TIDMAVO

RNS Number : 2447B

Advanced Oncotherapy PLC

31 May 2023

31 May 2023

ADVANCED ONCOTHERAPY PLC

("Advanced Oncotherapy", "AVO" or the "Company")

Partial conversion of Convertible Notes

Update on financing discussions

Further issue under Secured Convertible Note Facility

Advanced Oncotherapy (AIM: AVO), the developer of

next-generation proton therapy systems for cancer treatment,

announces that it has received a conversion notice for a portion of

the convertible notes, which were issued to a French counterparty,

as announced on 1 March 2023, into new ordinary shares of 25p each

in the share capital of the Company ("Ordinary Shares"). Further

details of the conversion are set out below:

-- Number of convertible notes converted: 10

-- Total value of the convertible notes being converted: GBP50,000

-- Conversion price: GBP0.25 being the higher of 90% of the

lowest daily VWAP in 15 days preceding conversion notice of

GBP0.0523854 or the nominal value of GBP0.25

-- Number of new Ordinary Shares issued from the conversion: 200,000

As set out in the Company's announcement on 1 March 2023, if the

conversion price is below the nominal value of the Ordinary Shares,

the Company shall pay the noteholder a conversion fee calculated to

compensate for the difference, which may be settled through the

issue of new Ordinary Shares or cash. As such, a conversion fee of

GBP56,702 (the "Conversion Fee") is to be paid. The Conversion Fee

will be settled through the issuance of 756,020 new Ordinary

Shares.

Application will be made for admission of the 200,000 new

Ordinary Shares deriving from the conversion of the convertible

notes and the 756,020 new Ordinary Shares in satisfaction of the

Conversion Fee to trading on AIM ("Admission") and it is expected

that Admission will occur on or around 6 June 2023.

Update on financing discussions

Advanced Oncotherapy's Board continues to consider financing

options that are in the best interests of the Company and its

shareholders and, since the announcement made by the Company on 5

May 2023, has taken steps to manage its working capital, including

through further cost reductions and managing of existing creditors

which will extend the Company's cash runway into June 2023. In

respect of further financing options being explored, the Company is

in discussions to raise further funding under the secured loan note

agreement as well as through other non-dilutive financing options

and the board is hopeful of securing additional financing during

June 2023. Whilst the Board is optimistic of a satisfactory outcome

on the financing options being explored, there ca n be no certainty

that these discussions will be successful, nor to the terms or

timing thereof.

Further announcements will be made with regards to financing at

the appropriate time.

Further issue under secured convertible loan note agreement

Further to the Company's announcements released on 1 March 2023

and 5 May 2023, the Company has issued convertible notes totalling

GBP34,600 under its secured convertible loan note agreement (the

"Secured Convertible Note") in settlement of amounts the Company

owed to an existing supplier.

This brings the total amount of Secured Convertible Notes to

GBP6,379,725.

As announced on 1 March 2023, the key terms of the Secured

Convertible Note are as set out in the table below:

Maturity Date 9 months from the date of the secured convertible

loan note agreement

Conversion Option to convert prior to the Maturity Date

at 20% discount to the next equity fund raising

of the Company

-----------------------------------------------------

Interest Rate Fixed interest of 1.25% per month until the earliest

of the full redemption or the conversion of the

loan

-----------------------------------------------------

Revenue share The Operator of the Harley Street Centre shall

entitlement pay to the Lenders a pro rata portion of the

for the Harley revenue generated by the Proton Therapy machine

Street machine which is to be installed in Harley Street. The

total revenue amount will be capped at GBP2.5

million per annum and the portion each Lender

will receive will be calculated on a pro rata

basis according to each Lender's loan amount

of the total Secured Convertible Note. The first

payment shall be made at the end of the first

full calendar year of operations of the proton

centre located on Harley Street (London, UK).

An annual payment shall be made for 10 consecutive

years. Even if the Secured Convertible Note is

redeemed prior to the maturity date or converted

into Ordinary Shares, the revenue share entitlement

will continue for the full 10 years.

-----------------------------------------------------

A summary of the other material terms of the Secured Convertible

Note is set out in the Appendix of this announcement.

Total voting rights

Following Admission, the Company's enlarged issued share capital

will comprise 538,437,229 Ordinary Shares, with voting rights. The

Company does not hold any Ordinary Shares in treasury. Therefore,

the total number of Ordinary Shares in the Company with voting

rights will be 538,437,229. This figure may be used by shareholders

in the Company as the denominator for the calculations by which

they will determine if they are required to notify their interest

in, or a change in their interest in, the share capital of the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Rule 2.9 disclosure

In accordance with Rule 2.9 of the Takeover Code, AVO confirms

that, following the receipt of funds under the Secured Convertible

Note , it now has 6,379,725 senior secured fixed rate convertible

loan notes ("Loan Notes") in issue (as at today's date), which have

a maturity date of 11 January 2024 and are convertible into

ordinary shares of 25p each in the Company at a conversion price

representing a 20% discount to the next equity fund raising

undertaken by the Company. The Loan Notes pay an interest rate of

1.25% per month and includes a revenue sharing agreement with

Harley Street Centre.

