Baker Steel Resources Trust Ltd Interim Management Statement (2056O)

October 09 2012 - 2:00AM

UK Regulatory

TIDMBSRT

RNS Number : 2056O

Baker Steel Resources Trust Ltd

09 October 2012

BAKER STEEL RESOURCES TRUST LTD

www.bakersteelresourcestrust.com

September 2012 Quarterly Factsheet

At 28 September 2012 Price / Index Level % Change in Quarter % Change in Year % Change from Inception

----------------------------- -------------------- -------------------- ----------------- ------------------------

Net Asset Value

(pence/share) 102.6 -10.7% -21.9% +2.6%*

----------------------------- -------------------- -------------------- ----------------- ------------------------

Diluted Net Asset Value

(pence/share) 102.2 -9.2% -19.0% n/a

----------------------------- -------------------- -------------------- ----------------- ------------------------

Ordinary Share Price

(pence/share) 87.5 -6.4% +13.3% -12.5%**

----------------------------- -------------------- -------------------- ----------------- ------------------------

Subscription Share Price

(pence/share) 12.5 -3.8% -30.6% n/a

----------------------------- -------------------- -------------------- ----------------- ------------------------

MSCI ACWI Index 331.58 +6.2% +10.7% +7.6%%

----------------------------- -------------------- -------------------- ----------------- ------------------------

HSBC Global Mining Index

(Sterling) 689.58 +3.9% -7.3% -18.9%

----------------------------- -------------------- -------------------- ----------------- ------------------------

CRB Index 309.3 +8.8% +1.3% +13.2%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Chinese Domestic Iron Ore

- Hebei/Tangshan (US$/t) 153.00 -13.1% -18.2% -20.3%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Copper (US$/t) 8211.50 +6.8% +8.2% +10.2%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Gold (US$/oz) 1772.10 +10.9% +13.3% +51.7%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Source: Bloomberg closing 27/4/10, **Issue price 28/4/10, * NAV

30/4/10

This document constitutes an interim management statement for

the period from 1 July 2012 to 8 October 2012 ("the Period").

Financial information has been drawn up as at 28/09/2012. There

have been no material changes since that date.

Review Investment Objective

At the end of September 2012, Baker Steel Resources To seek capital growth

Trust Limited ("BSRT" or "the Company") was fully over the long term through

invested. During the quarter there have been no a focused global portfolio

significant changes to the Company's portfolio consisting principally

as it was fully invested at the end of June 2012 of the equities, or related

and there were no realisations during the period. instruments, of natural

Following a weak first half of 2012, markets for resources companies.

mining equities stabilised during the third quarter

of 2012, with the HSBC Global Mining Index rising Investment Strategy

3.9%. The performance of commodities themselves

was mixed with the prices of the steel minerals, Investing predominantly

iron ore and coking coal weakening over fears in attractively valued

of a slowdown in Chinese growth. Conversely the private companies with

prices for precious metals and copper have remained strong development projects

strong albeit volatile. and focused management

During the quarter the net asset value of the and also in listed securities

Company fell 10.7%. This fall was largely due to exploit value inherent

to decisions to decrease the carrying values of in market inefficiencies.

Gobi Coal & Energy Limited ("Gobi") and Ferrous

Resources Limited ("Ferrous") as well as falls Asset Allocation

in the share prices of certain of the listed stocks

in the portfolio, particularly China Polymetallic Unlisted Equities GBP 65.0

Mining Limited. The decision to cut the carrying M 95.8 %

value of Gobi, which reduced overall NAV by 5.3%, Listed Equities GBP 5.4

was made following a fall in coking coal prices M 7.9 %

and a consequent postponement of its proposed Net Cash & GBP -2.5 M -3.7

IPO. %

In August 2012, Copperbelt Minerals signed a conditional Equivalents

Settlement Agreement with its joint venture partner Net Assets GBP67.9 M

Gécamines whereby Copperbelt will exit its Gearing: -3.7%

joint venture in the Democratic Republic of Congo

for deferred compensation. Since then good progress Shares in Issue

appears to have been made on satisfying the numerous

conditions precedent for completion of the transaction, Trading: The London Stock

which is expected to close before the year end. Exchange Ordinary: 66,142,533

Outlook Code: BSRT

At the beginning of October 2012, Ivanplats Limited ISIN GG00B6686L20

launched its roadshow to raise approximately C$300 Subscription: 13,085,150

million from an IPO on the Toronto Stock Exchange. Code: BSRW

Final pricing is expected during the week commencing ISIN GG00B64WLC23

15 October 2012 with the IPO anticipated to close

the following week. Based on the range indicated Financial Calendar

by Ivanplats' brokers, the Net Asset Value of

the Company would rise between approximately 9% Year End: 31 December

and 17%. As the Company will be subject to a lock-up

on its shareholding, the Board may apply a discount Interims: August

in assessing the Company's carrying value of Ivanplats Finals: April

following the IPO.

