Final Results

September 29 2009 - 2:00AM

UK Regulatory

TIDMAIEA

RNS Number : 8040Z

Airea PLC

29 September 2009

AIREA plc

Preliminary results for the year ended 30th June 2009

Review of Operations

Introduction

In our Interim Report we described the difficult trading conditions facing our

floor coverings businesses as a consequence of the global economic downturn. In

response we initiated a fundamental overhaul of our manufacturing footprint and

a far reaching companywide cost reduction programme. Our interim report included

the consequent provisions for impairment of property, plant and equipment,

surplus inventory and onerous leases. At the same time we have invested heavily

in new products for both businesses and we are encouraged by initial market

reaction as these new products are progressively introduced.

It is therefore pleasing to report that after incurring a loss in the first

half, the group returned to profitability and positive cash generation at the

operating level in the final six months of the period. We have made excellent

progress against our key objective of stabilising our residential business which

was close to break even in the second half of the financial year.

Group results

Within continuing operations, sales of floor covering products reduced by 15.8%

to GBP41.0m (2008: GBP48.7m). The operating loss was GBP8.8m (2008 profit:

GBP1.9m). This result was after exceptional operating costs of GBP4.3m

(2008:GBP0.4m) and goodwill impairment of GBP4.0m (2008: GBP8.0m). The

exceptional operating costs arose out of a critical review of our asset base and

relate to significant provisions for impairment of property, plant and

equipment, surplus inventories and onerous leases. The goodwill impairment

completes the write-off of the goodwill relating to the residential floor

coverings business. The operating result before these exceptional items was a

loss of GBP0.5m (2008: profit GBP0.5m). It was pleasing to note that the

operating result before exceptional items in the second half of the year was a

profit of GBP0.4m (2008: loss GBP0.1m) demonstrating the effectiveness of our

cost reduction measures in stemming the losses within the residential floor

coverings business.

After accounting for modest levels of finance income and finance costs, minor

adjustments in connection with discontinued activities and incorporating the

appropriate tax credit the result for the year was a loss of GBP9.0m (2008:

GBP3.6m). However, it should be noted that the results to 30th June 2008

included an exceptional profit on sale of fixed assets of GBP9.9m and a loss on

disposal of discontinued operations of GBP2.7m.

Net cash used in operating activities in the year amounted to GBP2.4m (2008:

GBP4.1m). Working capital reduced by GBP1.7m (2008 increase GBP1.9m) as a result

of the focus on inventory reduction and receivables management. Capital

expenditure was reduced from GBP2.3m to GBP0.9m, and was largely focussed on the

range renewal projects. Contributions of GBP2.5m (2008: GBP3.7m) were made to

the defined benefit pension scheme. The pension deficit reduced to GBP5.4m

(2008: GBP5.5m), and the group is in discussions with the trustees to agree an

appropriate level of future contributions based on the July 2008 actuarial

review.

The progression in results is illustrated in the following table:.

+-----------------------------------------+------------+-----------+------------+--------+

| Half year ended: | December | June 08 | December | June |

| | 07 | | 08 | 09 |

+-----------------------------------------+------------+-----------+------------+--------+

| | GBPm | GBPm | GBPm | GBPm |

+-----------------------------------------+------------+-----------+------------+--------+

| | | | | |

+-----------------------------------------+------------+-----------+------------+--------+

| Cash generated from (used in) | (4.3) | 0.2 | (2.9) | 0.5 |

| continuing operations | | | | |

+-----------------------------------------+------------+-----------+------------+--------+

| Operating (loss) / profit before | 0.6 | (0.1) | (0.9) | 0.4 |

| exceptional items from continuing | | | | |

| operations | | | | |

+-----------------------------------------+------------+-----------+------------+--------+

The loss per share was 19.40p (2008: 7.81p). No interim dividend was paid (2008:

0.80p per share) and the directors do not recommend the payment of a final

dividend (2008: 1.60p per share).

Key performance indicators

As part of its internal financial control procedures the board monitors certain

financial ratios. For the year to 30th June 2009 sales per employee amounted to

GBP115,000 (2008: GBP122,000), operating return on sales was 1.2% negative

(2008: 1.3% positive), return on average net operating assets was 2.7% negative

(2008: 2.2% positive) and working capital to sales percentage was 18.0% (2008:

16.1%). The decline in the ratios reflects the difficult trading conditions, and

the management action taken during the year addressed these issues. The working

capital ratio suffered from a reduction in trade and other payables due to the

tightening trade credit environment, and outweighed the improved performance in

inventory management and trade receivables control.

Management and personnel

Carolyn Tobin stepped down from the board on 31st December 2008 and Kevin Henry

stepped down from the board on 8th June 2009. Carolyn served the company for

over ten years as a non-executive director and Kevin served the company for over

25 years, most recently as group finance director and company secretary. We

would like to thank Carolyn and Kevin for their service and wish them well for

the future.

Martin Toogood joined the group as a non-executive director on 1st April 2009.

Martin has considerable experience at executive and non-executive level with a

number of major retailers in the UK and Europe and his knowledge of retail

markets will be of great assistance in these challenging times.

