TIDMBGLF

RNS Number : 6421M

Blackstone Loan Financing Limited

22 September 2021

22 SEPTEMBER 2021

FOR IMMEDIATE RELEASE

RELEASED BY BNP PARIBAS SECURITIES SERVICES S.C.A., JERSEY

BRANCH INTERIM RESULTS ANNOUNCEMENT

THE BOARD OF DIRECTORS OF BLACKSTONE LOAN FINANCING LIMITED

ANNOUNCE INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Blackstone Loan Financing Limited (formerly Blackstone / GSO

Loan Financing Limited)

(the "Company" or "BGLF")

Half Yearly Financial Report for the six months ended 30 June

2021

A Note from our Chair

During the first half of 2021, the Company's performance

continued to be positively impacted by reduced actual and expected

investment downgrade and default expectations. The Company's return

was also supported, through its investment in BCF, by the ability

to take advantage of the technical strength in the CLO liability

market to refinance and reset existing CLO investments.

As a result, the Company delivered a published NAV total return

per Ordinary Share of 10.59% for the six month period ended 30 June

2021 and ended the period with a published NAV per share of

EUR0.8875.

The Board's outlook for the remainder of 2021 is optimistic but

remains uncertain as the race between COVID-19 inoculations and the

spread of the Delta variant of the virus is at a key juncture. With

this uncertain trajectory of the markets and global economy in the

second half of 2021, the Board gains comfort from the disciplined

investment approach of the Company's Portfolio Adviser that selects

an underlying portfolio of high-quality companies supported by

robust underlying protections.

Charlotte Valeur

Chair

21 September 2021

Strategic Report

Strategic Report

Key Performance Indicators(1)

IFRS NAV Published NAV

NAV (1) EUR0.8945 EUR0.8875

(31 Dec 2020: EUR0.8557) (31 Dec 2020: EUR0.8435)

NAV total return 9.89% 10.59%

(1)

(31 Dec 2020: 8.85%) (31 Dec 2020: (0.22)%)

Discount (1) (11.68)% (10.99)%

(31 Dec 2020: (21.70)%) (31 Dec 2020: (20.57)%)

Dividend EUR0.035 EUR0.035

(30 Jun 2020: EUR0.030) (30 Jun 2020: EUR0.030)

Further information on the reconciliation between the IFRS NAVs

and the Published NAVs can be found below.

Performance

Ticker IFRS NAV Published Share Discount Discount Dividend

per Share NAV per Price(2) IFRS NAV Published Yield

Share NAV (1)

-------- ----------- ---------- ---------- ---------- ----------- ----------

BGLF

30 Jun

2021 EUR0.8945 EUR0.8875 EUR0.7900 (11.68)% (10.99)% 9.49%

31 Dec

2020 EUR0.8557 EUR0.8435 EUR0.6700 (21.70)% (20.57)% 10.45%(3)

-------- ----------- ---------- ---------- ---------- ----------- ----------

BGLP

30 Jun

2021 GBP0.7667 GBP0.7608 GBP0.6900 (10.00)% (9.31)% 9.32%

31 Dec

2020 GBP0.7647 GBP0.7538 GBP0.6000 (21.54)% (20.40)% 10.47%(3)

-------- ----------- ---------- ---------- ---------- ----------- ----------

LTM 3-Year Annualised Cumulative

Return(1) Annualised Since Inception Since Inception

--------------------- ----------- ------------ ----------------- -----------------

BGLF IFRS NAV 35.41 10.37 7.71 67.49

BGLF Published NAV 18.31 10.06 7.58 66.12

BGLF Ordinary Share

Price 31.16 7.81 6.59 55.73

European Loans 9.52 3.31 3.39 26.06

US Loans 11.67 4.36 4.07 31.09

--------------------- ----------- ------------ ----------------- -----------------

Reconciliation of IFRS NAV to Published NAV

At 30 June 2021, there was a difference between the NAV per

Ordinary Share as disclosed in the Condensed Statement of Financial

Position below, EUR0.8945 per Ordinary Share, ("IFRS NAV") and the

published NAV, EUR0.8875 per Ordinary Share, which was released to

the LSE on 21 July 2021 ("Published NAV"). A reconciliation is

provided in Note 14 below. The difference between the two

valuations is mainly due to the different valuation bases used.

Valuation Policy for the Published NAV

The Company publishes a NAV per Ordinary Share on a monthly

basis in accordance with its Prospectus. The valuation process in

respect of the Published NAV incorporates the valuation of the

Company's CSWs and underlying PPNs (held by the Lux Subsidiary).

These valuations are, in turn, based on the valuation of the BCF

portfolio using a CLO intrinsic calculation methodology per the

Company's Prospectus, which we refer to as a "mark to model"

approach. As documented in the Prospectus, certain "Market Colour"

(market clearing levels, market fundamentals, bids wanted in

competition ("BWIC"), broker quotes or other indications) is not

incorporated into this methodology. The Directors believe that this

valuation process is the appropriate way of valuing the Company's

holdings, and of tracking the long-term performance of the Company

as the underlying portfolio of CLOs held by BCF are comparable to

held to maturity instruments and the Company expects to receive the

benefit of the underlying cash-flows over the CLOs' entire life

cycle.

Valuation Policy for the IFRS NAV

For financial reporting purposes on an annual and semi-annual

basis, to comply with IFRS as adopted by the EU, the valuation of

BCF's portfolio is at fair value using models that incorporate

Market Colour at the period end date, which we refer to as a "mark

to market" approach. IFRS fair value is the price that would be

received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants as at the

measurement date, and is an "exit price" e.g. the price to sell an

asset. An exit price embodies expectations about the future cash

inflows and cash outflows associated with an asset or liability

from the perspective of a market participant. IFRS fair value is a

market-based measurement, rather than an entity-specific

measurement, and so incorporates general assumptions that market

participants are applying in pricing the asset or liability,

including assumptions about risk.

Both the mark to model Published NAV and mark to market IFRS NAV

valuation bases use modelling techniques and input from third-party

valuation specialists. The small number of CLOs held directly by

the Company, as a result of the Rollover Opportunity, are valued

using a mark to market approach for both the Published NAV and IFRS

NAV, consistent with the valuation methodology per the Company's

Prospectus.

The Directors, as set out in the Prospectus, will continue to

assess the performance of the Company using the Published NAV.

Additional information and commentary on Market Colour, credit risk

exposure and any material divergence from the different valuation

bases referred to above will be communicated by the Directors and

Portfolio Adviser if and when appropriate.

Dividend History

Whilst not forming part of the Company's investment objective or

investment policy, it is currently intended that dividends are

payable in respect of each calendar quarter, two months after the

end of that quarter.

On 22 January 2021, the Board announced that the Company had

adopted a revised Dividend Policy targeting a total 2021 annual

dividend of between EUR0.07 and EUR0.08 per ordinary share, to

consist of quarterly payments of EUR0.0175 per ordinary share for

the first three quarters and a final quarter payment of a variable

amount to be determined at that time. This revised Dividend Policy

follows the changes made to the Company's Dividend Policy in 2020,

to pay an annual dividend of between EUR0.06 and EUR0.07 per

Ordinary Share, (the Company subsequently paid an annual dividend

of EUR0.07, paying EUR0.015 for the first three quarters and

EUR0.025 for the final quarter). The changes made in 2020 were

pursuant to a review of the portfolio in light of COVID-19, and the

subsequent changes announced in January 2021 reflect an improved

outlook for both the portfolio and macro environment. These follow

careful analysis and consideration by the Board in discussion with

the Company's Investment Adviser. The Board continues to monitor

the dividend policy throughout the year.

