TIDMBSRT

RNS Number : 1105N

Baker Steel Resources Trust Ltd

26 August 2011

MANAGEMENT AND ADMINISTRATION

DIRECTORS: Howard Myles (Chairman)

Edward Flood

Charles Hansard

Clive Newall

Christopher Sherwell

all of whom are non-executive and independent

directors

REGISTERED OFFICE: Arnold House

St. Julian's Avenue

St. Peter Port

Guernsey

Channel Islands

MANAGER: Baker Steel Capital Managers (Cayman) Limited

PO Box 309

George Town

Grand Cayman KY1-1104

Cayman Islands

INVESTMENT MANAGER: Baker Steel Capital Managers LLP

86 Jermyn Street

London SW1Y 6JD

England

United Kingdom

BROKERS: RBC Capital Markets

71 Queen Victoria Street

London EC4V 4DE

United Kingdom

Winterflood Securities Limited

Cannon Bridge House

25 Dowgate Hill

London EC4R 2GA

United Kingdom

SOLICITORS TO THE COMPANY: Simmons & Simmons

(as to English law) CityPoint

One Ropemaker Street

London EC2Y 9SS

United Kingdom

ADVOCATES TO THE COMPANY: Ogier

(as to Guernsey law) Ogier House

St. Julian's Avenue

St. Peter Port

Guernsey GY1 1WA

Channel Islands

ADMINISTRATOR & COMPANY SECRETARY: HSBC Securities Services (Guernsey)

Limited

Arnold House

St. Julian's Avenue

St. Peter Port

Guernsey GY1 3NF

Channel Islands

SUB-ADMINISTRATOR TO THE COMPANY: HSBC Securities Services (Ireland)

Limited

1 Grand Canal Square

Grand Canal Harbour

Dublin 2

Ireland

CUSTODIAN TO THE COMPANY: HSBC Institutional Trust Services

(Ireland) Limited

1 Grand Canal Square

Grand Canal Harbour

Dublin 2

Ireland

AUDITORS: Ernst & Young LLP

Royal Chambers

St. Julian's Avenue

St. Peter Port

Guernsey GY1 4AF

Channel Islands

REGISTRAR: Capita Registrars (Guernsey) Limited

Longue Hougue House

St. Sampson

Guernsey GY2 4JN

Channel Islands

PRINCIPAL BANKER: HSBC Bank plc

8 Canada Square

London E14 5HQ

United Kingdom

DIRECTORS' REPORT

For the period from 1 January 2011 to 30 June 2011

To Shareholders of Baker Steel Resources Trust Limited

The Board is pleased to present the Company's Half-Yearly

Financial Report.

This Directors' Report has been produced solely to provide

additional information to Shareholders as a body, as required by

the UK Listing Authority's Disclosure and Transparency Rules. It

should not be relied upon by Shareholders or any other party for

any other purpose.

This Directors' Report relates to the period from 1 January 2011

to 30 June 2011 and contains information that covers this period

and information relating to any material changes up to the date of

publication of this Half-Yearly Report. Please note that more up to

date performance information, including the monthly report for the

period ending 31 July 2011, is available on the Company's website

www.bakersteelresourcestrust.com.

The objective of the Company is to seek capital growth over the

long term by investing through a focused global portfolio

consisting principally of the equities, or related instruments, of

natural resources companies. These investments will be

predominantly in private companies with strong development projects

and focused management, but also in listed securities to exploit

value inherent in market inefficiencies.

Financial Performance

The unaudited net asset value ("NAV") per Ordinary Share as at

30 June 2011 was 117.0p per share, up 13.2% from the Company's NAV

calculated on 31 December 2010. During this period the HSBC Global

Mining Index was down 5.1%

For the purpose of calculating the NAV per share, unquoted

investments are carried at fair value as at 30 June 2011 as

determined by the Directors and quoted investments are carried at

last traded price as at 30 June 2011.

Net assets at 30 June 2011 comprised the following:

GBPm % net assets

Unquoted Investments 72.4 93.7%

Quoted Investments 4.5 5.8%

Net cash 0.3 0.5%

------ ------

77.2 100.0

Issue of Shares

The Company was admitted to trading on the London Stock Exchange

on 28 April 2010. On that date, 30,468,865 Ordinary Shares and

6,093,772 Subscription Shares were issued pursuant to a placing and

offer for subscription and 35,554,224 Ordinary Shares and 7,110,822

Subscription Shares were issued pursuant to a scheme of

reorganisation of Genus Capital Fund.

In addition 10,000 Management Ordinary Shares were issued.

Following the exercise of Subscription Shares at the end of

September 2010, 7,543 Ordinary Shares were issued and as a result,

the Company had 66,040,632 Ordinary Shares and 13,197,051

Subscription Shares in issue at 31 December 2010.

Following the exercise of Subscription Shares at the end of

March 2011, 2,429 Ordinary Shares were issued and as a result, the

Company has 66,043,061 Ordinary Shares and 13,194,622 Subscription

Shares in issue at 30 June 2011.

Going Concern

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that it has the

resources to continue in business for the foreseeable future.

Furthermore, the Directors are not aware of any material

uncertainties that may cast significant doubt upon the Company's

ability to continue as a going concern. Therefore, the financial

statements have been prepared on a going concern basis.

Related Party Transactions

Transactions with related parties are based on terms equivalent

to those that prevail in an arm's length transaction. There were no

such transactions with related parties which took place for the

period ended 30 June 2011.

