TIDMBSRT

RNS Number : 4376M

Baker Steel Resources Trust Ltd

23 August 2013

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

23 August 2013

BAKER STEEL RESOURCES TRUST LTD

(the "Company")

Half-Yearly Report and Unaudited Condensed Interim Financial

Statements

For the period ended 30 June 2013

The Company has today, in accordance with DTR 6.3.5, released

its Half-Yearly Report and Unaudited Condensed Interim Financial

Statements for the period ended 30 June 2013. The Report is

available via www.bakersteelresourcestrust.com and will shortly be

submitted to the National Storage Mechanism and will also shortly

be available for inspection at www.hemscott.com/nsm.do

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

RBC Capital Markets +44 20 7653 4000

Martin Eales

Winterflood Investment Trusts +44 20 3100 0250

James Moseley

Pelham Bell Pottinger

Lorna Spears +44 20 7861 3883

Joanna Boon +44 20 7861 3867

HSBC Securities Services (Guernsey) Limited

Company Secretary + 44 (0)1481 707 000

DIRECTORS' REPORT

For the period from 1 January 2013 to 30 June 2013

To Shareholders of Baker Steel Resources Trust Limited (the

"Company")

The Board is pleased to present the Company's Interim Management

Report for the six months to 30 June 2013.

This Interim Management Report has been produced solely to

provide additional information to Shareholders as a body, as

required by the UK Listing Authority's Disclosure and Transparency

Rules. It should not be relied upon by Shareholders or any other

party for any other purpose.

This Interim Management Report relates to the period for the six

months to 30 June 2013 and contains information that covers this

period and the period up to the date of publication of this Interim

Report. Please note that more up to date performance information,

including the monthly report for the period ended 31 July 2013, is

available on the Company's website

www.bakersteelresourcestrust.com.

The objective of the Company is to seek capital growth over the

long term by investing through a focused global portfolio

consisting principally of the equities, or related instruments, of

natural resources companies. These investments will be

predominantly in private companies with strong development projects

and focused management, but also in listed securities to exploit

value inherent in market inefficiencies.

Financial Performance

The unaudited net asset value per Ordinary Share as at 30 June

2013 was 69.6p per share, down 36.2% in Sterling terms over the six

months. During this period the HSBC World Mining Index was down

28.9% in Sterling terms.

For the purpose of calculating the Net Asset Value ("NAV") per

share, all investments are carried at fair value as at 30 June

2013. The fair value of unquoted investments is determined by the

Directors and quoted investments are carried at last traded price

as at 28 June 2013 (last business day of the month).

Net assets at 30 June 2013 comprised the following:

GBPm % net assets

Unquoted Investments 30.3 65.9

Quoted Investments 16.3 35.5

Net Cash, Equivalents and Accruals (0.6) (1.4)

-------- -------

46.0 100.0

Issue of Shares

The Company was admitted to trading on the London Stock Exchange

on 28 April 2010. On that date, 30,468,865 Ordinary Shares and

6,093,772 Subscription Shares were issued pursuant to a placing and

offer for subscription and 35,554,224 Ordinary Shares and 7,110,822

Subscription Shares were issued pursuant to a Scheme of

Reorganisation of Genus Capital Fund.

In addition 10,000 Management Ordinary Shares were issued.

Following the exercise of Subscription Shares at the end of

September 2010, March 2011, March 2012, June 2012 and September

2012 a total of 119,444 Ordinary Shares were issued and as a

result, the Company has a total of 66,142,533 Ordinary and 10,000

Management Shares in issue.

The final exercise date for the Subscription Shares was 2 April

2013. No Subscription Shares were exercised at this time and all

Subscription Shares were subsequently cancelled.

Going Concern

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that it has the

resources to continue in business for the foreseeable future.

Although there is insufficient cash at 30 June 2013 to settle the

current payables and the Company had net current liabilities, this

was largely due to an accrual for the final tranche of settlement

monies relating to an agreement to acquire shares in Metals

Exploration plc as part of a phased issue of Metals Exploration

plc's shares entered into on 22 March 2013. The Company holds

listed securities that can be realised to meet liabilities as they

become due; as at 30 June 2013, approximately 8.7% of the Company's

assets were represented by cash and unrestricted listed and quoted

investments. The Directors are not aware of any material

uncertainties that may cast significant doubt upon the Company's

ability to continue as a going concern. Therefore, the financial

statements have been prepared on a going concern basis.

Related Party Transactions

Transactions with related parties are based on terms equivalent

to those that prevail in an arm's length transaction. There were no

such transactions with related parties which took place during the

period ended 30 June 2013.

Principal Risks and Uncertainties

The principal risks facing the Company relate to the Company's

investment activities. These risks are mainly market risk

(comprising market price risk, currency risk and interest rate

risk), commodity price risk, liquidity risk and credit risk, in

addition to mining development risk, licencing risk and emerging

market risk. An explanation of these risks is contained in the

Company's prospectus dated 31 March 2010 and in the Company's

Annual Report and Audited Financial Statements for the period ended

31 December 2012, both available on the Company's website

www.bakersteelresourcestrust.com.

A further risk facing the Company is regulatory risk, for

example that the loss of the Company's investment status or a

breach of the Rules of the UK Listing Authority, the London Stock

Exchange or the Guernsey Financial Services Commission, could have

adverse financial consequences and cause reputational damage.

The principal risks and uncertainties that the Company is

exposed to, generally and through mining and mineral development

related markets, have not changed significantly since the

publication of the Company's Annual Report and Audited Financial

Statements for the period ended 31 December 2012 and are not

anticipated to change for the remainder of 2013.

Director' Interests

The Directors' interests in the share capital of the Company at

30 June 2013 are set out below:

Number of

Ordinary Shares

---------------------- -----------------

Edward Flood 65,000

---------------------- -----------------

Christopher Sherwell 25,000

---------------------- -----------------

Clive Newall 25,000

---------------------- -----------------

Mr Sherwell also has an indirect interest in the shares of the

Company through an investment in another fund managed by the

Manager.