Ordinary Share Dividends for the Period Ended 30 June 2021

Period in respect of Date Declared Ex-dividend Date Payment Date Amount per Ordinary Share

-------------------------- -------------- ----------------- ------------- -------------------------

EUR

-------------------------- -------------- ----------------- ------------- -------------------------

1 Jan 2021 to 31 Mar 2021 23 Apr 2021 6 May 2021 4 June 2021 0.0175

1 Apr 2021 to 30 Jun 2021 21 Jul 2021 5 Aug 2021 3 Sep 2021 0.0175

-------------------------- -------------- ----------------- ------------- -------------------------

Ordinary Share Dividends for the Year Ended 31 December 2020

Period in respect of Date Declared Ex-dividend Date Payment Date Amount per Ordinary Share

--------------------------- -------------- ----------------- ------------- -------------------------

EUR

--------------------------- -------------- ----------------- ------------- -------------------------

1 Jan 2020 to 31 Mar 2020 23 Apr 2020 30 Apr 2020 29 May 2020 0.0150

1 Apr 2020 to 30 Jun 2020 21 Jul 2020 30 Jul 2020 28 Aug 2020 0.0150

1 Jul 2020 to 30 Sept 2020 21 Oct 2020 29 Oct 2020 27 Nov 2020 0.0150

1 Oct 2020 to 31 Dec 2020 22 Jan 2021 4 Feb 2021 5 Mar 2021 0.0250

--------------------------- -------------- ----------------- ------------- -------------------------

Period Highs and Lows

2021 2021 2020 2020

High Low High Low

Published NAV per Ordinary Share EUR0.8875 EUR0.8477 EUR0.8992 EUR0.7663

Ordinary Share Price (last price) (4) EUR0.8000 EUR0.6400 EUR0.8400 EUR0.4500

GBP Ordinary Share Price (last price) (4) GBP0.6964 GBP0.5601 GBP0.7200 GBP0.4200

------------------------------------------ --------- --------- --------- ---------

Schedule of Investments

As at 30 June 2021

Nominal Market % of Net Asset

Holdings Value Value

EUR

----------------------------------------- ----------- ----------- --------------

Investment held in the Lux Subsidiary:

CSWs 275,438,217 403,133,917 95.93

Shares (2,000,000 Class A and 1 Class B) 2,000,001 6,419,016 1.53

CLOs held directly 6,708,541 954,927 0.23

Other Net Assets n/a 9,697,071 2.31

----------------------------------------- ----------- ----------- --------------

Net Assets Attributable to Shareholders 420,204,931 100.00

----------------------------------------- ----------- ----------- --------------

Schedule of Significant Transactions

Date of Transaction Transaction Type Quantity Amount Reason

EUR

----------------------- -------------------------- ---------- ---------- -------------------

CSWs held by the Company - Ordinary Share Class

23 Feb 2021 Redemption 10,287,510 13,903,041 To fund dividend

06 April 2021 Issuance 6,170,000 6,170,000 Investments in PPNs

05 May 2021 Issuance 3,742,949 3,742,949 Investments in PPNs

14 May 2021 Redemption 9,067,077 12,522,939 To fund dividend

(1) Refer to the Glossary below for an explanation of the terms

used above and elsewhere within this report

(2) Bloomberg closing price at period end

(3) Dividend Yield presented as EUR 0.07 per annum, given the

first three quarterly dividends of EUR 0.015 per share and fourth

quarter dividend of EUR 0.025, and the share price as at 31

December 2020

(4) Source: Bloomberg

Chair's Statement

Company Returns and Net Asset Value (5)

The Company delivered an IFRS NAV total return per Ordinary

Share of 9.89% over the first six months of 2021, ending the period

with a NAV of EUR0.8945. The return was composed of 5.02% of

dividend income and 4.87% of net asset growth.

On a Published NAV basis, the Company delivered a total return

per Ordinary Share of 10.59% over the first six months of 2021 ,

ending the period with a NAV of EUR0.8875. The return was composed

of dividend income 5.06% and of net asset growth of 5.53%.

During the first half of 2021, the Company's performance

continued to be positively impacted by reduced actual and expected

investment downgrade and default expectations. The Company's return

was also supported, through its investment in BCF, by the ability

to take advantage of the technical strength in the CLO liability

market to refinance and reset existing CLO investments.

Due to improved forward looking expectations, the Company was

pleased to announce an increase to its stated dividend target to 7

to 8 cents per share for 2021. Consistent with this revised

guidance, the Company paid two dividends to Ordinary Shareholders

in respect of the six-month period ended 30 June 2021, totalling

EUR0.0350 per share. Details of all dividend payments can be found

within the Dividend History section at the front of this Half

Yearly Financial Report.

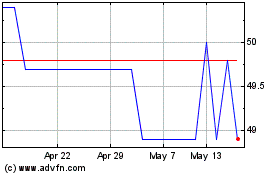

Historical BGLF NAV and Share Price

The graph shows cumulative Published NAV and Ordinary Share

price total returns and cumulative returns on European and US

loans.

[Graphs and charts are included in the published Half Yearly

Financial Report which is available on the Company's website at

https://www.blackstone.com/fund/bglfln-blackstone-gso-loan-financing-limited/]

Market Conditions

Continuing the tone set from the end of 2020, financial markets

performed strongly in the first half of 2021. Equity markets

reached record levels and credit spreads continued to grind

tighter, on the back of a repricing wave experienced in 1H 2021.

The line--of--sight to reopening and recovery in most developed

economies is becoming clearer, giving us cause for optimism even as

we continue to closely monitor potential economic impacts of the

COVID-19 Delta variant.

Ongoing monetary and fiscal support, accommodative capital

markets, the rollout of mass vaccination programmes, and the

reopening of major economies have all supported a move towards a

normalisation in economic activity. Consequently, credit

fundamentals have continued their improvement as evidenced by a

strong 1Q 2021 reporting period, and GDP expectations for 2021 are

a stark comparison to growth in 2020. Real GDP in the UK and US is

set to grow by 6.7% and 6.6%, compared to a contraction of 10.1%

and 3.5% in 2020, respectively (6) .

At the year's mid-point, below investment grade credit is on its

way to a full year of stable returns, with US interest rates now

well below March's high and possibly poised to rise again. We

believe loans will continue to perform well against other fixed

income asset classes given their floating rate nature and our

current view on relative value and the trajectory of interest

rates. We also expect ongoing CLO creation and demand from

investors searching for higher yielding assets to contribute

positively to the balance of supply and demand and help absorb the

healthy pipeline of new loan issuance expected for the second half

of the year.

Discount Management

The share price discount to Published NAV narrowed from 20.57%

at 31 December 2020 to 10.99% at 30 June 2021. As a Board, we

regularly weigh the balance between paying dividends, reinvesting

in BCF and seeking to ensure the Ordinary Shares trade as closely

as possible to their intrinsic value(7) . During 2021 year-to-date,

the Company repurchased 9,772,007 shares for EUR7,420,732 at a

weighted average discount of 12.11% using available cash with the

goal of reducing the discount. As of 17 September 2021, the share

price discount to Published NAV was 11.65%.

Brexit Update

The Board closely monitored the Brexit trade deal negotiations

during 2020, which culminated with a deal being finalised on 30

December 2020. The potential implications to BGLF of a "hard

Brexit" as a result of no trade deal being agreed before the

year-end deadline, was evaluated across its service providers,

including areas such as human resources, counterparty

relationships, supply chains, macroeconomic, and regulatory policy,

as well as with regards to its marketing registrations, and was

deemed to have a negligible impact on the long-term sustainability

of the Company. Since the UK left the EU, no material risks have

crystallised.

COVID-19

The Directors continue to carefully monitor the ongoing

developments regarding COVID-19, which continues to impact global

commercial activity and contribute to volatility in financial

markets. The global impact of the outbreak continues to evolve as

new variants develop, however the rollout of vaccination programmes

across the globe is encouraging and economic activity has shown

signs of normalisation. Whilst COVID-19 still presents a level of

uncertainty going forward, we are more informed as to its potential

effects on portfolio asset performance and therefore feel better

equipped to navigate this environment. Nevertheless, the potential

direct and indirect risks to the Company, to the extent known, will

be closely monitored and portfolio activity conducted in a way that

is consistent with the Company's stated objectives and the

Portfolio Advisor's investment philosophy of capital

preservation.

ESG

The practice of responsible investing remains a key focus for

investors. The Board regularly engages with the Company's Portfolio

Adviser regarding their ESG policy. Blackstone has committed to

being a responsible investor for over 35 years. This commitment is

affirmed across the organisation and guides its approach to

investing. A summary of Blackstone's responsible investing approach

can be found below .

The Board

Good governance remains at the heart of our work as a Board and

is taken very seriously. We believe that the Company maintains high

standards of corporate governance. The Board was very active during

the period, convening a total of 11 Board meetings and 14 Committee

meetings (including 6 NAV Review Committee meetings). The Board

also has a due diligence meeting scheduled with the Portfolio

Adviser in September 2021, the agenda for which covers risk and

compliance, risk oversight monitoring, finance and accounting and

the wider market. The Board will also be meeting with the BCF board

at the same time.

During the period, the Board and its advisers have met

frequently, with the Company's advisers providing general updates

as well as recommendations on pertinent matters such as the

Company's share repurchase programme. The Board deems the careful

consideration of such matters to be critical to ensuring the

long-term success of the Company, particularly in light of the

challenges and uncertainty faced since the start of 2020.

