Baker Steel Resources Trust Ltd 29 June 2012 NAV Statement (8890G)

July 05 2012 - 2:00AM

UK Regulatory

TIDMBSRT

RNS Number : 8890G

Baker Steel Resources Trust Ltd

05 July 2012

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

5 July 2012

29 June 2012 NAV Statement

Net Asset Values

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value and diluted net asset value per share

as at 29 June 2012:

Net asset value per Ordinary Share: 114.9 pence

Diluted net asset value per Ordinary Share: 112.5 pence

During the month, the undiluted NAV per share fell by 3.9%,

largely due to falls in the market prices of certain of the listed

investments in the portfolio together with a reduction in the

carrying value of Copperbelt Minerals Limited.

The Company has a total of 66,140,610 Ordinary Shares and

13,087,073 Subscription Shares in issue.

Portfolio update

Copperbelt Minerals Limited ("Copperbelt")

During June 2012, Copperbelt undertook a discounted rights issue

in which the Company participated on a pro rata basis. In line with

its valuation policy, the Company reduced the carrying value of its

investment to the price at which the rights issue was undertaken.

In addition, Copperbelt made an offer to buy back its outstanding

warrants in return for the issue of ordinary shares. The Company

accepted this offer in respect of the warrants held. The net effect

of both these actions has been a decrease in NAV of approximately

1.2%.

Since the abortive takeover of Copperbelt last year by the

Chinese African Development Fund, Copperbelt has been in

discussions with its partner Gecamines regarding the future

financing and development of their joint venture concerning the

Deziwa copper project in the Democratic Republic of Congo. The

funds raised by the rights issue have provided Copperbelt with

working capital to continue these negotiations.

The Company is fully invested with top 10 investments as follows

as a percentage of NAV:

Ivanplats Limited 28.7%

Gobi Coal & Energy Limited 23.1%

China Polymetallic Mining

Limited 8.8%

Ironstone Resources Limited 7.9%

Ferrous Resources Limited 7.2%

Black Pearl 6.2%

Bilboes Holdings 5.2%

Polar Silver 4.9%

Metals Exploration plc 3.2%

South American Ferro Metals

Limited 2.8%

Other Investments 4.6%

Net Cash, Equivalents and

Accruals -2.6%

Update on Investments

South American Ferro Metals Limited ("SAFM")

On 1 June 2012, SAFM announced that it had completed

construction of a concentrator at its Ponto Verde mine and

successfully installed a cone crusher within the processing plant.

The new plant was expected to reach steady state production of

20,000-24,000 tonnes of concentrate per month, at a planned grade

of 65-66% Fe by mid-June 2012. The concentrator is processing the

fines material that is discharged from the existing beneficiation

plant, which has previously been stockpiled. The addition of the

concentrator will increase saleable product from Ponto Verde by

around 50% and will have a material positive impact on SAFM's

monthly cash flow. A second stage concentrator to increase recovery

further is being considered and in addition a definitive

feasibility study is underway to expand the operation from 1.5

million run of mine ("ROM") tonnes mined per annum to 8 million ROM

tonnes per annum.

Ferrous Resources Limited ("Ferrous")

On 26 June 2012, Ferrous announced that following a

comprehensive review of Ferrous' strategic options and operations

by Ferrous' new CEO, Jayme Nicolato Correa, Ferrous has decided

upon a step-by-step organic growth strategy. This approach will

allow Ferrous to grow as a standalone entity by reducing overall

funding requirements. Ferrous also announced that following the

commencement of operations last year, it has turned EBITDA

positive. Ferrous aims to produce 3 million tonnes of ore for 2012

and increase production capacity to 5 million tonnes of ore whilst

completing feasibility studies for its infrastructure network and

the Viga mine and obtaining the necessary licensing at Viga Norte

and Serrinha. These operational objectives will be fully funded

from balance sheet cash and cash flow from existing operations and

require no additional capital raising.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone Trevor Steel

RBC Capital Markets +44 20 7653 4000

Martin Eales

Winterflood Investment Trusts +44 20 3100 0250

James Moseley

Pelham Bell Pottinger

Lorna Spears +44 20 7861 3883

Joanna Boon +44 20 7861 3867

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVVZLBBLDFEBBF

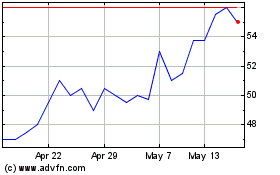

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024