Net Asset Value(s) (2865C)

March 03 2011 - 7:39AM

UK Regulatory

TIDMBSRT

RNS Number : 2865C

Baker Steel Resources Trust Ltd

03 March 2011

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

3 March 2011

28 February 2011 NAV Statement

Net Asset Values

Baker Steel Resources Trust Limited ("the Company") announces

its net asset value and diluted net asset value per share as at 28

February 2011:

Net asset value per Ordinary share: 101.4 pence

Diluted net asset value per Ordinary share: 101.2 pence

During the month the NAV per share rose 0.4% with strong

performance from Australian Stock Exchange listed South American

Ferro Metals Limited being partially offset by the continued

strength of Sterling against the US Dollar (which appreciated

1.5%), in which the largest of the portfolio's investments are

denominated.

The Company has a total of 66,030,632 Ordinary Shares and

13,197,051 Subscription Shares in issue.

Portfolio update

Silver Russian

During February, the Company sold US$900,000 of its recently

acquired interest in Silver Russian to a Russian investor who it is

anticipated will be able to assist in optimising value realisation

from the investment. The sale was transacted at the same US dollar

price at which the Company invested, in January 2011, resulting in

a current net investment of US$5.1million.

Prospective Investments

A number of prospective investments are in the final stages of

negotiation and it is expected that the Company will be close to

being fully invested by the first anniversary of the listing of the

Company in April.

The Company is 85.8% invested with the top shareholdings as

follows as a percentage of NAV:

Ivanhoe Nickel and Platinum

Limited 21.6%

Ferrous Resources Limited 16.9%

Gobi Coal & Energy Limited 9.5%

Ironstone Resources Limited 7.8%

South American Ferro Metals

Limited 6.0%

Copperbelt Minerals Limited 4.9%

Silver Russian 4.7%

Forbes & Manhattan Coal Corporation 4.7%

First Coal Corporation 4.0%

Other Investments 5.7%

Net Cash and equivalents 14.2%

Update on Investments

Ivanhoe Nickel & Platinum ("Ivanplats")

During February, the Investment Manager made a site visit to

Ivanplats' Turfspruit, nickel, platinum, palladium, copper and gold

project on the northern limb of the Bushveld Igneous Complex in

South Africa. Drilling during 2010 has intersected high-grade

mineralisation over substantial widths and a flattening of the

Platreef mineralisation at depth. A NI 43-101 compliant resource

and technical report has been produced by independent consultants,

AMEC. Previously, the Investment Manager's emphasis with respect to

valuation has been on Ivanplats' world class copper discovery,

Kamoa, in the Democratic Republic of Congo but it is clear that

Turfspruit also has the potential to be a major project with

substantial value. Ivanplats is planning to expand and upgrade the

current resource at Turfspruit substantially, with 14 drill rigs on

site during February.

The Wall Street Journal reported in February that Ivanplats is

considering an IPO during 2011 with a possible valuation of around

US$5 billion. The Company increased its carrying value of Ivanplats

at the end of January 2011, in view of recent private placements

and significant secondary trading in the "grey market. The

Company's current carrying value would imply an enterprise value

for the whole of Ivanplats at just over US$1 billion.

South American Ferro Metals Ltd ("SAFM")

On 14 February 2011, SAFM announced that the commissioning of

the beneficiation plant at its Ponto Verde Iron Ore Mine in Brazil

had reached an advanced stage following the completion of its

refurbishment. Production is increasing steadily towards its design

rate of 60,000 tonnes per month.

On 28 February 2011, SAFM announced that the production

milestone for the A Class performance shares had been achieved and

accordingly these shares had been converted into ordinary shares.

This conversion, together with a 17% rise in the ordinary share

price, contributed to a 27.5% rise in the value of the Company's

position in SAFM and a 1.3% increase in NAV.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone Trevor Steel

Winterflood Investment Trusts +44 20 3100 0291/0250

Robert Peel

James Moseley

RBC Capital Markets +44 20 7653 4000

Martin Eales

Pelham Bell Pottinger

Damian Beeley +44 20 7861 3139

Charles Vivian +44 20 7861 3126

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVFMGGFZFRGMZM

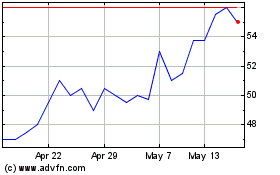

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024