TIDMBT.A

RNS Number : 8109Z

BT Group PLC

18 May 2023

Results for the full year to 31 March 2023

BT Group plc

18 May 2023

Philip Jansen, Chief Executive, commenting on the results, said

"We have delivered our outlook for FY23: this year we've grown

both pro forma revenue and EBITDA for the first time in six years

while navigating an extraordinary macro-economic backdrop. Over

the last four years we have stuck firmly to our strategy and it's

working.

"Openreach is competing strongly and it's clear that customers

love full fibre. The Openreach Board has reaffirmed its target

to reach 25 million premises with FTTP by the end of 2026 and plans

to further accelerate take-up on the network. In Consumer we're

delivering for customers with strong growth in FTTP and 5G, and

we're also seeing green shoots in B2B with a return to revenue

growth in the final quarter in Global and the creation of our newly

integrated Business unit.

"By continuing to build and connect like fury, digitise the way

we work and simplify our structure, by the end of the 2020s BT

Group will rely on a much smaller workforce and a significantly

reduced cost base. New BT Group will be a leaner business with

a brighter future."

Continued strong delivery against strategy

-- We delivered revenue and adjusted(1) EBITDA in line with our

outlook for FY23, despite significant headwinds; normalised free

cash flow was delivered at the lower end of our guidance range due

to increased cash capital expenditure, primarily in Openreach

-- FTTP build of 702k premises passed in the quarter at an

average build rate of 54k per week, with 41% of our 25m build

completed; FTTP footprint of 10.3m, up 43%, with a further 6m where

initial build is underway

-- Customer demand in Openreach for FTTP extremely strong with

FY23 orders up 70% year on year; take up rate grew to 30.4% with

record net adds of 395k in the quarter; base now c.3.1m

-- Record quarter of Consumer FTTP connections up 50% year-on-year with the base now over 1.7m

-- We have 8.6m 5G connections, up 62% on last year; our 5G

network now covers 68% of the population

-- Cost transformation on track with gross annualised cost

savings of GBP2.1bn since April 2020 against our GBP3bn target,

with a cost to achieve of GBP1.1bn against a target of GBP1.6bn

-- Created Business through the merger of Enterprise and Global

to enhance value for all B2B customers, strengthen our competitive

position and deliver material synergies

-- The UK Government announced a three-year 100% tax expensing

benefit on qualifying UK capex, effective from 1 April 2023; this

will allow Openreach to deliver increased connections and offset

inflation whilst reconfirming our 25m FTTP target by the end of

2026

-- New metrics announced to track our transformation into a

next-generation connectivity provider (see page 4), focussed on our

networks, our customers and becoming a more efficient

organisation

-- Total labour resource(2) to reduce from 130k to 75-90k by FY28-FY30

Pro forma full year revenue and adjusted(1) EBITDA growth:

-- Revenue GBP20.7bn, down 1% with the growth in Openreach more

than offset by decline in the other units

-- Adjusted(1) EBITDA GBP7.9bn, up 5% due to growth in Openreach

and Consumer offset by a decline in Enterprise

-- Revenue up 1% and adjusted(1) EBITDA up 3% on a Sports Joint Venture ('JV') pro forma(1) basis

-- Reported profit before tax GBP1.7bn, down 12% due to

increased depreciation from network build and specific items,

partially offset by adjusted(1) EBITDA growth

-- Reported capital expenditure ('capex') GBP5.1bn, down 4%;

capex excluding Spectrum up 5% due to higher fixed network

investment primarily in Openreach for building, and connecting more

customers to, FTTP; cash capex was c.GBP0.2bn higher at GBP5.3bn

(up 10%) as we reduced our capital creditors; significantly lower

capex in Q4 given unwind of Openreach work in progress ('WIP')

-- Net cash inflow from operating activities GBP6.7bn;

normalised free cash flow(1) GBP1.3bn, down 5% due to increased

cash capex and adverse working capital movements offset by EBITDA

growth and a tax refund; increase in Q4 due to timing of working

capital, lower cash capex, and increased EBITDA

-- Net debt GBP18.9bn, up GBP850m primarily due to pension scheme contribution of GBP1bn

