TIDMCCP

RNS Number : 5792R

Celtic PLC

12 September 2014

Celtic PLC

Announcement of Results for the year ended 30 June 2014

SUMMARY OF THE RESULTS

Operational Highlights

-- Winners of the SPFL.

-- Participated in the UEFA Champions League, having played 6

home European matches (2013: 6).

-- 28 home matches played at Celtic Park (2013: 30).

-- Scottish Cup Final and SPFL League Cup Final held at Celtic Park.

-- The Celtic Way officially opened in May 2014.

-- Successful hosting of the Commonwealth Games opening ceremony

Financial Highlights

-- Group revenue decreased by 14.6% to GBP64.74m (2013:

GBP75.82m), in part due to the GBP100 reward on season tickets.

-- Operating expenses (excluding exceptional operating expenses)

decreased by 4.5% to GBP59.89m (2013: GBP62.71m).

-- Investment in football personnel of GBP8.07m (2013: GBP9.67m).

-- Year end net cash at bank GBP3.83m (2013: GBP3.76m).

-- Exceptional costs of GBP4.66m (2013: GBP1.83m).

-- Profit before tax GBP11.17m (2013: GBP9.74m).

-- New long term bank facility agreement.

For further information contact:

Company

Ian Bankier, Celtic plc Tel: 0141 551 4235

Peter Lawwell, Celtic plc Tel: 0141 551 4235

Iain Jamieson, Celtic plc Tel: 0141 551 4235

Canaccord Genuity Limited, Nominated Adviser

Bruce Garrow Tel: 020 7523 8350

CHAIRMAN'S STATEMENT

This pleasing set of annual results arise principally because we

have enjoyed a second consecutive season winning our home league

and participating in UEFA Champions League football, together with

an increased contribution from the disposal of player registrations

during the year. The momentum accumulated from two such seasons has

placed us in a strong financial position going forward. I pay

tribute to Neil Lennon and his management team, who left the Club

in May, and thank them for their contribution and the success

achieved during their time with the Club.

Whilst the short term objectives of the Company are dominated by

our day to day success as a Club on the park, the chief role of the

Board is to ensure that the long term future of the Club, and the

Company, is secured. Ensuring the long term security of this Club

is a process of maximising the potential of the present and

managing the risks of the future. The Board is highly conscious of

the financial environment in which we play football here in

Scotland. The harsh reality is that the total income from

broadcasting rights available to the Scottish game is a tiny

fraction of what is available to our neighbours in England.

Within this context and in the face of these hard facts, the

Board has evolved the strategy that the Club, financially, has to

adopt a self-sustaining model. In plain words, we have to live

within our means. We cannot spend money that we don't have. This is

the only way to discharge our fundamental duty to protect the

future of this great Club for our fans and for future generations

of Celtic fans. Despite all of this, we share the fans'

disappointment over the failure to qualify for the group stages of

the UEFA Champions League this year.

Obviously, we work very hard to employ the funds we have to

allow the manager and the team to produce the best football results

they can. We do our utmost to acquire the best players we can

within our financial constraints and the manager and the football

operation use their best efforts to develop these players along

with the talented players produced by our Youth Academy. We fully

support our Chief Executive and his team as they manage this

delicate and often difficult balance. There is no other way to

manage a sustainable football club in Scotland.

As a result of these constraints, we are committed to improving

the football environment in which we play. We are represented at

the highest levels of Scottish and European football by our Chief

Executive, who is a board member of the European Club Association

and the Scottish Football Association as well as being a member of

the Professional Game Board of the Scottish FA, and by our

Financial Director, who is a board member of the Scottish

Professional Football League and a member of the European Club

Association's Finance Committee.

This year also saw the creation of Celtic FC Foundation, the

merger of Celtic Charity Fund and the Company's Community

Foundation Department to become a new, stronger charity with a

wider role and greater reach. In keeping with the charitable

principles and heritage of the Company, we are delighted to support

Celtic FC Foundation as it delivers change and purpose to the

Celtic Family and beyond.

The Foundation's priority is to provide assistance to those who

face daily challenges within its key priority areas: health;

equality; learning and poverty. In addition, support is offered in

the form of delivery and/or partnership to external charities and

other organisations who offer value in the community and whose

principles fit within these key priority areas.

