TIDMBXP

RNS Number : 4121S

Beximco Pharmaceuticals Ltd

06 November 2023

6 November 2023

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation 596/2014 which

is part of English Law by virtue of the European (Withdrawal) Act

2018, as amended. On publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

BEXIMCO PHARMACEUTICALS LIMITED

Financial Results for the First Quarter Ended 30 September

2023

Beximco Pharmaceuticals Limited ("Beximco Pharma", "BPL" or "the

Company"; AIM Symbol: BXP, LEI No.:213800IMBBD6TIOQGB56), the

fast-growing manufacturer of generic pharmaceutical products and

active pharmaceutical ingredients, today announces its unaudited

results for the three-month period ended 30 September 2023. The

information set out below has been released to the Dhaka and

Chittagong Stock Exchanges in compliance with the requirements from

the Bangladesh SEC.

Beximco Pharma Managing Director Nazmul Hassan MP commented:

"Amidst challenges, we delivered strong growth in revenue in

this first quarter. The ongoing macro-economic headwinds,

especially the devaluation of currency and high inflationary

pressures, weigh on our bottom line and somewhat overshadow our

accomplishment. That said, we remain confident in the strength of

the business and our strategy as we continue to focus on growth

through the delivery of high-quality, affordable medicines to

patients."

The detailed accounts can be viewed at the Company website: www.beximcopharma.com

For further information please visit www.beximcopharma.com or

enquire to:

Beximco Pharma

Nazmul Hassan MP, Managing Director

Tel: +880 2 586/11001, Ext.20080

S M Rabbur Reza, Chief Operating Officer

Tel: +880 2 58611001, Ext.20111

Mohammad Ali Nawaz, Chief Financial Officer

Tel: +880 2 58611001, Ext.20030

SPARK Advisory Partners Limited (Nominated Adviser)

Mark Brady / Andrew Emmott

Tel: +44 (0) 20 3368 3551 / 3555

SP Angel Corporate Finance LLP (Broker)

Matthew Johnson

Tel: +44 (0) 20 3470 0470

FTI Consulting

Simon Conway / Victoria Foster Mitchell

Tel: +44 (0) 20 3727 1000

Notes to Editors

About Beximco Pharmaceuticals Limited

Beximco Pharma is a leading manufacturer and exporter of

medicines based in Bangladesh. Since its inception in 1976, the

Company remains committed to health and wellbeing of people across

all the continents by providing access to contemporary medicines.

Company's broad portfolio of generics encompasses diverse delivery

systems such as tablets, capsules, liquids, semi-solids,

intravenous fluids, metered dose inhalers, dry powder inhalers,

sterile ophthalmic drops, insulins, prefilled syringes,

injectables, nebuliser solutions, oral soluble films etc. The

Company also undertakes contract manufacturing for multinational

and leading global generic pharmaceutical companies.

Beximco Pharma's state-of-the-art manufacturing facilities are

certified by global regulatory authorities of USA, Europe,

Australia, Canada, GCC and Latin America, among others and it has a

geographic footprint in more than 50 countries. More than 5,500

employees are driving the company towards achieving its aspiration

to be among the most admired companies in the world.

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Financial Position (Un-audited)