-- Gross IAS 19 deficit of GBP3.1bn, up from GBP1.1bn at 31

March 2022 mainly due to the impact of higher real gilt yields

partly offset by deficit contributions

-- Final dividend of 5.39 pence per share (pps) bringing the

full year dividend to 7.70pps, flat year on year

-- FY24 Outlook: revenue and EBITDA growth on a pro forma basis;

capital expenditure excluding spectrum of GBP5.0bn-GBP5.1bn;

normalised free cash flow of GBP1.0bn-GBP1.2bn

(1) See Glossary on page 3

(2) Total labour resource includes both employees directly

employed by BT and non-employees supplied by a third party

Full year to 31 March 2023 2022 Change

--------------------------- ---------------------------

Reported measures GBPm GBPm %

Revenue 20,681 20,850 (1)

Profit before tax 1,729 1,963 (12)

Profit after tax 1,905 1,274 50

Basic earnings per share 19.4p 12.9p 50

Net cash inflow from

operating

activities 6,724 5,910 14

Full year dividend 7.7p 7.7p -

Capital expenditure 5,056 5,286 (4)

-------------------------- --------------------------- --------------------------- --------------------------------

Adjusted measures

Adjusted(1) Revenue 20,669 20,845 (1)

Adjusted(1) EBITDA 7,928 7,577 5

Pro forma Revenue 20,431 20,306 1

Pro forma EBITDA 7,999 7,782 3

Adjusted(1) basic earnings

per

share 22.0p 20.3p 8

Normalised free cash

flow(1) 1,328 1,392 (5)

Capital expenditure

excluding

spectrum 5,056 4,807 5

Net debt(1,2) 18,859 18,009 GBP850m

-------------------------- --------------------------- --------------------------- --------------------------------

Customer-facing unit updates

Adjusted(1) revenue Adjusted(1) EBITDA Normalised free

cash flow(1)

-------------------------------------------- ---------------------------------------------

Full year

to 31 March 2023 2022 Change 2023 2022 Change 2023 2022 Change

------------

GBPm GBPm % GBPm GBPm% GBPm GBPm %

------------ ------------- ------------- -------------- -------------- ------------- ------------- ------------- ------------- --------------

Consumer 9,737 9,858 (1) 2,623 2,262 16 1,147 917 25

Enterprise 4,962 5,157 (4) 1,394 1,636 (15) 522 791 (34)

Global 3,328 3,362 (1) 458 456 - 63 131 (52)

Openreach 5,675 5,441 4 3,449 3,179 8 211 448 (53)

Other 27 27 - 4 44 (91) (615) (895) 31

Intra-group

items (3,060) (3,000) (2) - - - - -

------------ ------------- ------------- -------------- -------------- ------------- -------------- ------------- ------------- --------------

Total 20,669 20,845 (1) 7,928 7,577 5 1,328 1,392 (5)

------------ ------------- ------------- -------------- -------------- ------------- -------------- ------------- ------------- --------------

Fourth

quarter

to 31 March 2023 2022 Change 2023 2022 Change 2023 2022 Change

------------

GBPm GBPm % GBPm GBPm% GBPm GBPm %

------------ -------------- -------------- -------------- ------------ ------------- ------------- ---------- ----------- -----------

Consumer 2,306 2,416 (5) 659 557 18

Enterprise 1,270 1,290 (2) 384 384 -

Global 854 837 2 147 135 9

Openreach 1,420 1,373 3 879 811 8

Other 3 7 (57) (21) (18) (17)

Intra-group

items (764) (755) (1) - - -

------------ -------------- -------------- -------------- ------------ ------------- -------------- ---------- ----------- -----------

Total 5,089 5,168 (2) 2,048 1,869 10 1,222 513 138

------------ -------------- -------------- -------------- ------------ ------------- -------------- ---------- ----------- -----------

