TIDMAURA

RNS Number : 3944D

Aura Energy Limited

19 October 2022

19 October 2022

Aura Continues to Advance Tiris Uranium Project

KEY POINTS:

-- Tiris Resource Upgrade drilling and logging program is now

complete, with final results expected in December.

-- This represents a key milestone in pursuit of Aura's

objective to upgrade the Inferred resource to Measured and

Indicated ("M&I") categories.

-- Engineering and test work continues to confirm the Tiris flow

sheet for an initial 800,000 lb/pa, including capital and operating

cost estimates.

-- Formalisation of Tiris shareholder and government

arrangements with our hosts in Mauritania is imminent.

-- The Company is also progressing discussions regarding offtake

and financing opportunities for Tiris.

Aura Energy Limited (ASX: AEE, AIM: AURA) ("Aura", "the

Company") is pleased to announce the completion of air core

drilling at the Tiris Uranium Project ("Tiris" or the "Project") in

Mauritania, and the progress of the key 2022 milestones for the

Company towards the delivery of near-term Phase 1 uranium oxide

production.

Aura's primary objective in CY2022 was the 10,000-metre infill

drilling program to upgrade our Inferred resources of 26.3m lbs at

100ppm U(3) O(8) cut-off within Tiris East into Measured or

Indicated status, and to identify further exploration targets

within the tenure (please see ASX and AIM Announcement 19 April

2022). The drilling milestone is now complete, with the program

designed to provide the basis for growing the Project, which

already demonstrates low capital and low operating cost metrics,

and to underpin the potential for expansion to 2-4 Mlbs U(3) O(8)

pa.

The drilling and logging programme in Mauritania is now

successfully complete and validation samples have been delivered to

ALS Ireland and ANSTO Minerals, Australia. Final Resource modelling

results will be available once these validation results have been

received by the Company. An updated resource estimate is expected

before the end of 2022.

Aura's Chief Operating Officer, Dr Will Goodall, commented:

"Completion of drilling as part of the Resource Upgrade Program

is a key milestone in developing Tiris, and it is aligned with our

objective to achieve uranium production by 2025.

Importantly, it also demonstrates clear progress on the path set

in Q1 of this year to rapidly develop Tiris and grow its value for

all our stakeholders, including the government and community, with

whom we continue to work very closely. Through Q4 CY 2022 we expect

to finalise key negotiations with the Mauritanian government, which

remains very supportive of Tiris.

The Company continues to work towards near-term uranium

production, and we look forward to providing our shareholders with

further updates as programs are finalised."

Aura's strategy to deliver near-term production from Tiris is

being driven by the global shift towards safe, low carbon energy

sources. This has led to an increased focus on nuclear power for

low emissions energy, which in turn has prompted a surge in uranium

prices. During 2022 uranium prices have risen dramatically, from

around US$30/lb to today's level near US$50/lb, representing an

increase of approximately 60%.

Uranium Resource Upgrade Program

Historically, conversion of Inferred resources to Measured

and/or Indicated category has occurred at a ratio of approximately

65% with infill drilling. Using new sampling techniques, the

Company has consistently discovered additional mineralisation when

drilling areas with high surface radiometric signature. Together,

and assuming this trend continues, our objective of having

identified sufficient U(3) O(8) resources to support a 2-4Mlbs pa

operation within 5 years should be achieved.

The 2021 Tiris Feasibility Study update demonstrated that Tiris

is a low capital and low operating cost project, with a simple,

proven flowsheet. The Project has first mover opportunity with a

capital estimate of US$74.8m and C1 operating cost of US$25.43/lb

U(3) O(8) .[1] During 2022, considerable progress has been achieved

in our engineering program with:

-- Pilot plant of ore upgrading confirming grade increases of

500-600% while retaining 90% of the uranium[2];

-- A new circuit is being developed, which will recover a

by-product vanadium pentoxide from our proposed 800klbs project,

with the expectation of operating cost savings[3], and

-- In June, DRA Global and its subsidiary, SENET were appointed

to undertake the Front-End Engineering Design Study for our

800,000lb U(3) O(8) pa initial project with Wallbridge Gilbert

Aztec and Adelaide Control Engineering designing the processing

circuit. [4]

Figure 1 shows the delivery pathway for key programs in

development of the Tiris project to its full potential.

Figure 1 Tiris Project Development Timeline

Based on the work outlined in Figure 1, a key pillar for a Final

Investment Decision (FID) is expected in Q1 CY 2023 and will also

provide cost estimates and indicative economic analysis for an

expansion to a target of between 2 and 4 million lbs U(3) O(8)

production per year.

Figure 2 - Drilling team on-site at the Tiris Project

Mauritanian government relations

A concession agreement is being negotiated with the Government

of Mauritania, to be signed by both the President and the Minister

of Mines outlining our commitment to the key steps involved in

project development, including the approval process steps, and

gives certainty in relation to tenure and Aura's expansion into a

regional uranium producer. It will also confirm all aspects of the

host government's fiscal regime for at least 30 years. Constructive

discussions have continued throughout 2022 and a formal agreement

is imminent.

