0001691077

true

S-1/A

0

0

0

0

0

0

P5Y

0.089

0

0

0001691077

2021-01-01

2021-09-30

0001691077

2021-09-30

0001691077

2020-12-31

0001691077

2021-07-01

2021-09-30

0001691077

2020-07-01

2020-09-30

0001691077

2020-01-01

2020-09-30

0001691077

us-gaap:CommonStockMember

2020-12-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001691077

us-gaap:RetainedEarningsMember

2020-12-31

0001691077

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001691077

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001691077

2021-01-01

2021-03-31

0001691077

us-gaap:CommonStockMember

2021-03-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001691077

us-gaap:RetainedEarningsMember

2021-03-31

0001691077

2021-03-31

0001691077

us-gaap:CommonStockMember

2021-04-01

2021-06-30

0001691077

us-gaap:AdditionalPaidInCapitalMember

2021-04-01

2021-06-30

0001691077

us-gaap:RetainedEarningsMember

2021-04-01

2021-06-30

0001691077

2021-04-01

2021-06-30

0001691077

us-gaap:CommonStockMember

2021-06-30

0001691077

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001691077

us-gaap:RetainedEarningsMember

2021-06-30

0001691077

2021-06-30

0001691077

us-gaap:CommonStockMember

2021-07-01

2021-09-30

0001691077

us-gaap:AdditionalPaidInCapitalMember

2021-07-01

2021-09-30

0001691077

us-gaap:RetainedEarningsMember

2021-07-01

2021-09-30

0001691077

us-gaap:CommonStockMember

2021-09-30

0001691077

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0001691077

us-gaap:RetainedEarningsMember

2021-09-30

0001691077

us-gaap:CommonStockMember

2019-12-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001691077

us-gaap:RetainedEarningsMember

2019-12-31

0001691077

2019-12-31

0001691077

us-gaap:CommonStockMember

2020-01-01

2020-03-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-03-31

0001691077

us-gaap:RetainedEarningsMember

2020-01-01

2020-03-31

0001691077

2020-01-01

2020-03-31

0001691077

us-gaap:CommonStockMember

2020-03-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2020-03-31

0001691077

us-gaap:RetainedEarningsMember

2020-03-31

0001691077

2020-03-31

0001691077

us-gaap:CommonStockMember

2020-04-01

2020-06-30

0001691077

us-gaap:AdditionalPaidInCapitalMember

2020-04-01

2020-06-30

0001691077

us-gaap:RetainedEarningsMember

2020-04-01

2020-06-30

0001691077

2020-04-01

2020-06-30

0001691077

us-gaap:CommonStockMember

2020-06-30

0001691077

us-gaap:AdditionalPaidInCapitalMember

2020-06-30

0001691077

us-gaap:RetainedEarningsMember

2020-06-30

0001691077

2020-06-30

0001691077

us-gaap:CommonStockMember

2020-07-01

2020-09-30

0001691077

us-gaap:AdditionalPaidInCapitalMember

2020-07-01

2020-09-30

0001691077

us-gaap:RetainedEarningsMember

2020-07-01

2020-09-30

0001691077

us-gaap:CommonStockMember

2020-09-30

0001691077

us-gaap:AdditionalPaidInCapitalMember

2020-09-30

0001691077

us-gaap:RetainedEarningsMember

2020-09-30

0001691077

2020-09-30

0001691077

us-gaap:ComputerEquipmentMember

2021-01-01

2021-09-30

0001691077

YAYO:OfficerFurnitureMember

2021-01-01

2021-09-30

0001691077

us-gaap:LeaseholdImprovementsMember

2021-01-01

2021-09-30

0001691077

us-gaap:VehiclesMember

2021-01-01

2021-09-30

0001691077

YAYO:WarrantsMember

2021-09-30

0001691077

YAYO:OptionsMember

2021-09-30

0001691077

YAYO:WarrantsMember

2020-09-30

0001691077

YAYO:OptionsMember

2020-09-30

0001691077

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-09-30

0001691077

us-gaap:ComputerEquipmentMember

2021-09-30

0001691077

us-gaap:ComputerEquipmentMember

2020-12-31

0001691077

YAYO:OfficerFurnitureMember

2021-09-30

0001691077

YAYO:OfficerFurnitureMember

2020-12-31

0001691077

us-gaap:LeaseholdImprovementsMember

2021-09-30

0001691077

us-gaap:LeaseholdImprovementsMember

2020-12-31

0001691077

us-gaap:VehiclesMember

2021-09-30

0001691077

us-gaap:VehiclesMember

2020-12-31

0001691077

us-gaap:VehiclesMember

2020-01-01

2020-09-30

0001691077

srt:MinimumMember

2021-09-30

0001691077

srt:MaximumMember

2021-09-30

0001691077

YAYO:NotesPayableOneMember

2021-09-30

0001691077

YAYO:NotesPayableOneMember

2020-12-31

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

2021-09-30

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

2021-01-01

2021-09-30

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

srt:MinimumMember

2021-01-01

2021-09-30

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

srt:MaximumMember

2021-01-01

2021-09-30

0001691077

YAYO:NotePayabletoSmallBusinessAdministrationMember

2021-09-30

0001691077

YAYO:NotePayabletheSmallBusinessAdministrationMember

2021-01-01

2021-09-30

0001691077

YAYO:NotesPayableTwoMember

2021-09-30

0001691077

YAYO:NotesPayableTwoMember

2020-12-31

0001691077

YAYO:PaycheckProtectionProgramMember

2021-09-30

0001691077

YAYO:PaycheckProtectionProgramMember

2021-01-01

2021-09-30

0001691077

YAYO:NotesPayableThreeMember

2021-09-30

0001691077

YAYO:NotesPayableThreeMember

2020-12-31

0001691077

YAYO:NotesPayableFinanceCompanyMember

2021-09-30

0001691077

YAYO:NotesPayableFinanceCompanyMember

srt:MinimumMember

2021-01-01

2021-09-30

0001691077

YAYO:NotesPayableFinanceCompanyMember

srt:MaximumMember

2021-01-01

2021-09-30

0001691077

YAYO:NotesPayableFinanceCompanyMember

2021-01-01

2021-09-30

0001691077

YAYO:NotesPayableFourMember

2021-09-30

0001691077

YAYO:NotesPayableFourMember

2020-12-31

0001691077

us-gaap:LondonInterbankOfferedRateLIBORMember

2021-09-30

0001691077

us-gaap:LondonInterbankOfferedRateLIBORMember

YAYO:NotePayableMember

2021-01-01

2021-09-30

0001691077

us-gaap:LondonInterbankOfferedRateLIBORMember

2021-01-01

2021-09-30

0001691077

us-gaap:LondonInterbankOfferedRateLIBORMember

2020-12-31

0001691077

YAYO:TermLoanAgreementMember

YAYO:EICFAgentLLCMember

2021-07-09

0001691077

YAYO:EICFAgentLLCMember

YAYO:TermLoanAgreementMember

2021-07-07

2021-07-09

0001691077

YAYO:TermLoanAgreementMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2021-07-07