Signed for and on behalf of the Directors

Howard Myles

Chairman

22 August 2013

INVESTMENT MANAGER'S REPORT

For the period from 1 January 2013 to 30 June 2013

Top 10 Holdings - 30 June 2013

% of NAV

Ivanplats Limited 16.8%

Bilboes Gold Limited 13.1%

Ironstone Resources Limited 12.4%

Gobi Coal & Energy Limited 12.1%

Black Pearl Limited Partnership 12.1%

China Polymetallic Mining Limited

(Five Stars BS Ltd) 10.2%

Polar Silver / Argentum 8.5%

Metals Exploration plc 6.2%

Ferrous Resources Limited 6.1%

South American Ferro Metals Limited 1.1%

Other Investments 2.8%

Net Cash and Equivalents (1.4%)

Top 10 Holdings - 30 June 2012

Ivanplats Limited* 28.7%

Gobi Coal & Energy Limited* 23.1%

China Polymetallic Mining Limited (Five

Stars BS Ltd) 8.8%

Ironstone Resources Limited 7.9%

Ferrous Resources Limited 7.2%

Black Pearl Limited Partnership 6.2%

Bilboes Gold Limited 5.2%

Polar Silver / Argentum 4.9%

Metals Exploration plc 3.2%

South American Ferro Metals Limited 2.8%

Other Investments 4.6%

Net Cash and Equivalents (2.6%)

* represented less than 20% in aggregate of the value of gross

assets as at the date of the last relevant acquisition

Review

At the end of June 2013, Baker Steel Resources Trust Limited was

fully invested. During the first six months of the year, the net

asset value per share fell 36.2% to 69.6 pence broadly tracking an

extremely weak market for mining shares with the HSBC Global Mining

Index falling 28.9% in Sterling terms and the XAU Index falling

41.8% in Sterling terms. The biggest contributor to this fall was

the Company's largest investment, Ivanplats Limited, whose share

price on the Toronto Stock Exchange fell 69.4% in Canadian dollar

terms during the period, despite announcing good progress at both

of its two main projects. This resulted in an approximate 25% fall

in the NAV of the Company during the period. At the half year, in

accordance with its valuation policies, the Board decided that the

extreme market weakness in listed mining equities should be

reflected in the carrying values of certain of the unlisted

holdings in the portfolio in the absence of relevant transactions

and taking into account the specific progress and structure of each

investment. In order to quantify how the share price of a

particular stock might have moved during the period had it been

listed, the Investment Manager maintains an index of comparable

listed companies for each unlisted investment. Following this

review, the Company wrote down the carrying values of Ferrous

Resources Limited and Gobi Coal & Energy Limited by 40% and 50%

respectively in line with movements in their respective indices.

These impairments were responsible for falls in the NAV over the

period of approximately 2% and 7% respectively.

The Company made one significant realisation during the period,

the disposal of its shares in Copperbelt Minerals Limited

("Copperbelt") as part of a return of capital following the buyout

of Copperbelt's Deziwa copper project in the Democratic Republic of

Congo by its joint venture partner, Gécamines. The buy-back valued

Copperbelt at US$14 per share compared to the Company's carrying

value at 31 December 2012 of US$7 per share. This transaction

resulted in an increase in the NAV of the Company of approximately

2%. The Company also sold 8% of its holding in Ivanplats for an

average price of GBP2.32 per share versus an average cost of

GBP1.78 per share, once these shares were released from lock-up in

April 2013. A further 8% was released from lock-up in July 2013 and

will be followed by further 8% releases every three months

thereafter.

The Company has reinvested part of these proceeds in a top-up

investment in Metals Exploration plc, in conjunction with other

major shareholders, allowing Metals Exploration plc to commence

full construction of its Runruno Gold Mine in the Philippines.

Runruno is due to produce approximately 100,000 ounces gold per

annum with the first gold pour scheduled towards the end of

2014.

Despite the disappointing performance of the NAV, reflecting

wider investor sentiment towards the mining sector, the Company's

investments continue to make good progress and the Investment

Manager's confidence in the underlying projects has been reinforced

by site visits to the majority of its investee companies during the

period. Ivanplats announced resource upgrades at its two main

projects, the Kamoa copper project in the Democratic Republic of

Congo and the Platreef platinum/nickel project in South Africa and

is due to announce the results of Preliminary Economic Assessments

on each during the second half of 2013. Bilboes Gold has poured its

first gold from the redevelopment of its oxide operations in

Zimbabwe and is on course to be producing at the rate of

approximately 12,000 ounces gold per year by the end of 2013. In

addition infill drilling at Bilboes's project is progressing well

in order to deliver a feasibility study into its larger sulphide

project in 2014. Ironstone has had good success from its

metallurgical testwork programme and is on course to publish a

Preliminary Economic Assessment during the second half of 2013.

Black Pearl has commenced commissioning the first two dredges at

its iron sands project in Indonesia and is on course for full

production of 10 million tonnes of concentrate from next year.

China Polymetallic Mining reached full production rate at its

Shizishan Silver Lead Zinc Mine in China at the end of 2012 and is

on track to generate substantial cash flows in 2013 which could

lead to a maiden dividend. Ferrous is on course for production of 5

million tonnes of iron ore product in 2013, an approximate 60%

increase over 2012 and it has completed a positive feasibility to

increase production to 17 million tonnes of iron ore by 2017.

The only investment where little progress has been made is Gobi

Coal and Energy which halted development of its Shinejinst coking

coal project in Mongolia in the light of a deteriorating

environment for investment in Mongolia and weakening prices for

coking coal delivered at the Chinese border. It is hoped that the

recent re-election of the incumbent President of Mongolia will lead

to an improvement in the investment climate in that country and

allow Gobi to move Shinejinst into production.