In addition, the Mauritanian Government's ANARPAM Agency[5] will

hold a 15% Free Participation interest in earnings from Tiris[6].

The other characteristics of the Shareholders Agreement are now

being finalised.

Mauritania is a member state of the International Atomic Energy

Agency ("IAEA") and has a well-established Law on Nuclear Energy.

During September, Key Management Plans for authorisation of uranium

production and export from Tiris were submitted to Mauritania's

National Authority for Radioprotection, Safety and Nuclear Security

("ARSN") with approval for exports anticipated in mid-2023.

Table 1 - Tiris Uranium Project Global Resource Estimate

100 All 102.1 253 56.9 82 18.4

---------------- ----------- --------- --------- --------- --------

200 All 55.0 336 40.8 109 13.2

---------------- ----------- --------- --------- --------- --------

300 All 24.8 452 24.7 146 8.0

---------------- ----------- --------- --------- --------- --------

Table 2 - Tiris Resource Classification - Total,

Feb 2022

100 Measured 10.2 235.7 5.3 76.4 1.7

--------

Indicated 29.0 222.1 14.2 72.0 4.6

-------------- ----------- -------- ---------------- ------ --------

Total

M&I 39.2 226 19.5 73 6.3

-------------- ----------- -------- ---------------- ------ --------

Inferred 62.9 270 37.4 87 12.1

-------------- ----------- -------- ---------------- ------ --------

200 Measured 4.6 355.0 3.6 115.0 1.2

-------------- ----------- -------- ---------------- ------ --------

Indicated 12.8 315.4 8.9 102.2 2.9

-------------- ----------- -------- ---------------- ------ --------

Total

M&I 17.4 326 12.5 106 4.1

-------------- ----------- -------- ---------------- ------ --------

Inferred 37.6 678.4 28.3 219.8 9.2

-------------- ----------- -------- ---------------- ------ --------

300 Measured 2.1 496.8 2.3 161.0 0.7

-------------- ----------- -------- ---------------- ------ --------

Indicated 4.7 453.6 4.7 147.0 1.5

-------------- ----------- -------- ---------------- ------ --------

Total

M&I 6.8 467 7.0 151 2.3

-------------- ----------- -------- ---------------- ------ --------

Inferred 18.0 881.2 17.7 285.5 5.7

-------------- ----------- -------- ---------------- ------ --------

This ASX Release as authorised by the Aura Energy Board of

Directors.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

For Further Information, please contact:

David Woodall Jane Morgan

Managing Director and CEO JMM

Aura Energy Limited Investor & Media Relations

info@auraenergy.com.au info@janemorganmanagement.com.au

+61 405 555 618

SP Angel Corporate Finance LLP WH Ireland Limited

(Nominated Advisor and Joint (Joint Broker)

Broker) Jessica Cave

David Hignell Andrew de Andrade

Kasia Brzozowska +44 (0) 207 220 1666

+44 (0) 203 470 0470

About Aura Energy (ASX:AEE, AIM:AURA)

Aura Energy is an Australian-based minerals company with

major uranium and polymetallic projects with large resources

in Africa and Europe. The Company is principally focused

on initial uranium production at its Tiris Uranium Project,

an evolving major greenfields uranium discovery in Mauritania,

with Aura announcing a Resource Upgrade in August 2021,

bringing the total JORC Resource to 56 Mlbs (at a 100 ppm

U(3) O(8) lower cut-off grade).

Aura also completed a 2021 capital estimate update for

the Tiris Definitive Feasibility Study, to reflect current

global pricing, reconfirming Tiris as one of the lowest

capex, lowest operating cost uranium projects slated for

development.

In October 2021, the Company entered a US$10m Offtake Financing

Agreement with Curzon, which includes an additional up

to US$10m facility, bringing the maximum available under

the agreement to US$20m.

In 2022, Aura will continue to transition from an advanced

uranium explorer to uranium producer, to capitalise on

the growing appetite for nuclear power as a critical, baseload,

near-zero-carbon energy source to help drive the global

shift towards decarbonising energy generation.

Disclaimer Regarding Forward Looking Statements

This ASX announcement (Announcement) contains various

forward-looking statements. All statements other than statements of

historical fact are forward-looking statements. Forward-looking

statements are inherently subject to uncertainties in that they may

be affected by a variety of known and unknown risks, variables and

factors which could cause actual values or results, performance or

achievements to differ materially from the expectations described

in such forward-looking statements. The Company does not give any

assurance that the anticipated results, performance or achievements

expressed or implied in those forward-looking statements will be

achieved.

Mineral Resource and Ore Reserve Estimates

The information in this announcement that relates to Mineral

Resources or Ore Reserves is extracted from the reports titled '

Tiris Uranium Project - Resource Upgrade of 10% ' released to the

Australian Securities Exchange (ASX) on 27 August 2021 and 'Tiris

Uranium Project DFS Update' released to the ASX on 18 August 2021

and for which Competent Persons' consents were obtained. Each

Competent Person's consent remains in place for subsequent releases

by the Company of the same information in the same form and

context, until the consent is withdrawn or replaced by a subsequent

report and accompanying consent. The Company confirms that it is

not aware of any new information or data that materially affects

the information included in the original ASX announcements and, in

the case of estimates of Mineral Resources or Ore Reserves, that

all material assumptions and technical parameters underpinning the

estimates in the original ASX announcements continue to apply and

have not materially changed.