The work of the Board is also assisted by the Audit Committee,

NAV Review Committee, Management Engagement Committee, the

Remuneration and Nomination Committee, the Risk Committee and the

Inside Information Committee.

The Company is a member of the Association of Investment

Companies (the "AIC") and adheres to the AIC Code of Corporate

Governance (the "AIC Code") which is endorsed by the Financial

Reporting Council (the "FRC"), and meets the Company's obligations

in relation to the UK Corporate Governance Code 2018 (the "UK

Code").

Shareholder Communications

During 1H 2021, using our Portfolio Adviser and Brokers, we

continued our programme of engagement with current and prospective

Shareholders. We sincerely hope that you found the monthly

factsheets, quarterly letters, quarterly update webcasts and market

commentary valuable. We are always pleased to have contact with

Shareholders, and we welcome any opportunity to meet with you and

obtain your feedback.

Prospects and Opportunities in 2021

The Board's outlook for the remainder of 2021 is optimistic but

remains uncertain as the race between COVID-19 inoculations and the

spread of the Delta variant of the virus is at a key juncture. The

line--of--sight to reopening and recovery in most developed

economies is becoming clearer, giving us cause for optimism even as

we continue to closely monitor potential economic impacts of the

COVID-19 Delta variant. With this uncertain trajectory of the

markets and global economy in the second half of 2021, the Board

gains comfort from the disciplined investment approach of the

Company's Portfolio Adviser that selects an underlying portfolio of

high-quality companies supported by robust underlying

protections.

The Board wishes to express its thanks for the support of the

Company's Shareholders.

Charlotte Valeur

Chair

21 September 2021

(5) Past performance is not necessarily indicative of future

results, and there can be no assurance that the Company will

achieve comparable results, will meet its target returns, achieve

its investment objectives, or be able to implement its investment

strategy.

(6) Bloomberg, as of 30/06/2021. Data for 2021 represents

consensus economic forecasts.

(7) Represents the BGLF Euro share price.

Portfolio Adviser's Review

- Loan markets continued their momentum from 2020, with

reopening themed sectors and lower rated assets leading the

outperformance. US and European loans returned 3.48% and 2.91% year

to date (8) . Corporate fundamentals are showing signs of

improvement and defaults continue to beat expectations. The

last-twelve-month ("LTM") par-weighted default rate was 1.3% and

0.5% for US and European Loans, down from 4.4% and 1.2% at the end

of 2020, respectively(9) .

- Owing to favourable conditions for CLO creation and

management, total year to date CLO activity is tracking at record

pace, with refinancings and resets accounting for the majority.

After trending towards multi-year tight spreads through 1H 2021,

CLO liability spreads retreated from their lows under the pressure

of heavy supply, however the arbitrage still remains favourable for

equity investors.

- Trading activity in the CLO portfolio activity focused on

opportunistically capturing the emerging recovery and increasing

spread to preserve net interest margins. On the liability side, BCF

took advantage of the technical strength in the CLO market to

refinance three CLOs, reset seven CLOs, and issue four new CLOs,

all whilst achieving very competitive debt pricing. Additionally,

two CLOs were redeemed.

- Similarly to the fourth quarter of 2020, BCF benefitted from

improved liquidity and equity valuations in the secondary market

and sold down certain non-retention CLO income note positions, with

executed prices that exceeded modelled marks as well as

mark-to-market prices(10).

- CLO securitisations in BCF generated positive cashflow over

2021, supported by uninterrupted distributions from the underlying

CLO portfolio. The weighted average annualised distribution rates

for European and US CLO income notes were 15.6% and 21.7%,

respectively, with strong contributions across vintages and an

additional tailwind from CLO redemptions (11) .

Bank Loan Market Overview

Leveraged loan markets started 2021 on strong footing as the

rally in risk assets continued. Markets were buoyed by the

continued global rollout of COVID-19 vaccinations, with an

additional tailwind from global monetary and fiscal stimulus

implemented in the prior year. Many market indicators pointed to a

broad-based recovery which culminated in year to date returns of

2.91% and 3.48% for European and US leverage loans, respectively,

notably surpassing the returns achieved throughout all of

2020(12).

Following the onset of the pandemic, the wave of CCC downgrades

and defaults anticipated had been avoided in a meaningful manner.

Concurrent with economic activity reverting to a more 'normalised'

state, corporate fundamentals displayed a tangible improvement

after a strong first quarter results period. Earnings for the

second quarter, whilst not yet announced, are expected to show

further improvement. Paired with slowing debt growth, we expect

that corporate issues should be well equipped to grow into their

higher levered capital structures brought forward from 2020.

The US loan last-twelve-month ("LTM") par-weighted default rate

ended June 2021 at 1.3%, down from 4.4% at the end of 2020(13).

Defaults for European Loans were lower at 0.5%, compared to 1.2% at

the end of 2020. Whilst there has not been a revision for European

Loans, J.P. Morgan lowered their US loan default expectations to

0.65% and 1.25% for the end of 2021 and 2022, respectively, just as

the ratio of upgrades to downgrades for US loans reached 2:1 at the

end of June(14).

Complementing improving corporate fundamentals was a

well-balanced technical backdrop. Contributions from both debt

refinancing and increased M&A activity led to an increased pace

of European and US loan issuance. Year-to-date gross supply was

EUR82 billion and $417 billion compared to EUR65 billion and $395

billion for the whole of 2020, respectively(15). Healthy demand for

loans has resulted in the market being well bid despite the

increased issuance, resulting in the average price for European and

US indices increasing to EUR99.10 and $97.96 from EUR98.64 and

$95.73 at the end of 2020, respectively(16). Similarly, European

and US loan spreads (represented by 3-year discount margin)

tightened by 19 bp and 43 bp over the same period to 403 bp and 443

bp, respectively(17). Record-setting Collateralised Loan Obligation

("CLO") creation(18), a search of yield in Europe, and demand for

assets with an inflation and interest rate hedge contributed to

healthy inflows, allaying concerns of oversupply.

The broader risk-on sentiment continued to drive outperformance

of CCC-rated assets and COVID-19 impacted sectors. However, as we

approached the end of June, signs of softening were starting to

emerge due to a rise in the Delta variant, stoking concerns of

another prolonged spike in COVID-19 cases across the globe, with

implications for the real economy. Looking forward to the second

half of 2021, we will continue to monitor any effects in the

markets that we invest and position our portfolio

appropriately.

CLO Market Overview

Momentum in the CLO market gathered pace through the year. CLO

liability spreads trended towards multi-year tights and increased

confidence in both underlying collateral quality and CLO structures

themselves led to a sharp increase in CLO activity. Managers aiming

to capitalise on the low cost of funding originated new CLOs, but

more noticeably, those aiming to reduce the cost of debt or lock in

longer reinvestment periods took to the market in earnest. As such,

year-to-date total CLO volumes in Europe were EUR53.5 billion,

which exceeded any full year activity ever recorded, and $220

billion in the US, which was nearly double that of 2020(19).

Re-financings and resets dominated this activity, accounting for

72% and 63% of European and US volumes. This optionality is a key

benefit for CLO equity investors who as a result would be afforded

higher expected future cashflows in aggregate and an immediate

increase in equity net asset value ("NAV") as a result.

In the first quarter, demand for CLO debt was broad based across

tranches. After the rally in risk assets pushed global credit

spreads tighter, CLO debt seemed increasingly attractive on a

relative value basis given the low yield environment. However, as

the second quarter progressed, US and European CLO liability

spreads retreated from their lows under the pressure of heavy

supply. We understand investors were full on allocations after

investing heavily earlier in the year, ultimately leading to an

upwards readjustment in CLO liability spreads as we moved towards

June. In Europe, AAA-rated CLO spreads finished at 94 bp at the end

of June after hitting lows in the high 70 bp region in March

(compared to 105 bp at the end of 2020)(20). Similarly, US CLO

AAA-rated spreads were 113 bp as of the end of June after reaching

100 bp in March 2021 (compared to 132 bp at the end of

2020)(21).

In tandem with improving collateral quality and robust loan

market performance, CLO fundamentals improved in 2021. In Europe,

CCC buckets fell from 6.4% at the end of 2020 to 5.0%, and

defaulted assets to 0% from 0.3% over the same period. There was

also an improvement in Weighted Average Rating Factor ("WARF") by

281 to 2,890 and an increase in junior overcollateralisation ("OC")

cushions by 53 bp to 401 bp during the first half. Weighted Average

Asset Price ("WAP") also increased by 1.1 to 99.0 and Weighted

Average Spreads ("WAS") decreased by 7bp to 370bp. Notably, CLO

equity market value NAVs increased by 12.6 to 63.4(22).