At 30 June 2013 Price / Index % Change % Change from

Level in Six Months Inception

--------------------------------------------- -------------- --------------- --------------

Net Asset Value (pence/share)

(Sterling) 69.6 -36.2% -30.4%*

--------------------------------------------- -------------- --------------- --------------

Ordinary Share Price (pence/share)

(Sterling) 55.0 -34.5% -45.0%**

--------------------------------------------- -------------- --------------- --------------

MSCI World Index (US$) 355.81 +4.7% +15.4%

--------------------------------------------- -------------- --------------- --------------

HSBC Global Mining Index (Sterling) 504.73 -28.9% -40.7%

--------------------------------------------- -------------- --------------- --------------

CRB Index (US$) 275.62 -6.6% +0.9%

--------------------------------------------- -------------- --------------- --------------

Chinese Domestic Iron Ore - Hebei/Tangshan

(US$/t) 166 -4.0% -13.5%

--------------------------------------------- -------------- --------------- --------------

Copper (US$/t) 6731.00 -14.9% -9.7%

--------------------------------------------- -------------- --------------- --------------

Gold (US$/oz) 1234.57 -26.3% +5.7%

--------------------------------------------- -------------- --------------- --------------

Source: Bloomberg closing 27/4/10, **Issue price 28/4/10, * NAV

30/4/10

Outlook

Prices for metals have trended lower especially gold which fell

26.3% in US dollar terms in the first half of the year. Equity

markets for mining shares which were already weak in 2012 have

reacted to the lower commodity prices by falling even further

during 2013, with the HSBC Global Mining Index down 28.9% in

Sterling terms during the first half. With investor rating of the

mining sector approaching historic lows, the turnaround in

valuations could be dramatic once sentiment changes towards the

sector. It is important that the Company does not have to sell at

the current distressed prices to meet redemptions, as is the case

for many open-ended investment funds. It is therefore able to "wait

out the storm" until sentiment improves and in the expectation that

the investments can be sold closer to their inherent values.

Baker Steel Capital Managers LLP

22 August 2013

DIRECTORS' RESPONSIBILITY STATEMENT

For the period from 1 January 2013 to 30 June 2013

The Directors' Report and the Investment Manager's Report

comprise the Half-Yearly Management Report.

To the best of the knowledge of the Directors:

This Half-Yearly Management Report and CondensedInterim

Financial Statements give a true and fair view of the assets,

liabilities, financial position and profit of the Company and have

been prepared in accordance with International Accounting Standard

(IAS) 34 Interim Financial Reporting.

The Half-Yearly Management Report includes a fair review of the

information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred in the period

from 1 January 2013 to 30 June 2013 and their impact on the set of

financial statements; and a description of the principal risks and

uncertainties for the remainder of the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the period from

1 January 2013 to 30 June 2013 and that have materially affected

the financial position or performance of the entity during that

period.

Signed on behalf of the Board of Directors by:

Howard Myles Christopher Sherwell

22 August 2013

UNAUDITED PORTFOLIO STATEMENT

AT 30 JUNE 2013

Shares Investments Fair value % of Net

/Warrants/ GBP equivalent assets

Nominal

Listed Equity Shares

Australian Dollars

20,560,122 South American Ferro Metals Limited 520,104 1.13

Australian Dollars Total 520,104 1.13

----------------- ---------

Canadian Dollars

3,383,333 BacTech Environmental Corporation 84,490 0.18

1,100,000 Forbes & Manhattan Coal Corporation 350,236 0.76

9,004,496 Ivanplats Limited 7,740,902 16.82

1,931,667 REBgold Corporation 108,536 0.24

Canadian Dollars Total 8,284,164 18.00

----------------- ---------

Great Britain Pounds

48,202,024 Metals Exploration Plc 2,831,869 6.15

Great Britain Pounds Total 2,831,869 6.15

----------------- ---------

United States Dollars

55,246,318 China Polymetallic Mining Limited 4,688,998 10.19

United States Dollars Total 4,688,998 10.19

----------------- ---------

Total Listed Equity Shares 16,325,135 35.47

----------------- ---------

Fixed Income Instruments

Canadian Dollars

Ironstone Resources Limited Convertible

250,500 Note 156,389 0.34

REBGold Corporation Unsecured Convertible

150,000 Debenture 93,646 0.20

Canadian Dollars Total 250,035 0.54

----------------- ---------

United States Dollars

5,100,000 Argentum Convertible Note 3,355,263 7.29

830,000 Polar Silver Convertible Note 546,053 1.19

United States Dollars Total 3,901,316 8.48

----------------- ---------

Total Fixed Income Instruments 4,151,351 9.02

----------------- ---------

Unlisted Equity Shares and Warrants

Canadian Dollars

6,282,341 Ironstone Resources Limited 5,490,953 11.93

143,143 Ironstone Resources Limited Warrants 22/02/2018 29,219 0.07

3,036,605 Ironstone Resources Limited Warrants 30/09/2013 9,219 0.02

10,250,000 REBgold Corporation Warrants 17/06/2015 26 -

2,400,000 REBgold Corporation Warrants 10/11/2016 5 -

6,666,667 REBgold Corporation Warrants 06/08/2013 0 -

Canadian Dollars Total 5,529,422 12.02

--------------- -----------

Great Britain Pounds

1,594,646 Celadon Mining Limited 143,518 0.31

Great Britain Pounds Total 143,518 0.31

--------------- -----------

United States Dollars

3,034,734 Archipelago Metals Limited 499,134 1.08

451,445 Bilboes Gold Limited 6,010,396 13.06

7,000,000 Black Pearl Limited Partnership 5,587,303 12.14

5,713,642 Ferrous Resources Limited 2,819,231 6.13

4,244,550 Gobi Coal and Energy Limited 5,584,934 12.14

1,186 Polar Silver Resources Limited 780 -

United States Dollars Total 20,501,778 44.55

--------------- -----------

Total Unlisted Equity Shares and Warrants 26,174,718 56.88

--------------- -----------

Financial assets held at fair value through

profit or loss 46,651,204 101.37

--------------- -----------

Other assets & liabilities (629,820) (1.37)