As we look forward to the year to come, I am delighted to

welcome Ronny Deila to Celtic. The Board is fully supportive of the

philosophy and long term approach of the coaching team. We look

forward with anticipation to the development of a new team on the

pitch that will, no doubt, feed from the passion and dedication of

our supporters, and to the continued development of the Club to

maintain stability and success for the long term.

I thank each and every one of our fans, sponsors, partners and

shareholders for their continuing commitment to this great

institution.

Ian P Bankier

12 September 2014

Chairman

CHIEF EXECUTIVE'S REVIEW

The year ended 30 June 2014 saw success on and off the pitch and

the beginning of a transition for Celtic, which I am sure will

build on the good work of previous years, delivering stability,

growth and success for the future.

Our core business strategy is focussed on a football operation

with a self sustaining financial model and relies upon: the youth

academy; player development; player recruitment; management of the

player pool; and sports science and performance analysis; to

deliver long term, sustainable football success. The Board reviews

our strategy on an ongoing basis and we believe that it continues

to support the stability and growth of the club in the short and

long term. Our year end cash at bank position has increased

slightly to GBP3.83m (2013: GBP3.76m), however it should be noted

that, during the year, fluctuating cash requirements mean that we

are in a net debt position, which peaked at GBP6.50m during

2013/14.

The Club won the inaugural Scottish Professional Football League

Premiership, securing the league title on 26(th) March, the

earliest that the top division had been won in 85 years. Despite

disappointing results in the domestic cup competitions, our

qualification for the group stages of the UEFA Champions League

contributed to a successful season for the Club, one that would

come to be the last for Neil Lennon. Adding to the honours that he

won as a player, Neil's time as manager of Celtic was a great

success, supported by Johan Mjallby and Garry Parker. I thank them

for their commitment to Celtic and to the success that we have

enjoyed.

Our Youth Academy enjoyed another very impressive year, with

teams participating in the UEFA Youth League and experiencing

domestic success including the SPFL Under 20 league (for the fifth

time in a row), SPFL Under 19 League, the SPFL Under 19 League Cup

and the Glasgow Cup (Under 17s). During the year we were delighted

to see the continued emergence of first team players from the

Academy squads, which is so important to the culture of the Club.

The partnership between the Youth Academy and St. Ninian's High

School in Kirkintilloch continues to grow, with development of

talent on the pitch and in the classroom producing young players

ready to move on to full time football.

The continued commitment of our supporters, shareholders,

partners and colleagues is reflected in a successful year for

ticket sales, stadium operations, catering and hospitality,

merchandising, multimedia and commercial activities. This continued

support is appreciated and not taken for granted. We are committed

to the development of the Celtic brand, including the improvement

of the match day experience for our supporters at Celtic Park,

which is at the heart of our ongoing strategy.

The opening of the Celtic Way and the development works around

Celtic Park was a milestone for the Club and marked the end of a

long term project to assemble and develop the land around the

stadium for the benefit of the Club, our supporters and the local

community. These developments were completed in time for the Club

to host the SPFL League Cup Final, the Scottish Cup Final and,

after the year end, the Opening Ceremony of the Glasgow 2014

Commonwealth Games. Celtic Park and the Celtic brand were showcased

on the world stage. We will do all that we can to capitalise on

that, adding value for the future.

In June 2014 the appointment of Ronny Deila, a young manager

with progressive ideas, marked the beginning of a period of

transition for the Club. The Board will support Ronny and his

coaching team in the transfer market and in the development of the

football operation generally. The Board's commitment is clear. The

Board will re-invest every penny received back into the Club for

the longer term. We will continue to invest, not only in our own

academy but also to scour the world for talent to develop and to

make a difference at the Club. We cannot, however, put into

jeopardy the long term future of this Club or its supporters with

reckless spending. Costs must be managed, particularly given the

challenges presented in the Scottish football environment.

Improvement in the football environment in which the Club plays

remains an important element of our strategy.

The recent result in the qualifiers for the group stages for the

Champions League and some results in the SPFL have been

disappointing. Football success is crucial to the Club, but the

experience of the appointments of Martin O'Neill, Gordon Strachan

and Neil Lennon shows us that time is needed to develop through

periods of transition. Each of those managers developed into great

managers of the Club. One of Ronny Deila's main strengths is

developing players and he is excited by the young talent that we

have at the Club, including graduates from our Youth Academy, for

example Callum McGregor, Liam Henderson and Eoghan O'Connell, and

seven new players joining this summer. Although Fraser Forster,

Georgios Samaras and Tony Watt left the squad that completed last

season, we feel that our squad has grown in strength and depth. We

are sure that, with the support of the Club and its supporters,

Ronny will deliver a team that we can all be proud of.