Principal Risks and Uncertainties

The principal risks facing the Company relate to the Company's

investment activities. These risks are mainly market risk

(comprising market price risk, currency risk and interest rate

risk), commodity price risk, liquidity risk and credit risk, in

addition to mining development risk, licencing risk, and emerging

market risk. An explanation of these risks is contained in the

Company's prospectus dated 31 March 2010, available on the

Company's website www.bakersteelresourcestrust.com.

A further risk facing the Company includes regulatory risk (that

the loss of the Company's investment status or a breach of The

Rules of the UK Listing Authority, the London Stock Exchange or the

Guernsey Financial Services Commission, could have adverse

financial consequences and cause reputational damage).

The principal risks and uncertainties that the Company is

exposed to through mining and mineral development related markets

have not significantly changed since the publication of the

Company's Annual Report and Audited Financial Statements for the

period ended 31 December 2010 and are not anticipated to change for

the remainder of 2011.

Directors' Interests

The Directors' interests in the share capital of the Company at

30 June 2011 were as follows:

Number of Number of

Ordinary Shares Subscription Shares

Edward Flood 65,000 13,000

Christopher Sherwell 25,000 5,000

Clive Newall 25,000 5,000

Signed for and on behalf of the Directors:

Howard Myles

Chairman

26 August 2011

INVESTMENT MANAGER'S REPORT

For the period from 1 January 2011 to 30 June 2011

Investment Update

Largest Investments - 30 June 2011

% of NAV

Ivanplats Limited 27.6%

Gobi Coal & Energy Limited 16.9%

Ferrous Resources Limited 13.8%

First Coal Corporation 7.6%

Ironstone Resources Limited 7.0%

Silver China (Five Stars BS

Ltd) 5.6%

Bilboes Holdings 4.8%

Copperbelt Minerals Limited 4.3%

Polar Silver (Argentum) 4.1%

Forbes & Manhattan Coal Corporation 2.7%

Other Investments 5.1%

Net Cash and Equivalents 0.5%

30 June 2010

% of NAV

Net Cash and Equivalents 41.4%

Ferrous Resources Limited 19.5%

Ivanhoe Nickel and Platinum Limited 18.1%

Gobi Coal & Energy Limited 11.0%

Copperbelt Minerals Limited 5.7%

First Coal Corporation 3.5%

Other Investments 4.8%

Review

At the end of June 2011, Baker Steel Resources Trust Limited was

99.5% invested in line with the intention to invest the Company's

capital within a year or so of listing. The investment portfolio

has also been diversified to include silver and gold exposure, in

addition to base metals, iron ore and metallurgical coal. During

the half year, the NAV per share rose 13.2% to 117.0 pence largely

due to increases in the values of Ivanplats Limited ("Ivanplats")

and Gobi Coal and Energy Limited ("Gobi") as both companies

progress towards a listing, possibly in the second half of 2011 or

early in 2012.

In particular Ivanplats, the Company's largest holding, agreed

with ITOCHU Corporation of Japan for it to acquire an 8% interest

in Ivanplats' Platreef project in South Africa for 22.4 billion

Japanese Yen, valuing the Platreef Project at approximately US$3.5

billion. Ivanplats rates its Kamoa copper deposit as the most

significant copper discovery in the Democratic Republic of Congo

since Belgian colonial-era exploration more than 100 years ago. If

Kamoa were to be attributed an equivalent value to the Platreef

project on IPO, this would suggest a valuation more than four times

the Company's current carrying value or almost a doubling of the

current NAV per share. Ivanplats has suggested that subject to

market conditions, it will consider initiating the IPO later this

year or early in 2012.

During the period, the Company made three new significant

additions to its portfolio. US$5.1 million was invested in Polar

Silver Resources Limited, a private company which holds a 50%

indirect interest in the Prognoz silver project, 444km north of

Yakutsk in Russia ("Prognoz"). A NI 43-101 compliant report by

independent consultant Micon International Limited ("Micon") in

July 2009, estimated an indicated resource of 5.86 million tonnes

of ore grading 773g/t silver containing 146 million ounces silver

and inferred resources of 9.64 million tonnes of ore grading 473g/t

silver containing 147 million ounces silver at Prognoz. Polar

Silver has commissioned Micon to undertake a NI 43-101 compliant

scoping study on Prognoz, which is expected to be completed in the

second half 2011 ahead of a proposed IPO. The second investment was

US$7million in 'Silver China', a private company which has an

interest in a significant silver-lead-zinc deposit in south-west

China, where a mine is under construction with first production

expected later this year. The Company is precluded from disclosing

the identity of Silver China or providing further details, until a

prospectus is issued, as Silver China is currently planning a

listing. During June 2011, the Company completed a US$6 million

investment in Bilboes, a private Zimbabwean gold mining company

which owns four previously producing oxide mines in Zimbabwe.

International consultant, SRK, signed off JORC compliant resources

totaling 778,000 ounces and also suggested that there is a good

opportunity to expand significantly the current resource base

through drilling of the underlying sulphide mineralisation. Bilboes

plans to use the proceeds of the investment on resource drilling

and the commencement of a bankable feasibility study.

