30 December 2011 NAV Statement (0923V)

January 06 2012 - 2:00AM

UK Regulatory

TIDMBSRT

RNS Number : 0923V

Baker Steel Resources Trust Ltd

06 January 2012

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

6 January 2012

30 December 2011 NAV Statement

Net Asset Values

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value and diluted net asset value per share

as at 30 December 2011:

Net asset value per Ordinary share: 130.3 pence

Diluted net asset value per Ordinary share: 125.2 pence

During the month, the undiluted NAV per share rose by 12.9%

largely due to increases in the carrying value of the Company's

holdings in Gobi Coal & Energy Limited ("Gobi Coal") and China

Polymetallic Mining Limited ("CPM"). This follows a successful fund

raising by Gobi Coal and the listing on the Hong Kong Stock

Exchange of CPM.

The rise in December has contributed to an increase in the NAV

per share of 26.0% during 2011.

The Company has a total of 66,033,061 Ordinary Shares and

13,194,622 Subscription Shares in issue.

Portfolio update

Gobi Coal & Energy Limited ("Gobi Coal")

On 9 December 2011, Gobi Coal informed shareholders that it had

completed a placing of 14 million new shares (15% of the enlarged

issued share capital) to two sovereign wealth funds raising a total

of US$91 million. This placing was undertaken at a price of US$6.50

per share compared to the Company's carrying value of US$4.00 per

share at 30 November 2011. The funds will enable Gobi Coal to

construct Phase 1 of the Shinejinst Mine and bring it into

production in anticipation of an IPO during 2012.

Accordingly, the Company's carrying value of Gobi Coal shares

has been uplifted to the value of the fund raising, resulting in an

increase in the NAV of the Company of approximately 7.7% from the

30 November 2011 value in Sterling terms.

China Polymetallic Mining Limited ("CPM")

On 14 December 2011, CPM listed on the Hong Kong Stock Exchange.

CPM started production at the first of its mines, the Shizishan

silver/lead/zinc mine in Yunnan Province, China, during the third

quarter of 2011. The Shizishan mine is due to reach full annual

capacity of 5.1 million ounces of silver, 57,000 tonnes of lead and

35,000 tonnes of zinc in concentrate during the second half of

2012. CPM has a strong pipeline of exploration and development

projects in Yunnan Province, the first of which is the Lushan

tungsten-tin polymetallic mine which is planned to start trial

production in the second half of 2012.

Based on the closing listed share price on 30 December 2011, the

Company's carrying value of CPM increased by approximately 76% over

the 30 November 2011 value and has in turn resulted in a 3.7%

increase in the NAV of the Company in Sterling terms.

South American Ferro Metals Limited ("SAFM")

On 28 December 2012, SAFM announced the conversion of the class

B performance shares. These shares were the last of the performance

shares to be converted, following the conversion of the class A and

class C performance shares earlier in 2011. This conversion came as

a result of the definition by SAFM of a maiden JORC-compliant

mineral resource at its Ponto Verde iron ore project in Brazil. The

resource was estimated at 230.6 million tonnes ore grading 44.52%

Fe compared to the required hurdle for conversion of the class B

performance shares of 50 million tonnes iron ore.

The Company is fully invested with top 10 investments as follows

as a percentage of NAV:

Ivanplats Limited 25.6%

Gobi Coal & Energy Limited 20.6%

Ferrous Resources Limited 12.8%

China Polymetallic Mining

Limited 8.9%

Ironstone Resources Limited 6.1%

Black Pearl 5.2%

Bilboes Holdings 4.5%

Polar Silver 4.1%

Metals Exploration plc 4.0%

South American Ferro Metals

Limited 3.1%

Other Investments 5.9%

Net Cash, Equivalents and

Accruals -0.8%

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone Trevor Steel

RBC Capital Markets +44 20 7653 4000

Martin Eales

Winterflood Investment Trusts +44 20 3100 0250

James Moseley

Pelham Bell Pottinger

Lorna Spears +44 20 7861 3883

Joanna Boon +44 20 7861 3867

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVEAKFSESFAEFF

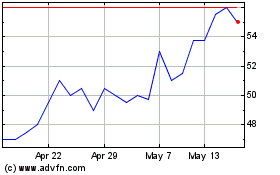

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024