2021-07-09

0001691077

srt:MaximumMember

2021-07-07

2021-07-09

0001691077

YAYO:TermLoanAgreementMember

2021-07-09

0001691077

us-gaap:CommonStockMember

2021-07-07

2021-07-09

0001691077

YAYO:ExchangeAgreementsMember

YAYO:HolderMember

2021-07-08

0001691077

YAYO:NotePayableMember

us-gaap:WarrantMember

2021-07-08

0001691077

YAYO:NotePayableMember

us-gaap:WarrantMember

2021-07-07

2021-07-08

0001691077

YAYO:MrJohnGrayMember

2021-01-08

0001691077

YAYO:MrJohnGrayMember

2021-01-07

2021-01-08

0001691077

YAYO:MrJohnGrayMember

2021-02-10

2021-02-12

0001691077

YAYO:SecuritiesPurchaseAgreementMember

YAYO:InvestorsMember

2021-04-01

2021-04-12

0001691077

YAYO:SecuritiesPurchaseAgreementMember

YAYO:InvestorsMember

2021-04-12

0001691077

YAYO:SecuritiesPurchaseAgreementMember

YAYO:InvestorsMember

YAYO:ConvertibleNotePayableMember

2021-04-12

0001691077

YAYO:SecuritiesPurchaseAgreementMember

YAYO:InvestorsMember

us-gaap:WarrantMember

2021-04-12

0001691077

YAYO:SecuritiesPurchaseAgreementMember

YAYO:InvestorsMember

YAYO:ConvertibleNoteAndWarrantMember

2021-04-12

0001691077

YAYO:ConvertibleNotePayableMember

2020-12-31

0001691077

YAYO:ConvertibleNotePayableMember

2021-01-01

2021-09-30

0001691077

YAYO:ConvertibleNotePayableMember

2021-09-30

0001691077

YAYO:ExchangeAgreementMember

YAYO:SeriesBConvertiblePreferredStockMember

2021-01-01

2021-09-30

0001691077

YAYO:ExchangeAgreementMember

YAYO:SeriesBConvertiblePreferredStockMember

2021-09-30

0001691077

YAYO:ExchangeAgreementMember

us-gaap:WarrantMember

2021-09-30

0001691077

YAYO:ExchangeAgreementMember

us-gaap:SeriesBPreferredStockMember

2021-09-30

0001691077

us-gaap:SeriesBPreferredStockMember

2021-09-30

0001691077

YAYO:BoardofDirectorMember

2021-01-01

2021-09-30

0001691077

YAYO:BoardofDirectorMember

2021-09-30

0001691077

YAYO:StockOptionsMember

2021-01-01

2021-09-30

0001691077

us-gaap:StockOptionMember

2021-01-01

2021-09-30

0001691077

YAYO:StockOptionsMember

2021-01-01

2021-09-30

0001691077

YAYO:InvestorsMember

2021-01-01

2021-09-30

0001691077

YAYO:LegalSettlementsMember

2021-01-01

2021-09-30

0001691077

YAYO:AcuitasGroupHoldingsLLCMember

2021-01-01

2021-09-30

0001691077

us-gaap:StockOptionMember

2020-12-31

0001691077

us-gaap:StockOptionMember

2021-01-01

2021-09-30

0001691077

us-gaap:StockOptionMember

2021-09-30

0001691077

YAYO:ExercisePriceRangeOneMember

2021-09-30

0001691077

YAYO:ExercisePriceRangeTwoMember

2021-09-30

0001691077

YAYO:ExercisePriceRangeThreeMember

2021-09-30

0001691077

YAYO:ExercisePriceRangFourMember

2021-09-30

0001691077

YAYO:ExercisePriceRangFiveMember

2021-09-30

0001691077

YAYO:ExercisePriceRangSixMember

2021-09-30

0001691077

YAYO:ExercisePriceRangeFourMember

2021-09-30

0001691077

us-gaap:WarrantMember

2021-09-30

0001691077

us-gaap:WarrantMember

2021-01-01

2021-09-30

0001691077

srt:MinimumMember

2021-01-01

2021-09-30

0001691077

srt:MaximumMember

2021-01-01

2021-09-30

0001691077

YAYO:InsuranceBrokerageFirmMember

2021-01-01

2021-09-30

0001691077

YAYO:InsuranceBrokerageFirmMember

2020-01-01

2020-09-30

0001691077

YAYO:InsuranceBrokerageFirmMember

2021-09-30

0001691077

YAYO:InsuranceBrokerageFirmMember

2020-12-31

0001691077

YAYO:ExecutiveChairmanMember

2021-01-01

2021-09-30

0001691077

YAYO:FormerCEOMember

2020-12-31

0001691077

YAYO:FormerCEOMember

2021-01-01

2021-09-30

0001691077

YAYO:ExecutiveChairmanMember

2021-09-30

0001691077

YAYO:FormerCEOMember

2021-09-30

0001691077

YAYO:SettlementAgreementMember

YAYO:FirstFireGlobalOpportunitiesFundLLCMember

2021-02-10

2021-02-11

0001691077