Good operational progress was made during the first half of the

year at several of the companies in which BSRT is invested. Ferrous

Resources announced that it had achieved a number of important

milestones in developing its fully integrated iron ore project in

Brazil including the grant of three key licences for the

installation of the Viga Mine and for a port terminal and the

pipeline between these two facilities. Production of iron ore has

commenced and Ferrous has stated that it remains on schedule to

achieve its target of exporting 25 million tonnes of iron ore per

annum from 2014. South American Ferro Metals ("SAFM") announced the

commissioning of the beneficiation plant at its Ponto Verde Iron

Ore Mine in Brazil with production increasing steadily towards its

design rate of 60,000 tonnes per month. SAFM also achieved the

production milestone for the A Class performance shares held by the

Company, and accordingly these shares were converted into ordinary

shares.

Price / Index % Change % Change

At 30 June 2011 Level in Six Months from Inception

--------------------------- -------------- --------------- ----------------

Net Asset Value

(pence/share) 117.0 +13.2% +19.5%*

--------------------------- -------------- --------------- ----------------

Ordinary Share Price

(pence/share) 103.63 +32.0% +3.6%**

--------------------------- -------------- --------------- ----------------

Subscription Share Price

(pence/share) 22.5 +45.2% n/a

--------------------------- -------------- --------------- ----------------

MSCI World Index 341.82 +3.4% +10.9%

--------------------------- -------------- --------------- ----------------

HSBC Global Mining Index 1536.72 -5.1% +18.2%

--------------------------- -------------- --------------- ----------------

CRB Index 338.05 +1.6% +23.7%

--------------------------- -------------- --------------- ----------------

Chinese Domestic Iron

Ore - Hebei/Tangshan

(US$/t) 209.0 -2.8% +8.9%

--------------------------- -------------- --------------- ----------------

Copper (US$/t) 9414.0 -2.4% +26.3%

--------------------------- -------------- --------------- ----------------

Gold (US$/oz) 1500.35 +5.6% +28.5%

--------------------------- -------------- --------------- ----------------

Source: Bloomberg closing 27/4/10, **Issue price 28/4/10, * NAV

30/4/10

Outlook

Following a strong second half of 2010, markets for mining

equities paused for breath with the HSBC Global Mining Index

falling 5.1% during the first half 2011. The half year saw growing

disconnect between the prices of mining equities and commodities,

particularly gold with the metal rising 5.6% and the FTSE Gold

Mines Index falling 10.1%. This can only be partially explained by

an increase in companies' operating and capital costs as a result

of commodity price rises and is more likely a move away from risk

as governments in Western economies tackle high debt problems. The

cashflows of the producing mining companies have remained robust

and we would expect a recovery in the rating of mining equities in

the second half of the year, in the absence of a major fall in

commodity prices.

The Company's portfolio is well placed to benefit from a

stronger market for mining shares with its top three holdings

representing 58.3% of net assets all potentially seeking an IPO in

the second half of this year.

Baker Steel Capital Managers LLP

August 2011

DIRECTORS' RESPONSIBILITY STATEMENT

For the period from 1 January 2011 to 30 June 2011

To the best of the knowledge of the Directors:

The Directors' Report and the Investment Manager's Report

comprise the Half-Yearly Management Report.

This Half-Yearly Management Report and Condensed Interim

Financial Statements give a true and fair view of the assets,

liabilities, financial position and profit of the Company and have

been prepared in accordance with International Accounting Standard

(IAS) 34 Interim Financial Reporting.

The Half-Yearly Management Report includes a fair review of the

information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred in the period

from 1 January 2011 to 30 June 2011 and their impact on the set of

financial statements; and a description of the principal risks and

uncertainties for the remainder of the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the period from

1 January 2011 to 30 June 2011 and that have materially affected

the financial position or performance of the entity during that

period.

Signed on behalf of the Board of Directors by:

Howard Myles Christopher Sherwell

26 August 2011

UNAUDITED PORTFOLIO STATEMENT

AT 30 JUNE 2011

Shares Investments Fair value % of Net

/Warrants/ GBP equivalent assets

Nominal

Listed equity shares

Australian Dollars

11,668,950 South American Ferro Metals 1,247,207 1.61

Australian Dollars Total 1,247,207 1.61

--------------- ---------

Canadian Dollars

3,383,333 BacTech Environmental Corporation 480,499 0.62

1,100,000 Forbes & Manhattan Corporation 2,116,090 2.74

16,916,667 REBgold Corporation 655,226 0.85

Canadian Dollars Total 3,251,815 4.21

--------------- ---------

Total investments in listed equity shares 4,499,022 5.82

--------------- ---------

Fixed income instruments

United States Dollars

Polar Silver (Argentum) 0.1%

US$5,100,000 25/01/2013 3,175,394 4.11

United States Dollars Total 3,175,394 4.11

--------------- ---------

Total investments in fixed income instruments 3,175,394 4.11

--------------- ---------

Unlisted equity shares and warrants

Australian Dollars

South American Ferro Metals Class

4,445,586 B 332,609 0.43

South American Ferro Metals Class

4,445,586 C 330,233 0.43

Australian Dollars Total 662,842 0.86

--------------- ---------

Canadian Dollars

BacTech Mining Corporation

10,250,000 Warrants 17/06/2015 193,873 0.25

BacTech Mining Corporation

6,666,667 Warrants 06/08/2013 85,642 0.11

7,428,571 First Coal Corporation 5,850,464 7.58

6,282,341 Ironstone Resources Limited 5,342,176 6.92

Ironstone Resources Limited

3,036,605 Warrants 31/03/2012 56,063 0.07

Canadian Dollars Total 11,528,218 14.93

--------------- ---------

Great Britain Pounds

1,594,646 Celadon Mining Limited 143,518 0.19

Great Britain Pounds Total 143,518 0.19

--------------- ---------

United States Dollars

3,034,734 Archipelago Metals 377,901 0.49

451,445 Bilboes Holdings (Private) Limited 3,735,770 4.84

268,889 Copperbelt Minerals 3,348,347 4.33

5,713,642 Ferrous Resources 10,672,390 13.82

Silver China (Five Stars BS

7,000,000 Limited) 4,358,384 5.64

5,244,550 Gobi Coal and Energy 13,061,578 16.91

1,957,499 Ivanplats Limited 21,328,829 27.61

1,020 Polar Silver Resources Limited 635 -

United States Dollars Total 56,883,834 73.64

--------------- ---------

Total investments in unlisted equity shares 69,218,412 89.62

--------------- ---------

Financial assets held at fair value through

profit or loss 76,892,828 99.55

Other assets & liabilities 349,211 0.45

Total equity 77,242,039 100.00

--------------- ---------

CONDENSED INTERIM STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2011

Unaudited Audited

30 June 31 December

2011 2010

Notes GBP

Assets

Cash and cash equivalents 8 2,219,003 1,013,506

Receivables 329,114 330,561

Financial assets held at fair value

through profit or loss (Cost

2011:GBP60,468,629 and 2010:

GBP63,126,417) 3 76,892,828 67,160,848

----------- -------------

Total assets 79,440,945 68,504,915

=========== =============

Equity and liabilities

Liabilities

Performance fees payable 6 1,978,050 -

Management fees payable 6 103,183 79,513

Directors' fees payable 36,192 36,000

Formation expenses payable 26,529 26,529

Audit fees payable 24,835 40,000

Administration fees payable 5 7,429 10,193

Other payables 22,688 38,382

Total liabilities 2,198,906 230,617

----------- -------------

Equity

Management Ordinary Shares 10,000 10,000

Ordinary Shares 64,657,584 64,655,155

Revenue reserve 12,574,455 3,609,143

Total equity 77,242,039 68,274,298

----------- -------------

Total equity and liabilities 79,440,945 68,504,915

=========== =============

Ordinary Shares in issue 9 66,043,061 66,040,632

Net asset value per Ordinary Share (in

Pence) - Basic 4 117.0 103.4

These financial statements were approved by the Board of Directors

on 26 August 2011 and signed on its behalf by:

Howard Myles Christopher Sherwell

CONDENSED INTERIM STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD FROM 1 JANUARY 2011 TO 30 JUNE 2011

Unaudited Unaudited Unaudited

period ended period ended period ended

30 June 30 June 30 June

2011 2011 2011

Revenue Capital Total

Notes GBP GBP GBP

Income

Interest income 71,324 - 71,324

Net gain on financial

assets and

liabilities at fair

value through profit

or loss - 11,801,907 11,801,907

Net foreign exchange

loss (52,889) (52,889)

Other income 112 - 112

-------------- -------------- --------------

Net income 71,436 11,749,018 11,820,454

-------------- -------------- --------------

Expenses

Performance fees 7 1,978,050 - 1,978,050

Management fees 7 554,807 - 554,807

Directors' fees and

expenses 70,000 - 70,000

Administration fees 6 42,767 - 42,767

Custody fees 24,576 - 24,576

Audit fees 20,000 - 20,000

Other expenses 164,942 - 164,942

Total expenses 2,855,142 - 2,855,142

-------------- -------------- --------------

Total comprehensive

(expense)/income for

the period (2,783,706) 11,749,018 8,965,312

============== ============== ==============

Net (expense)/income

for the period per

Ordinary Share:

Basic and diluted (in

pence) 4 (4.2) 17.8 13.6

Weighted Average

Number of Ordinary

Shares Outstanding:

Basic and diluted 4 66,041,847

In the current period there were no gains or losses

other than those recognised above.

The Directors consider all results to derive from

continuing activities.

CONDENSED INTERIM STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD FROM 9 MARCH 2010 TO 30 JUNE 2010

Unaudited Unaudited Unaudited

period ended period ended period ended

*30 June *30 June *30 June

2010 2010 2010

Revenue Capital Total

Notes GBP GBP GBP

Income

Net loss on financial

assets and

liabilities at fair

value through profit

or loss - (1,589,253) (1,589,253)

Net foreign exchange

gain - 460,613 460,613

-------------- -------------- --------------

Net income - (1,128,640) (1,128,640)

-------------- -------------- --------------

Expenses

Management fees 7 204,514 - 204,514

Formation expenses 152,870 - 152,870

Directors' fees and

expenses 25,414 - 25,414

Administration fees 6 21,600 - 21,600

Audit fees 11,429 - 11,429

Custody fees 7,331 - 7,331

Other expenses 12,430 - 12,430

Total expenses 435,588 - 435,588

-------------- -------------- --------------

Total comprehensive

expense for the

period (435,588) (1,128,640) (1,564,228)

============== ============== ==============

Net expense for the

period per Ordinary

Share:

Basic (in pence) 4 (0.66) (1.71) (2.37)

Diluted (in pence) 4 (0.65) (1.71) (2.36)

Weighted Average

Number of Ordinary

Shares Outstanding:

Basic 4 66,033,089

Diluted 4 66,194,820

In the current period there were no gains or losses

other than those recognised above.