--------------- -----------

Total equity 46,021,384 100.00

--------------- -----------

CONDENSED INTERIM STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2013

Unaudited Audited

30 June 31 December

2013 2012

Notes GBP GBP

Assets

Cash and cash equivalents 92,836 601,174

Other receivables 3,791 57,671

Financial assets held at fair value through

profit or loss

(Cost: GBP61,575,120 (2012: GBP64,336,833)) 3 46,651,204 75,359,488

Total assets 46,747,831 76,018,333

------------- -------------

Equity and Liabilities

Liabilities

Purchase awaiting settlement 559,394 -

Performance fees payable 6 - 3,651,275

Management fees payable 6 53,657 79,317

Directors' fees payable 36,192 36,000

Audit fees payable 21,573 29,736

Administration fees payable 13,777 7,889

Other payables 41,854 14,461

Total liabilities 726,447 3,818,678

------------- -------------

Equity

Management Ordinary Shares 7 10,000 10,000

Ordinary Shares 7 64,767,056 64,767,056

Profit and loss account (18,755,672) 7,422,599

Total equity 46,021,384 72,199,655

------------- -------------

Total equity and liabilities 46,747,831 76,018,333

============= =============

Ordinary Shares in issue 7 66,152,533 66,152,533

Net asset value per Ordinary Share (in Pence) 4 69.6 109.1

These financial statements were approved by the Board of Directors

on 22 August 2013 and signed on its behalf by:

Howard Myles Christopher Sherwell

CONDENSED INTERIM STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD FROM 1 JANUARY 2013 TO 30 JUNE 2013

Unaudited Unaudited Unaudited

period period ended period ended

ended 30 June 30 June

30 June 2013 2013

2013

Revenue Capital Total

Notes GBP GBP GBP

Income

Interest income 9,831 - 9,831

Net loss on financial assets and

liabilities at fair value through

profit or loss - (25,452,324) (25,452,324)

Net foreign exchange loss - (12,267) (12,267)

Other income 8,028 - 8,028

Net income/(loss) 17,859 (25,464,591) (25,446,732)

---------- -------------- --------------

Expenses

Management fees 6 458,417 - 458,417

Directors' fees 70,000 - 70,000

Directors' expenses 2,796 - 2,796

Audit fees 20,000 - 20,000

Administration fees 52,215 - 52,215

Custody fees 20,807 - 20,807

Other expenses 107,304 - 107,304

Total expenses 731,539 - 731,539

---------- -------------- --------------

Total comprehensive loss for the

period (713,680) (25,464,591) (26,178,271)

========== ============== ==============

Net loss for the period per Ordinary

Share:

Basic and diluted (in pence) 4 (1.1) (38.5) (39.6)

Weighted Average Number of Ordinary

Shares Outstanding:

Basic and diluted 4 66,152,533

In the period ended 30 June 2013 there were no gains or losses other than those recognised

above.

The Directors consider all results to derive from continuing activities.

CONDENSED INTERIM STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD FROM 1 JANUARY 2012 TO 30 JUNE 2012

Unaudited Unaudited Unaudited

period ended period ended period ended

30 June 30 June 30 June

2012 2012 2012

Revenue Capital Total

Notes GBP GBP GBP

Income

Net loss on financial assets and

liabilities at fair value through

profit or loss - (9,911,647) (9,911,647)

Net foreign exchange loss - (18,710) (18,710)

Net loss - (9,930,357) (9,930,357)

-------------- -------------- --------------

Expenses

Management fees 6 608,334 - 608,334

Directors' fees 70,000 - 70,000

Audit fees 20,000 - 20,000

Administration fees 50,665 - 50,665

Custody fees 26,032 - 26,032

Other expenses 106,420 - 106,420

Total expenses 881,451 - 881,451

-------------- -------------- --------------

Total comprehensive loss for the

period (881,451) (9,930,357) (10,811,808)

============== ============== ==============

Net loss for the period per Ordinary

Share:

Basic and diluted (in pence) 4 (1.4) (15.0) (16.4)

Weighted Average Number of Ordinary

Shares Outstanding:

Basic and diluted 4 66,096,836

In the period ended 30 June 2012 there were no gains or losses other than those recognised

above.

The Directors consider all results to derive from continuing activities.

CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD FROM 1 JANUARY 2013 TO 30 JUNE 2013

Management

Ordinary Ordinary Profit and Period ended

Shares Shares loss account 2013

GBP GBP GBP GBP

Balance as at 1 January

2013 10,000 64,767,056 7,422,599 72,199,655

Net loss for the period - - (26,178,271) (26,178,271)

Balance as at 30 June 2013 10,000 64,767,056 (18,755,672) 46,021,384

=========== =========== =============== =============

CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD FROM 1 JANUARY 2012 TO 30 JUNE 2012

Management

Ordinary Ordinary Profit and Period ended

Shares Shares loss account 2012

GBP GBP GBP GBP

Balance as at 1 January

2012 10,000 64,657,584 22,056,066 86,723,650

Proceeds on issue of Ordinary

Shares - 107,549 - 107,549

Net loss for the period - - (10,811,808) (10,811,808)

Balance as at 30 June 2012 10,000 64,765,133 11,244,258 76,019,391

=========== =========== =============== =============

CONDENSED INTERIM STATEMENT OF CASH FLOWS

FOR THE PERIOD FROM 1 JANUARY 2013 TO 30 JUNE 2013

Period ended Period ended

30 June 30 June

2013 2012

Notes GBP GBP

Cash flows from operating activities

Net loss for the period (26,178,271) (10,811,808)

Adjustments to reconcile income for the

period to net cash used in operating activities:

Net change in fair value of financial

assets at fair value through profit or

loss 25,452,324 9,911,647

Net decrease in other receivables 53,880 19,233

Net decrease in other payables (3,092,231) (36,339)