YAYO:SettlementAgreementMember

YAYO:FirstFireGlobalOpportunitiesFundLLCMember

2021-02-11

0001691077

us-gaap:SubsequentEventMember

YAYO:ConvertibleNoteAgreementMember

2021-12-10

0001691077

us-gaap:SubsequentEventMember

2021-12-09

2021-12-10

0001691077

2020-01-01

2020-12-31

0001691077

2019-01-01

2019-12-31

0001691077

us-gaap:CommonStockMember

2018-12-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0001691077

us-gaap:RetainedEarningsMember

2018-12-31

0001691077

2018-12-31

0001691077

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0001691077

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0001691077

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001691077

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001691077

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001691077

us-gaap:ComputerEquipmentMember

2020-01-01

2020-12-31

0001691077

us-gaap:VehiclesMember

2020-01-01

2020-12-31

0001691077

YAYO:WarrantsMember

2020-12-31

0001691077

YAYO:OptionsMember

2020-12-31

0001691077

YAYO:WarrantsMember

2019-12-31

0001691077

YAYO:OptionsMember

2019-12-31

0001691077

us-gaap:ComputerEquipmentMember

2019-12-31

0001691077

us-gaap:EquipmentMember

2020-01-01

2020-12-31

0001691077

us-gaap:EquipmentMember

2019-01-01

2019-12-31

0001691077

us-gaap:VehiclesMember

2019-12-31

0001691077

us-gaap:VehiclesMember

2019-01-01

2019-12-31

0001691077

srt:MinimumMember

2020-12-31

0001691077

srt:MaximumMember

2020-12-31

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

2020-12-31

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

2020-01-01

2020-12-31

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

srt:MinimumMember

2019-01-01

2019-12-31

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

srt:MaximumMember

2019-01-01

2019-12-31

0001691077

YAYO:NotesPayableOneMember

2019-12-31

0001691077

YAYO:NotePayabletoSmallBusinessAdministrationMember

2020-12-31

0001691077

YAYO:NotePayabletheSmallBusinessAdministrationMember

2020-01-01

2020-12-31

0001691077

YAYO:NotesPayableTwoMember

2019-12-31

0001691077

YAYO:PaycheckProtectionProgramMember

2020-01-01

2020-12-31

0001691077

YAYO:PaycheckProtectionProgramMember

2020-12-31

0001691077

YAYO:NotesPayableThreeMember

2019-12-31

0001691077

YAYO:NotesPayableFinanceCompanyMember

2020-12-31

0001691077

YAYO:NotesPayableFinanceCompanyMember

2020-01-01

2020-12-31

0001691077

YAYO:NotesPayableFourMember

2019-12-31

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

2017-01-01

2017-12-31

0001691077

YAYO:UnsecuredNotePayableToIndividualInvestorsMember

2019-01-01

2019-12-31

0001691077

YAYO:ThreeInvestorsMember

2020-01-01

2020-12-31

0001691077

YAYO:BoardofDirectorMember

2020-01-01

2020-12-31

0001691077

YAYO:VendorsMember

2020-01-01

2020-12-31

0001691077

YAYO:VendorsMember

2019-12-31

0001691077

us-gaap:IPOMember

2019-01-01

2019-12-31

0001691077

us-gaap:IPOMember

2019-12-31

0001691077

YAYO:ExercisePriceRangeOneMember

2020-12-31

0001691077

YAYO:ExercisePriceRangeTwoMember

2020-12-31

0001691077

srt:MinimumMember

2020-01-01

2020-12-31

0001691077

us-gaap:IPOMember

2020-12-31

0001691077

us-gaap:IPOMember

2020-01-01

2020-12-31

0001691077

YAYO:ChiefExecutiveOfficerAndDirectorMember

2020-01-01

2020-12-31

0001691077

YAYO:ChiefExecutiveOfficerAndDirectorMember

2019-01-01

2019-12-31

0001691077

YAYO:ChiefExecutiveOfficerAndDirectorMember

2019-12-01

2019-12-31

0001691077

YAYO:ChiefExecutiveOfficerAndDirectorMember

2020-12-31

0001691077

YAYO:ChiefExecutiveOfficerAndDirectorMember

2019-12-31

0001691077

YAYO:InsuranceBrokerageFirmMember

2020-01-01

