TIDMAML

RNS Number : 6044H

Aston Martin Lagonda Global Hld PLC

04 December 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE

OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

4 December 2020

Aston Martin Lagonda Global Holdings plc

("Aston Martin Lagonda", the "Company" or the "Group")

Results of the General Meeting

Further to the announcement on 18 November 2020, the Company

announces that, at the General Meeting held earlier today, the

resolutions set out in the Notice of General Meeting (the

"Resolutions") contained in the combined prospectus and circular

published by the Company on 18 November 2020 (the "Prospectus")

were duly passed without amendment on a poll by the requisite

majorities of shareholders of the Company.

Resolutions 3, 6, 9, 10 and 11 were passed as special

resolutions and the full text of the Resolutions is set out in the

Notice of General Meeting.

Details of the total votes received in relation to the

Resolutions (representing 52.44% of the issued share capital of

1,824,014,450 ordinary shares) are as follows:

RESOLUTION VOTES

FOR* AGAINST** WITHHELD*** TOTAL

----------------------- -------------------- ------------- -------------

Votes % Votes % Votes

------------- -------- ----------- ------- ------------- -------------

To authorise the

Directors to implement

the Strategic

Cooperation and

allot the Consideration

1 Shares 951,988,221 99.63% 3,519,421 0.37% 1,042,353 955,507,642

----------------------------- ------------- -------- ------- -------------

To authorise the

Directors to allot

2 the Placing Shares 951,997,229 99.63% 3,541,413 0.37% 1,011,353 955,538,642

----------------------------- ------------- -------- ------- -------------

To authorise the

Directors to disapply

pre-emption rights

in connection

3 with the Placing 951,956,534 99.63% 3,563,951 0.37% 1,029,510 955,520,485

----------------------------- ------------- -------- ------- -------------

To approve the

related party

transaction in

connection with

4 the Placing**** 495,960,049 99.29% 3,535,216 0.71% 1,055,455 499,495,265

----------------------------- ------------- -------- ------- -------------

To authorise the

Directors to allot

shares in connection

with the Warrants

5 Issue 951,993,574 99.63% 3,514,199 0.37% 1,042,222 955,507,773

----------------------------- ------------- -------- ------- -------------

To authorise the

Directors to disapply

pre-emption rights

in connection

with the Warrants

6 Issue 951,985,561 99.63% 3,515,036 0.37% 1,049,398 955,500,597

----------------------------- ------------- -------- ------- -------------

To authorise the

subdivision and

consolidation

of shares in connection

with the Capital

7 Reorganisation 952,054,521 99.64% 3,479,354 0.36% 1,007,733 955,533,875

----------------------------- ------------- -------- ------- -------------

To renew existing

share allotment

authority to account

for the effect

of the Capital

8 Reorganisation 951,938,733 99.62% 3,597,632 0.38% 1,013,630 955,536,365

----------------------------- ------------- -------- ------- -------------

To renew existing

pre-emption disapplication

authority to account

for the effect

of the Capital

9 Reorganisation 951,981,128 99.63% 3,553,586 0.37% 1,015,281 955,534,714

----------------------------- ------------- -------- ------- -------------

To renew existing

additional pre-emption

disapplication

authority to account

for the effect

of the Capital

10 Reorganisation 951,986,578 99.63% 3,547,936 0.37% 1,015,481 955,534,514

----------------------------- ------------- -------- ------- -------------

To renew existing

share buyback

authority to account

for the effect

of the Capital

11 Reorganisation 952,032,322 99.63% 3,509,577 0.37% 1,008,096 955,541,899

----------------------------- ------------- -------- ------- -------------

* Votes in favour include votes where the Chair of the General

Meeting was given discretion regarding how to vote.

** Percentages are expressed as a proportion of total votes cast

(which does not include votes withheld).

*** A 'vote withheld' is not a vote under English law and is not

counted in the calculation of votes 'for' and 'against' the

Resolutions.

**** In accordance with the Listing Rules, the Yew Tree

Consortium, their associates (as defined in the Listing Rules) and

the Consortium Directors were not permitted to vote on Resolution 4

concerning the related party transaction.