------------- -------------

Net cash used in operating activities (3,764,298) (917,267)

------------- -------------

Cash flows from investing activities

Purchase of financial assets at fair value

through profit or loss (1,655,154) (364,615)

Sale of financial assets at fair value

through profit or loss 4,911,114 -

Net cash provided by/(used in) investing

activities 3,255,960 (364,615)

------------- -------------

Cash flows from financing activities

Proceeds from shares issued 7 - 107,549

Net cash provided by financing activities - 107,549

------------- -------------

Net decrease in cash and cash equivalents (508,338) (1,174,333)

Cash and cash equivalents at the beginning

of the period 601,174 1,629,044

Cash and cash equivalents at the end of

the period 92,836 454,711

============= =============

Represented by:

Cash and cash equivalents 92,836 454,711

Cash and cash equivalents at the end of

the period 92,836 454,711

============= =============

NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

FOR THE PERIOD FROM 1 JANUARY 2013 TO 30 JUNE 2013

1. GENERAL INFORMATION

Baker Steel Resources Trust Limited (the "Company") is a

closed-ended investment company with limited liability incorporated

on 9 March 2010 in Guernsey under the Companies (Guernsey) Law,

2008 with registration number 51576. The Company is a registered

closed-ended investment scheme registered pursuant to the POI Law

and the Registered Collective Investment Scheme Rules 2008 issued

by the Guernsey Financial Services Commission (GFSC). On 28 April

2010 the Ordinary Shares and Subscription Shares of the Company

were admitted to the Official List of the UK Listing Authority and

to trading on the Main Market of the London Stock Exchange. The

Company's Ordinary and Subscription Shares were admitted to the

Premium Listing Segment of the Official List on 28 April 2010.

Effective 1 June 2012 the Subscription Shares were assigned to the

Standard Segment of the Offical List.

The final exercise date for the Subscription Shares was 2 April

2013. No Subscription Shares were exercised at this time and all

Subscription Shares were subsequently cancelled.

The Company's portfolio is managed by Baker Steel Capital

Managers (Cayman) Limited (the "Manager"). The Manager has

appointed Baker Steel Capital Managers LLP (the "Investment

Manager") as the Investment Manager to carry out certain duties.

The Company's investment objective is to seek capital growth over

the long-term through a focused, global portfolio consisting

principally of the equities, or related instruments, of natural

resources companies. The Company invests predominantly in unlisted

companies (i.e. those companies which have not yet made an initial

public offering or "IPO") and also in listed securities (including

special situations opportunities and less liquid securities) with a

view to exploiting value inherent in market inefficiencies and

pricing anomalies.

The Half-Yearly financial report has not been audited or

reviewed by the auditors pursuant to the Auditing Practices Board

guidance on review of Interim Financial Information.

2. SIGNIFICANT ACCOUNTING POLICIES

a) Basis of preparation

The unaudited condensed interim financial statements of the

Company have been prepared in accordance with International

Accounting Standards (IAS) 34: Interim Financial Reporting.

The financial statements have been prepared on a historic cost

basis except for financial assets and financial liabilities at fair

value through profit or loss, which are designated at fair value

through profit or loss.

The accounting policies used in the preparation of these

financial statements are consistent with those used in the

Company's most recent annual financial statements for the year

ended 31 December 2012. There have been no changes to the Company's

accounting policies since the date of the Company's last annual

financial statements, for the year ended 31 December 2012, except

the adoption of IFRS 13 as described in Note 2b. The format of

these financial statements differs in some respects from that of

the most recent annual financial statements, in that the notes to

the financial statements are condensed.

The Company's functional currency is the Great Britain pound

sterling ("GBP"), being the currency in which its Ordinary Shares

are issued and in which returns are made to shareholders. The

presentation currency is the same as the functional currency. The

Company invests in companies around the world whose shares are

denominated in various currencies. Currently the majority of the

portfolio is denominated in US Dollars but this will not

necessarily remain the case as the portfolio develops.

The Statement of Comprehensive Income is presented in accordance

with the Statement of Recommended Practice ("SORP") 'Financial

Statements of Investment Trust Companies and Venture Capital

Trusts' issued in January 2009 by the Association of Investment

Companies, to the extent that it does not conflict with

International Financial Reporting Standards ("IFRS").

Income encompasses both revenue and capital gains/losses.

Revenue includes items such as dividends, interests, fees, rental

income and other equivalent items. Capital is the return, positive

or negative, from holding investments other than that part of the

return that is revenue. The SORP provides guidance on whether to

treat them as capital or revenue. Where specific guidance is not

given an item is recognised in accordance with its economic

substance.

b) Standards issued that are effective and adopted

IFRS 13, 'Fair Value Measurement'

IFRS 13 is effective for periods beginning on or after 1 January

2013, and has been adopted by the Company. The standard improves

consistency and reduces complexity by introducing a precise

definition of fair value and a single source of fair value

measurement and disclosure requirements for use across IFRSs. The

requirements do not extend the use of fair value accounting but

provide guidance on how it should be applied where its use is

already required or permitted by other standards within IFRS. If an

asset or liability measured at fair value has a bid price and an

ask price, the standard requires valuation to be based on a price

within the bid-ask spread that is most representative of fair value

and allows the use of mid-market pricing or other pricing

conventions that are used by market participants as a practical

expedient for fair value measurement within a bid-ask spread. On

adoption of the standard the Company reviewed its valuation methods

for listed financial assets and liabilities and continues to use

last traded prices where the Directors consider this represents

fair value, being the price for which shares can be sold. This is

consistent with the methods prescribed in the Company's offering

document for the calculation of its Net Asset Value. The use of

last traded prices is recognised as a standard pricing convention

within the industry and the Directors consider that it is,

generally, most representative of fair value. Last traded prices

may be adjusted, if appropriate, for various factors including

liquidity, bid-ask spread and credit considerations, where the

Directors consider this to be a better representation of fair

value. Such adjustments are generally based on available market

evidence. With respect to unlisted and unquoted investments, the

Directors consider that the adoption of IFRS 13 does not affect the

measurement of fair value which is further described in Note 3.

3. FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS

Listed equity

30 June 2013 shares Unlisted equity shares Fixed income instruments Warrants Total

GBP GBP GBP GBP GBP

Financial assets at fair

value through profit or loss

Cost 24,848,725 32,718,928 4,007,467 - 61,575,120

Unrealised (loss)/ gain (8,523,590) (6,582,679) 143,884 38,469 (14,923,916)

Market value at 30 June 2013 16,325,135 26,136,249 4,151,351 38,469 46,651,204

============= ====================== ======================== ======== =============

Listed equity

31 December 2012 shares Unlisted equity shares Fixed income instruments Warrants Total

GBP GBP GBP GBP GBP

Financial assets at fair value

through profit or loss

Cost 24,353,651 35,760,976 4,222,206 - 64,336,833

Unrealised gain/(loss) 13,860,840 (2,745,946) (111,943) 19,704 11,022,655

Market value at 31 December

2012 38,214,491 33,015,030 4,110,263 19,704 75,359,488

============= ====================== ======================== ======== ===========

The following table analyses investments by type and by level

within the fair valuation hierarchy at 30 June 2013.

Quoted prices

in active Quoted market Unobservable

markets based observables inputs

Level 1 Level 2 Level 3 Total

GBP GBP GBP GBP

Financial assets at fair

value

through profit or loss

Listed equity shares 3,895,235 12,429,900 - 16,325,135

Unlisted equity shares - - 26,136,249 26,136,249

Warrants - - 38,469 38,469

Fixed income instruments - - 4,151,351 4,151,351

------------- ------------------ ------------ -----------

3,895,235 12,429,900 30,326,069 46,651,204

============= ================== ============ ===========

The following table analyses investments by type and by level

within the fair valuation hierarchy at 31 December 2012.

Quoted prices

in active Quoted market Unobservable

markets based observables inputs

Level 1 Level 2 Level 3 Total

GBP GBP GBP GBP

Financial assets at fair

value

through profit or loss

Listed equity shares 4,560,241 33,654,250 - 38,214,491

Unlisted equity shares - - 33,015,030 33,015,030

Warrants - - 19,704 19,704

Fixed income instruments - - 4,110,263 4,110,263

------------- ------------------ ------------ -----------

4,560,241 33,654,250 37,144,997 75,359,488

============= ================== ============ ===========

The table below shows a reconciliation of beginning to ending

fair value balances for Level 3 investments and the amount of total

gains or losses for the year included in earnings attributable to

the change in unrealised gains or losses relating to assets and

liabilities held at 30 June 2013.

Fixed income

Total Equities instruments Warrants

GBP GBP GBP GBP

Opening balance 1 January

2013 37,144,997 33,015,030 4,110,263 19,704

Purchases of investments 256,669 - 256,669 -

Sale of investments (3,765,151) (3,282,589) (482,562) -

Change in net unrealised

(losses)/ gains (3,562,142) (3,836,733) 255,826 18,765

Net realised gains 251,696 240,541 11,155 -

------------- ------------- ------------- ---------

Closing balance 30

June 2013 30,326,069 26,136,249 4,151,351 38,469

============= ============= ============= =========

The table below shows a reconciliation of beginning to ending

fair value balances for Level 3 investments and the amount of total

gains or losses for the year included in earnings attributable to

the change in unrealised gains or losses relating to assets and

liabilities held at 31 December 2012.

Fixed income

Total Equities instruments Warrants

GBP GBP GBP GBP

Opening balance 1 January

2012 79,407,912 75,640,878 3,565,922 201,112

Purchases of investments 801,287 88,489 712,798 -

Transfer out of Level

3 (15,347,517) (15,347,517) - -

Change in net unrealised

losses (27,716,685) (27,366,820) (168,457) (181,408)

------------- ------------- ------------- ----------

Closing balance 31

December 2012 37,144,997 33,015,030 4,110,263 19,704

============= ============= ============= ==========

In determining an investment's placement within the fair value

hierarchy, the Directors take into consideration the following

factors:

Investments whose values are based on quoted market prices in

active markets are classified within Level 1. These include listed

equities with observable market prices. The Directors do not adjust

the quoted price for such instruments, even in situations where the

Company holds a large position and a sale could reasonably impact

the quoted price.

Investments that trade in markets that are not considered to be

active but are valued based on quoted market prices, dealer

quotations or alternative pricing sources supported by observable

inputs, are classified within Level 2. These include certain less

liquid listed equities. As Level 2 investments include positions

that are not traded in active markets and/or are subject to

transfer restrictions, valuations may be adjusted to reflect

illiquidity and/or non-transferability, which are generally based

on available market information. The Company held such investments

at 30 June 2013 amounting to GBP12,429,900 (30 June 2012:

GBPNil).

Investments classified within Level 3 have significant

unobservable inputs. They include unlisted fixed income

instruments, unlisted equity shares and warrants. Level 3

investments are valued using valuation techniques explained in the

Company's accounting policies. The inputs used by the Directors in

estimating the value of Level 3 investments include the original

transaction price, recent transactions in the same or similar

instruments if representative in volume and nature, completed or

pending third-party transactions in the underlying investment of

comparable issuers, subsequent rounds of financing,

recapitalisations and other transactions across the capital

structure, offerings in the equity or debt capital markets, and

changes in financial ratios or cash flows. Level 3 investments may

also be adjusted to reflect illiquidity and/or non-transferability,

with the amount of such discount estimated by the Directors in the

absence of market information. In cases where there have been no

relevant transactions during the year, the Directors will take due

consideration of the change in Development Risk Adjusted Net

Present Values of the assets underlying the investments, prepared

by the Investment Manager, since the last change in valuation and

of whether such change is indicative of a change in fair value.