The Directors consider all results to derive from

continuing activities.

* For the period from 9 March 2010 (date of incorporation)

to 30 June 2010.

CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD FROM 1 JANUARY 2011 TO 30 JUNE 2011

Management Period ended

Ordinary Ordinary Revenue 30 June

Shares Shares reserve 2011

GBP GBP GBP GBP

Balance at 1 January

2011 10,000 64,655,155 3,609,143 68,274,298

Proceeds on issue of

Ordinary Shares - 2,429 - 2,429

Net income for the

period - - 8,965,312 8,965,312

Balance as at 30 June

2011 10,000 64,657,584 12,574,455 77,242,039

=========== =========== =========== =============

CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30

JUNE 2010

Management Period ended

Ordinary Ordinary Revenue 30 June

Shares Shares reserve 2010

GBP GBP GBP GBP

Proceeds on issue of

Ordinary Shares 10,000 66,023,089 - 66,033,089

Share issue costs - (1,381,175) - (1,381,175)

Net expense for the

period - - (1,564,228) (1,564,228)

Balance as at 30 June

2010 10,000 64,641,914 (1,564,228) 63,087,686

=========== ============ ============ =============

CONDENSED INTERIM STATEMENT OF CASH FLOWS

FOR THE PERIOD FROM 1 JANUARY 2011 TO 30 JUNE 2011

Period ended Period ended

30 June *30 June

2011 2010

Notes GBP GBP

Cash flows from operating activities

Net income/(expense) for the period 8,965,312 (1,564,228)

Adjustments to reconcile

income/(expense) for the period to net

cash used in operating activities:

Net change in fair value of financial

assets and at fair value through

profit or loss (11,801,907) 1,589,253

Net decrease/(increase) in other

receivables 1,447 (4,415)

Net increase in other payables 1,968,289 368,577

------------- -------------

Net cash (used in)/provided by

operating activities (866,859) 389,187

------------- -------------

Cash flows from investing activities

Purchase of financial assets at fair

value through profit or loss (12,813,034) (3,364,134)

Sale of financial assets at fair value

through profit or loss 7,382,961 -

Maturity of financial assets at fair

value through profit or loss 7,500,000 -

------------- -------------

Net cash provided by/(used in)

investing activities 2,069,927 (3,364,134)

------------- -------------

Cash flows from financing activities

Proceeds from shares issued 2,429 30,468,865

Share issue costs - (1,381,175)

Net cash provided by financing

activities 2,429 29,087,690

------------- -------------

Net increase in cash and cash

equivalents 1,205,497 26,112,743

Cash and cash equivalents at the

beginning of the period 1,013,506 -

Cash and cash equivalents at the end of

the period 7 2,219,003 26,112,743

============= =============

Represented by:

Cash and cash equivalents 2,219,003 26,113,077

Bank overdraft - (334)

Cash and cash equivalents at the end of

the period 7 2,219,003 26,112,743

============= =============

* For the period from 9 March 2010 (date of incorporation) to 30

June 2010.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIOD FROM 1 JANUARY 2011 TO 30 JUNE 2011

1. GENERAL INFORMATION

Baker Steel Resources Trust Limited (the "Company") is a

closed-ended investment company with limited liability incorporated

on 9 March 2010 in Guernsey under the Companies (Guernsey) Law 2008

with registration number 51576. The Company is a registered

closed-ended investment scheme registered pursuant to the POI

(Protection of Investors) Law and The Registered Collective

Investment Scheme Rules 2008 issued by the Guernsey Financial

Services Commission (GFSC). On 28 April 2010 the Ordinary Shares

and Subscription Shares of the Company were admitted to the

Official List of the UK Listing Authority and to trading on the

Main Market of the London Stock Exchange.

The Company is managed by Baker Steel Capital Managers (Cayman)

Limited (the "Manager"). The Manager has appointed Baker Steel

Capital Managers LLP (the "Investment Manager") as the investment

manager to carry out certain duties. The Company's investment

objective is to seek capital growth over the long-term through a

focused, global portfolio consisting principally of the equities,

or related instruments, of natural resources companies. The Company

invests predominantly in unlisted companies (i.e. those companies

that have not yet made an initial public offering or "IPO") and

also in listed securities (including special situations

opportunities and less liquid securities) with a view to exploiting

value inherent in market inefficiencies and pricing anomalies.

These condensed interim financial statements have not been

audited or reviewed by the auditors pursuant to the Auditing

Practices Board Guidance on the Review of the interim financial

information performed by the independent auditor of the

Company.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The unaudited condensed interim financial statements of the

Company have been prepared in accordance with International

Accounting Standards (IAS) 34: Interim Financial Reporting.

The financial statements have been prepared on a historic cost

basis except for financial assets and financial liabilities at fair

value through profit or loss, which are designated at fair value

through profit or loss.

The accounting policies used in the preparation of these

financial statements are consistent with those used in the

Company's most recent annual financial statements for the year

ended 31 December 2010. There have been no changes to the Company's

accounting policies since the date of the Company's last annual

financial statements, for the year ended 31 December 2010. The

format of these financial statements differs in some respects from

that of the most recent annual financial statements, in that the

notes to the financial statements are presented in summary

form.

The Company has adopted the Great Britain pound sterling ("GBP")

as its presentation currency, being the currency in which its

Ordinary Shares and Subscription Shares are issued. The

presentation currency is the same as the functional currency.