As at September 30, 2023

Taka '000

September June 30,

30, 2023 2023

ASSETS

Non-Current Assets 48,409,531 48,280,929

Property, Plant and Equipment- Carrying

Value 42,356,471 42,245,615

Right-of-use Assets 538,197 562,224

Intangible Assets 4,766,816 4,721,035

Deferred Tax Asset 52,504 56,512

Goodwill 674,570 674,570

Other Investments 20,973 20,973

Current Assets 20,942,045 20,875,854

Inventories 11,958,465 12,133,278

Spares & Supplies 888,249 819,740

Accounts Receivable 3,671,221 3,574,655

Loans, Advances and Deposits 3,049,766 2,984,877

Advance Income Tax 230,467 227,618

Short Term Investment 200,000 -

Cash and Cash Equivalents 943,877 1,135,686

---------- ----------

TOTAL ASSETS 69,351,576 69,156,783

---------- ----------

SHAREHOLDERS' EQUITY AND LIABILITIES

Equity Attributable to the Owners of

the Company 45,233,894 43,680,704

Issued Share Capital 4,461,121 4,461,121

Share Premium 5,269,475 5,269,475

Excess of Issue Price over Face Value

of GDRs 1,689,637 1,689,637

Capital Reserve on Merger 294,951 294,951

Revaluation Surplus 1,140,210 1,141,178

Unrealized Gain/(Loss) 18,148 18,148

Retained Earnings 32,360,352 30,806,194

Non-Controlling Interest 3,953,454 3,938,962

TOTAL EQUITY 49,187,348 47,619,666

Non-Current Liabilities 8,383,552 8,272,093

Long Term Borrowings-Net of Current

Maturity 2,306,715 2,550,833

Liability for Gratuity, Pension and

WPPF & Welfare Funds 3,535,080 3,170,764

Deferred Tax Liability 2,541,757 2,550,496

Current Liabilities and Provisions 11,780,676 13,265,024

Short Term Borrowings 4,732,715 6,621,170

Long Term Borrowings-Current Maturity 1,468,445 1,439,895

Creditors and Other Payables 3,706,475 3,531,707

Accrued Expenses 1,032,588 1,129,700

Dividend Payable / Unclaimed Dividend 88,235 88,465

Income Tax Payable 752,218 454,087

---------- ----------

TOTAL EQUITY AND LIABILITIES 69,351,576 69,156,783

---------- ----------

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Profit or Loss and Other Comprehensive

Income (Un-audited)

For the Period July - September 2023

Taka '000

July -September July -September

2023 2022

Net Revenue 11,159,367 9,787,202

Cost of Goods Sold (6,251,512) (5,351,036)

--------------- ---------------

Gross Profit 4,907,855 4,436,166

--------------- ---------------

Operating Expenses (2,598,458) (2,313,283)

--------------- ---------------

Administrative Expenses (304,684) (274,747)

Selling, Marketing and Distribution

Expenses (2,293,774) (2,038,536)

--------------- ---------------

Profit from Operations 2,309,397 2,122,883

Other Income 144,875 168,042

Finance Cost (297,754) (310,973)

Profit Before Contribution to WPPF

& Welfare Funds 2,156,518 1,979,952

Contribution to WPPF & Welfare Funds (103,572) (98,210)

--------------- ---------------

Profit Before Tax 2,052,946 1,881,742

Income Tax Expenses (485,545) (469,029)

--------------- ---------------

Current Tax (489,995) (393,848)

Deferred Tax 4,450 (75,181)

--------------- ---------------

Profit After Tax 1,567,401 1,412,713

Profit/(Loss) Attributable to:

--------------- ---------------

Owners of the Company 1,552,909 1,447,027

Non-Controlling Interest 14,492 (34,314)

--------------- ---------------

1,567,401 1,412,713

Other Comprehensive Income/(Loss) - (3,340)

--------------- ---------------

Total Comprehensive Income 1,567,401 1,409,373

Total Comprehensive Income Attributable

to:

--------------- ---------------

Owners of the Company 1,552,909 1,443,687

Non-Controlling Interest 14,492 (34,314)

--------------- ---------------

1,567,401 1,409,373

=============== ===============

Earnings Per Share

(EPS) Tk. 3.48 3.24

=============== ===============

Number of Shares Nos. 446,112,089 446,112,089

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Changes in Equity (Un-audited)

For the Period July - September 2023

As at September 30, 2023

Taka '000

----------------------------------------------------------------------------------------------------------------------------------------

Share Share Excess Capital Revaluation Unrealized Retained Equity Non- Total

Capital Premium of Issue Reserve Surplus Gain/ Earnings attributable Controlling Equity

Price on Merger (Loss) to Owners Interests

over of the

Face Company

Value

of GDRs

--------- --------- --------- --------- ------------- ---------- ---------- ------------ ----------- ----------

Balance

as on July

01, 2023 4,461,121 5,269,475 1,689,637 294,951 1,141,178 18,148 30,806,194 43,680,704 3,938,962 47,619,666

--------- --------- --------- --------- ------------- ---------- ---------- ------------ ----------- ----------

Total

Comprehensive

Income:

------------------------------------------------------------------------------------------------------------------------

Profit/(Loss)

for the

Period - - - - - - 1,552,909 1,552,909 14,492 1,567,401

--------- --------- --------- --------- ------------- ---------- ---------- ------------ ----------- ----------

Other - - - - - - - - - -

Comprehensive

Income/(Loss)

--------- --------- --------- --------- ------------- ---------- ---------- ------------ ----------- ----------

Adjustment

for

Depreciation

on Revalued

Assets - - - - (1,249) - 1,249 - - -

--------- --------- --------- --------- ------------- ---------- ---------- ------------ ----------- ----------

Adjustment

for Deferred

Tax on

Revalued

Assets - - - - 281 - - 281 - 281

--------- --------- --------- --------- ------------- ---------- ---------- ------------ ----------- ----------

Balance

as on

September

30, 2023 4,461,121 5,269,475 1,689,637 294,951 1,140,210 18,148 32,360,352 45,233,894 3,953,454 49,187,348

--------- --------- --------- --------- ------------- ---------- ---------- ------------ ----------- ----------

