TIDM33JE TIDMALFA

RNS Number : 3680S

Barclays Bank PLC

09 March 2023

NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR THE

SOLICITATION OF AN OFFER TO BUY SECURITIES IN ANY JURISDICTION,

INCLUDING THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR THE

REPUBLIC OF SOUTH AFRICA.

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

COMPLETION OF ACCELERATED BOOKBUILD OFFERING OF 16 MILLION

EXISTING ORDINARY SHARES IN ALFA FINANCIAL SOFTWARE HOLDINGS PLC

("ALFA" OR THE "COMPANY")

9 MARCH, 2023

Further to the announcement on 8 March 2023, CHP Software and

Consulting Limited (the "Seller") announces that it has completed

the sale of 16 million ordinary shares in Alfa at a price of

GBP1.35 per share (the "Offering"), raising gross proceeds of

approximately GBP22 million. Alfa is not party to the Offering and

will not receive any proceeds from the Offering.

Following the Offering, Andrew Page's indirect shareholding is

162,818,036 shares, representing approximately 54.92% of the issued

share capital of Alfa.

The Seller has undertaken that, following completion of the

Placing, it will not dispose of further shares in the Company for a

period of at least 90 days, subject to customary exceptions.

Allocations will be confirmed today, 9 March 2023, for

settlement on 13 March 2023.

Barclays Bank PLC, acting through its investment bank

("Barclays"), Investec Bank PLC ("Investec") and Panmure Gordon

(UK) Limited ("Panmure Gordon") acted as Joint Global Coordinators

and Bookrunners for the Offering.

Enquiries:

Barclays +44 (0)20 7623 2323

Joint Global Co-ordinator and Joint Bookrunner

Dominic Harper

Casey Bandman

Investec +44 (0)20 7597 5692

Joint Global Co-ordinator and Joint Bookrunner

Patrick Robb

Virginia Bull

Panmure Gordon +44 (0)20 7886 2500

Joint Global Co-ordinator and Joint Bookrunner

Rupert Dearden

James Sinclair-Ford

Important Notice

MEMBERS OF THE GENERAL PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN

THE PLACING. THIS ANNOUNCEMENT AND ANY OFFER OF SECURITIES TO WHICH

IT RELATES ARE ONLY ADDRESSED TO AND DIRECTED AT (1) IN ANY MEMBER

STATE OF THE EUROPEAN ECONOMIC AREA, PERSONS WHO ARE QUALIFIED

INVESTORS IN SUCH MEMBER STATE WITHIN THE MEANING OF THE PROSPECTUS

REGULATION (REGULATION (EU) 2017/1129) (THE "EU PROSPECTUS

REGULATION")); AND (2) IN THE UNITED KINGDOM, PERSONS WHO ARE

QUALIFIED INVESTORS IN SUCH MEMBER STATE WITHIN THE MEANING OF THE

PROSPECTUS REGULATION as it forms part of domestic law by virtue of

the European Union (Withdrawal) Act 2018 (THE "UK PROSPECTUS

REGULATION") WHO (I) HAVE PROFESSIONAL EXPERIENCE IN MATTERS

RELATING TO INVESTMENTS WHO FALL WITHIN ARTICLE 19(5) OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER

2005 (AS AMED) (THE "ORDER"); OR (II) FALL WITHIN ARTICLE 49(2)(A)

TO (D) OF THE ORDER OR (III) ARE PERSONS TO WHOM AN OFFER OF THE

PLACING SHARES MAY OTHERWISE LAWFULLY BE MADE (ALL SUCH PERSONS

REFERRED TO IN (1) AND (2) TOGETHER BEING REFERRED TO AS "RELEVANT

PERSONS"). THE INFORMATION REGARDING THE PLACING SET OUT IN THIS

ANNOUNCEMENT MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE

NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO

WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT

PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

This announcement and the information contained herein is for

information purposes only and does not constitute or form part of

any offer of, or the solicitation of an offer to acquire or dispose

of securities in the United States, Canada, Australia, South Africa

or Japan or in any other jurisdiction in which such an offer or

solicitation is unlawful.

The securities referred to herein have not been, and will not

be, registered under the US Securities Act of 1933, as amended (the

"US Securities Act"), or under the applicable securities laws of

any state or other jurisdiction of the United States or of Canada,

Australia, South Africa or Japan. Such securities may not be

offered or sold in the United States unless registered under the US

Securities Act or offered in a transaction exempt from, or not

otherwise subject to, the registration requirements of the US

Securities Act and the securities laws of any relevant state or

other jurisdiction of the United States. There will be no public

offering of such securities in the United States or in any other

jurisdiction.