The statement of comprehensive income is presented in accordance

with the Statement of Recommended Practice 'Financial Statements of

Investment Trust Companies and Venture Capital Trusts' issued in

January 2009 by the Association of Investment Companies, to the

extent that it does not conflict with International Financial

Reporting Standards (IFRS).

3. FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT

OR LOSS

Listed Unlisted

equity equity Fixed income

30 June 2011 shares shares instruments Warrants Total

GBP GBP GBP GBP GBP

Financial

assets at

fair value

through

profit or

loss

Cost 4,169,537 53,067,152 3,231,939 - 60,468,628

Unrealised

gain/(loss) 329,485 15,815,682 56,545 335,578 16,537,290

Market value

at 30 June

2011 4,499,022 68,882,834 3,175,394 335,578 76,892,828

============ ============ ============ ========== ==========

Listed Unlisted

31 December equity equity Fixed income

2010 shares shares instruments Warrants Total

GBP GBP GBP GBP GBP

Financial

assets at

fair value

through

profit or

loss

Cost 5,021,326 36,930,304 12,766,600 8,408,187 63,126,417

Unrealised

(loss)/gain 1,983,502 (1,741,792) (13,090)* 3,805,811 4,034,431

Market value

at 31

December

2010 7,004,828 35,188,512 12,753,510 12,213,998 67,160,848

============ ============ ============ ========== ==========

* includes interest income of GBP170,235.

The following table analyses investments by type and by level

within the fair valuation hierarchy at 30 June 2011.

Quoted prices Quoted market

in active based Unobservable

markets observables inputs

Level 1 Level 2 Level 3 Total

GBP GBP GBP GBP

Financial assets

at fair value

through profit or

loss

Listed equity

shares 4,499,022 - - 4,499,022

Unlisted equity

shares - - 68,882,834 68,882,834

Warrants - - 335,578 335,578

Fixed income

instruments 3,175,394 - - 3,175,394

------------- ----------------- ------------ ----------

7,674,416 - 69,218,412 76,892,828

============= ================= ============ ==========

The following table analyses investments by type and by level

within the fair valuation hierarchy at 31 December 2010.

Quoted prices Quoted market

in active based Unobservable

markets observables inputs

Level 1 Level 2 Level 3 Total

GBP GBP GBP GBP

Financial assets

at fair value

through profit or

loss

Listed equity

shares 7,004,828 - - 7,004,828

Unlisted equity

shares - - 35,188,512 35,188,512

Warrants - - 12,213,998 12,213,998

Fixed income

instruments 12,753,510 - - 12,753,510

------------- ----------------- ------------ ----------

19,758,338 - 47,402,510 67,160,848

============= ================= ============ ==========

In determining an investment's placement within the fair value

hierarchy, the Directors take into consideration the following.

Investments whose values are based on quoted market prices in

active markets are classified within level 1. These include listed

equities and fixed income instruments with observable market price.

The Directors do not adjust the quoted price for such instruments,

even in situations where the Company holds a large position and a

sale could reasonably impact the quoted price.

Investments that trade in markets that are not considered to be

active but are valued based on quoted market prices, dealer

quotations or alternative pricing sources supported by observable

inputs, are classified within level 2. These include certain less

liquid listed equities. As level 2 investments include positions

that are not traded in active markets and/or are subject to

transfer restrictions, valuations may be adjusted to reflect

illiquidity and/or non-transferability, which are generally based

on available market information. The Company did not hold any such

investments at 30 June 2011.

Investments classified within level 3 have significant

unobservable inputs. They include unlisted equity shares and

warrants. Level 3 investments are valued using valuation techniques

explained in the Company's accounting policies. The inputs used by

the Directors in estimating the value of level 3 investments

include the original transaction price, recent transactions in the

same or similar instruments, completed or pending third-party

transactions in the underlying investment of comparable issuers,

subsequent rounds of financing, recapitalisations and other

transactions across the capital structure, offerings in the equity

or debt capital markets, and changes in financial ratios or cash

flows. Level 3 investments may also be adjusted to reflect

illiquidity and/or non-transferability, with the amount of such

discount estimated by the Directors in the absence of market

information.

4. NET ASSET VALUE PER SHARE AND EARNING PER SHARE

Basic net asset value per share is based on the net assets of

GBP77,242,039 (31 December 2010: GBP68,274,298) and 66,043,061 (31

December 2010: 66,040,632) Ordinary Shares, being the number of

shares in issue at the period end. The subscription shares are

entitled to be converted to Ordinary Shares at 100p per share.

The calculation for basic net asset value is as below:-

30 June 2011 31 December 2010

Ordinary Subscription Ordinary Subscription

Shares Shares Shares Shares

Net assets at the

period end (GBP) 77,242,039 13,194,622 68,274,298 13,197,051

Number of shares 66,043,061 13,194,622 66,040,632 13,197,051

Basic net asset value

per share (in pence) 117.0 103.4

The basic and diluted earnings per share is based on the net

income for the period of the Company of GBP8,965,312 and on

66,041,847 Ordinary Shares, being the weighted average number of

shares in issue during the period.

For the period from 9 March 2010 to 30 June 2010, the basic

earnings per share is based on the net loss for the period of the

Company of GBP1,564,228 and on 66,033,089 Ordinary Shares, being

the weighted average number of shares in issue during the period.