The following table presents the Company's other assets and

liabilities at 30 June 2013. The assets and liabilities in the

table are carried at amortised cost; their carrying values are a

reasonable approximation of fair value.

Level Level Total

1 Level 2 3

30 June 2013

GBP GBP GBP GBP

Assets

Cash and cash equivalents 92,836 - - 92,836

Other receivables - 3,791 - 3,791

Total assets 92,836 3,791 - 96,627

-------- -------- ------ -------------

Liabilities

Due to broker 559,394 - 559,394

Investment management fees payable - 53,657 - 53,657

Directors' Fees Payable - 36,192 - 36,192

Audit fees payable - 21,573 - 21,573

Administration fees payable - 13,777 - 13,777

Other payables - 41,854 - 41,854

Total liabilities 559,394 167,053 - 726,447

-------- -------- ------ -------------

Cash and cash equivalents include cash in hand, deposits held

with banks and other short-term investments in an active

market.

Other receivables include the contractual amounts for settlement

of trades and other obligations due to the Fund. Amount due to

brokers, investment management fees payable, directors' fees

payable, audit fees payable, administration fees payable and other

payables represent the contractual amounts and obligations due by

the Fund for settlement for trades and expenses.

4. NET ASSET VALUE PER SHARE AND EARNINGS PER SHARE

Basic Net Asset Value per share is based on the net assets of

GBP46,021,384 (31 December 2012: GBP72,199,655) and 66,152,533 (31

December 2012: 66,152,533) Ordinary Shares, being the number of

shares in issue at the period end. The final exercise date for the

Subscription Shares was 2 April 2013. No Subscription Shares were

exercised at this time and all Subscription Shares were

subsequently cancelled. The Subscription Shares were entitled to be

converted to Ordinary Shares at 100p per share. The calculation for

basic net asset value is as below:-

30 June 2013 31 December 2012

Ordinary Subscription Ordinary Subscription

Shares Shares Shares Shares

Net assets at the period end

(GBP) 46,021,384 - 72,199,655 13,085,150

Number of shares 66,152,533 - 66,152,533 13,085,150

Basic net asset value per share

(in pence) 69.6 109.1

The basic earnings per share is based on the net loss for the

period of the Company of GBP26,178,271 (net loss for the year ended

31 December 2012: GBP14,633,467) and on 66,152,533 (31 December

2012: 66,152,533) Ordinary Shares, being the weighted average

number of Ordinary Shares in issue during the period. In addition,

at 31 December 2012 the average market share price during the

period of 95.8p was lower than the exercise price of 100p. Basic

and diluted earnings per share were the same due to the fact that

the conversion of subscription shares to ordinary shares would

decrease the loss per share, and hence subscription shares were

anti-dilutive. This calculation was prepared in accordance with

IFRS.

5. TAXATION

The Company is a Guernsey Exempt Company and is therefore not

subject to taxation on its income under the Income Tax (Exempt

Bodies) (Guernsey) Ordinance, 1989. An annual exempt fee of GBP600

has been paid.

6. MANAGEMENT AND PERFORMANCE FEES

The Manager was appointed pursuant to a management agreement

with the Company dated 31 March 2010 (the "Management Agreement").

The Company pays to the Manager a management fee which is equal to

1/12th of 1.75% of the total market capitalisation of the Company

per month. The management fee is calculated and accrued as at the

last Business Day of each month and is paid monthly in arrears.

The Manager may in certain circumstances also be entitled to be

paid a performance fee if the Net Asset Value at the end of any

Performance Period exceeds the Hurdle as at the end of the

Performance Period. The performance period is each 12 month period

ending on 31 December in each year (the "Performance Period"). For

this purpose the "Hurdle" means an amount equal to the Issue Price

of GBP1 per Ordinary Share multiplied by the number of Shares in

issue as at Admission, as increased at a rate of 8% per annum

compounded to the end of the relevant Performance Period. In

respect of any Performance Period which is less than a full 12

months, the Hurdle is applied pro rata. The performance fee is

subject to adjustments for any issue and/or repurchase of Ordinary

Shares.

The amount of the performance fee (if any) is 15 per cent of the

total increase in the Net Asset Value, if the Hurdle has been met,

at the end of the relevant Performance Period over the highest

previously recorded Net Asset Value as at the end of a Performance

Period in respect of which a performance fee was last accrued, (or

the Issue Price multiplied by the number of shares in issue as at

Admission, if no performance fee has been so accrued) having made

adjustments for numbers of Ordinary Shares issued and/or

repurchased as described above. In addition, the performance fee

will only become payable if there have been sufficient net realised

gains.

If the Company wishes to terminate the Management Agreement

without cause it is required to give the Manager 12 months prior

notice or pay to the Manager an amount equal to: (a) the aggregate

investment management fee which would otherwise have been payable

during the 12 months following the date of such notice (such amount

to be calculated for the whole of such period by reference to the

Market Capitalisation prevailing on the Valuation Day on or

immediately prior to the date of such notice); and (b) any

performance fee accrued at the end of any Performance Period which

ended on or prior to termination and which remains unpaid at the

date of termination which shall be payable as soon as, and to the

extent that, sufficient cash or other liquid assets are available

to the Company (as determined in good faith by the Directors),

provided that such accrued performance fee shall be paid prior to

the Company making any new investment or settling any other

liabilities; and (c) where termination does not occur at 31

December in any year, any performance fee accrued at the date of

termination shall be payable as soon as and to the extent that

sufficient cash or other liquid assets are available to the Company

(as determined in good faith by the Directors), provided that such

accrued performance fee shall be paid prior to the Company making

any new investment or settling any other liabilities.

The performance fees accrued for the period ended 30 June 2013

were GBPNil (30 June 2012: GBPNil) of which GBPNil was payable at

30 June 2013 (31 December 2012: GBP3,651,275).

No further performance fee will be accrued or paid until the Net

Asset Value exceeds GBP86,831,199 (131.3p per share) as adjusted

for further issues and repurchases of shares.