2020-12-31

0001691077

YAYO:InsuranceBrokerageFirmMember

2019-01-01

2019-12-31

0001691077

YAYO:InsuranceBrokerageFirmMember

2019-12-30

0001691077

YAYO:InsuranceBrokerageFirmMember

2020-12-30

0001691077

YAYO:UptickCapitalLLCMember

YAYO:AdvisoryAgreementMember

2017-08-06

2017-08-07

0001691077

YAYO:ConvertiblePromissoryNoteMember

2021-01-08

0001691077

YAYO:ConvertiblePromissoryNoteMember

2021-01-02

2021-01-08

0001691077

YAYO:ConvertiblePromissoryNoteMember

2021-02-20

2021-02-25

0001691077

YAYO:FirstFireSettlementMember

2021-02-13

2021-02-15

0001691077

YAYO:FirstFireSettlementMember

2021-02-15

0001691077

YAYO:BoardofDirectorMember

2021-01-01

2021-03-30

0001691077

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-03-30

0001691077

2021-01-01

2021-03-30

0001691077

YAYO:ExecutiveChairmanMember

2021-01-01

2021-03-30

0001691077

us-gaap:SubsequentEventMember

YAYO:ConvertiblePromissoryNoteMember

YAYO:SecuritiesPurchaseAgreementMember

2021-04-11

2021-04-12

0001691077

us-gaap:SubsequentEventMember

YAYO:ConvertiblePromissoryNoteMember

YAYO:SecuritiesPurchaseAgreementMember

2021-04-12

0001691077

YAYO:SecuritiesPurchaseAgreementMember

us-gaap:SubsequentEventMember

2021-04-12

0001691077

us-gaap:SubsequentEventMember

YAYO:SecuritiesPurchaseAgreementMember

us-gaap:CommonStockMember

2021-04-12

0001691077

us-gaap:SubsequentEventMember

YAYO:SecuritiesPurchaseAgreementMember

us-gaap:CommonStockMember

2021-09-08

0001691077

us-gaap:SubsequentEventMember

YAYO:SecuredTermLoanFacilityMember

YAYO:GuaranteeAndSecurityAgreementMember

srt:MaximumMember

2021-07-09

0001691077

us-gaap:SubsequentEventMember

YAYO:FundedUponClosingMember

YAYO:GuaranteeAndSecurityAgreementMember

2021-07-09

0001691077

us-gaap:SubsequentEventMember

YAYO:AdditionalBorrowingsUnderDelayedDrawTermLoanFacilityMember

YAYO:GuaranteeAndSecurityAgreementMember

2021-07-09

0001691077

us-gaap:SubsequentEventMember

YAYO:SecuredTermLoanFacilityMember

YAYO:GuaranteeAndSecurityAgreementMember

2021-07-05

2021-07-09

0001691077

us-gaap:SubsequentEventMember

YAYO:SecuredTermLoanFacilityMember

YAYO:GuaranteeAndSecurityAgreementMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2021-07-09

0001691077

us-gaap:SubsequentEventMember

YAYO:SecuredTermLoanFacilityMember

YAYO:GuaranteeAndSecurityAgreementMember

us-gaap:CommonStockMember

2021-07-09

0001691077

us-gaap:SubsequentEventMember

YAYO:ExchangeAgreementMember

us-gaap:SeriesBPreferredStockMember

2021-07-08

0001691077

us-gaap:SubsequentEventMember

YAYO:ExchangeAgreementMember

us-gaap:SeriesBPreferredStockMember

2021-07-07

2021-07-08

0001691077

us-gaap:SubsequentEventMember

2021-10-20

2021-10-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As

filed with the Securities and Exchange Commission on December 13, 2021

Registration

No. 333-257992

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT

NO. 3

TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVmo,

Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

7371

|

|

81-3028414

|

|

(State

or Other Jurisdiction of Incorporation or Organization)

|

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(I.R.S.

Employer

Identification Number)

|

433

N. Camden Drive, Suite

600

Beverly Hills,

CA 90210

(310) 926-2643

(Address, Including Zip Code, and Telephone Number,

Including

Area Code, of Registrant’s Principal Executive Offices)

Stephen

M. Sanchez

Chief Executive Officer

433 N. Camden Drive, Suite 600

Beverly Hills, CA 90210

(310) 926-2643

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies

to

M.

Ridgway Barker, Esq.

Joseph A. Tagliaferro III, Esq.

