TIDMWET

28 September 2012

Watermark Global Plc

("Watermark" or the "Company")

Interim Results for the six months Ended 30 June 2012

Watermark Global ( WET:LSE), the AIM-quoted company with

Investments in acid mine drainage and coal briquetting in South

Africa announces its interim results today.

Highlights

-- Sale of subsidiary Western Utilities Corporation (Pty) Ltd ("WUC") to

Mine Restoration Investments Ltd. ("MRI") for a total of

GBP4.5m

Re-categorised as an investment company on AIM

-- MRI briquetting project making good progress with pilot plant about to

commence and commercial scale start-up set for February 2013

-- Profit after tax to 30 June 2012 was GBP2,716,000 (2011 loss: GBP620,000),

earnings per share of 0.17p (2011 loss: 0.076p per share)

-- Stated net asset value at 30 June 2012 was 0.33p per share

Results Summary

Profit after tax for the six month period ended 30 June 2012 was

GBP2,716,000 (2011: loss of GBP629,000), a profit of 0.17p per

share (2011: loss of 0.076p per share). This profit is inclusive of

the gain made in the sale of WUC to MRI of GBP2,751,000. The cash

position of the Company at 30 June 2012 was approximately

GBP796,000.

Additional Information:

Notes from a question and answer session held with Jaco Schoeman

will be available on the Company's website

www.watermarkglobalplc.com

Enquiries:

Watermark Global Plc

Charles Zorab, Investor Relations Tel: + 44(0) 20 7233 1462

czorab@watermarkglobalplc.com

Nominated Adviser: Cenkos Securities

Ian Soanes Tel: +44(0)20 7397 8900

CHAIRMAN'S STATEMENT

During the period, Watermark entered a new phase with the

agreement to sell its wholly-owned subsidiary Western Utilities

Corporation (Pty) Ltd. ("WUC") to Mine Restoration Investments

Limited ("MRI"). The reasons undertaking this transaction are worth

repeating.

Despite the Inter Ministerial Committee of the South African

government acknowledging, in a report in February 2011, that WUC's

project for treating polluted water in the Witwatersrand basins was

the cheapest and most appropriate technology, it had not been

granted the rights to implement the project. Your Board considered

that it could not wait for, nor rely upon, the award of a contract

to treat Acid Mine Drainage ("AMD"). Although we remain convinced

of our position, thanks to the large amount of work which we have

already done, the tender for the long-term treatment of AMD has

still not been held. Implementation of the project following the

long-term tender would take a further 18 months and of course would

have placed a further burden on our financial resources.

It was therefore decided to negotiate the acquisition, via WUC,

of a coal briquetting project in Kwa Zulu Natal (South Africa) in

order to diversify the Company's interests. At the same time, we

were approached by MRI to sell our direct 100% ownership of WUC for

a mixture of cash and shares which would de-risk Watermark's

position further and provide the operating businesses with improved

access to financing. In consideration for the disposal we received

a 40% stake in MRI plus a cash payment of GBP1.8m valuing WUC at

GBP4.5m.

Shares in MRI were re-listed in June 2012 on the AltX market of

the Johannesburg Stock Exchange and a placing of its shares was

undertaken at a price of R0.19 per share. This enabled MRI to

complete the acquisition of WUC and meet its obligations.

Subsequently it has been agreed that approximately GBP1.55m of the

proceeds will be lent until January 2013 to an existing shareholder

of MRI, secured against 105m MRI shares with a guaranteed minimum

share price on disposal of R0.20 per share.

Watermark is now categorised by AIM as an investment company

rather than an operating company. No doubt the current economic

climate will create some interesting possibilities and we have

commenced the process of reviewing a number of opportunities. Our

main areas of interest and our expertise remain in natural

resources but we are happy to review opportunities beyond South

Africa. As an investment company, Watermark no longer needs a Chief

Executive Officer and so Jaco Schoeman has stepped down to become a

non-executive director. I would like to thank Jaco very much for

the way in which he has led the Company in the past and am pleased

that not only will he continue on as a director of your Company,

but he is interim Chief Executive Officer of MRI and will remain as

our representative on their board as well.

The Company's assets now comprise largely listed investments and

cash or cash equivalents. At 30 June 2012 they were more than

GBP5.0 million or 0.33 pence per share. The Company's net asset

value is significantly greater than the Company's share price even

without adjusting for the current market price of MRI (which would

make the net asset value nearer to 0.4 pence per share) and we are

working to achieve a share price that more accurately reflects the

value of the Company.

We thank all shareholders for their continued interest in

Watermark and look forward to bringing you further updates on the

progress of MRI as well as other opportunities in the coming

months.

