TIDMAURR

RNS Number : 1628Q

Aurora Russia Limited

14 October 2011

14 October 2011

Aurora Russia Limited

Trading Update

Aurora Russia Limited ("Aurora Russia" or "the Company")

announces a trading update ahead of its interim results for the six

months ended 30 September 2011 which are expected to be released in

mid December.

Strategy

As announced on 5 August 2011, the Board is committed to a clear

exit strategy for its investments and focusing on realising value

from what is a mature portfolio. Three investments are considered

to be potential IPO candidates and this option is being actively

pursued, alongside a potential trade sale of each.

An exit strategy has been put in place for each investment on a

two year time horizon, with a goal of realising, on balance, at

least the current NAV from the portfolio. The Board believes that

the current NAV reflects a realistic assessment of the potential

value within the investments that could be realised on a two year

timeframe.

The Company and the Manager have been engaged in discussions

with market participants in London, Moscow and recently visited

Warsaw to discuss the potential IPO of the three investee companies

deemed substantial enough to be viable IPO candidates. Although the

recent turmoil in the market has put most IPOs on hold, there is

significant interest in each of the investee companies and we will

continue to pursue discussions regarding this route to exit. The

Company would expect to have more substantive news in this regard

early in the New Year.

The Manager

The Company's engagement of the Manager now falls under the

remit of the Management Engagement Committee and will be formally

reviewed from time to time alongside all service providers as part

of the committee's work.

The Manager is supportive of the Company strategy regarding its

two year timeframe in which to exit the Company's investments. The

work now being undertaken by the Manager in this regard is building

on work that was already taking place under the realisation

strategy in place since last year's AGM.

Portfolio company update and progress on realisation

strategy

Each of the Company's investments continues to make progress.

Particularly pleasing is the rapid growth of OSG, Superstroy and

Unistream.

Future quarterly reporting on the investee companies will follow

the format below, with figures from OSG, as an international

business, reported in sterling, whilst updates from other

businesses will be in Russian roubles to give a clear picture of

their underlying operations. In the six months to 30 September 2011

the Russian rouble weakened by 9.8% against sterling and thus the

translation of the figures below into sterling would reduce the

growth of Superstroy and Unistream, but nonetheless have shown

significant growth in the period.

OSG

Aug YTD Aug YTD

GBPm 2010 2011 %

Revenue 8.6 11.4 34

EBITDA 1.0 1.3 30

EBITDA Margin 12% 12%

For the first 8 months of 2011 OSG had 34% growth in revenues

from GBP8.6 million for the same period in 2010 to GBP11.4 million

in 2011. EBITDA has grown by 30% over the same period from GBP1

million to GBP1.3 million. As with many companies in Russia, OSG

generally has a stronger second half of the year and management is

confident that in 2011 this will remain the case.

As of the end of August OSG had 2.9 million boxes in storage

with racked storage capacity utilization at c.80%. Net Debt of the

company stood at GBP4.1million.

The fact that OSG has the number one position in Russia, a

country only beginning to scratch the surface of the potential

market for third party document storage, makes its strategic

position potentially attractive for a trade buyer, but equally the

transparency of its model and its potential for growth would make

an IPO an eminently viable alternative once stock market investor

appetite returns.

Superstroy

Aug YTD Aug YTD

RURb 2010 2011 %

Revenue 4.29 5.66 32

EBITDA 0.08 0.01 Neg

EBITDA Margin 2% 0%

For the first 8 months of 2011 Superstroy had 32% growth in

revenues from RUR4.29 billion for the same period in 2010 to

RUR5.66 billion in 2011 with like-for-like growth of 17%. YTD

EBITDA is close to zero due to substantial pre-opening costs

relating to the opening of its largest hypermarket in April.

Adjusted for these pre-opening costs YTD EBITDA was RUR73 million.

For DIY sales in Russia August usually is a peak month due to

strong seasonality and, not surprisingly, Superstroy's August

EBITDA margin reached 5% helping it to offset negative EBITDA it

accumulated in 1H. It is expected that in the September-December

period Superstroy will continue generating positive EBITDA.

Aurora Russia, in conjunction with the other investors in

Superstroy, is looking at all potential routes to exit. Exposure to

Russian retail is sought after by both trade buyers and investors,

and hence the Company is examining a variety of potential paths to

exit.

Unistream

Aug YTD Aug YTD

RURb 2010 2011 %

Volumes 72.0 84.8 18

Revenue 1.31 1.47 12

Op Income 0.59 0.73

Profit before tax 45% 50%

(PBT) -0.04 0.07

PBT Margin -3.2% 4.5% 23

Unistream's volumes grew 18% in the first 8 months of 2011 YoY

from RUR72 billion to RUR84.8 billion. Total revenues were RUR1.47

billion increasing 12% compared to the prior year period.

Unistream's operating profit grew by 23% YoY driven by the growth

of volumes though its own points of sale which therefore reduced

the payment of commissions to counterparties. Growth of income from

FX operations was 37% YoY. For the first 8 months of the year the

company produced profit before tax of RUR70 million versus an

operating loss of RUR40 million in the same period of last

year.

Since it began its loyalty card programme a year ago, Unistream

has distributed c. 900,000 loyalty cards. Amongst other

information, each loyalty card customer provides Unistream with a

mobile phone number so that the company can send a text message

informing the sender when a recipient has picked up a transfer. The

data collected through the loyalty card programme gives the company

valuable customer information which will assist the company in

adding supplementary revenue streams.

With the global financial system currently under scrutiny the

exit of Unistream will require the business to overcome the

scepticism of investors towards financial businesses. Nevertheless,

its continued good growth and increasing depth of customer

relationship through its loyalty card should ensure a better

reception than most financial businesses in the current

climate.

Flexinvest Bank and Kreditmart

Assets 31 Dec 31 Aug

RURm 2010 2011

Net Loans 364 334

Goodwill 128 128

Cash 213 104

Other Assets 104 90

Bonds 52 150

Total Assets 861 806

As at 31 August 2011, Flexinvest and Kreditmart had total assets

of RUR806 million. Of this, the net loan book accounted for RUR334

million and is sufficiently reserved with RUR40 million of

provisions. RUR150 million is invested in liquid Russian blue-chip

bonds such as Russian Railways, Gazprom, AHML, State owned

Rosselkhozbank and City of Moscow yielding on average 5.9% YTM.

Flexinvest continued to make progress in implementing its new

credit card and deposit products strategy. Since the last update,

the bank issued its first cards to some employees for tests. Also,

it has recently launched a deposit marketing campaign to attract

deposits from the bank's neighborhood. As of September 15 the bank

had collected RUR3.6 million in deposits as a result of this

action.

The bank's web site has been redesigned and the new site went

live in early October. In addition to the new brand and product

information updates, it has an electronic application form which

allows customers to submit their applications online and also,

allow the bank to start advertising on the internet.

Aurora Russia is seeking as cost effective a way as possible to

exit the loss-making business of Kreditmart and a strategy for exit

from Flexinvest will be spelt out to the market early in 2012, once

the initial results of the neighborhood bank initiative are

known.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTEXLFFFBFEFBK

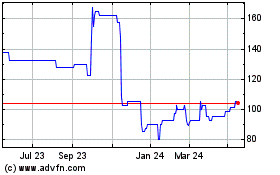

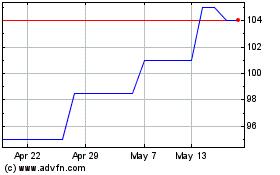

Aurrigo (LSE:AURR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Aurrigo (LSE:AURR)

Historical Stock Chart

From Jul 2023 to Jul 2024