In the US, CCC buckets improved to 5.9% from 7.7%, defaulted

assets fell to 0% from 0.5% and WARF metrics declined by 2014.

Likewise, junior OC cushions increased by 107 bp to 384 bp over the

same period. WAP also increased by 1.4 to 98.7 and WAS decreased by

6 bp to 371 bp. CLO equity NAV also posted an impressive gain of

17.3 to 61.6(23).

As we look forward, CLO supply is expected to grow further,

albeit at a slightly slower pace experienced year to date. In

Europe, total full year CLO supply is forecast to be EUR75-EUR90

billion, an increase of 31%-57% from the midyear point(24). Total

US BSL CLO supply is expected to increase by 47-62% to $300-$330

billion over the same period, setting a full year record if

achieved(25). Although liability spreads have recently widened, our

belief is that the attractive relative value versus other fixed

income asset classes may continue to attract investors and keep a

ceiling on any material repricing. With global loan prices having

largely returned close to par, focus for equity investors has

reverted back to a natural spread arbitrage. As such, we expect

supply to continue but again with refinancing and reset activity

accounting of the majority.

Portfolio Update

BCF

Year to date trading activity continued to focus on protecting

investor capital, proactive management of credit ratings but with

flexibility for portfolio rotation to capture emerging trends. CLOs

opportunistically added names to take advantage of the 'reopening

trade' as visibility improved around the vaccine rollout and

economic reopening. As the rally continued, it was evident

valuations were becoming increasingly stretched as market

participants were discounting an overly optimist forward looking

view. As such, closer attention was paid to long-term corporate

fundamental value to assess those names in which we had longer-term

conviction. We also used the repricing wave in the first quarter to

exit lower spread risk in an effort to preserve net interest

margins. This became an ongoing theme, deploying capital in primary

and secondary markets into higher spread assets with more

compelling valuation profiles.

Consistent with the supportive conditions for CLO creation and

management noted above, BCF has been very active in both new

issuance and optimisation of its liability portfolio. Year to date,

BCF has invested in two European and two US new issue CLOs(26),

further diversifying the portfolio across both vintage and

geography.

The portfolio was well positioned at to take advantage of the

technical strength in the CLO liability market during the first six

months of 2021. BCF refinanced three CLOs and reset seven CLOs year

to date, in most cases reducing the weighted average cost of

capital and extending the duration of cashflows received in the

case of the resets, which is immediately accretive to the NAV of

these CLOs.

It is also worth noting that Blackstone Credit achieved close to

the lowest, if not the lowest, weighted average cost of capital at

the time of pricing during the first half of the year, with further

pricing differentiation between managers depending on their

perceived 'tier'(27). Blackstone Credit was the second most active

manager in the market when considering total CLO activity(28).

Compared to estimates at the initial onset of the COVID-19

pandemic, default rates have fared much better than expected. The

year-to-date default loss rate for the BCF portfolio was 0.00%,

compared to 0.07% for European loans and 0.32% for US loans. Taking

in to account our in-house views of the current portfolio and the

broader recovery, lower default and downgrade expectations have

been fed into modelled valuations. This benefit was most pronounced

in June's positive NAV valuation and we would expect further

improvements in assumptions to contribute to the stability and

growth of BCF's NAV going forward.

BCF also recycled parts of the portfolio during the first half

of 2021. Similarly to the fourth quarter of 2020, BCF benefitted

from improved liquidity and equity valuations in the secondary

market and sold down certain non-retention CLO income note

positions, with executed prices that exceeded modelled marks as

well as mark-to-market prices(29). This included the full sale of

Myers Park and Greenwood Park CLO equity, and a partial sale of

Deer Park CLO equity, which held the record sale price for European

CLO equity at the time of trade.

Additionally, two CLOs have been redeemed year to date. For

Orwell Park, this outcome was economically favourable when compared

with the option of a reset. In the case of Stratus 2020-2, a static

CLO issued during the dislocation in 2020, Blackstone Credit

purchased assets at a discount which were ultimately taken out at

favourable levels, resulting in a realised IRR to date of

34.9%(30). Proceeds will ultimately be allocated towards more

efficient uses to potentially enhance the return profile of the

portfolio.

At the end of June, 38% of BCF's portfolio was composed of US

CLO securities(31) and CLO warehouses (first loss positions),

compared to 41% in December 2020. European CLO income notes

decreased marginally to 40% from 41% at the end of 2020. Exposure

to directly held loans, net of leverage, increased from 13% to 23%

(32) . The weighted average remaining reinvestment period for the

portfolio's CLOs increased in the first six months to 2.0 years

from 1.9 years, largely driven by the addition of new CLOs and

resets of existing CLOs in Europe.

As of 30 June 2021, the weighted average asset coupon of the

portfolio decreased to 3.68% from 3.74% since 31 December 2020,

consistent with a general tightening of loan spreads over the

period. The cost of liabilities narrowed to 1.70% from 1.82% over

the same period, due in part to liability management of the CLO

portfolio and refinancing of BCF's lending facility. The combined

effect resulted in an increase to BCF's net interest margin of 5bp,

to 1.97% in June (from 1.92% at the end of December 2020).

BCF has continued to generate uninterrupted cashflows from its

CLO income note investments throughout 2021. As of 30 June 2021,

the weighted average annualised distribution rates for European and

US CLO income notes were 15.6% and 21.7%, respectively, with strong

contributions across vintages and an additional tailwind from

Orwell Park and Stratus 2020-2 redemptions. This is compared to

15.6% and 17.1% respectively for 2020.

Looking forward, we will continue actively evaluating those CLOs

that are callable as the year progresses, weighing the relative

merits of a refinancing, reset, redemption or sale, and which is

most economically beneficial to that particular CLO.

CLO Portfolio Positions

Closing / Deal Position % of % of Reinvest. Current Current Current NIM

[Expected Close] Size Owned Tranche BCF Period Asset Liability Net 3M Distributions

Date (M) (M) NAV Left Coupon Cost Interest Prior Through Last Payment

(Yrs) Margin Date

--------------------

Ann. Cum.

EUR CLO Income Note Investments

EUR EUR

Phoenix Park Jul-14 417 23.3 51.4% 1.2% 1.83 3.58% 1.78% 1.81% 1.87% 14.2% 95.9%

Sorrento Park Oct-14 248 29.5 51.8% 0.8% 0.00 3.59% 2.38% 1.21% 1.64% 14.6% 96.3%

Castle Park Dec-14 216 24.0 52.2% 1.0% 0.00 3.51% 2.31% 1.20% 1.63% 14.2% 92.4%

Dartry Park Mar-15 427 26.6 51.1% 1.4% 3.83 3.60% 1.67% 1.93% 1.90% 14.0% 82.3%

Tymon Park Dec-15 333 22.7 51.0% 1.3% 0.00 3.54% 1.51% 2.03% 2.17% 16.1% 85.9%

Elm Park May-16 522 31.9 56.1% 2.0% 4.29 3.55% 1.70% 1.85% 2.18% 14.1% 65.5%

Griffith Park Sep-16 456 26.0 53.4% 1.6% 1.89 3.59% 1.57% 2.01% 2.10% 10.3% 48.3%

Clarinda Park Nov-16 417 23.1 51.2% 1.4% 3.63 3.61% 1.70% 1.91% 1.96% 11.4% 51.3%

Palmerston Park Apr-17 415 24.0 53.3% 1.4% 0.00 3.52% 1.55% 1.97% 2.09% 14.1% 56.8%

Clontarf Park Jul-17 414 29.0 66.9% 1.7% 0.10 3.49% 1.59% 1.90% 1.94% 15.4% 58.7%

Willow Park Nov-17 412 23.4 60.9% 1.5% 1.04 3.48% 1.58% 1.90% 1.98% 17.8% 60.1%

Marlay Park Mar-18 413 24.6 60.0% 1.6% 0.79 3.50% 1.40% 2.10% 2.16% 19.6% 59.7%

Milltown Park Jun-18 409 24.1 65.0% 1.8% 1.04 3.54% 1.50% 2.05% 2.12% 18.0% 51.3%

Richmond Park Jul-18 548 46.2 68.3% 2.0% 0.04 3.51% 1.53% 1.98% 2.03% 18.5% 50.8%

Sutton Park Oct-18 408 24.0 66.7% 1.7% 1.87 3.57% 1.72% 1.85% 1.88% 17.7% 41.6%

Crosthwaite Park Feb-19 516 33.0 64.7% 2.1% 4.21 3.58% 1.75% 1.83% 1.62% 13.8% 28.2%