The management fees paid for the period ended 30 June 2013 were

GBP458,417 (30 June 2012: GBP608,334) of which GBP53,657 was

payable at 30 June 2013 (31 December 2012: GBP79,317).

7. SHARE CAPITAL

The share capital of the Company on incorporation was

represented by an unlimited number of Ordinary Shares of no par

value. The Company may issue an unlimited number of shares of a

nominal or par value and/or of no par value or a combination of

both.

The Company has a total of 66,142,533 Ordinary Shares in issue.

In addition, the Company has 10,000 Management Ordinary Shares in

issue, which are held by the Investment Manager.

The final exercise date for the Subscription Shares was 2 April

2013. No Subscription Shares were exercised at this time and all

Subscription Shares were subsequently cancelled.

The Ordinary Shares are currently admitted to the Premium

Listing segment of the Official List.

The details of issued share capital of the Company are as

follows:

30 June 2013 31 December 2012

Issued and fully paid share capital

Ordinary Shares of no par value* 66,152,533 66,152,533

Subscription Shares of no par value - 13,085,150

============= =================

The issue of Ordinary Shares during the period ended 30 June

2013 took place as follows:

Subscription

Ordinary Shares Shares

Balance at 1 January 2013 66,152,533 13,085,150

Cancellation of Subscription Shares - (13,085,150)

Balance at 30 June 2013 66,152,533 -

================ =============

The issue of Ordinary Shares during the year ended 31 December

2012 took place as follows:

Subscription

Ordinary Shares Shares

Balance at 1 January 2012 66,043,061 13,194,622

Conversion of Subscription Shares 109,472 (109,472)

Balance at 31 December 2012 66,152,533 13,085,150

================ =============

* On 9 March 2010, 1 Management Ordinary Share was issued and on

26 March 2010, 9,999 Management Ordinary Shares were issued.

8. RELATED PARTY TRANSACTIONS

The Directors' interests in the share capital of the Company at

30 June 2013 were as follows:

Number of Number of

Ordinary Shares Subscription Shares

Edward Flood 65,000 -

Christopher Sherwell 25,000 -

Clive Newall 25,000 -

The Directors' interests in the share capital of the Company at

31 December 2012 were as follows:

Number of Number of

Ordinary Shares Subscription Shares

Edward Flood 65,000 13,000

Christopher Sherwell 25,000 5,000

Clive Newall 25,000 5,000

Mr Sherwell also has an indirect interest in the share of the

Company through an investment in another fund managed by the

Manager.

The Manager, Baker Steel Capital Managers (Cayman) Limited, had

an interest in 504,832 Ordinary Shares at 30 June 2013 and 31 Dec

2012.

The Investment Manager, Baker Steel Capital Managers LLP, had an

interest in 10,000 Management Ordinary Shares at 30 June 2013 and

31 Dec 2012.

9. APPROVAL OF HALF-YEARLY REPORT AND UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS

The Half-Yearly Report and Unaudited Condensed Interim Financial

Statements to 30 June 2013 were approved by the Board of Directors

on 22 August 2013.

MANAGEMENT AND ADMINISTRATION

DIRECTORS: Howard Myles (Chairman)

Edward Flood

Charles Hansard

Clive Newall

Christopher Sherwell

(all of whom are non-executive and independent)

REGISTERED OFFICE: Arnold House

St. Julian's Avenue

St. Peter Port

Guernsey

Channel Islands

MANAGER: Baker Steel Capital Managers (Cayman) Limited

PO Box 309

George Town

Grand Cayman KY1-1104

Cayman Islands

INVESTMENT MANAGER: Baker Steel Capital Managers LLP

86 Jermyn Street

London SW1Y 6JD

England

United Kingdom

BROKERS: RBC Capital Markets

Thames Court

One Queenhithe

London EC4V 3DQ

United Kingdom

Winterflood Securities Limited

Cannon Bridge House

25 Dowgate Hill

London EC4R 2GA

United Kingdom

SOLICITORS TO THE COMPANY: Simmons & Simmons

(as to English law) CityPoint

One Ropemaker Street

London EC2Y 9SS

United Kingdom

ADVOCATES TO THE COMPANY: Ogier

(as to Guernsey law) Ogier House

St. Julian's Avenue

St. Peter Port

Guernsey GY1 1WA

Channel Islands

ADMINISTRATOR & COMPANY SECRETARY: HSBC Securities Services (Guernsey) Limited

Arnold House

St. Julian's Avenue

St. Peter Port

Guernsey GY1 3NF

Channel Islands

SUB-ADMINISTRATOR TO THE COMPANY: HSBC Securities Services (Ireland) Limited

1 Grand Canal Square

Grand Canal Harbour

Dublin 2

Ireland

CUSTODIAN TO THE COMPANY: HSBC Institutional Trust Services (Ireland) Limited

1 Grand Canal Square

Grand Canal Harbour

Dublin 2

Ireland

AUDITORS: Ernst & Young LLP

Royal Chambers

St. Julian's Avenue

St. Peter Port

Guernsey GY1 4AF

Channel Islands

REGISTRAR: Capita Registrars (Guernsey) Limited

Longue Hougue House

St. Sampson

Guernsey GY2 4JN

Channel Islands

UK PAYING AGENT AND TRANSFER AGENT: Capita Registrars

The Registry

34 Beckenham Road

Beckenham

Kent BR3 4TU

United Kingdom

RECEIVING AGENT Capita Registrars

Corporate Actions

The Registry

34 Beckenham Road

Beckenham

Kent BR3 4TU

United Kingdom

PRINCIPAL BANKER: HSBC Bank plc

8 Canada Square

London E14 5HQ

United Kingdom

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGZRKFGGFZM

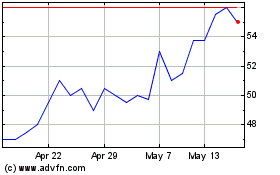

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024