The passing of the Resolutions will enable the Company to

proceed with the Placing, Strategic Cooperation, Warrants Issue,

Financing Transactions and Capital Reorganisation.

Following the passing of the Resolutions, 83,333,333 Placing

Shares will be issued to institutional placees, 40,000,000 Placing

Shares will be issued to Yew Tree Overseas Limited, 60,000,000

Placing Shares will be issued to Zelon Holdings Inc., 66,666,667

Placing Shares will be issued to Permian Investment Partners, LP,

and 224,657,287 Tranche 1 Consideration Shares will be issued to

Mercedes-Benz AG.

The Placing, Strategic Cooperation and Financing Transactions

remain conditional upon, amongst other things, Admission of the

Placing Shares and Tranche 1 Consideration Shares becoming

effective by not later than 8.00 a.m. on 7 December 2020 (or such

later time and/or date as the Joint Global Co-ordinators and the

Company may agree).

Applications have been made to the FCA for 250,000,000 Placing

Shares and 224,657,287 Tranche 1 Consideration Shares to be

admitted to the premium listing segment of the Official List and to

the London Stock Exchange for such Placing Shares and Tranche 1

Consideration Shares to be admitted to trading on the main market

for listed securities. The Placing Shares and the Tranche 1

Consideration Shares will be issued under the authority granted by

the Resolutions at today's General Meeting.

It is expected that Admission of the Placing Shares and Tranche

1 Consideration Shares will take place at 8.00 a.m. on 7 December

2020.

As set out in the expected timetable of principal events in

connection with the General Meeting contained in the Prospectus,

and in the announcement made by the Company on 18 November 2020,

the Record Date for the Capital Reorganisation is 6.00 p.m. on 11

December 2020.

A copy of the Resolutions passed at the General Meeting has been

submitted to the National Storage Mechanism in accordance with

Listing Rule 9.6.2R and will be available for inspection at

http://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Capitalised terms used but not otherwise defined in this

announcement have the meanings given to them in the Prospectus,

which is available on the Company's website (

www.astonmartinlagonda.com/investors/October-2020-Placing ).

Enquiries

Investors and Analysts

Charlotte Cowley Director of Investor +44 (0)7771 976764

Relations charlotte.cowley@astonmartin.com

Media

Kevin Watters Director of Communications +44 (0)7764 386683

kevin.watters@astonmartin.com

Grace Barnie Corporate Communication +44 (0)7880 903490

Manager grace.barnie@astonmartin.com

Tulchan Communications

Harry Cameron and Simon Pilkington +44 (0)20 73534200

Barclays (Sponsor and Financial

Adviser)

Derek Shakespeare

Enrico Chiapparoli

Tom Macdonald

Darren Johnson +44 (0)20 7623 2323

J.P. Morgan Cazenove (Financial

Adviser)

Robert Constant

James A. Kelly

Will Holyoak +44 (0)20 7742 4000

IMPORTANT NOTICE

This announcement has been issued by and is the sole

responsibility of the Company. The information contained in this

announcement is for background purposes only and does not purport

to be full or complete. No reliance may or should be placed by any

person for any purpose whatsoever on the information contained in

this announcement or on its accuracy or completeness. The

information in this announcement is subject to change.

This announcement is not a prospectus and is for information

purposes only. Neither this announcement nor anything contained in

it shall form the basis of, or be relied upon in conjunction with,

any offer or commitment whatsoever in any jurisdiction.

A copy of the Prospectus is available on the Company's website

at www.astonmartinlagonda.com/investors/October-2020-Placing .

