Baker Steel Resources Trust Ltd Net Asset Value(s) (8610I)

June 05 2014 - 2:01AM

UK Regulatory

TIDMBSRT

RNS Number : 8610I

Baker Steel Resources Trust Ltd

05 June 2014

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

5 June 2014

30 May 2014 Unaudited NAV Statement

Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 30 May 2014:

Net asset value per Ordinary Share: 58.5 pence

During the month, the NAV per share decreased by 2.8%

predominantly due to a fall in the share price of Ivanhoe Mines on

the Toronto Stock Exchange following its fundraising at a discount

to the prevailing market price.

At 30 May 2014, the Company had a total of 66,142,533 Ordinary

Shares in issue.

The Company is fully invested with top 10 investments as follows

as a percentage of NAV:

Ivanhoe Mines Limited 14.9%

Black Pearl Limited Partnership 14.6%

Ironstone Resources Limited 13.1%

Gobi Coal & Energy Limited 13.1%

Bilboes Gold Limited 10.6%

Polar Silver Resources Ltd 9.4%

Metals Exploration plc 9.3%

Ferrous Resources Limited 6.6%

China Polymetallic Mining Limited 5.0%

South American Ferro Metals Limited 1.8%

Other Investments 2.4%

Net Cash, Equivalents and Accruals -0.8%

Investment Update

Ivanhoe Mines Limited ("Ivanhoe")

On 2 June 2014, Ivanhoe announced that it had been granted the

mining right for the development of its Platreef platinum,

palladium, rhodium and gold (3PE+AU), nickel and copper project in

South Africa. This is a significant milestone for Ivanhoe as it

also confirms approval by the South African Department of Minerals

and Energy of Ivanhoe's Broad-Based Black Economic Empowerment

(B-BBEE) structure. Once in production, the Platreef project is

planned to produce 785,000 ounces of 3PE+Au at an estimated US$341

per ounce of 3PE+Au, net of by-products. The ongoing work on the

project is being funded by the investment from a Japanese

consortium led by Itochu which acquired a 10% interest in the

Platreef Project for US$290 million in two tranches.

During May 2014, Ivanhoe undertook a fundraising via a "bought

deal" underwritten by three Canadian investment banks. The raising

involved the issue of a unit comprising one share plus one share

warrant carrying the right to acquire one share at C$1.80 per share

for 18 months. The units were placed at C$1.50 per share. A total

of C$150 million was raised including the subscription of C$25

million by Ivanhoe's Executive Chairman, Robert Friedland, plus a

15% over allotment provision. The proceeds of the raising will be

used to progress the Kamoa copper and the Kipushi zinc/copper

projects both in the Democratic Republic of Congo. The Company

participated in the fundraising.

Metals Exploration Limited ("Metals Ex")

On 27 May 2014, Metals Ex announced that it had entered into a

US$83 million debt facility with HSBC and BNP Paribas banks to fund

the remaining development and construction of its Runruno Gold

project in the Philippines. Metals Ex reported that project

construction is 67% complete and is on schedule for commissioning

and first gold production in the first quarter of 2015. Once in

full production the mine is forecast to produce approximately

100,000 ounces of gold per annum at an operating cost of US$474 per

ounce. Completion of the debt facility, sufficient to take the

Runruno project through to full production, is an important

milestone for Metals Ex, as barring unforeseen circumstances, it

removes financing risk for the project.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

Bell Pottinger

Lorna Cobbett +44 20 7861 3883

Joanna Boon +44 20 7861 3867

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure is set

out in the Company's Prospectus dated 31 March 2010.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVMMGGVDDKGDZM

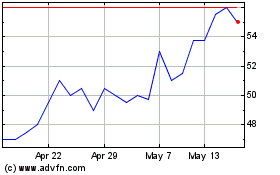

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024