The main objectives for the forthcoming season are success in

all three domestic competitions and the UEFA Europa League, playing

creative and exciting football, and to build a team for the

qualifiers of the UEFA Champions League next year. I am confident

that, with the strong base that the Club has developed over

previous years, and with the continued support of our supporters,

partners and colleagues, these objectives will be achieved.

Peter Lawwell

12 September 2014

Chief Executive

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

2014 2013

Operations Operations

excluding excluding

intangible Intangible intangible Intangible

asset asset asset asset

trading trading Total trading trading Total

Notes GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Continuing operations:

Revenue 2 64,736 - 64,736 75,816 - 75,816

Operating expenses (excluding

exceptional operating expenses) 2 (59,885) - (59,885) (62,714) - (62,714)

------------ ----------- --------- ------------ ----------- ---------

Profit from trading before

asset transactions and

exceptional

items 4,851 - 4,851 13,102 - 13,102

Exceptional operating expenses 3 (575) (4,089) (4,664) (1,331) (501) (1,832)

Amortisation of intangible

assets 2 - (5,300) (5,300) - (5,930) (5,930)

Profit on disposal of intangible

assets - 17,052 17,052 - 5,195 5,195

Loss on disposal of property,

plant and equipment (101) - (101) (96) - (96)

------------ ----------- --------- ------------ ----------- ---------

Operating profit / (loss) 4,175 7,663 11,838 11,675 (1,236) 10,439

============ =========== ============ ===========

Finance income 53 21

Finance expense (721) (721)

--------- ---------

Profit before tax 11,170 9,739

Income tax expense 5 - -

--------- ---------

Profit and total comprehensive

income for the year 11,170 9,739

========= =========

Profit attributable to equity

holders of the parent 11,170 9,739

========= =========

Total comprehensive income

attributable to equity holders

of the parent 11,170 9,739

========= =========

Basic earnings per Ordinary

Share from continuing operations

and for the year 6 12.21p 10.73p

Diluted earnings per share

from continuing operations

and for the year 6 8.60p 7.56p

CONSOLIDATED BALANCE SHEET

2014 2013

Notes GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 55,594 52,456

Intangible assets 7,197 9,798

---------

62,791 62,254

========= ==========

Current assets

Inventories 1,696 1,734

Trade and other receivables 17,258 3,934

Cash and cash equivalents 14,739 14,348

---------

33,693 20,016

========= ==========

Total assets 96,484 82,270

========= ==========

Equity

Issued share capital 24,357 24,341

Share premium 14,529 14,486

Other reserve 21,222 21,222

Capital reserve 2,695 2,650

Accumulated losses (8,972) (20,142)

---------

Total equity 53,831 42,557

========= ==========

Non-current liabilities

Interest-bearing liabilities/bank loans 9,844 10,219

Debt element of Convertible Cumulative

Preference Shares 4,284 4,345

Provisions 1,047 -

Deferred income 59 119

--------- ----------

15,234 14,683

========= ==========

Current liabilities

Trade and other payables 16,937 14,048

Current borrowings 485 489

Provisions 265 1,240

Deferred income 9,732 9,253

27,419 25,030

========= ==========

Total liabilities 42,653 39,713

========= ==========

Total equity and liabilities 96,484 82,270

========= ==========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Other Capital Retained