AVO also confirms that as at the close of business on 30 May

2023 its issued share capital consisted of 537,481,209 ordinary

shares of 25 pence each. The International Securities

Identification Number for the Company's ordinary shares is

GB00BD6SX109.

Advanced Oncotherapy plc www.avoplc.com

Dr. Michael Sinclair, Executive Tel: +44 (0) 20 3617

Chairman 8728

Nicolas Serandour, CEO

WH Ireland Limited (Financial Tel: +44 (0) 20 7220

adviser) 1666

Antonio Bossi / James Bavister AVOPLC@whirelandcm.com

Allenby Capital Limited (Nomad

and Joint Broker)

Nick Athanas / Piers Shimwell (Corporate Tel: +44 (0) 20 3328

Finance) 5656

Amrit Nahal / Matt Butlin (Sales

& Corporate Broking)

SI Capital Ltd (Joint Broker)

Nick Emerson Tel: +44 (0) 1483 413

500

Jon Levinson Tel: +44 (0) 20 3871

4066

About Advanced Oncotherapy Plc www.avoplc.com

Advanced Oncotherapy, a UK headquartered company with offices in

London, Geneva, The Netherlands and in the USA, is a provider of

particle therapy with protons that harnesses the best in modern

technology. Advanced Oncotherapy's team "ADAM," based in Geneva,

focuses on the development of a proprietary proton accelerator

called, Linac Image Guided Hadron Technology (LIGHT). LIGHT's

compact configuration delivers proton beams in a way that

facilitates greater precision and electronic control.

Advanced Oncotherapy will offer healthcare providers affordable

systems that will enable them to treat cancer with innovative

technology as well as expected lower treatment-related side

effects.

Advanced Oncotherapy continually monitors the market for any

emerging improvements in delivering proton therapy and actively

seeks working relationships with providers of these innovative

technologies. Through these relationships, the Company will remain

the prime provider of an innovative and cost-effective system for

particle therapy with protons.

Appendix

Secured Convertible Note

Financing Secured interest-bearing convertible facility

instrument

Principal Up to GBP15 million

---------------------------------------------------

Maturity 9 months from the date of the secured convertible

Date loan note agreement

---------------------------------------------------

Conversion Option to convert prior to the Maturity Date

at 20% discount to the next equity fund raising

of the Company

---------------------------------------------------

Interest Fixed interest of 1.25% per month until the

Rate earliest of the full redemption or the conversion

of the loan

---------------------------------------------------

Revenue share The Operator of the Harley Street Centre

entitlement shall pay to the Lenders a pro rata portion

for the Harley of the revenue the Operator will receive

Street machine from the Proton Therapy machine which is

to be installed in Harley Street. The total

revenue amount will be capped at GBP2.5 million

per annum and the portion each Lender will

receive will be calculated on a pro rata

basis according to each Lender's loan amount

of the total Secured Convertible Note. The

first payment shall be made at the end of

the first full calendar year of operations

of the proton centre located on Harley Street

(London, UK). An annual payment shall be

made for 10 consecutive years. Even if the

Secured Convertible Note is redeemed prior

to the maturity date or converted into Ordinary

Shares, the revenue share entitlement will

continue for the full 10 years.

---------------------------------------------------

Security Secured against the same assets as the existing

facilities in place with Nerano Pharma Ltd,

on a pari passu basis, such as the LIGHT

components being built in Daresbury and Geneva,

associated intellectual property and the

property at Harley St.

---------------------------------------------------

Assignment All transfers and assignments are subject

and transfer to the Lender receiving the Company's prior

by the Lender consent not to be unreasonably withheld.

Such proposed transfer or assignment will

not be permitted when the proposed transferee

or assignee is a person whose principal business

or material activity is investing in distressed

debt or the purchase of loans or other debt

securities with the intention of (or view

to) owning the equity (loan to own) or gaining

control of a business or exploiting holdout

or blocking positions.

---------------------------------------------------

AOB In the event other investors wish to subscribe

to this instrument up to a maximum aggregated

amount of GBP15 million those investors would

benefit from the same terms as detailed above,

notably in relation to the interest rate

and (on a pro rata basis) the security package

and revenue share entitlement.

Any subscription under the Secured Convertible

Note is subject to the consent of the Lenders

and Nerano Pharma Ltd ("Nerano") and disclosure

to the Lenders and Nerano of the identity

of such new subscriber.

---------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDNKDBPABKDAPN

(END) Dow Jones Newswires

May 31, 2023 12:57 ET (16:57 GMT)

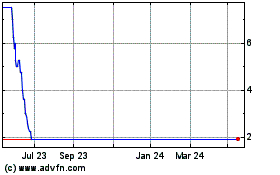

Advanced Oncotherapy (LSE:AVO)

Historical Stock Chart

From Oct 2024 to Nov 2024

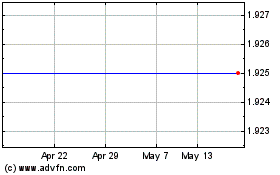

Advanced Oncotherapy (LSE:AVO)

Historical Stock Chart

From Nov 2023 to Nov 2024