Diluted earnings per ordinary share is calculated by adjusting

basic earnings per ordinary share to reflect the notional exercise

of the number of dilutive subscription shares outstanding during

the period, using a weighted average calculation based on the

average market price per ordinary share during the period. The

diluted earnings per share figure is similar to the basic earnings

per share figure because the average market share price during the

period of 101.2p is only 1.2% greater than the exercise price.

These calculations are prepared in accordance with the IFRS.

5. TAXATION

The Company is a Guernsey Exempt Company and is therefore not

subject to taxation on its income under the Income Tax (Exempt

Bodies) (Guernsey) Ordinance, 1989. An annual exempt fee of GBP600

has been paid.

6. ADMINISTRATION FEES

The Administrator, HSBC Securities Services (Guernsey) Limited,

is paid fees for acting as administrator of the Company at the rate

of 7 basis points of gross asset value up to US$250 million and the

rate reduces to 5 basis points of gross asset value above US$250

million. The Administrator is also reimbursed by the Company for

reasonable out-of-pocket expenses. These fees accrue and are

calculated as at the last Business Day of each month and paid

monthly in arrears.

The Administrator is also entitled to a fee for its provision of

corporate secretarial services provided to the Company on a time

spent basis and subject to a minimum annual fee of GBP40,000. The

Company is also responsible for any sub-administration fees as

agreed in writing from time to time, and reasonable out-of-pocket

expenses.The Administrator is also entitled to fees of EUR5,000 for

preparation of the financial statements of the Company.

The administration fees paid for the period ended 30 June 2011

were GBP42,767 (30 June 2010: GBP21,600) of which GBP7,429 was

payable at 30 June 2011 (31 December 2010: GBP10,193).

7. MANAGEMENT AND PERFORMANCE FEES

The Manager was appointed pursuant to a management agreement

with the Company dated 31 March 2010 (the "Management Agreement").

The Company pays to the Manager a management fee which is equal to

1/12th of 1.75% of the total market capitalisation of the Company

per month. The management fee is calculated and accrued as at the

last Business Day of each month and is paid monthly in arrears.

The Manager may in certain circumstances also be entitled to be

paid a performance fee if the Net Asset Value at the end of any

Performance Period exceeds the Hurdle as at the end of the

Performance Period. For this purpose the "Hurdle" means an amount

equal to the Issue Price of GBP1 multiplied by the number of shares

in issue as at Admission, as increased at a rate of 8% per annum

compounded to the end of the relevant Performance Period. In

respect of the first Performance Period and any other Performance

Period which is less than a full 12 months, the Hurdle will be

applied pro rata. The performance fee is subject to adjustments for

any issue and/or repurchase of Ordinary Shares.

The amount of the performance fee (if any) will be 15 per cent

of the total increase in the Net Asset Value at the end of the

relevant Performance Period over the highest previously recorded

Net Asset Value as at the end of a Performance Period in respect of

which a performance fee was last accrued, (or the Issue Price

multiplied by the number of shares in issue as at Admission, if no

performance fee has been so accrued) having made adjustments for

numbers of Ordinary Shares issued and/or repurchased as described

above.

The first performance period commenced on the date of Admission

and ended on 31 December 2010 and thereafter, is each 12 month

period ending on 31 December in each year (the "Performance

Period"). The last Performance Period will end on the date on which

the Management Agreement is terminated or the Company is wound up.

The performance fees accrued for the period ended 30 June 2011 were

GBP1,978,050 (30 June 2010: GBPNil).

The management fees paid for the period ended 30 June 2011 were

GBP554,807 (30 June 2010: GBP204,514) of which GBP103,183 was

payable at 30 June 2011 (31 December 2010: GBP79,513).

8. CASH AND CASH EQUIVALENTS

31 December

30 June 2011 2010

GBP GBP

Represented by:

Deposits at HSBC Bank plc 2,219,003 1,013,506

============= ============

9. SHARE CAPITAL

The authorised share capital of the Company on incorporation was

represented by an unlimited number of Ordinary Shares of no par

value. The Company raised GBP30,468,865 through the issue of

30,468,865 Ordinary Shares and 6,093,772 Subscription Shares via a

Placing and Offer. In addition, the Company issued 35,554,224

Ordinary Shares and 7,110,822 Subscription Shares to the holders of

shares in Genus Capital Fund pursuant to a scheme of reorganisation

of Genus Capital Fund, in exchange for substantially all the

non-cash assets of Genus Capital Fund which are detailed as

follows:

Transfer

Quantity Investments value

GBP

Listed equity shares

358,333 MBAC Fertilizer Corporation 567,717

567,717

------------

Unlisted equity shares and warrants

500 BacTech Mining 328,699

1,594,646 Celadon Mining 297,720

268,889 Copperbelt Minerals 3,545,594

6,123,642 Ferrous Resources 14,130,705

2,571,429 First Coal Corporation 2,315,920

3,350,285 Gobi Coal and Energy 4,417,716

500,000 Ivanhoe Nickel and Platinum 2,884,457

791,666 Ivanhoe Nickel Platinum warrants 1 for 1.2 ordinary 5,480,463

306,980 Ivanhoe Nickel Platinum warrants 1 for 1 ordinary 1,770,941

6,500,000 South American Ferro Metals 2,024,889

37,197,104

------------

Total assets transferred 37,764,821

Less Cash (2,210,597)

Value of shares issued 35,554,224

------------

With effect from 30 September 2010, 7,543 Ordinary Shares were

issued as a result of the exercise of Subscription Shares. With

effect from 31 March 2011, 2,429 Ordinary Shares were issued as a

result of the exercise of Subscription Shares. The Company has in

issue 66,033,061 Ordinary Shares and 13,194,622 Subscription Shares

denominated in sterling. In addition, the Company has 10,000

Management Ordinary Shares in issue, which are held by the

Investment Manager.