Group capital premium reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Equity shareholders'

funds

as at 1 July 2012 24,264 14,443 21,222 2,630 (29,881) 32,678

Share capital issued 1 43 - - - 44

Transfer to capital

reserve (20) - - 20 - -

Reduction in debt

element of convertible

cumulative preference

shares 96 - - - - 96

Profit and total comprehensive

income for the year - - - - 9,739 9,739

Equity shareholders'

funds

as at 30 June 2013 24,341 14,486 21,222 2,650 (20,142) 42,557

Share capital issued 1 43 - - - 44

Transfer to capital

reserve (45) - - 45 - -

Reduction in debt

element of convertible

cumulative preference

shares 60 - - - - 60

Profit and total comprehensive

income for the year - - - - 11,170 11,170

Equity shareholders'

funds

as at 30 June 2014 24,357 14,529 21,222 2,695 (8,972) 53,831

======== ======== ======== ======== ========= ======

CONSOLIDATED CASH FLOW STATEMENT

2014 2013

Note GBP000 GBP000

Cash flows from operating activities

Profit for the year 11,170 9,739

Depreciation 1,747 1,823

Amortisation of intangible assets 5,300 5,930

Impairment of property, plant and equipment - 37

Impairment of intangible assets 4,089 501

Profit on disposal of intangible assets (17,052) (5,195)

Loss on disposal of property, plant and

equipment 101 96

Net finance costs 668 700

--------- --------------

6,023 13,631

Decrease in inventories 38 426

Increase in receivables (819) (510)

Increase / (decrease) in payables and

deferred income 2,734 (3,012)

--------- --------------

Cash generated from operations 7,976 10,535

Net interest paid (153) (173)

--------- --------------

Net cash flow from operating activities

- A 7,823 10,362

--------- --------------

Cash flows from investing activities

Purchase of property, plant and equipment (3,000) (1,352)

Purchase of intangible assets (9,880) (9,503)

Proceeds from sale of intangible assets 5,620 7,521

--------- --------------

Net cash used in investing activities

- B (7,260) (3,334)

--------- --------------

Cash flows from financing activities

Repayment of debt (379) (379)

Dividends paid (482) (499)

--------- --------------

Net cash used in financing activities

- C (861) (878)

--------- --------------

Net (decrease) / increase in cash equivalents

A+B+C (298) 6,150

Cash and cash equivalents at 1 July 2013 14,348 8,198

--------- --------------

Cash and cash equivalents including overdraft

at 30 June 2014 14,050 14,348

========= ==============

NOTES TO THE FINANCIAL STATEMENTS

1. BASIS OF PREPARATION

These Financial Statements have been prepared in accordance with

the recognition and measurement principles of IFRS as adopted by

the European Union. The accounting policies have been consistently

applied to both years presented.

2. REVENUE AND OPERATING EXPENSES

REVENUE 2014 2013

GBP000 GBP000

The Group's revenue comprised:

Football and Stadium Operations 28,273 32,687

Merchandising 13,520 14,976

Multimedia and Other Commercial Activities 22,943 28,153

--------- --------

64,736 75,816

========= ========

OPERATING EXPENSES 2014 2013

GBP000 GBP000

The Group's operating expenses comprised:

Football and Stadium Operations (excluding

exceptional items and asset transactions) 48,938 51,385

Exceptional items excluding impairment

of intangible assets 575 1,331

Impairment of intangible assets 4,089 501

Amortisation of intangible assets 5,300 5,930

Profit on disposal of intangible assets (17,052) (5,195)

Loss on disposal of property, plant

and equipment 101 96

--------- --------

Total Football and Stadium Operations 41,951 54,048

Merchandising 8,667 9,008

Multimedia and Other Commercial Activities 2,280 2,321

52,898 65,377

========= ========

3. EXCEPTIONAL OPERATING EXPENSES

The exceptional operating expenses of GBP4.66m (2013: GBP1.83m)

can be analysed as follows:

Exceptional operating expenses comprised 2014 2013

GBP000 GBP000

Impairment of property, plant and equipment - 37

Impairment of intangible assets 4,089 501

Compromise payments on contract termination 575 54

Onerous lease provision - 1,240

-------- --------

4,664 1,832

======== ========

4. DIVIDENDS PAYABLE

A 6% (before tax credit deduction) non-equity dividend of

GBP0.53m (2013: GBP0.53m) was paid on 1 September 2014 to those

holders of Convertible Cumulative Preference Shares on the share

register at 29 July 2014. On 31 August 2007 the entitlement to a

dividend on the Convertible Preferred Ordinary Shares ceased. A

number of shareholders elected to participate in the Company's

scrip dividend reinvestment scheme for the financial year to 30

June 2014. Those shareholders have received new Ordinary Shares in

lieu of cash. Theimplementation of the presentational aspects of

IAS32 ("Financial Instruments: disclosure") in the preparation of

the annual results, requires that the Group's Preference Shares and

Convertible Preferred Ordinary Shares, as compound financial

instruments, are classified as a combination of debt and equity and

the attributable non-equity dividends are classified as finance

costs. No dividends were payable or proposed to be payable on the

Company's Ordinary Shares.