The Ivanplats IPO will not only be an important The final date to subscribe

milestone for the Company, as its largest investment for Subscription Shares

(31.3% NAV), but could also be a significant indicator is 2 April 2013

for the state of the IPO market in general and

therefore the prospects for other IPO's within

the Company's portfolio companies.

------------------------------------------------------------- -----------------------------------------

Top 10 Investments (at 28 September 2012) Investment Manager

Baker Steel Capital Managers

Ivanplats Limited 31.3% NAV LLP

A private company with major copper and zinc projects

in the Democratic Republic of Congo and a platinum/nickel Investment Advisers

project in South Africa. AWR Lloyd Capital Ltd

Gobi Coal & Energy Limited 19.4% NAV Rock Capital Partners Ltd

A private company with three coking coal projects

in Mongolia. Management Fees

Ironstone Resources Limited 8.9% NAV Monthly: 1/12 of 1.75%

A private company with an iron ore/vanadium project of

in Canada. Market Capitalisation

China Polymetallic Mining Limited 8.2% NAV Performance: 15% of NAV

A company listed on the Hong Kong Stock Exchange growth (if over 8% p.a.

with a producing silver/lead/zinc mine and other compound hurdle rate, with

development opportunities in China. high watermark)

Black Pearl Limited Partnership 7.0% NAV

Black Pearl is the private vehicle through which Board

the investment in the Black Pearl beach placer Howard Myles (Chairman)

iron sands project in West Java, Indonesia is Ed Flood

held. Charles Hansard

Ferrous Resources Limited 6.5% NAV Clive Newall

A private company with five iron ore projects Chris Sherwell

in Brazil.

Bilboes Gold Limited 5.9% NAV Joint Brokers

A private company with four previously producing

gold mines in Zimbabwe. RBC Capital Markets

Polar Silver Resources Limited 5.4% NAV +44(0)20 7653 4253

A private company which holds a 50% interest in

a silver project in Russia. Winterflood Investment

Metals Exploration plc 4.1% NAV Trusts

A company listed on the AIM market of the London +44(0)20 3100 0000

Stock Exchange with a gold project in the Philippines.

South American Ferro Metals Limited 2.5% NAV Contact:

A company listed on the Australian Stock Exchange

with a producing iron ore mine in Brazil. Baker Steel Capital Managers

LLP

The remainder of the Portfolio (excluding cash) 86 Jermyn Street,

comprises seven holdings totalling 4.5% NAV. London SW1Y 6JD

Further information is available on BSRT's website: +44 (0) 20 7389 8237

www.bakersteelresourcestrust.com

enquiries@bakersteelresourcestrust.com

Baker Steel Resources Trust

Limited is incorporated

in Guernsey

Registration Number: 51576

Arnold House, St Julian's

Avenue,

St Peter Port, Guernsey

--------------------------------------------------------------- ------------------------------------------

Important Information

This document is issued by Baker Steel Capital Managers LLP (a Limited

Liability Partnership registered in England No OC301191 and authorised

and regulated by the Financial Services Authority). The information contained

in this document is not intended to and does not constitute an offer, solicitation,

inducement, invitation or commitment to purchase, subscribe to, provide

or sell any securities, service or product or to provide any recommendations

which should be relied upon for financial, securities, investment or other

advice or to take any decision based on such information. Individual advice

should be sought from legal, financial, personal and other advisors before

making any investment or financial decision or purchasing any financial,

securities or investment-related service or product. As a registered collective

investment scheme, shares in Baker Steel Resources Trust Ltd are not permitted

to be directly offered to the public in Guernsey but may be offered to

regulated entities in Guernsey or offered to the public by entities appropriately

licensed under the Protection of Investors (Bailiwick of Guernsey) Law

1987 as amended.

The Net Asset Value ("NAV") figures stated are based on unaudited estimated

valuations of the underlying investments and not necessarily based on observable

inputs. Such estimates are not subject to any independent verification

or other due diligence and may not comply with generally accepted accounting

practices or other generally accepted valuation principles. In addition,

some estimated valuations are based on the latest available information

which may relate to some time before the date set out above. Accordingly,

no reliance should be placed on such estimated valuations and they should

only be taken as an indicative guide. Other risk factors which may be relevant

to the NAV figures are set out in the Company's Prospectus dated 31 March

2010.

-----------------------------------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSZMMGGKRZGZZM

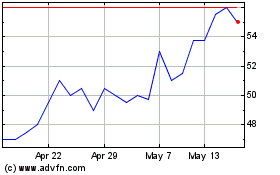

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024