The Company confirms that the form and context in which the

Competent Person's findings are presented have not been materially

modified from the original ASX announcements.

In respect to Resource statements there is a low level of

geological confidence associated with inferred mineral resource and

there is no certainty that further exploration work will result in

the determination of indicated measured resource or that the

production target will be realised.

Competent Persons

The Competent Person for the portion of the 2022 Tiris Vanadium

Mineral Resource Estimate and classification relating to the

Hippolyte, Hippolyte South, Lazare North, and Lazare South deposits

is Mr Arnold van der Heyden of H&S Consulting Pty Ltd. The

information in the report to which this statement is attached that

relates to the 2018 Mineral Resource Estimate is based on

information compiled by Mr van der Heyden. Mr van der Heyden has

sufficient experience that is relevant to the resource estimation

to qualify Mr van der Heyden as a Competent Person as defined in

the 2012 edition of the 'Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves'. Mr van

der Heyden is an employee of H&S Consultants Pty Ltd, a Sydney

based geological consulting firm. Mr van der Heyden is a Member and

Chartered Professional of The Australasian Institute of Mining and

Metallurgy (AusIMM) and consents to the inclusion in the report of

the matters based on his information in the form and context in

which it appears.

The Competent Person for the portion of the 2022 Tiris Vanadium

Resource Estimate and classification relating to all other deposits

within the resource (Sadi South, Sadi North, Marie, Hippolyte West,

Oum Ferkik East, Oum Ferkik West deposits) is Mr Oliver Mapeto, an

independent resources consultant.

The information in the report to which this statement is

attached that relates to the 2018 Resource Estimate is based on

information compiled by Mr Mapeto. Mr Mapeto has sufficient

experience that is relevant to the resource estimation to qualify

Mr Mapeto as a Competent Person as defined in the 2012 edition of

the 'Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves'. Mr Mapeto is a Member of The

Australasian Institute of Mining and Metallurgy (AusIMM) and

consents to the inclusion in the report of the matters based on his

information in the form and context in which it appears.

The Competent Person for drill hole data and for integrating the

different resource estimates is Mr Neil Clifford. The information

in the report to which this statement is attached that relates to

compiling resource estimates and to drill hole data is based on

information compiled by Mr Neil Clifford. Mr Clifford has

sufficient experience that is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify Mr Clifford as a

Competent Person as defined in the 2012 edition of the

'Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves'. Mr Clifford is a consultant to Aura

Energy. Mr Clifford is a Member of the Australasian Institute of

Geoscientists. Mr Clifford consents to the inclusion in the report

of the matters based on his information in the form and context in

which it appears.

Notes to Project Description

The Company confirms that the material assumptions underpinning

the Tiris Uranium Production Target and the associated financial

information derived from the Tiris production target as outlined in

the Aura Energy release dated 18 August 2021 for the Tiris Uranium

Project Definitive Feasibility Study continue to apply and have not

materially changed.

The Tiris Uranium Project Resource was released on 27 August

2021 "Resource Upgrade of 10% - Tiris Uranium Project". The Company

confirms that it is not aware of any new information or data that

materially affects the information included in the relevant market

announcement and that all material assumptions and technical

parameters underpinning the estimates in the relevant market

announcements continue to apply and have not materially

changed.

In respect to Resource statements there is a low level of

geological confidence associated with inferred mineral resource and

there is no certainty that further exploration work will result in

the determination of indicated measured resource or that the

production target will be realised.

[1] ASX and AIM Release: "Tiris Uranium DFS Complete" 29 July

2019

[2] ASX and AIM Release: " Tests confirm average 550% upgrading

of uranium at Tiris", 23 June 2022

[3] ASX and AIM Release: "Aura Defines Vanadium JORC Resource at

Tiris Uranium Project" 16 Feb 2022

[4] ASX and AIM Release "PRE-INVESTMENT DECISION CAPEX AND OPEX

ENGINEERING OPTIMISATION COMMENCED FOR TIRIS, 30(th) June 2022

[5] National Agency for Geological Research and Mining

Properties: https://anarpam.mr/en/agence-anarpam/

[6] ASX and AIM Release: "Tiris Uranium DFS Complete" 29 July

2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLZZMMGNLMGZZG

(END) Dow Jones Newswires

October 19, 2022 03:25 ET (07:25 GMT)

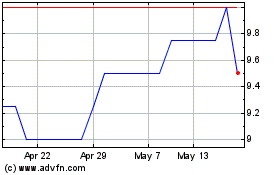

Aura Energy (LSE:AURA)

Historical Stock Chart

From May 2024 to Jun 2024

Aura Energy (LSE:AURA)

Historical Stock Chart

From Jun 2023 to Jun 2024