Withers Bergman LLP

1925 Century Park East, Suite 400

Los Angeles, CA 90067

Telephone: (310) 277-9930

Facsimile: (310) 951-9139

|

Barry

Grossman, Esq.

Sarah

E. Williams, Esq.

Ellenoff

Grossman & Schole LLP

1345

Avenue of the Americas

New

York, New York 10105

(212)

370-1300

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☑

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large

accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

|

|

|

|

|

Non-accelerated

filer

|

☑

|

Smaller

reporting company

|

☑

|

|

|

|

|

|

|

|

|

Emerging

growth company

|

☑

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

CALCULATION

OF REGISTRATION FEE

Title

of each class of

securities to be registered(1)

|

|

Proposed

Maximum

Aggregate

Offering

Price(5)

|

|

|

Amount

of

Registration

Fee

|

|

|

Common

Stock, par value $0.000001 per share (the “Common Stock”)(2)

|

|

$

|

17,250,000

|

|

|

$

|

1,599.08

|

|

|

Representative’s

Warrants(3)

|

|

|

—

|

|

|

|

—

|

|

|

Shares

of Common Stock issuable upon exercise of Representative’s Warrants(4)

|

|

$

|

1,035,000

|

|

|

$

|

95.94

|

|

|

Total(6)

|

|

$

|

18,285,000

|

|

|

$

|

1,695.02

|

|

|

(1)

|

In

the event of a stock split, stock dividend, or similar transaction involving our Common Stock, the number of shares of Common Stock

underlying the warrants registered hereby shall automatically be increased to cover the additional shares of Common Stock issuable

pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”).

|

|

(2)

|

Includes

shares of Common Stock that may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments,

if any.

|

|

(3)

|

No

additional registration fee is payable pursuant to Rule 457(g) under the Securities Act.

|

|

(4)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under

the Securities Act. The representative’s warrants are exercisable for up to the number

of shares of Common Stock equal to 5% of the aggregate number of shares of Common Stock sold

in this offering at a per share exercise price equal to 120% of the public offering

price of the shares. As estimated solely for the purpose of calculating the registration

fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering

price of the representative’s warrants is $103,500, which is equal to 120%

of $750,000 (5% of the proposed maximum aggregate offering price of $17,250,000).

|

|

(5)

|

Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act.

|

|

(6)

|

Of this total registration fee, $1,322.84 has already

been paid.

|

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act, or until the Registration Statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY

PROSPECTUS

|

SUBJECT

TO COMPLETION

|

DATED

DECEMBER 13, 2021

|

16,666,667

Shares

Common

Stock

EVmo,

Inc.

This

is a firm commitment public offering of 16,666,667 shares of common stock, par value $0.000001 per share (the “Common Stock”)

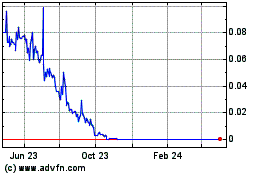

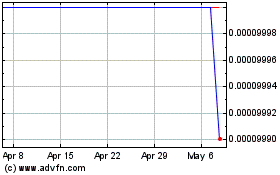

of EVmo, Inc., a Delaware corporation, at an assumed offering price of $0.90 per share. Our Common Stock is

traded on the Pink Open Market and quoted on the OTC Market under the symbol “YAYO.” On November 19, 2021, the last

reported sale price of the Common Stock on the OTC Market was $0.90 per share (the “Assumed Offering Price”). The

Assumed Offering Price used throughout this prospectus has been included for illustration purposes only and the final public offering

price of the shares of Common Stock in this offering will be determined through negotiation between us and the underwriters in the offering

and the recent market price used throughout this prospectus may not be indicative of the final offering price.

We will offer and sell our Common Stock to retail

customers only in New York. We will rely upon the exemption from registration for sale to institutional investors in every other state.

The definition of an “institutional investor” varies from state to state but generally includes financial institutions, broker-dealers,

banks, insurance companies and other qualified entities.

We

are an “emerging growth company” and a “smaller reporting company,” each as defined under the federal securities

laws and, as such, have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future

filings. See the section titled “Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing

in our securities involves risks. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of the

risks that you should consider in connection with an investment in our Common Stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per

Share

|

|

|

Total

|

|

|

Initial

public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting

discounts and commissions(1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds,

before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

Underwriting

discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the initial public offering price payable

to the underwriters. We have agreed to reimburse the underwriters for certain expenses and the underwriters will receive compensation

in addition to underwriting discounts and commissions. We have also agreed to issue warrants to the representative of the underwriters

(the “Representative’s Warrants”) as a portion of the underwriting compensation payable to the underwriters

in connection with this offering. See the section titled “Underwriting” beginning on page 52 of this prospectus for additional

disclosure regarding underwriter compensation and offering expenses.

|

We

have granted to the underwriters of this offering an option for a period of 45 days from the date of this prospectus to purchase up to

an additional 2,500,000 shares of our Common Stock, an amount equal to 15% of the number of shares offered hereby, on the same

terms and conditions described herein, solely to cover over-allotments, if any. See “Underwriting” for more information.

The

underwriters expect to deliver the shares of Common Stock against payment on or about,

2021, subject to customary closing

conditions.