Dunedin Park Sep-19 408 25.3 52.9% 1.6% 2.81 3.59% 1.78% 1.81% 1.87% 12.4% 19.7%

Seapoint Park Nov-19 405 21.6 70.5% 1.6% 2.89 3.58% 1.84% 1.74% 1.82% 16.7% 21.4%

Holland Park Nov-19 428 39.1 72.1% 1.6% 2.87 3.60% 1.90% 1.70% 1.73% 11.1% 16.6%

Vesey Park Apr-20 404 24.5 80.3% 1.9% 3.38 3.62% 1.97% 1.65% 1.71% 24.8% 25.9%

Avondale Park Jun-20 284 18.7 63.0% 1.7% 2.05 3.61% 2.52% 1.10% 1.10% 16.3% 14.0%

Deer Park Sep-20 344 20.5 71.9% 1.6% 2.29 3.56% 2.27% 1.30% 1.32% 8.4% 4.8%

Marino Park Dec-20 324 17.0 71.4% 1.6% 2.55 3.73% 1.84% 1.89% 1.98% n/a n/a

Carysfort Park Apr-21 406 25.1 80.7% 2.0% 4.08 3.67% 1.68% 2.00% 2.00% n/a n/a

Rockfield Park Jul-21 404 24.0 80.0% 2.0% 4.04 n/a n/a n/a n/a n/a n/a

USD CLO Income Note Investments

Dorchester Park Feb-15 $ $ 67.0% 1.2% 0.00 3.60% 1.85% 1.76% 1.92% 16.5% 101.3%

385 44.5

Grippen Park Mar-17 611 29.8 50.1% 1.6% 0.80 3.90% 1.92% 1.98% 1.78% 14.7% 60.3%

Thayer Park May-17 525 27.4 50.1% 1.3% 4.80 3.74% 1.82% 1.92% 1.87% 16.0% 63.1%

Catskill Park May-17 1,029 56.0 51.6% 2.7% 0.80 3.81% 1.76% 2.05% 1.68% 15.1% 59.2%

Dewolf Park Aug-17 614 31.7 51.6% 1.7% 1.29 3.80% 1.90% 1.89% 1.83% 15.9% 57.6%

Gilbert Park Oct-17 1,022 51.8 50.8% 2.7% 1.30 3.84% 1.86% 1.97% 1.81% 16.2% 56.4%

Long Point Park Dec-17 611 29.5 50.1% 1.6% 1.55 3.81% 1.61% 2.19% 2.05% 20.8% 68.6%

Stewart Park Jan-18 874 92.2 50.1% 1.8% 1.51 3.81% 1.65% 2.16% 2.02% 14.2% 46.0%

Cook Park Apr-18 1,025 53.6 50.1% 2.9% 1.80 3.80% 1.53% 2.26% 2.13% 18.2% 54.9%

Fillmore Park Jul-18 561 30.2 54.3% 1.8% 2.04 3.79% 1.71% 2.08% 1.92% 15.8% 42.7%

Harbor Park Dec-18 715 39.7 50.1% 2.3% 2.56 3.82% 1.80% 2.02% 1.91% 16.1% 37.7%

Buckhorn Park Mar-19 502 24.2 50.1% 1.4% 2.80 3.78% 2.16% 1.63% 1.49% 16.2% 33.7%

Niagara Park Jun-19 453 22.1 50.1% 1.4% 3.05 3.81% 1.96% 1.86% 1.84% 15.7% 28.4%

Southwick Park Aug-19 503 26.1 59.9% 1.5% 3.06 3.82% 2.13% 1.70% 1.67% 17.0% 28.3%

Beechwood Park Dec-19 810 48.9 61.1% 2.7% 3.55 3.87% 2.17% 1.70% 1.62% 15.9% 21.1%

Allegany Park Jan-20 505 30.2 66.2% 1.8% 3.55 3.84% 2.13% 1.71% 1.64% 12.8% 16.2%

Harriman Park Apr-20 503 29.2 70.0% 1.9% 4.76 3.87% 1.81% 2.06% 1.72% 28.7% 28.7%

Cayuga Park Aug-20 393 22.9 72.0% 1.6% 2.05 3.83% 2.31% 1.52% 1.43% 23.9% 16.3%

Point Au Roche

Park Jun-21 457 26.5 61.2% 1.7% 5.05 3.99% 1.71% 2.28% n/a n/a n/a

Vertical Retention Investments

Tallman Park May-21 $ 410 2.1 5.0% 0.2% 4.80 3.90% 1.69% 2.21% n/a n/a n/a

US Warehouse Initial Closing Investment Investment Current Current Current Net Interest

Investments Investment / [Expected (EURM) ($M) Loan Asset Liability Margin

Date Close] Exposure Coupon Coupon

Date ($M)

Peace Park

Warehouse May-21 [Sep-21] EUR 10.4 $ 12.7 $ 265.4 3.93% 1.25% 2.69%

Redeemed Vintage Redemption Deal Position % of Tranche Current Realised Cumulative

CLOs Date Size Owned Prior Prior To valuation IRR to Distributions

(M) To Redemption Redemption as % of date Through

(M) BCF NAV Last Payment

Date

Orwell EUR

Park 2015 May-21 303 EUR 24.2 51.0% 0.05% 13.4% 156.4%

Stratus

2020-2 2020 Jun-21 $ 261 $ 24.2 100.0% 0.03% 34.9% 125.2%

As of 30 June 2021, the Fund was invested in accordance with its

and BCF's investment policy and was diversified across 699 issuers

through the directly held loans and CLO portfolio, and across 30

countries and 29 different industries. No individual borrower

represented more than 2% of the overall portfolio at the end of

June 2021.

Key Portfolio Statistics

Current WA

% of Current WA Liability WA Remaining

NAV Asset Coupon Cost RPs (CLOs)

As at 30 June 2021

EUR CLOs 40.06% 3.57% 1.78% 2.0 yrs

US CLOs 37.16% 3.80% 1.85% 2.1 yrs

Directly Held Loans

(less leverage) 22.51% 3.66% 1.35% n/a

US CLO Warehouses 0.94% 3.93% 1.25% n/a

Net Cash & Expenses -0.67% - - n/a

As at 31 December

2020

EUR CLOs 40.56% 3.63% 1.76% 1.5 yrs

US CLOs 39.82% 3.80% 1.89% 2.2 yrs

Directly Held Loans

(less leverage) 12.66% 3.85% 1.85% n/a

US CLO Warehouses 0.86% 3.99% 1.34% n/a

Net Cash & Expenses 6.10% - - n/a

Top 10 Industries

Industry % of Portfolio

30 June 2021 31 December 2020

========================================= ============ ================

Healthcare and Pharmaceuticals 15.92% 15.21%

========================================= ============ ================

High Tech Industries 10.03% 9.32%

========================================= ============ ================

Services Business 9.56% 10.44%

========================================= ============ ================

Banking, Finance, Insurance, Real Estate 7.43% 8.71%

========================================= ============ ================

Media Broadcasting and Subscription 6.84% 6.81%

========================================= ============ ================

Chemicals, Plastics and Rubber 6.26% 6.03%

========================================= ============ ================

Hotels, Gaming and Leisure 5.99% 6.22%

========================================= ============ ================

Construction and Building 5.71% 5.21%

========================================= ============ ================

Telecommunications 4.12% 4.55%

========================================= ============ ================

Services Consumer 3.91% 3.72%

========================================= ============ ================

Top 5 Countries

Country % of Portfolio

30 June 2021 31 December 2020

United States 49.20% 52.73%

United Kingdom 10.27% 9.81%

France 8.05% 7.36%

Netherlands 6.19% 4.52%

Germany 5.72% -

Luxembourg - 6.26%

Top 20 Issuers

# Portfolio Total Moody's Country WA WA WA WA

Facilities Par Par Industry Price Spread Coupon Maturity

(EURM) Outstanding (All-In (Years)

(EURM) Rate)

------------- ---------- --------- ----------- ------------------ ----------- ----- ------ ------- --------

Retail (Global United

Euro Garages 6 190 5,783 Petrol Stations) Kingdom 99.1 4.20% 4.28% 3.8

Euro Garages is the leading global independent convenience retail

and fuel station operator with a fuel, convenience retail and

Food-to-Go offering with partnerships with leading brands such

as Esso, BP, Shell, Dunkin Donuts and Pizza Hut among others.

Media Broadcasting

Numericable 4 166 4,950 and Subscription France 98.8 3.13% 3.18% 4.4

Numericable is one of the largest telecommunications operators

in France by revenues and number of subscribers, with major positions

in residential fixed, residential mobile, B2B, wholesale and media.