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

This announcement does not contain or constitute an offer for

sale or the solicitation of an offer to purchase securities in the

United States. None of the securities referred to in this

announcement or in the Prospectus have been or will be registered

under the US Securities Act of 1933 (the "Securities Act") or under

any securities laws of any state or other jurisdiction of the

United States and may not be offered, sold, taken up, exercised,

resold, transferred or delivered, directly or indirectly, within

the United States except pursuant to an applicable exemption from

or in a transaction not subject to the registration requirements of

the Securities Act and in compliance with any applicable securities

laws of any state or other jurisdiction of the United States. There

will be no public offer of any such securities in the United

States. None of the securities referred to in this announcement or

in the Prospectus, nor the Form of Proxy, this announcement or any

other document connected with the matters discussed in this

announcement or in the Prospectus has been or will be approved or

disapproved by the United States Securities and Exchange Commission

or by the securities commissions of any state or other jurisdiction

of the United States or any other regulatory authority, and none of

the foregoing authorities or any securities commission has passed

upon or endorsed the merits of such securities or documents or the

accuracy or adequacy of this announcement or any other such

document. Any representation to the contrary is a criminal offence

in the United States.

No offer or invitation to purchase or subscribe for, or any

solicitation to purchase or subscribe for, any securities will be

made in any jurisdiction in which such an offer or solicitation is

unlawful. The information contained in this announcement is not for

release, publication or distribution to persons in the United

States or Australia, Canada, Japan or the Republic of South Africa,

and should not be distributed, forwarded to or transmitted in or

into any jurisdiction, where to do so might constitute a violation

of local securities laws or regulations.

The distribution of this announcement into jurisdictions other

than the United Kingdom may be restricted by law, and, therefore,

persons into whose possession this announcement comes should inform

themselves about and observe any such restrictions. Any failure to

comply with any such restrictions may constitute a violation of the

securities laws of such jurisdiction. In particular, subject to

certain exceptions, neither this announcement nor the Prospectus

should be distributed, forwarded to or transmitted in or into the

United States, Australia, Canada, Japan or the Republic of South

Africa or any other jurisdiction where to do so might constitute a

violation of local securities laws or regulations.

The contents of this announcement are not to be construed as

legal, business, financial or tax advice. Each Shareholder or

prospective investor should consult his, her or its own legal

adviser, business adviser, financial adviser or tax adviser for

legal, financial, business or tax advice.

Notice to all investors

Barclays Bank PLC, acting through its investment bank

("Barclays"), which is authorised by the Prudential Regulation

Authority and regulated in the United Kingdom by the Financial

Conduct Authority and the Prudential Regulation Authority, is

acting exclusively for the Company and no one else in connection

with the Admission of the Tranche 1 Consideration Shares and the

Placing Shares and will not be responsible to anyone other than the

Company for providing the protections afforded to clients of

Barclays nor for providing advice in relation to Admission of the

Tranche 1 Consideration Shares and the Placing Shares or any

transaction, matter or arrangement referred to in this announcement

or in the Prospectus.

J.P. Morgan Securities plc (which conducts its UK investment

banking business as "J.P. Morgan Cazenove") is authorised by the

Prudential Regulation Authority and regulated by the Prudential

Regulation Authority and Financial Conduct Authority. J.P. Morgan

Cazenove is acting exclusively for the Company and no one else in

connection with the Strategic Cooperation and will not be

responsible to anyone other than Aston Martin Lagonda Global

Holdings plc for providing the protections afforded to clients of

J.P. Morgan Cazenove nor for providing advice to any person in

relation to the Strategic Cooperation or any matter or arrangement

referred to in this announcement or in the Prospectus.

None of Barclays or J.P. Morgan Cazenove, nor any of their

respective subsidiaries, branches or affiliates, nor any of their

respective directors, officers or employees owes or accepts any

duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of Barclays or J.P. Morgan

Cazenove in connection with this Announcement, any statement

contained herein, or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMEANALELNEFEA

(END) Dow Jones Newswires

December 04, 2020 04:51 ET (09:51 GMT)

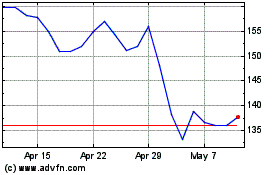

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Jul 2024 to Jul 2024

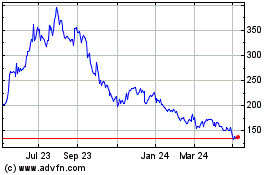

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Jul 2023 to Jul 2024