Roger Salt was appointed company secretary of the company on 8th June 2009.

Roger has been with the group for over five years and continues to act as

finance director - operations in addition to his new role.

At the completion of his second term of office, Tim Vernon will be retiring from

the board at the AGM on November 6th. He will be succeeded as non-executive

chairman by Martin Toogood.

There have been a number of changes in key personnel during the year and we

would like to thank all our team members throughout the group for their

dedication and commitment and for helping the group face the current challenges.

Current trading and future prospects

Market conditions are extremely challenging and our plans do not assume that

there will be any improvement at least for the next twelve months. However as a

consequence of the actions taken during the period both of our businesses are

well placed to withstand further economic uncertainty and take advantage of any

improvement in business and consumer confidence as and when this happens.

Our Residential business has undergone a period of major change. We are already

benefitting from the streamlined manufacturing footprint, but just as important

are the changes made to the product portfolio with the vast majority of products

having been redesigned and repackaged in recent months and we are greatly

encouraged by the positive reaction they have received so far from both the

independent and multiple retail sector.

Our Commercial floor coverings business continues to demonstrate notable

resilience to the uncertainty of market conditions, and has undoubtedly

benefitted from its strength in the public sector. In anticipation of expected

weakening of public sector spending the business has successfully targeted

additional non public sector opportunities and broadened its product range.

We are confident we are pursuing the right strategy for the business, but market

conditions remain uncertain, and will probably remain so for some time to come,

therefore we will remain highly focussed on preserving and improving our cash

resources.

Enquiries:

Neil Rylance 01924 266561

Chief executive officer

Andrew Kitchingman0845 270 8610

Managing Director - Corporate Finance

Brewin Dolphin

The financial information set out in the announcement does not constitute the

group's statutory accounts for the years ended 30 June 2009 or 30 June 2008. The

financial information for the year ended 30 June 2008 is derived from the

statutory accounts for that year which have been delivered to the Registrar of

Companies. The auditors reported on those accounts; their report was unqualified

and did not contain a statement under s237(2) or (3) of the Companies Act 1985.

The consolidated balance sheet at 30th June 2009 and the consolidated income

statement, the statement of recognised income and expense and the consolidated

cash flow statement for the year then ended have been extracted from the Group's

2009 statutory financial statements upon which the auditor's opinion is

unqualified and does not include any statement under s498(2) or s498(3) of the

Companies Act 2006.

The announcement has been agreed with the company's auditor for release.

+-----------------------------------------+---------+---------+----------+---------+----------+

| Consolidated Income Statement | | | | | |

+-----------------------------------------+---------+---------+----------+---------+----------+

| year ended 30th June 2009 | | | | | |

+-----------------------------------------+---------+---------+----------+---------+----------+

| | | | 2009 | | 2008 |

+-----------------------------------------+---------+---------+----------+---------+----------+

| | | | GBP000 | | GBP000 |

+-----------------------------------------+---------+---------+----------+---------+----------+

| CONTINUING OPERATIONS | | | | | |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Revenue | | | 40,970 | | 48,713 |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Operating costs | | | (45,792) | | (48,648) |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Impairment of goodwill | | | (4,000) | | (8,012) |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Exceptional profit on sale of property | | | - | | 9,858 |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Operating (loss)/profit after | | | (8,822) | | 1,911 |

| exceptional items | | | | | |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Analysed between: | | | | | |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Operating (loss)/profit before | | | (496) | | 484 |

| exceptional items | | | | | |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Exceptional operating costs | | | (4,326) | | (419) |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Impairment of goodwill | | | (4,000) | | (8,012) |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Exceptional profit on sale of property | | | - | | 9,858 |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Finance income | | | 97 | | 383 |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Finance costs | | | (340) | | (237) |

+-----------------------------------------+---------+---------+----------+---------+----------+

| (Loss)/profit before taxation | | | (9,065) | | 2,057 |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Taxation | | | 103 | | (1,623) |

+-----------------------------------------+---------+---------+----------+---------+----------+

| (Loss)/profit from continuing | | | (8,962) | | 434 |

| operations | | | | | |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Loss from discontinued operations | | | (10) | | (4,047) |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Loss for the year | | | (8,972) | | (3,613) |

+-----------------------------------------+---------+---------+----------+---------+----------+

| Loss per share | | | | | |

+-----------------------------------------+---------+---------+----------+---------+----------+

| (basic and diluted) | | | (19.40)p | | (7.81)p |

+-----------------------------------------+---------+---------+----------+---------+----------+

| (Loss)/earnings per share from continuing | | | | |

| operations | | | | |

+---------------------------------------------------+---------+----------+---------+----------+

| (basic and diluted) | | | (19.38)p | | 0.94p |

+-----------------------------------------+---------+---------+----------+---------+----------+

+-----------------------------------------+---------+----------+----------+----------+----------+

| Consolidated Balance Sheet | | | | | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| as at 30th June 2009 | | | | | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| | | 2009 | 2008 |