AkzoNobel Chemicals,

Specialty Plastics

Chemicals 2 162 4,612 and Rubber Netherlands 99.6 2.90% 2.94% 4.3

AkzoNobel Specialty Chemicals represents a collection of specialty

and commodity chemical and polymer businesses split across five

divisions: Surface Chemistry (surfactants and polymers), ethylene

and sulfur derivatives, polymer chemistry (includes catalysts

and polymer additives), industrial chemicals (includes chlor-alkali

and other industrial chemicals), and pulp and performance chemicals

(includes hydrogen peroxide and other bleaching chemicals, and

variety of other chemicals).

Healthcare

Sivantos and

/ Siemens 2 160 2,981 Pharmaceuticals Denmark 99.4 3.94% 3.96% 4.7

Sivantos/Siemens was created following the completion of the merger

between Sivantos and Widex. The combined company operates in 125

markets and holds the third position in the hearing aid market

globally.

Media Broadcasting

Ziggo 2 158 4,379 and Subscription Netherlands 99.3 2.86% 2.88% 7.4

Ziggo is one of the largest cable operators in the Netherlands.

The company provides radio, television, internet, and telephone

services. The company was created as a result of the merger between

Multikabel, @Home and Casema.

McAfee, High Tech United

LLC 2 156 3,359 Industries States 100.2 3.61% 3.65% 3.3

McAfee, LLC is the second largest security software vendor globally,

after Symantec. McAfee serves both the consumer and enterprise

security markets, with a focus on consumer endpoint protection.

Media Broadcasting United

Virgin Media 4 155 5,379 and Subscription Kingdom 99.4 2.68% 2.71% 7.3

Virgin Media is a British telecommunications company which provides

telephone, television, and internet services in the United Kingdom.

Virgin Media is a subsidiary of Liberty Global, an international

television and telecommunications company.

Thyssenkrupp

Elevators 3 153 3,324 Capital Equipment Germany 100.3 4.00% 4.08% 6.1

Thyssenkrupp is the number four player in the global market for

elevator and escalator technology. The company designs, manufacturers,

installs, services, and modernises elevators, escalators, and

platform lifts.

Media Broadcasting

UPC 4 145 3,476 and Subscription Netherlands 99.4 2.73% 2.75% 7.6

UPC is a cable operator in Switzerland, Poland & Slovakia. It

offers broadband, tv and mobile services.

Beverage,

Food and United

Froneri 2 141 4,409 Tobacco Kingdom 98.4 2.33% 2.36% 5.6

Froneri is a global ice cream manufacturer with its headquarters

in North Yorkshire, England. It is the second largest ice cream

producer by volume in the world, after Unilever. Froneri was created

in 2016 as a joint venture between Nestle and PAI Partners to

combine their ice cream activities.

Chemicals,

Plastics United

Ineos Quattro 4 122 4,236 and Rubber Kingdom 99.4 2.48% 2.72% 5

Ineos, through its subsidiaries, manufactures specialty and intermediate

chemicals such as ethylene oxide, acetate esters, glycol, and

specialty polymers. Ineos serves customers worldwide.

TDC A/S 2 120 2,950 Telecommunications Denmark 99.6 3.09% 3.09% 3.9

TDC Group is the Danish telecom incumbent offering mobile services,

broadband as well as tv and entertainment services. The company

is active in B2B and Wholesale segments and has a presence in

Norway.

Banking,

Finance,

Insurance

and Real

ION Trading 2 120 3,141 Estate (FIRE) Ireland 100.5 4.48% 4.57% 6.8

Ion Trading is a global financial software and services company

that offers mission critical trading infrastructure solutions

to banks and other financial institutions. In particular, the

company provides high performance trading solutions for electronic

fixed income markets, including support for cash, futures, repos,

money markets, interest rate swaps and credit default swaps. The

group serves 800+ customers worldwide.

BMC Software

Finance High Tech United

Inc. 2 114 3,615 Industries States 100.2 3.93% 3.96% 4.3

BMC Software is a prominent provider of business management software

used for a variety of functions and processes. The company's software

and services are used in automation and development, IT optimization,

security and compliance, multi-cloud management, artificial intelligence

and machine learning.

Healthcare

and United

IMS Health 4 110 3,097 Pharmaceuticals States 99.5 1.95% 1.98% 3.1

IQVIA, formed after a merger between Quintiles and IMS Health,

provides information and technology services to the pharmaceutical

and healthcare industries. The Company offers services such as

product and portfolio management capabilities, commercial effectiveness

solutions, managed care, and consumer health.

Financiere Healthcare

Chopin (Ceva and

Sante) 1 109 2,050 Pharmaceuticals France 100.5 4.50% 4.50% 4.8

Ceva Santé Animale is a private global veterinary pharmaceutical

company headquartered in France that focuses on the research,

development, production and marketing of pharmaceutical products

and vaccines for poultry, swine, cattle and pets. Ceva provides

four major products (anti-infectives, vaccines, reproduction and

animal behaviour / cardiology) for all major species.

Veritas US High Tech United

INC. 2 108 1,655 Industries States 100.9 4.88% 5.88% 4.2

Veritas Technologies, LLC represents the legacy Information Management

division of Symantec Corporation. For over two decades the Company

has been a market leader in information management software and

solutions that help organizations protect, manage and analyze

their mission-critical enterprise data, such as emails, documents

and spreadsheets, as well as their applications, such as financial,

human resources, supply chain management and enterprise resource

planning ("ERP") systems, collaboration tools and databases. The

Company offers industry-leading backup and recovery solutions

, as either independent software or integrated software-hardware

appliances.

Ahlsell

Investco Construction

AB 1 99 1,808 and Building Sweden 99.4 3.50% 3.50% 4.6

Ahlsell is the leading distributor of building products Nordic

region. Its three main product groups are HVAC, Electrical, and

Tools & Supplies.

CRH Europe Construction

Distribution 2 96 1,650 and Building Netherlands 100 4.12% 4.12% 5.1

CRH European Distribution is a leading regional distributor of

general building products in Germany, Netherlands, Belgium, France,

Switzerland and Austria. The Company specializes in the sale and

distribution of basic building materials and sanitary, heating

and plumbing products. CRH European Distribution was formed as

a subsidiary of CRH through a series of 53 acquisitions since

2004.

Hotels,

Gaming and United

Hotel Beds 3 95 1,808 Leisure Kingdom 91.9 4.42% 4.42% 4.7

HBG is the leading global B2B distributor of accommodation and

ancillary products to the world's travel trade. HBG contracts

directly with 180k hotels and other service providers (e.g. transfers,

excursions, tours, meetings, visa services) in over 180 countries

to provide Travel Operators (TOs), Travel agents (TAs) and Online

Travels agents (OTAs) with an inventory of hotel rooms and ancillary

travel services. HBG operates across four segments the largest

being the Bedbank division. HBG is #1 in the highly-fragmented

bedbank market.

Directly Held CLOs

The majority of the outstanding positions of Rollover Assets

were sold within the first quarter of 2020. As of 30 June 2021, the

market value of Rollover Assets had increased to EUR954,927 or

0.23% of NAV (31 December 2020: market value totalled EUR 549,437

or 0.13% of NAV). This increase is solely due to market

movements.

Subsequent to 30 June 2021, the Company disposed of the final

Rollover Assets, being 2 Mezzanine Notes, for a total consideration

of EUR1,411,355.

Regulatory Update

In Europe, the European Regulation on sustainability-related

disclosures in the financial services sector ("SFDR") was published

on 27 November 2019. With an effective date of 10 March 2021, SFDR

requires certain firms, including private banks, wealth managers

and advisers to comply with new rules on disclosure as regards

sustainable investments and sustainability risks. Asset managers,

including Blackstone Credit ("BX Credit") (formerly GSO Capital

Partners LP), have been working to implement procedures which will

allow us, where required, to comply with the SFDR when the

regulatory reporting requirements come into effect. BX Credit

continues to monitor regulatory developments with regards to SFDR,

including the publication of additional Regulatory Technical

Standards (which, with regards to the SFDR reporting requirements,

are now expected in July 2022, recently extended from January

2022).

In connection with the Securitisation Regulation, widely

anticipated secondary legislation setting out the prescribed form

of reporting templates was published on 3 September 2020 and use of

these reporting templates became mandatory to investors from 23

September 2020. BX Credit was well positioned to transition to the

use of these formal reporting templates, and these reporting

templates are used in respect of all in-scope CLOs.