5. TAX ON ORDINARY ACTIVITIES

No provision for corporation tax or deferred tax is required in

respect of the year ended 30 June 2014. Estimated tax losses

available for set-off against future trading profits amount to

approximately GBP13.30m (2013: GBP23.44m) and, in addition, the

available capital allowances pool is approximately GBP10.74m (2013:

GBP12.82m). These estimates are subject to the agreement of the

current and prior years' corporation tax computations with H M

Revenue and Customs.

6. EARNINGS PER SHARE

2014 2013

GBP000 GBP000

Reconciliation of earnings to basic earnings:

Net earnings attributable to equity holders

of the parent 11,170 9,739

Basic earnings 11,170 9,739

======== ========

Reconciliation of basic earnings to diluted

earnings:

Basic earnings 11,170 9,739

Non-equity share dividend 526 527

Diluted earnings 11,696 10,266

======== ========

No.'000 No.'000

Reconciliation of basic weighted average

number of ordinary shares to

diluted weighted average number of ordinary

shares:

Basic weighted average number of ordinary

shares 91,485 90,730

Dilutive effect of convertible shares 44,573 45,098

-------- --------

Diluted weighted average number of ordinary

shares 136,058 135,828

======== ========

Earnings per share has been calculated by dividing the profit

for the period of GBP11.17m (2013: GBP9.74m) by the weighted

average number of Ordinary Shares of 91.5m (2013: 90.7m) in issue

during the year. Diluted earnings per share as at 30 June 2014 has

been calculated by dividing the profit for the period by the

weighted average number of Ordinary Shares, Preference Shares and

Convertible Preferred Ordinary Shares in issue, assuming conversion

at the balance sheet date, and the full exercise of outstanding

share purchase options, if dilutive, in accordance with IAS33

Earnings Per Share. As at June 2014 and June 2013 no account was

taken of potential share purchase options, as these potential

Ordinary Shares were not considered to be dilutive under the

definitions of the applicable accounting standards.

7. BANKING FACILITIES

Following a review of potential future banking facility

requirements, the Company entered into a new lending agreement with

the Co-operative Bank effective as of 30 August 2014. This new

agreement has a combined borrowing facility of GBP20.40m which

consists of a GBP6.00m revolving credit facility and GBP14.40m in

long term loans. The revolving credit facility will bear interest

at base rate plus 1.00% and will reduce by GBP0.50m after year one

and a further GBP0.50m after year two. The facility will be repaid

or reviewed after three years.

The long term loans will bear interest at London Inter-Bank

Offered Rate plus 1.125%. The loans are floating rate loans and

therefore expose the Group to cash flow risk. The loans are

repayable in equal quarterly instalments of GBP0.05m from the

commencement date until full repayment of GBP12.40m in July 2019.

The Group has the option to repay the loans earlier than these

dates without penalty.

The borrowing facility will continue to be secured over Celtic

Park, land adjoining the stadium and at Westhorn and

Lennoxtown.

8. ANNUAL REPORT & ACCOUNTS

Copies of the Annual Report & Accounts together with the

Notice and Notes of the 2014 AGM will be issued to all shareholders

in due course.

The financial information set out above was approved by the

directors on 12 September 2014 and does not constitute the

Company's statutory accounts for the years ended 30 June 2014 or 30

June 2013. The auditor's opinion on the 2014 statutory accounts is

unmodified and does not include a statement under Sections 498 (2)

or (3) of the Companies Act 2006. The statutory accounts for 2013

have been filed and those for 2014 will be delivered to the

Registrar of Companies in due course.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFDFLEFLSEEU

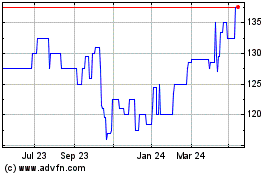

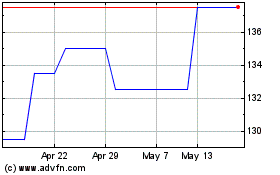

Celtic (LSE:CCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Celtic (LSE:CCP)

Historical Stock Chart

From Jul 2023 to Jul 2024