+-----------------------------------------+---------+---------------------+---------------------+

| | | GBP000 | GBP000 | GBP000 | GBP000 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Non-current assets | | | | | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Property, plant and equipment | | | 7,938 | | 8,865 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Goodwill | | | - | | 4,000 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Deferred tax asset | | | 2,217 | | 1,540 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Loan notes | | | - | | 300 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| | | | 10,155 | | 14,705 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Current assets | | | | | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Loan notes | | 150 | | - | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Inventories | | 6,995 | | 10,970 | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Trade and other receivables | | 5,622 | | 8,793 | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Income tax receivable | | 121 | | 448 | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Cash and cash equivalents | | 3,242 | | 6,063 | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| | | | 16,130 | | 26,274 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Non-current assets held for sale | | | - | | 452 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Total assets | | | 26,285 | | 41,431 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Current liabilities | | | | | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Trade and other payables | | (5,391) | | (10,891) | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Provisions | | (722) | | - | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| | | | (6,113) | | (10,891) |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Non-current liabilities | | | | | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Provisions | | (1,038) | | - | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Pension deficit | | (5,440) | | (5,500) | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Deferred tax | | (159) | | (252) | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| | | | (6,637) | | (5,752) |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Total liabilities | | | (12,750) | | (16,643) |

+-----------------------------------------+---------+----------+----------+----------+----------+

| | | | 13,535 | | 24,788 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Equity | | | | | |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Called up share capital | | | 11,561 | | 11,561 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Share premium account | | | 504 | | 504 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Capital redemption reserve | | | 2,395 | | 2,395 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| Retained earnings | | | (925) | | 10,328 |

+-----------------------------------------+---------+----------+----------+----------+----------+

| | | | 13,535 | | 24,788 |

+-----------------------------------------+---------+----------+----------+----------+----------+

+-----------------------------------------+---------+---------+--+----------+----------+--+---------+

| Consolidated Cash Flow Statement | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| year ended 30th June 2009 | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| | | | 2009 | | 2008 |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| | | | GBP000 | | GBP000 |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Operating activities | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Cash used in operations | | | (2,401) | | (4,148) |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Interest received | | | 64 | | 187 |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Income tax received | | | 435 | | 5 |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| | | | (1,902) | | (3,956) |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Investing activities | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Purchase of property, plant and | | | (878) | | (2,323) |

| equipment | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Proceeds on disposal of property, plant | | | 549 | | 16,261 |

| and equipment | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Disposal of subsidiary undertaking | | | - | | 2,409 |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| | | | (329) | | 16,347 |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Financing activities | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Equity dividends paid | | | (740) | | (1,110) |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Redemption of loan notes | | | 150 | | (88) |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Repayment of bank loans | | | - | | (3,652) |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| | | | (590) | | (4,850) |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Net (decrease)/ increase in cash and | | | (2,821) | | 7,541 |

| cash equivalents | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Cash and cash equivalents at start of | | | 6,063 | | (1,478) |

| the year | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Cash and cash equivalents at end of the | | | 3,242 | | 6,063 |

| year | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| Statement of Recognised Income and Expense | | | | |

+---------------------------------------------------+---------+-------------+----------+------------+

| year ended 30th June 2009 | | | | | |

+-----------------------------------------+---------+---------+-------------+----------+------------+

| | | 2009 | 2008 |

+-----------------------------------------+---------+-----------------------+-----------------------+

| | | GBP000 | GBP000 | GBP000 | GBP000 |

+-----------------------------------------+---------+------------+----------+-------------+---------+

| Loss attributable to shareholders of | | | (8,972) | | (3,613) |

| the group | | | | | |

+-----------------------------------------+---------+------------+----------+-------------+---------+

| Actuarial losses recognised in the | | (2,140) | | (920) | |

| pension scheme | | | | | |

+-----------------------------------------+---------+------------+----------+-------------+---------+

| Related deferred taxation | | 599 | | 276 | |

+-----------------------------------------+---------+------------+----------+-------------+---------+

| | | | (1,541) | | (644) |

+-----------------------------------------+---------+------------+----------+-------------+---------+

| Total recognised income and expense | | | (10,513) | | (4,257) |

| relating to the year | | | | | |

+-----------------------------------------+---------+------------+----------+-------------+---------+

| | | | | | |

+-----------------------------------------+---------+---------+--+----------+----------+--+---------+

Notes:

In accordance with Rule 20 of the AIM Rules, Airea confirms that the annual

report and accounts for the year ended 30th June 2009 will be posted to

shareholders and will be available to view on the Company's website at

www.aireaplc.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR CKFKBOBKDDCB

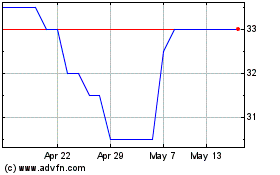

Airea (LSE:AIEA)

Historical Stock Chart

From Jun 2024 to Jul 2024

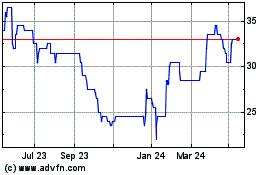

Airea (LSE:AIEA)

Historical Stock Chart

From Jul 2023 to Jul 2024