Risk Management

Given the natural asymmetry of fixed income, our experienced

credit team focuses on truncating downside risk and avoiding

principal impairment and believes that the best way to control and

mitigate risk is by remaining disciplined in all market cycles and

by making careful credit decisions while maintaining adequate

diversification. BCF's portfolio is managed to minimise default

risk and credit related losses, which is achieved through in-depth

fundamental credit analysis and diversified portfolios in order to

avoid the risk of any one issuer or industry adversely impacting

overall performance. As outlined in the Portfolio Update section,

BCF is broadly diversified across issuers, industries, and

countries.

BCF's base currency is denominated in Euro, though investments

are also made and realised in other currencies. Changes in rates of

exchange may have an adverse effect on the value, price, or income

of the investments of BCF. BCF may utilise different financial

instruments to seek to hedge against declines in the value of its

positions as a result of changes in currency exchange rates.

Through the construction of solid credit portfolios and our

emphasis on risk management, capital preservation, and fundamental

credit research, we believe the Company's investment strategy will

continue to be successful.

Blackstone Responsible Investing Approach

The Importance of Responsible Investing

For over 35 years, Blackstone has been committed to being a

responsible investor. This commitment is affirmed across the

organisation and guides our approach to investing. We believe that

adequate consideration of environmental, social, and governance

("ESG") factors for each potential investment enhances our

assessment of risk and also helps us identify opportunities for

transformation at each company where we invest. Consequently, we

believe that a comprehensive ESG program drives value and enhances

returns. We also believe that understanding ESG factors helps us

understand trends and how they will shape demand and markets in

years to come. Our framework applies to all investment

opportunities, though the exact application of that framework

varies by asset class, investment objective and the unique

characteristics of each investment.

Objectives

Blackstone's responsible investing objectives are outlined

below:

-- Integration

Consider environmental, social, and governance issues when

evaluating investment opportunities and when managing / monitoring

portfolios and assets. Pursue high-quality sources of ESG data and

intelligence; where appropriate, integrate that data into our

research process and also use that data to enhance our

understanding of markets and consumer trends. Actively use ESG

considerations to transform our portfolio companies in ways that

both manage risk and are value accretive for our investment

portfolios. In addition, integrate ESG considerations into our

business practices outside of the investment process.

-- Engagement

Work together with our portfolio entities, managers, transaction

partners, peers, and other partners to advance principles of

responsible investment and corporate social responsibility. Share

our ESG philosophy broadly and use our leadership position to

influence others and advance the dialogue of the importance of ESG

integration in finance and for corporate actors generally.

-- Reporting

Be transparent with our investors and other stakeholders about

Blackstone's responsible investing initiatives, successes, and

goals.

Approach and Responsibilities

Across all of Blackstone's businesses, ESG is core to what we

do. Our approach includes an evaluation of ESG considerations (pre-

and post-investment decision making) as a standard part of the

investment and the asset / portfolio management processes. Primary

responsibility lies with our investment teams because these

considerations support investment decisions. Together with

Portfolio Operations and our asset management teams, the investment

teams are also expected to continue to keep these issues front of

mind through the life of the investment.

Blackstone's Chief Sustainability Officer supports the

investment and asset management teams by driving initiatives that

are aimed at improving operational and environmental performance

across the portfolio. Other functional experts within Portfolio

Operations (including Talent Management, Procurement and Healthcare

Cost Containment) may consider ESG insights in delivering operating

intervention capabilities across the portfolio.

Blackstone's ESG Steering Committee coordinates ESG initiatives

across the firm to ensure consistency in approach and, with the

assistance of the Legal & Compliance department, compliance

with Blackstone's ESG policy. Additionally, BXC has an ESG Working

Group that meets monthly and discusses a variety of ESG-related

topics, including, as applicable: review of investments, investor

requests, market trends and newly adopted or pending legislation,

rules, and regulation, and revisions and/or amendments to BXC ESG

Policy. Below is a visual of Blackstone's ESG leadership and

integrated team approach.

[Graphs and charts are included in the published Half Yearly

Financial Report which is available on the Company's website at

https://www.blackstone.com/fund/bglfln-blackstone-gso-loan-financing-limited/]

Blackstone Credit's Commitment to ESG

BX Credit's focus on ESG stems from our commitment to prudent

investing and our culture that prioritizes robust corporate

governance. Our investment team understands Blackstone's focus on

corporate governance, including ESG, and that appreciation is

reflected in the investments we make and how we engage with our

portfolio companies after an investment is made. Review of ESG

risks to investment performance is integrated into BX Credit's

investment analysis and decision-making processes from

pre-investment diligence to post-investment monitoring.

BX Credit recognises the value that incorporating ESG factors in

our investment research creates both in terms of mitigating risk

and enhancing long-term performance across our various investments.

To that end, BX Credit integrates review and consideration of

applicable ESG factors into its decision-making processes, as

summarized below:

Comprehensive Due Diligence

Investment teams within BX Credit consider ESG factors that may

impact investment performance during the due diligence phase of an

investment. ESG due diligence will vary based on (i) the nature of

BX Credit's investment, (ii) the transaction process and timeline,

(iii) the level of access to information, specifically as it

pertains to ESG factors, and (iv) the target portfolio company's

(the "Target") sector or business model. Investment teams will

engage with target companies, sponsor partners, and review publicly

available information to develop insights into the Target's

business and operations. External ESG experts and legal counsel may

also be engaged, as necessary. In 2020, BX Credit worked with a

third party ESG consulting firm to create a sector-specific tool

based on the Sustainability Accounting Standards Board ("SASB")

that provides a framework to conduct ESG due diligence . The

proprietary tool helps our teams identify the most material ESG

risks that may impact a company's performance, so that we are able

to focus our diligence on assessing these risks in a more targeted

fashion. The tool includes industry-specific due diligence

questions, KPIs to track,

detailed guidance on considerations for evaluating the topic and

resources for additional research. We will then compare the

findings from our proprietary ESG research with the ESG due

diligence from a sponsor partner (if applicable).

Investment Committee Engagement and Documentation

Material ESG considerations and risks arising from diligence are

described in the appropriate investment committee materials and

discussed in the relevant investment committee forum. If material

ESG risks are identified, BX Credit may seek to remedy the

situation via additional due diligence, the hiring of specialist

advisors, further discussions with company management or decide not

to move forward with the investment.

Active Post-Investment Monitoring

On an ongoing basis, investment teams monitor the performance of

BX Credit's investments, which includes, but is not limited to,

assessing financial, operational, industry-specific and ESG-related

factors, as applicable. Periodically, BX Credit investment teams

will update the investment committee on the performance of issuers

and highlight any material ESG considerations or risks that warrant

investment committee discussion, both in the context of the

company's industry and on a stand-alone basis.

As a credit investor, BX Credit will have less control over

portfolio companies than equity investors; however, we may seek to

reinforce certain aspects of value-enhancing ESG compliance through

contractual obligations and covenants in governing agreements with

portfolio companies. Underwriting due diligence includes among

other things, material environmental, public health, safety, social

and governance issues associated with lending to a company.

At this time, BX Credit does not explicitly track exposure to

climate risk or monitor the carbon footprint of an investment. In

practice, we take the ESG factors that may impact investment

performance into consideration and incorporate such factors into

our initial evaluation of an investment and our ongoing investment

monitoring process. Our evaluation criteria are based on the

materiality of the ESG risk considering (a) whether it has a

current impact or a potential future impact and (b) any mitigating

actions the issuer undertakes to address the risk. In general,

industries with a high carbon footprint face significant transition

risk with regard to climate change, and that risk would need to be

evaluated before making an investment decision.

Blackstone Ireland Limited

21 September 2021

(8) Credit Suisse Leveraged Loan Index, Credit Suisse Western

European Leveraged Loan Index (Hedged to Euro), as of 30 June

2021.

(9) Credit Suisse Default Report, as of 30 June 2021.

(10) Based on mark to model modified bid prices as of the most

recent month end prior to the transaction trade date and mark to

market bid prices as of the day prior to transaction date. Modelled

marks are only available on a mid basis, therefore a modified bid

is calculated by incorporating the basis between mark to market bid

and mid prices.

(11) Blackstone Credit, Intex. As at 7 January 2021.

(12) Credit Suisse, as of 30 June 2021.

(13) Credit Suisse, as of 30 June 2021.

(14) J.P. Morgan, Moody's, S&P Upgrades vs. Downgrades and

LCD LLI Industry Weights and Total Returns, as of 30 June 2021.

(15) S&P LCD, as of 30 June 2021.