Peter Marks

Chairman

Condensed Consolidated Statement of Comprehensive Income

For the period ending 30 June 2012

Six months ended

Note 30/06/2012 30/06/2011

GBP'000 GBP'000

Continuing operations

Revenue - -

Cost of sales - -

Gross profit - -

Interest income 1 1

Depreciation (1) (1)

Finance cost - (9)

Consulting expenses (16) -

Other expenses (97) (321)

Loss before tax (113) (312)

Taxation - -

Loss for the period from 113 (312)

continuing operations

Discontinued Operations

Profit/(Loss) for the year from 9 2,751 (433)

discontinued operations

Profit/(Loss) for the period 2,638 (745)

Other comprehensive income

Exchange differences on translating

foreign operations

Exchange differences arising 78 116

during the period

Total comprehensive income/ 2,716 (629)

(loss) for the period

Total comprehensive income

(loss) attributable to

Owners of Watermark Global Plc 2,716 (629)

Profit/(Loss) per share

From continued operations

Basic 6 0.17p (0.076p)

Fully diluted 6 0.17p (0.076p)

Condensed Consolidated Statement of Financial Position

As at 30 June 2012

Notes 30/06/2012 31/12/2011

GBP'000 GBP'000

Assets

Non Current assets

Other Financial Instruments 10 2,701 -

Property, plant and equipment 1 -

2,702 -

Current assets

Trade and other receivables 1,579 32

Cash and cash equivalents 796 764

2,375 796

Assets of disposal groups classified - 3,664

as held for sale

Total assets 5,077 4,460

Equity and liabilities

Ordinary shares 2,247 2,247

Share premium account 8 10,856 10,856

Share option reserve 8 1,428 1,428

Foreign exchange reserves 8 - 78

Retained earnings 8 (9,513) (12,150)

Equity attributable to 5,018 2,459

owners of the Company

Non-controlling interest - 74

Total equity 5,018 2,533

Current liabilities

Trade and other payables 59 189

Liabilities of disposal groups - 1,738

classified as held for sale

Total liabilities 59 1,927

Total equity and liabilities 5,077 4,460

Condensed Consolidated Statement of Changes in Equity

For the period ended 30 June 2012

Share Capital Share Premium Share Option Retained FX Reserves Attributable Total

GBP'000 GBP'000 Reserve Earnings GBP'000 to Owners

GBP'000 GBP'000 GBP'000 GBP'000

Balance 1,454 9,808 1,420 (11,154) 148 1,676 1,676

01/01/2011

Loss for - - - (745) - (745) (745)

the

period

Other - - - - 116 116 116

comprehensive

income

Total - - - (745) 264 (629) (629)

comprehensive

income

for the

period

Share 645 860 - - - 1,505 1,505

placement

Issue of 41 55 - - - 96 96

ordinary

shares

for

raising

fees

Balance 2,140 10,723 1,420 (11,899) 264 2,648 2,648

30/06/2011

Balance 2,247 10,856 1,428 (12,150) 78 2,458 2,458

01/01/2012

Loss for - - - 2,637 - 2,638 2,638

the

period

Other - - - - (78) (78) (78)

comprehensive

income

Total - - - 2,637 (78) 2,560 2,560

comprehensive

income

for the

period

Balance 2,247 10,856 1,428 (9,513) - 5,018 5,018

30/06/2012

The following describes the nature and purpose of each reserve

within owners' equity:

ReserveDescription and purpose

Share capital Amount subscribed for share capital at nominal

value

Share premium Amount subscribed for share capital in excess of

nominal value, net of allowable expenses

Share option reserve Reserve for share options granted but not

exercised

Retained earnings Cumulative net gains and losses recognised in

the statement of comprehensive income

Foreign exchange reserves Cumulative net gains and losses

recognised on consolidation

Condensed Consolidated Statement of Cash Flows

For the period ended 30 June 2012

Six Months ended

30/06/2012 30/06/2011

GBP'000 GBP'000

Cash flows from operating activities

Profit/(Loss) before taxation 2,638 (745)

Depreciation 1 4

Foreign exchange differences (171) 370

Re-measurement of Subsidiary on disposal (2,931) -

Expenses for equity settled commissions - 96

Interest paid - 139

Interest received (1) (1)

(464) (137)

Changes in working capital 2,100 (143)

Decrease/(increase) in trade and other receivables

Decrease / (Increase) in trade (1,869) 18

creditors and other payables

Net cash used in operating activities (233) (262)