The securities referred to herein have not been approved or

disapproved by the US Securities and Exchange Commission, any state

securities commission or other regulatory authority in the United

States, nor have any of the foregoing authorities passed upon or

endorsed the merits of the Placing or the accuracy or adequacy of

this announcement. Any representation to the contrary is a criminal

offence in the United States.

No prospectus or offering document has been or will be prepared

in connection with the Placing. Any investment decision to buy

securities in the Placing must be made solely on the basis of

publicly available information. Such information is not the

responsibility of and has not been independently verified by any of

the Seller, Barclays, Investec, Panmure Gordon or any of their

respective affiliates.

Neither this announcement nor any copy of it may be taken,

transmitted or distributed, directly or indirectly, in or into or

from the United States (including its territories and possessions,

any state of the United States and the District of Columbia),

Canada, Australia, South Africa or Japan. The distribution of this

announcement may be restricted by law in certain jurisdictions and

persons into whose possession this document or other information

referred to herein comes should inform themselves about and observe

any such restriction. Any failure to comply with these restrictions

may constitute a violation of the securities laws of any such

jurisdiction.

The distribution of this announcement and the offering or sale

of the Placing Shares in certain jurisdictions may be restricted by

law. No action has been taken by the Seller, Barclays, Investec,

Panmure Gordon or any of their respective affiliates that would, or

which is intended to, permit a public offer of the Placing Shares

in any jurisdiction or possession or distribution of this

announcement or any other offering or publicity material relating

to the Placing Shares in any jurisdiction where action for that

purpose is required. Persons into whose possession this

announcement comes are required by the Seller, Barclays, Investec

and Panmure Gordon to inform themselves about and to observe any

applicable restrictions.

Barclays, which is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority in the United Kingdom is acting

only for the Seller in connection with the Placing and will not be

responsible to anyone other than the Seller for providing the

protections offered to the clients of Barclays nor for providing

advice in relation to the Placing or any matters referred to in

this announcement.

Investec, which is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority in the United Kingdom is acting

only for the Seller in connection with the Placing and will not be

responsible to anyone other than the Seller for providing the

protections offered to the clients of Investec nor for providing

advice in relation to the Placing or any matters referred to in

this announcement.

Panmure Gordon, which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom is acting for the

Seller in connection with the Placing and will not be responsible

to anyone other than the Seller for providing the protections

offered to the clients of Panmure Gordon nor for providing advice

in relation to the Placing or any matters referred to in this

announcement.

Barclays, Investec, Panmure Gordon and any of their respective

affiliates acting as an investor for its own account may

participate in the offering on a proprietary basis and in that

capacity may retain, purchase or sell for their own account such

Placing Shares. In addition, they may enter into financing

arrangements and swaps with investors in connection with which they

may from time to time acquire, hold or dispose of Placing Shares.

None of Barclays, Investec or Panmure Gordon intends to disclose

the extent of any such investment or transactions otherwise than in

accordance with any legal or regulatory obligation to do so.

This document includes statements that are, or may be deemed to

be, forward-looking statements. These forward-looking statements

may be identified by the use of forward-looking terminology,

including the terms "intends", "expects", "will", or "may", or, in

each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts. Any

forward-looking statements are subject to risks relating to future

events and assumptions relating to the Company's business, in

particular from changes in political conditions, economic

conditions, evolving business strategy, or the retail industry. No

assurances can be given that the forward-looking statements in this

document will be realised. As a result, no undue reliance should be

placed on these forward-looking statements as a prediction of

actual results or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIFFFELVTITIIV

(END) Dow Jones Newswires

March 09, 2023 02:00 ET (07:00 GMT)

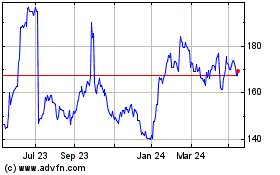

Alfa Financial Software (LSE:ALFA)

Historical Stock Chart

From Jun 2024 to Jul 2024

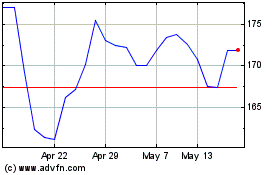

Alfa Financial Software (LSE:ALFA)

Historical Stock Chart

From Jul 2023 to Jul 2024