(16) Credit Suisse, as of 30 June 2021.

(17) Credit Suisse, as of 30 June 2021.

(18) As reported by S&P LCD during 1H 2021.

(19) S&P LCD CLO databank, as of 30 June 2021.

(20) Barclays, as of 30 June 2021. Data reflects generic

top-tier manager CLO discount margins from longer reinvestment

period CLOs.

(21) Barclays, as of 30 June 2021. Data reflects generic

top-tier manager CLO discount margins from longer reinvestment

period CLOs.

(22) Paragraph data source: Barclays, as of 30 June 2021. Data

reflects median observations. Data as of latest trustee reports at

month-end, including only reinvesting deals. Underlying data from

Kanerai, Intex, Markit.

(23) Paragraph data source: Barclays, as of 30 June 2021. Data

reflects median observations. Data as of latest trustee reports at

month-end, including only reinvesting deals. Underlying data from

Kanerai, Intex, Markit.

(24) Barclays, as of 16 July 2021.

(25) Barclays, as of 16 July 2021.

(26) Investment in Tallman park was through a vertical retention

position financed by a repurchase agreement. BCF owns 5% of each

tranche, including equity.

(27) As reported by Creditflux and S&P LCD.

(28) Creditflux.

(29) Based on mark to model modified bid prices as of the most

recent month end prior to the transaction trade date and mark to

market bid prices as of the day prior to transaction date. Modelled

marks are only available on a mid basis, therefore a modified bid

is calculated by incorporating the basis between mark to market bid

and mid prices.

(30) Realised IRRs are reflective of distributions made to

equity holders to date based on data available on Intex as of 7

July 2021. Stratus 2020-2 equity will be fully redeemed once all

accrued interest been received and distributed.

(31) US CLO securities held by BCF are almost exclusively CLO

income notes except for Tallman Park senior debt securities (part

of the vertical retention investment).

(32) Portfolio percentages are based on BCF NAV as of 30 June

2021 and 31 December 2020.

Strategic Overview

Purpose

As an investment company, our purpose is to provide permanent

capital to BCF, a company established by Blackstone Ireland Limited

("BIL") (formerly Blackstone/GSO Debt Funds Management Europe

Limited) as part of its loan financing programme, with a view to

generating stable and growing total returns for Shareholders

through dividends and value growth.

We deliver our purpose through working in line with our values,

which form the backbone of what the Company does and are an

important part of our culture.

Values

Integrity and Trust - The Board seeks to act with integrity in

everything it does and to be trustworthy. The Directors seek to

uphold the highest standards of professionalism driven by our

corporate governance processes.

Transparency - The Board aims to ensure all of the Company's

activities are undertaken with the utmost transparency and openness

to sustain trust.

Opportunity - The ability of the Board to identify and seize

opportunities which are in the best interests of our

shareholders.

Sustainability - The Company aims to maintain and deliver

attractive and sustainable returns for its shareholders.

Principal Activities

The Company was incorporated on 30 April 2014 as a closed-ended

investment company limited by shares under the laws of Jersey and

is authorised as a listed fund under the Collective Investment

Funds (Jersey) Law 1988. The Company continues to be registered and

domiciled in Jersey. The Company's Ordinary Shares are quoted on

the Premium Segment of the Main Market of the LSE.

The Company's share capital consists of an unlimited number of

shares of any class. As at 30 June 2021, the Company's issued share

capital was 469,787,075(33) Ordinary Shares. The Company also held

13,115,719(34) (31 December 2020: 5,879,463) ordinary shares in

treasury.

The Company has a wholly-owned Luxemburg subsidiary, Blackstone

/ GSO Loan Financing (Luxembourg) S. à r.l. which has an issued

share capital of 2,000,000 Class A shares and 1 Class B share. All

of the Class A and Class B shares were held by the Company as at 30

June 2021 together with 275,438,217 class B CSWs issued by the Lux

Subsidiary. The Lux Subsidiary invests in PPNs issued by BCF, which

in turn invests in CLOs and loans. As at 30 June 2021, the Company

also held CLO Mezzanine Notes which formed part of the Rollover

Assets. These were subsequently disposed of on 8 September

2021.

The Company is a self-managed company. BIL acts as Portfolio

Adviser to the Company and, pursuant to the Advisory Agreement,

provides advice and assistance to the Company in connection with

its investment in the CSWs. Blackstone Liquid Credit Strategies LLC

("BLCS") (formerly GSO/Blackstone Debt Funds Management LLC) acts

as Portfolio Manager in relation to the Rollover Assets (as defined

in the Company's Prospectus published on 23 November 2018). BNP

Paribas Securities Services S.C.A., Jersey Branch acts as

Administrator, Company Secretary, Custodian and Depositary to the

Company.

Directors' Interests

The Directors held the following number of Ordinary Shares in

the Company as at the period end and the date these condensed

financial statements were approved:

Shares Type As at 30 June As at 31 December

2021 2020

Charlotte Valeur Ordinary 11,500 11,500

Gary Clark Ordinary 168,200 168,200

Heather MacCallum Ordinary - -

Mark Moffat Ordinary 771,593 771,593

Steven Wilderspin Ordinary 20,000 20,000

------------------ --------- ------------- -----------------

Investment Objective

As outlined in the Company's Prospectus, the Company's

investment objective is to provide Shareholders with stable and

growing income returns, and to grow the capital value of the

investment portfolio by exposure to floating rate senior secured

loans and bonds directly and indirectly through CLO Securities and

investments in Loan Warehouses. The Company seeks to achieve its

investment objective through exposure (directly or indirectly) to

one or more companies or entities established from time to time

("Underlying Companies"), such as BCF.

Investment Policy

Overview

As outlined in the Company's Prospectus, the Company's

investment policy is to invest (directly, or indirectly through one

or more Underlying Companies) in a diverse portfolio of senior

secured loans (including broadly syndicated, middle market or other

loans) (such investments being made by the Underlying Companies

directly or through investments in Loan Warehouses), bonds and CLO

Securities, and generate attractive risk-adjusted returns from such

portfolios. The Company intends to pursue its investment policy by

investing (through one or more subsidiaries) in profit

participating instruments (or similar securities) issued by one or

more Underlying Companies.

Each Underlying Company will use the proceeds from the issue of

the profit participating instruments (or similar securities),

together with the proceeds from other funding or financing

arrangements it has in place currently or may have in the future,

to invest in: (i) senior secured loans, bonds, CLO Securities and

Loan Warehouses; or (ii) other Underlying Companies which,

themselves, invest in senior secured loans, bonds, CLO Securities

and Loan Warehouses. The Underlying Companies may invest in

European or US senior secured loans, bonds, CLO Securities, Loan

Warehouses and other assets in accordance with the investment

policy of the Underlying Companies. Investments in Loan Warehouses,

which are generally expected to be subordinated to senior finance

provided by third-party banks, will typically be in the form of an

obligation to purchase preference shares or a subordinated loan.

There is no limit on the maximum US or European exposure. The

Underlying Companies do not invest substantially directly in senior

secured loans or bonds domiciled outside North America or Western

Europe.

Investment Limits and Risk Diversification

The Company's investment strategy is to implement its investment

policy by investing directly or indirectly through the Underlying

Companies, in a portfolio of senior secured loans and bonds or in

Loan Warehouses containing senior secured loans and bonds and, in

connection with such strategy, to own debt and equity tranches of

CLOs and, in the case of European CLOs and certain US CLOs, to be

the risk retention provider in each.

The Underlying Companies may periodically securitise a portion

of the loans, or a Loan Warehouse in which they invest, into CLOs

which may be managed either by such Underlying Company itself, by

BIL or DFM (or one of their affiliates), in their capacity as the

CLO Manager.

Where compliance with the European Risk Retention Requirements

is sought (which may include both EUR and US CLOs) the Underlying

Companies will retain exposures of each CLO, which may be held

as:

-- CLO Income Notes equal to: (i) between 51% and 100% of the

CLO Income Notes issued by each such CLO in the case of European

CLOs; or (ii) CLO Income Notes representing at least 5% of the

credit risk relating to the assets collateralising the CLO in the

case of US CLOs (each of (i) and (ii), (the "horizontal strip");

or

-- Not less than 5% of the principal amount of each of the

tranches of CLO Securities in each such CLO (the "vertical

strip").

To the extent attributable to the Company, the value of the CLO

Income Notes retained by Underlying Companies in any CLO will not

exceed 25% of the Published NAV of the Company at the time of

investment.

Investments in CLO Income Notes and loan warehouses are highly

leveraged. Gains and losses relating to underlying senior secured