Cash flows from investing activities

Payments for Equity Investment (2,685) -

Proceeds from disposal of Subsidiary 2,949 -

Interest received 1 -

Net cash used in investing activities 265 -

Cash flows from financing activities

Proceeds from share placement - 1,505

Interest paid - (139)

Net cash from financing activities - 1,366

Net increase in cash and cash equivalents 32 1,104

Cash and cash equivalents brought forward 764 396

Cash and cash equivalents carried forward 796 1,500

Notes to the condensed consolidated financial statements

For the period ended 30 June 2012

1.Incorporation and principal activities

Country of incorporation

Watermark Global Plc was incorporated in the United Kingdom as a

public limited company on 19 August 2005. Its registered office is

42, Queen Anne's Gate, London SW1H 9AP. The Company is domiciled in

South Africa.

Principal activities

The principal activity of the Group during the period was that

of commercialising process technologies, namely the process

technology for the treatment of acid mine drainage and briquetting

of coal fines. The principal activity of the Company was that of a

holding Company.

2.Accounting policies

2.1Statement of compliance

These financial statements do not comprise statutory accounts

within the meaning of Section 434 of the Companies Act 2006. The

financial information contained in this condensed set of financial

statements in respect of the year ended 31 December 2011 has been

extracted from the Annual Report and Accounts, which were approved

by the Board of Directors on13 June 2012 and delivered to the

Registrar of Companies. The report of the auditors on those

accounts was unqualified and did not contain any statement under

Section 498 of the Companies Act 2006.

The half-yearly results for the current and comparative periods

are unaudited. The auditors have carried out a review of this

condensed set of financial statements for the six months ended 30

June 2012 and their report is set out at the end of these financial

statements.

This condensed set of financial statements has been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. This condensed set of financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2011 which have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 31 December 2011 as

described in those annual financial statements.

2.2Going Concern

The directors of the company are of the opinion that the Company

and Group will continue to trade as a going concern for the next

twelve months. The disposal of Western Utilities Corporation (Pty)

Ltd to MRI, including the listing of the shares on the Johannesburg

Stock Exchange, was completed on the 25 June 2012. The company

received payment of GBP1.8 million of which approximately GBP1.55m

have been lent to a MRI Shareholder, repayment is expected by 12

January 2013. This funding together the current cash reserves will

be sufficient to enable the continuing group to continue trade for

the next twelve months.

2.3.Investment

Investments are stated at cost less impairment in value, which

is recognised as an expense in the period the impairment is

identified.

3.Segmental Information

3.1Segmental information for the period ended 30 June 2012

For management purposes, the Group is organised into two

operating divisions; Corporate and Water Technology. These

divisions are the basis on which the Group reports its primary

segment information. This information also represents the

geographical segments of the United Kingdom and South Africa. Due

to the sale of the water technology division (Note 9) the water

technology segment has been classified as discontinued

Corporate

United Kingdom

GBP'000

Result

Segment result from continuing 441

operations

Interest 1

income

Loss before 442

tax

Discontinued activities - water 2,196

technology (South Africa)

2,638

Other segment items included in the income statement:

Corporate Water Technology

United Kingdom South Africa Total

(Discontinued)

GBP'000 GBP'000 GBP'000

Depreciation 1 1 2

Corporate Water Technology

Statement of United Kingdom South Africa Consolidation Total

Financial (Discontinued) Adjustments

Position

GBP'000 GBP'000 GBP'000 GBP'000

Segment assets 4,785 4,453 (4,162) 5,076

Segment (318) (6,069) 6,329 (58)

liabilities

Net 4,467 (1,616) 2,167 5,018

assets/(liabilities)

3.2Segmental information for the period ended 30 June 2011

Corporate

United Kingdom

GBP'000

Result

Segment result from continuing (313)

operations

Interest 1

income

Loss before (312)

tax

Discontinued activities - water (433)

technology (South Africa)

(745)

Other segment items included in the income statement:

Corporate Water

Technology Total

United Kingdom South Africa

(Discontinued)

GBP'000 GBP'000 GBP'000

Depreciation - 4 4

Share based payments 96 - 96

for capital raising

Corporate Water

Technology

Statement of United Kingdom South Africa Consolidation Total

Financial (Discontinued) Adjustments

Position

GBP'000 GBP'000 GBP'000 GBP'000

Segment assets 5,027 4,465 (2,390) 7,102

Segment (186) (5,600) 3,559 (2,227)

liabilities

Net 4,841 (1,135) 1,169 4,875

assets/(liabilities)

4.Other gains and losses

30 June 2012 30 June 2011

GBP GBP

Gains on disposal of disposal 555 -

groups held for sale

Western Utilities Corporation (Pty) ltd was classified and

accounted for at 31 December 2011 as a disposal group held for

sale. The value of the investment was re-measured to fair value

based on the outstanding loan owned to the group. The gain arises

from the disposal of the group being the difference of the

re-measured net asset value and the purchase price.