The

date of this prospectus is December 13, 2021

EVmo,

Inc.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

have not, and the underwriters have not, authorized anyone to provide you with information different than that which is contained in

this prospectus or in any free writing prospectus that we have authorized for use in connection with this offering. We are offering to

sell, and seeking offers to buy, shares of Common Stock only in jurisdictions where offers and sales are permitted. The distribution

of this prospectus and the offering of the Common Stock in certain jurisdictions may be restricted by law. This prospectus does not constitute,

and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any Common Stock offered by this prospectus

by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

You

should assume that the information appearing in this prospectus and in any free writing prospectus that we have authorized for use in

connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results

of operations and prospects may have changed since those dates. You should read this prospectus and any free writing prospectus that

we have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also

read and consider the information in the documents to which we have referred you in the sections of this prospectus entitled “Where

You Can Find More Information.”

For

investors outside of the United States: No action is being taken in any jurisdiction outside of the United States that would permit a

public offering of the shares of our Common Stock or possession or distribution of this prospectus in any such jurisdiction. Persons

outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the shares of Common Stock and the distribution of this prospectus outside of the United States.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to this prospectus

were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should

not be relied on as accurately representing the current state of our affairs.

Unless

the context requires otherwise, references in this prospectus to “EVmo,” “EVmo, Inc.,” the “Company,”

“we,” “us,” and “our” refer to EVmo, Inc., a Delaware corporation.

This

prospectus may make reference to trademarks, servicemarks and tradenames owned by us or other companies. All such trademarks, servicemarks

and tradenames, if any, included in this prospectus are the property of their respective owners.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should

consider before investing in our securities. Before deciding to invest in our securities, you should read this entire prospectus carefully,

including the section of this prospectus entitled “Risk Factors” beginning on page 8. All brand names or trademarks appearing

in this report are the property of their respective holders.

Overview

of the Company

EVmo,

Inc. is a holding company operating principally through two wholly-owned subsidiaries: (i) Rideshare Car Rentals LLC, a Delaware limited

liability company (“Rideshare”), and (ii) Distinct Cars, LLC, a Delaware limited liability company (“Distinct Cars”).

Rideshare offers an online bookings platform (the “Rideshare Platform”) while Distinct Cars maintains a fleet of passenger

vehicles and transit vans for use in the last-mile logistical space for rent to our customers who are drivers in the ridesharing and

delivery gig industries, while also providing them with insurance coverage and issuing them insurance cards in their own names. This

enables such drivers to meet the vehicle suitability and other requirements of rideshare and delivery gig companies such as Uber, Lyft,

DoorDash and Grubhub. Through Rideshare and Distinct Cars, we seek to become a leading provider of rental vehicles to drivers in the

ridesharing and delivery gig spaces, and an industry leader in supplying transit vans for last-mile logistics. “Gig” generally

refers to a labor market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs.

Drivers

can rent their vehicles using the Rideshare Platform, which enables them to check inventory and performance and review vehicle data.

Drivers have the ability to book vehicles online by the day, week or month, at their option, make payments, check insurance, or extend

their rental with a minimum of inconvenience, while at the same time incurring no maintenance expenses. Depending on the make and model

of the requested vehicle, rental prices begin at $39 per day or $795 per month. The Rideshare Platform is available on desktop, iOS and

Android devices. We initially launched the Rideshare Platform in Los Angeles, CA and have since expanded it in the following markets:

Oakland, CA; Las Vegas, NV; Chicago, IL; Newark, NJ; Baltimore, MD; and Dallas, TX.

In

March 2021, we formed another wholly-owned subsidiary, EV Vehicles LLC, a Delaware limited liability company, which we intend to utilize

as the corporate platform to implement our strategy to transition our entire fleet of rental vehicles from standard vehicles with internal

combustion engines to electric by 2024.

Our

Market

We

service drivers in the ridesharing and delivery gig industries by providing them with qualifying vehicles and insurance, enabling them

to work for Transportation Network Companies (“TNCs”) such as Uber and Lyft. We strongly believe this is a vibrant and growing

market, as the advent of ridesharing and food delivery gigs over the last decade has permanently changed the transportation industry.

The U.S. Department of Labor-Bureau of Labor Statistics in its April 2021 report has reported that consumer expenditures on transportation

were approximately $1.1 trillion in 2019. Further, according to such statistics, transportation (including vehicle purchases and expenditures

for gasoline and motor oil) was the second largest household expenditure after housing and the aggregate consumer spending on transportation

was almost twice as large as that of healthcare and three times as large as entertainment. The use of rideshare and food delivery gig

applications on smart phones has been transformative, allowing Uber, for example, to announce in mid-2016 that it had completed its two

billionth ride only six months after it marked its first one billion rides.

One

of the challenges the ridesharing and delivery gig industries faces is ensuring that driver growth keeps pace with the massive demand.

Lyft recently reported an increase in active riders by over 940,000 in the first quarter of 2021 than in the fourth quarter of 2020,

and that by the end of February 2021 rider growth had exceeded driver growth. Uber had 3.5 million active drivers on its platform during

the first three months of the year but is also reporting a shortage. In April 2021, it announced a $250 million stimulus to entice both

former and new drivers to work for them.

