Baker Steel Resources Trust Ltd Net Asset Value(s) (5183I)

July 04 2013 - 2:00AM

UK Regulatory

TIDMBSRT

RNS Number : 5183I

Baker Steel Resources Trust Ltd

04 July 2013

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

4 July 2013

28 June 2013 Unaudited NAV Statement

Net Asset Values

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share as at 28 June 2013:

Net asset value per Ordinary Share: 69.6 pence

During the month, the NAV per share decreased by 24.8% primarily

as a result in the fall in the price of Ivanplats on the Toronto

Stock Exchange and write downs to Gobi Coal and Ferrous

Resources.

At 28 June 2013, the Company had a total of 66,142,533 Ordinary

Shares in issue.

The Company is fully invested with top 10 investments as follows

as a percentage of NAV:

Ivanplats Limited 16.8%

Bilboes Gold Limited 13.1%

Ironstone Resources Limited 12.4%

Gobi Coal & Energy Limited 12.1%

Black Pearl Limited Partnership 12.1%

China Polymetallic Mining Limited 10.2%

Polar Silver Resources Ltd 8.5%

Ferrous Resources Limited 6.1%

Metals Exploration plc 6.1%

South American Ferro Metals Limited 1.1%

Other Investments 2.8%

Net Cash, Equivalents and Accruals -1.3%

Investment Update

During the first 6 months of the year the NAV per share has

fallen 36.2% compared to the HSBC Global Mining Index which has

fallen 28.9% in Sterling terms.

At the half year and full year, the Board reviews whether

general market movements in mining equities should be reflected in

the carrying values of the unlisted holdings in the portfolio in

the absence of relevant transactions and taking into account the

specific progress and structure of each investment. In order to

quantify how the share price of a particular stock might have moved

during the period had it been listed, the Investment Manager

maintains an index of comparable listed companies for each unlisted

investment.

Following the review at 28 June 2013, the Board has decided to

write down the values of its holdings in Ferrous Resources Limited

and Gobi Coal Limited in line with movements in their respective

indices.

It is emphasised that these write downs are not a reflection of

the viability of Ferrous or Gobi's projects which remain robust,

rather a reflection of the general market movement of comparable

listed companies.

Ferrous Resources Limited ("Ferrous")

As mentioned in the 31 May 2013 NAV Statement, following a site

visit to Ferrous' operations in Brazil it appears that Ferrous is

making good progress on the ground under its new management and

generating positive EBITDA from its current operations. Despite

this and in the absence of any verifiable "grey market"

transactions since the beginning of the year, it has been decided

to write down the Company's carrying value of Ferrous by 40% in

line with the movement of an index of comparable listed iron ore

stocks.

The management of Ferrous is planning to be in a position by the

year end to announce how it will finance its major expansion to 17

million tonnes of iron ore product. It is expected that the terms

of such financing will allow the Company to review its valuation of

Ferrous again.

Gobi Coal & Energy Limited ("Gobi")

In mid 2012, Gobi halted development of its Shinejinst coking

coal project in Mongolia in the light of a deteriorating

environment for investment in Mongolia and weakening prices for

coking coal delivered at the Chinese border. Following this, the

Company wrote down its carrying value of Gobi by 38.5% in 2012.

Share prices of listed coal companies and in particular

Mongolian coals stocks have continued to deteriorate in the first

half of 2013 with the index attributable to Gobi falling

approximately 50%, of which around half might be attributed to be

specific to investor sentiment towards Mongolia. In line with this,

the Company has decided to reduce its carrying value of Gobi by

50%. The revised carrying value remains slightly above the

Company's acquisition price.

Shinejinst remains a good quality mining project and it is hoped

that the re-election of the incumbent President of Mongolia last

week will lead to an improvement in the investment climate in that

country and allow Gobi to move Shinejinst into production.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

RBC Capital Markets +44 20 7653 4000

Martin Eales

Winterflood Investment Trusts +44 20 3100 0250

James Moseley

Pelham Bell Pottinger

Lorna Spears +44 20 7861 3883

Joanna Boon +44 20 7861 3867

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure is set

out in the Company's Prospectus dated 31 March 2010.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVDMGGNGFKGFZM

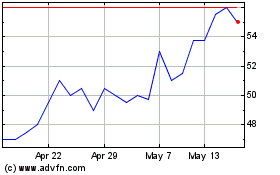

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024