5.Taxation

No provision has been made for income tax for the period under

review.

6.Profit per share

Profit per share for the period under review attributable to

shareholders is GBP 2,638,000 (2011: Loss GBP745,000). This is

divided by the weighted average number of shares outstanding for

the period calculated to be 1,531,374,350 (2011: 969,540,827) to

give basic profit per share of 0.17p (2011: (0.076p loss)

The calculation of dilutive loss per share is based on the

weighted average number of shares outstanding adjusted by dilutive

share options. The group's share options are non-dilutive as the

market price of the shares is below the exercise price.

Consequently the diluted loss per share has been stated at the same

figure as the loss per share.

7.Share capital

No changes in share capital for the period under review.

8.Reserves

Group foreign Company and Company and Group profit

exchange Group Group and

reserve share share loss

option premium account

reserve account

GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 148 1,420 9,808 (11,153)

2011

Loss for - - - (997)

the year

Exchange (70) - - -

difference

Options granted - 8 - -

to Directors

New shares - - 860 -

issued

Share based - - 188 -

payments

At 31 December 78 1,428 10,856 (12,150)

2011

Loss for the - - - 2,637

period

Exchange (78) - - -

difference

At 30 June 2012 - 1,428 10,856 (9,513)

9.Discontinued Operations

Discontinued operation

A discontinued operation is a component of the Group's

activities that is distinguishable by reference to geographical

area or line of business that is held for sale, has been disposed

of or discontinued, or is a subsidiary acquired exclusively for

resale. When an operation is classified as discontinued, the

comparative income statement is represented as if the operation had

been discontinued from the start of the comparative period.

Disposal of an operation

On 25 June 2012, Watermark sold its wholly-owned operating

subsidiary, Western Utilities Corporation (Pty) Limited to Mine

Restoration Investments Limited for a consideration of GBP4.50

million comprising GBP1.81 million in cash and GBP2.69 million in

MRI shares.

Loss for the year from discontinued operations

30 June 2012 30 June 2011

GBP GBP

Revenue 2 120

Operating costs (299) (406)

Interest income 1 1

Finance costs 116 (148)

Loss before tax (180) (432)

Taxation - -

Loss from discontinued activities (180) (433)

after taxation

Profit on re-measurement to fair

value less cost to sell

Gain on disposal of operations 2,931 -

Profit/(loss) for the year from 2,751 (433)

discontinued operations

The Western Utilities Corporations (Pty) ltd has been classified

and accounted for at 31 December 2011 as a disposal group held for

sale.

10.Other Financial Assets

30 June 2012 31 December 2011

GBP GBP

Available-for-sale investments

carried at fair value

Shares(i) 2,685 -

Loans to related parties(ii) 16 -

2,701 -

(i) The Group holds 40 % of the ordinary share capital of in

Mine Restoration Investments Limited, company involved in providing

solutions to the waste that occurs from coal mining (coal fines),

as well as Acid Mine Drainage (AMD). The Group does not have any

direct control over the company.

Independent Auditors' Report on Review of Consolidated

Half-Yearly Financial Information

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly report for the six

months ended 30 June 2012 which comprises the consolidated

statement of comprehensive income, consolidated statement of

financial position, consolidated statement of changes in equity,

consolidated statement of cash flows and the comparative figures

and associated notes. We have read the other information contained

in the half-yearly financial report and considered whether it

contains any apparent misstatements or material inconsistencies

with the information in the condensed set of financial

statements.

This report is made solely to the company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

'Review of Interim Financial Information Performed by the

Independent Auditor of the Entity'. Our work has been undertaken so

that we might state to the company those matters we are required to

state to them in an independent review report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company, for our

review work, for this report, or for the conclusions we have

formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union.

As disclosed in Note 2 the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed consolidated set of financial

statements included in this half-yearly financial report has been

prepared in accordance with International Accounting Standard 34,

'Interim Financial Reporting', as adopted by the European

Union.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2012 is not prepared, in all material respects, in accordance

with International Accounting Standard 34 as adopted by the

European Union.

MOORE STEPHENS LLP

150 Aldersgate Street

LONDON

EC1A 4AB

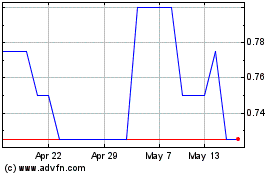

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Sep 2023 to Sep 2024