Accordingly,

the TNCs have actively taken steps to satisfy their driver demand by setting up programs designed to get eligible drivers into qualified

cars. Uber has entered into multiple partnerships with car rental companies, and Lyft Express Driver is partnered with Hertz. We believe

EVmo can be a major independent player in this space, since we also supply TNC drivers with qualifying vehicles, which we expect will

eventually be electric vehicles, and provide them access to the Rideshare Platform, which is a driver-friendly mechanism to manage their

vehicle rental and allowing them to generate income.

Our

Growth Strategy

Our

current growth strategy, which we formulated in early 2021, centers around our goal to transition our entire vehicle fleet to electric

vehicles. We initiated this strategy for several reasons. First, we believe that industry trends are clear that electric vehicles will

become the mainstay of the automobile market over the next 10 years. The Ford Motor Company has recently announced its intention to invest

more than $30 billion in vehicle electrification through 2025, and has stated that it expects electric vehicles will comprise nearly

half of all global sales by 2030. General Motors has stated that its goal is to exclusively sell electric vehicles by 2035. Apple and

Hyundai are collaborating on producing an electric vehicle, and industry leader Tesla is rapidly growing and expanding its electric vehicle

product line. While, according to LMC Automotive, only 410,000 electric vehicles were built in North America in 2020, annual production

is expected to increase to at least 1.4 million vehicles by 2028.

Second,

we believe that both drivers and riders will be increasingly drawn to electric vehicles for their environmental benefits, especially

as they become comparable to combustion cars in terms of pricing, mileage and the number of available options to choose from. The demand

for clean energy products is undeniable, and electric vehicles should be no exception as consumers continue to seek out eco-friendly

alternatives.

Finally,

we concluded that governmental policies and mandates will ultimately force the hand of both the automobile industry and consumers. Fuel

economy and carbon dioxide emission targets are under constant review by the Environmental Protection Agency and many state governments,

and in our opinion, this has helped shape manufacturing strategies and consumer preferences. Several states and municipalities have taken

steps to either halt the sales of gasoline-fueled vehicles in the near future, or to promote the sale of electric vehicles. For example,

the governor of California issued an executive order in September 2020 requiring all in-state sales of new passenger cars and trucks

to be zero- emissions by 2035. In Oregon, residents can receive a rebate of up to $2,500 on the purchase or lease of a qualifying electric

vehicle.

While

we will incur a considerable short-term operating expense in turning over our fleet, we firmly believe that the reputational and brand

benefits we will realize from being known as a TNC vehicle provider with an entirely electric fleet will quickly allow us to differentiate

ourselves and significantly grow our business. The trends we describe above will directly impact the ridesharing and delivery gig industries,

as we believe that both TNC drivers and riders will increasingly express a preference for electric vehicles. By making ourselves an early

industry leader in this area, we believe that we will be well-positioned to market ourselves successfully and become profitable, using

our current business model of vehicle rentals to TNC drivers. We currently have 40 electric vehicles in our fleet and we expect this

number to grow to approximately 150-200 by the end of 2021. We expect to complete our transition to wholly electric by 2024.

Impact

of COVID-19 on our Business

On

January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID-19) a “Public Health Emergency

of International Concern,” and on March 11, 2020, it characterized the outbreak as a “pandemic.” In response, numerous

states and cities ordered their residents to cease traveling to non-essential jobs and to curtail all unnecessary travel, and similar

restrictions were recommended by the federal government. Beginning in the first quarter of 2020, which saw the initial rapid spread of

COVID-19, rideshare companies were severely and negatively impacted, as demand plummeted. Consequently, the Company experienced a decline

in revenue during the first half of 2020, which had a negative impact on our cash flows, but we then saw a positive upward movement in

revenue during the second half of 2020, which has continued into the first three fiscal quarters of 2021. As of the date of this

prospectus, one vaccination for COVID-19 has received full approval from the Food and Drug Administration, while others have received

emergency-use authorization, and many of the lockdown restrictions imposed by state and local governments have abated. Still, the pandemic

has not yet ended, and there have been multiple waves where infections, hospitalizations, and deaths have sharply increased. Most recently,

variants of the original virus have been identified, and many Americans have resisted obtaining one of the vaccinations. At this time,

we cannot predict the ultimate impact that COVID-19 may have on our business over the entirety of this year, and possibly beyond.

Corporate

History and Information

EVmo

was initially formed on June 21, 2016 as a Delaware limited liability company under the name “YayYo, LLC.” The Company was

subsequently converted into a Delaware corporation pursuant to Section 265 of the Delaware General Corporation Law (the “DGCL”).

The Company now operates as a “C” corporation formed under the laws of the State of Delaware.

We

became a reporting company when, on March 17, 2017, an offering circular on Form 1-A relating to a best-efforts offering of our Common

Stock pursuant to “Regulation A+” of the Securities Act, was qualified by the Securities and Exchange Commission (the “SEC”).

Then, on November 15, 2019, we completed an initial public offering of 2,625,000 shares of Common Stock, at $4.00 per share, for gross

proceeds, before underwriting discounts and commissions and expenses, of $10.5 million and our Common Stock was listed on the Nasdaq

Capital Market (“Nasdaq”) under the ticker symbol “YAYO.”