The subscription rights conferred by the Subscription Shares are

exercisable every six months from 30 September 2010 until 31 March

2013 (inclusive). Each Subscription Share carries the right to

subscribe for one Ordinary Share at a price of 100 pence.

On 28 April 2010 the Ordinary Shares and Subscription Shares

were admitted to the Official List of the UK Listing Authority and

to trading on the Main Market of the London Stock Exchange.No

application has been or will be made to have the Management

Ordinary Shares admitted to listing on the Official List or to

trading on the London Stock Exchange's Main Market for listed

securities.

Holders of Ordinary Shares have the right to receive notice of

and to attend and vote at general meetings of the Company. Each

holder of Ordinary Shares being present in person or by proxy at a

meeting will, upon a show of hands, have one vote and upon a poll

each such holder of Ordinary Shares present in person or by proxy

will have one vote for each Ordinary Share held by him.

Holders of Management Ordinary Shares have the right to receive

notice of and to attend and vote at general meetings of the

Company, except that the holders of Management Ordinary Shares are

not entitled to vote on any resolution relating to certain specific

matters, including a material change to the Company's investment

objective, investment policy or borrowing policy. Each holder of

Management Ordinary Shares being present in person or by proxy at a

meeting will, upon a show of hands, have one vote and upon a poll

each such holder of Management Ordinary Shares present in person or

by proxy will have one vote for each Management Ordinary Share held

by him.

Holders of Subscription Shares are not entitled to attend or

vote at meetings of Shareholders.

Holders of Ordinary Shares and Management Ordinary Shares are

entitled to receive, and participate in, any dividends or other

distributions out of the profits of the Company available for

dividend and resolved to be distributed in respect of any

accounting period or other income or right to participate therein.

The Subscription Shares carry no right to any dividend or other

distribution by the Company.

The details of issued share capital of the Company are as

follows:

30 June 2011 31 December 2010

Issued and fully paid share capital

Ordinary Shares of no par value* 66,033,061 66,030,632

Subscription Shares of no par value 13,194,622 13,197,051

============= =================

The issue of Ordinary Shares during the period ended 30 June

2011 took place as follows:

Subscription

Ordinary Shares* Shares

Balance at 1 January 2011 66,030,632 13,197,051

Conversion of Subscription Shares 2,429 (2,429)

Balance at 30 June 2011 66,033,061 13,194,622

================= =============

The issue of Ordinary Shares during the period ended 31 December

2010 took place as follows:

Subscription

Ordinary Shares* Shares

Issued during the period via Placing

and Offer 30,468,865 6,093,772

Conversion of Subscription Shares 7,543 (7,543)

Issued during the period to holders

of Genus Capital Fund 35,554,224 7,110,822

Balance at 31 December 2010 66,030,632 13,197,051

================= =============

* In addition 10,000 Management Ordinary Shares were issued. On

9 March 2010, 1 Management Ordinary Share was issued and on 26

March 2010, 9,999 Management Ordinary Shares were issued.

Capital Management

The Company's investment objective is to seek capital growth

over the long-term through a focused, global portfolio consisting

principally of the equities or related instruments of natural

resources companies.

The Company's investment strategy is to invest in natural

resources companies, predominantly unlisted. Whilst there are no

fixed limits on the allocation of investments between unlisted

securities and listed equities, equity-related securities and cash,

typically the Investment Manager will aim for the Company over the

long term to be between 40% and 100% invested by value of gross

assets with up to 10% by value of gross assets to be held in cash

and cash like holdings. The Company will aim to hold sufficient

cash to meet ongoing operational expenses. Where deemed

appropriate, the Company may borrow up to 10% of NAV for temporary

purposes such as settlement mismatches.

At 30 June 2011 the Company was 99.55% invested (31 December

2010: 79.7%).

It is not currently envisaged that any income or gains will be

distributed by way of dividend, although this does not preclude the

Directors from declaring a dividend at any time in the future if

they consider it appropriate to do so.

The Board monitors the extent to which capital has been deployed

and the manner in which capital has been invested, using inter

alia, sectoral and geographic analyses.

The Company is not subject to any externally imposed capital

requirements.

10. DIRECTORS' INTERESTS

The Directors' interests in the share capital of the Company at

30 June 2011 and 31 December 2010 were as follows:

Number of Number of

Ordinary Shares Subscription Shares

Edward Flood 65,000 13,000

Christopher Sherwell 25,000 5,000

Clive Newall 25,000 5,000

11. SUBSEQUENT EVENTS

There were no significant subsequent events since the period

end.

12. APPROVAL OF HALF-YEARLY REPORT AND UNAUDITED CONDENSED

INTERIM FINANCIAL STATEMENTS

The Half-Yearly Report and Unaudited Condensed Interim Financial

Statements to 30 June 2011 were approved by the Board of Directors

on 26 August 2011.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGZRLVFGMZG

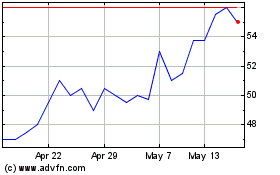

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024