Performance against FY23 outlook

FY23 performance FY23 outlook

----------------

Change in adjusted(1) Up 1% Growth on a Sports JV

pro forma(1) revenue pro forma(1) basis

Adjusted(1) EBITDA GBP7.9bn At least GBP7.9bn

Capital expenditure(1) GBP5.1bn c.GBP5.0bn

Normalised free cash flow(1) GBP1.3bn Lower end of the GBP1.3bn-GBP1.5bn

range

---------------------------- ---------------- ----------------------------------

(1) See Glossary on page 3

Glossary

Adjusted Before specific items. Adjusted results are consistent

with the way that financial performance is measured

by management and assist in providing an additional

analysis of the reporting trading results of the group.

EBITDA Earnings before interest, tax, depreciation and amortisation.

Adjusted EBITDA EBITDA before specific items, share of post tax profits/losses

of associates and joint ventures and net non-interest

related finance expense.

Free cash flow Net cash inflow from operating activities after net

capital expenditure.

Capital expenditure Additions to property, plant and equipment and intangible

assets in the period.

Normalised Free cash flow (net cash inflow from operating activities

free cash flow after net capital expenditure) after net interest

paid and payment of lease liabilities, before pension

deficit payments (including their cash tax benefit),

payments relating to spectrum, and specific items.

It excludes cash flows that are determined at a corporate

level independently of ongoing trading operations

such as dividends paid, share buybacks, acquisitions

and disposals, repayment and raising of debt, cash

flows relating to loans with joint ventures, and cash

flows relating to the Building Digital UK demand deposit

account which have already been accounted for within

normalised free cash flow. For non-tax related items

the adjustments are made on a pre-tax basis.

Net debt Loans and other borrowings and lease liabilities (both

current and non-current), less current asset investments

and cash and cash equivalents, including items which

have been classified as held for sale on the balance

sheet. Currency denominated balances within net debt

are translated into sterling at swapped rates where

hedged. Fair value adjustments and accrued interest

applied to reflect the effective interest method are

removed. Amounts due to joint ventures held within

loans and borrowings are also excluded.

Service revenue Earned from services delivered using our fixed and

mobile network connectivity, including but not limited

to, broadband, calls, line rental, TV, residential

BT Sport subscriptions, mobile data connectivity,

incoming & outgoing mobile calls and roaming by customers

of overseas networks.

Sports JV pro On 1 September 2022 BT Group and Warner Bros. Discovery

forma announced completion of their transaction to form

a 50:50 joint venture (JV) combining the assets of

BT Sport and Eurosport UK. Financial information stated

as pro forma is unaudited and is presented to estimate

the impact on the group as if trading in relation

to BT Sport had been equity accounted for in previous

periods, akin to the JV being in place historically.

Please refer to Additional Information on page 46

for a bridge between financial information on a reported

basis and a Sports JV pro forma basis.

Specific items Items that in management's judgement need to be disclosed

separately by virtue of their size, nature or incidence.

In the current period these relate to changes to our

assessment of our provision for historic regulatory

matters, restructuring charges, divestment-related

items and net interest expense on pensions.

------------------- --------------------------------------------------------------

We assess the performance of the group using a variety of

alternative performance measures. Reconciliations from the most

directly comparable IFRS measures are in Additional Information on

pages 46 to 48 .

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/8109Z_1-2023-5-17.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR LDLLFXELZBBF

(END) Dow Jones Newswires

May 18, 2023 02:00 ET (06:00 GMT)

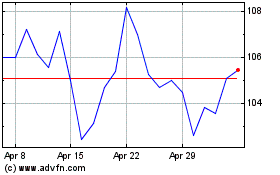

Bt (LSE:BT.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

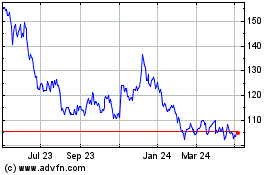

Bt (LSE:BT.A)

Historical Stock Chart

From Jul 2023 to Jul 2024