Net Asset Value

(NAV) Per Share Tk. 101.40

------------------------- --------- -------------- ------------ ----------------- ---------- ------------ ----------- ----------

As at September 30, 2022

------------------------------------------------------------------------------------------------------------------------------------

Share Share Excess Capital Revaluation Unrealized Retained Equity Non- Total

Capital Premium of Issue Reserve Surplus Gain/ Earnings attributable Controlling Equity

Price on (Loss) to Owners Interests

over Merger of the

Face Company

Value

of GDRs

--------- --------- --------- ------- ----------- ---------- ---------- ------------ ----------- ----------

Balance

as on July

01, 2022 4,461,121 5,269,475 1,689,637 294,951 1,116,896 20,532 27,747,886 40,600,498 4,035,507 44,636,005

--------- --------- --------- ------- ----------- ---------- ---------- ------------ ----------- ----------

Total

Comprehensive

Income:

--------------------------------------------------------------------------------------------------------------------

Profit/(Loss)

for the

Period - - - - - - 1,447,027 1,447,027 (34,314) 1,412,713

--------- --------- --------- ------- ----------- ---------- ---------- ------------ ----------- ----------

Other

Comprehensive

Income/(Loss) - - - - - (3,340) - (3,340) - (3,340)

--------- --------- --------- ------- ----------- ---------- ---------- ------------ ----------- ----------

Adjustment

for

Depreciation

on Revalued

Assets - - - - (1,409) - 1,409 - - -

--------- --------- --------- ------- ----------- ---------- ---------- ------------ ----------- ----------

Adjustment

for Deferred

Tax on

Revalued

Assets - - - - 317 - - 317 - 317

--------- --------- --------- ------- ----------- ---------- ---------- ------------ ----------- ----------

Balance

as on

September

30, 2022 4,461,121 5,269,475 1,689,637 294,951 1,115,804 17,192 29,196,322 42,044,502 4,001,193 46,045,695

--------- --------- --------- ------- ----------- ---------- ---------- ------------ ----------- ----------

Net Asset Value (NAV)

Per Share Tk. 94.25

------------------------------------ --------- ------- ----------- ---------- ---------- ------------ ----------- ----------

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Cash Flows (Un-audited)

For the Period July - September 2023

Taka '000

July -September July -September

2023 2022

Cash Flows from Operating Activities:

--------------- ---------------

Receipts from Customers and Others 11,197,080 9,853,354

Payments to Suppliers and Employees (7,998,606) (8,584,421)

--------------- ---------------

Cash Generated from Operations 3,198,474 1,268,933

Interest Paid (295,410) (310,322)

Interest Received - 1,310

Income Tax Paid (194,713) (275,443)

Net Cash Generated from Operating Activities 2,708,351 684,478

Cash Flows from Investing Activities:

--------------- ---------------

Acquisition of Property, Plant and Equipment (513,160) (636,985)

Intangible Assets (97,638) (45,431)

Disposal of Property, Plant and Equipment 3,488 20

Disposal of Intangible Assets - 52,125

Short Term Investment (200,000) -

Net Cash Used in Investing Activities (807,310) (630,271)

Cash Flows from Financing Activities:

--------------- ---------------

Net Increase /(Decrease) in Long Term

Borrowings (211,318) (619,541)

Net Increase/(Decrease) in Short Term

Borrowings (1,888,455) 256,464

Dividend Paid (231) (295)

--------------- ---------------

Net Cash (Used in) / from Financing

Activities (2,100,004) (363,372)

Increase/(Decrease) in Cash and Cash

Equivalents (198,963) (309,165)

Cash and Cash Equivalents at Beginning

of Period 1,135,686 1,168,674

Effect of Exchange Rate Changes on Cash

and Cash Equivalents 7,154 13,144

--------------- ---------------

Cash and Cash Equivalents at End of

Period 943,877 872,653

Number of Shares 446,112,089 446,112,089

Net Operating Cash Flows Per Share 6.07 1.53

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFFLFVRLRLEIIV

(END) Dow Jones Newswires

November 06, 2023 02:00 ET (07:00 GMT)

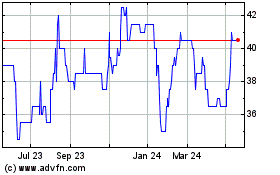

Beximco Pharma (LSE:BXP)

Historical Stock Chart

From Oct 2024 to Nov 2024

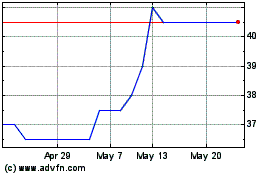

Beximco Pharma (LSE:BXP)

Historical Stock Chart

From Nov 2023 to Nov 2024