 36,007 31,388

--------- ---------

Approved by the Board on 11 August 1997

.........................

Fergus J McCann Director

Eric J Riley Director

NOTE

1.THE ABOVE RESULTS FOR THE YEAR HAVE BEEN EXTRACTED FROM THE

ANNUAL REPORT AND ACCOUNTS WHICH WILL BE DESPATCHED TO

SHAREHOLDERS ON 12 AUGUST 1997.

END

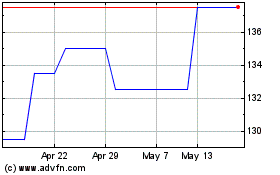

Celtic (LSE:CCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

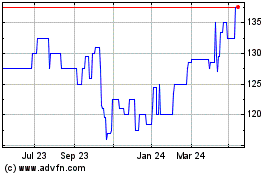

Celtic (LSE:CCP)

Historical Stock Chart

From Jul 2023 to Jul 2024