On

February 10, 2020, after being advised by Nasdaq that it believed we no longer met the conditions for continued listing, the Company

announced its intent to voluntarily delist its Common Stock. Since delisting from Nasdaq, our Common Stock has been quoted and traded

on the Pink Open Market, which is operated by OTC Markets Group, under the same ticker symbol. The delisting was effective on March 1,

2020.

In

September 2020, we changed our name from YayYo, Inc. to Rideshare Rental, Inc., in order for our corporate brand to better reflect our

principal businesses, ridesharing and vehicle rentals. In February 2021, we again changed our name to EVmo, Inc., to underscore our commitment

to making a full transition to electric vehicles by the end of 2024.

Our

address is 433 N. Camden Drive, Suite 600, Beverly Hills, CA 90210. Our telephone number is (310) 926-2643 and our website may be accessed

at www.evmo.com.

Implications

of Being an Emerging Growth Company and a Smaller Reporting Company

We

qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS

Act”). As an “emerging growth company,” we may take advantage of specified reduced disclosure and other requirements

that are otherwise applicable generally to public companies. These provisions include, but are not limited to:

|

|

●

|

requiring

only two years of audited financial statements in addition to any required unaudited interim financial statements, with a correspondingly

reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our

periodic filings made under the Securities Act of 1933, as amended (the “Securities Act”);

|

|

|

|

|

|

|

●

|

reduced

disclosure about our executive compensation arrangements;

|

|

|

|

|

|

|

●

|

no

non-binding shareholder advisory votes on our executive compensation, including any golden parachute arrangements; and

|

|

|

|

|

|

|

●

|

exemption

from compliance with the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant

to Section 404(b) of the Sarbanes Oxley Act of 2002 (“SOX”).

|

We

may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We

will continue to remain an emerging growth company until the earliest of the following: (i) the last day of the fiscal year following

the fifth anniversary of the date of the completion of this offering; (ii) the last day of the fiscal year in which our total annual

gross revenue is equal to or more than $1.07 billion; (iii) the date on which we have issued more than $1 billion in nonconvertible debt

during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities

and Exchange Commission (the “SEC”).

We

are also a “smaller reporting company” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies.

To the extent that we continue to qualify as a smaller reporting company after we cease to qualify as an emerging growth company, certain

of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including

exemption from compliance with the auditor attestation requirements pursuant to SOX and reduced disclosure about our executive compensation

arrangements. We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based

on the price of our Common Stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the

event we have no public float or a public float that is less than $700 million, annual revenues of $100 million or more during the most

recently completed fiscal year.

We

may choose to take advantage of some, but not all, of these exemptions. We have taken advantage of reduced reporting requirements in

this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies

in which you hold stock. In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition

period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply

to private companies. We have elected to avail ourselves of the extended transition period for complying with new or revised financial

accounting standards. As a result of the accounting standards election, we will not be subject to the same implementation timing for

new or revised accounting standards as other public companies that are not emerging growth companies which may make comparison of our

financials to those of other public companies more difficult.

THE

OFFERING

The

following summary contains general information about this offering. The summary is not intended to be complete. You should read the full

text and more specific details contained elsewhere in this prospectus.

|

Common

Stock Offered by Us

|

|

16,666,667

shares of Common Stock.

|

|

|

|

|

|

Option

to Purchase Additional Shares of Common Stock

|

|

We

have granted the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to additional shares

of our Common Stock, an amount equal to 15% of the number of shares offered hereby, on the same terms and conditions as set forth

herein, to cover over-allotments, if any.

|

|

|

|

|

|

Common

Stock to be Outstanding Immediately After this Offering

|

|

52,424,816

shares (or 54,924,816 shares

if the underwriters exercise their option to purchase additional shares in full) (based on Assumed Offering Price of $0.90).

|

|

|

|

|

|

Use

of Proceeds

|

|

We

estimate that we will receive net proceeds from this offering of approximately $13,950,000 million, or approximately $16,042,500

million if the representative of the underwriters exercises its option to purchase additional shares in full, in each case, after

deducting underwriting discounts and our estimated offering expenses.

|

|

|

|

|

|

|

|

We

currently intend to use: (i) $2,303,750 of the net proceeds that we receive from this offering to redeem 230,375 outstanding shares

of Series B preferred stock, par value $0.000001 per share (the “Series B Preferred Stock”) at a redemption price of

$10.00 per share; (ii) $8,000,000 for the acquisition of electric vehicles; (iii) $1,000,00 for the replacement of standard

vehicles while our transition to all-electric is pending; and (iv) $700,000 to be allocated to our marketing budget and enhancements

to the Rideshare Platform, with the remainder to help finance our transition to electric vehicles through vehicle acquisitions and

provide additional working capital for general corporate purposes. In addition, we may use a portion of the net proceeds from this

offering to pursue potential strategic acquisitions, although we do not have any specific plans or arrangements to do so at this

time. See “Use of Proceeds” on page 21 of this prospectus.

|

|

|

|

|

|

Risk

Factors

|

|

Investing

in our Common Stock involves significant risks. Before making a decision whether to invest in our Common Stock, please read the information

contained under the heading “Risk Factors” beginning on page 8 of this prospectus.

|

|

|

|

|

|

Common

Stock Trading Symbol

|

|

“YAYO”

|

The

number of shares of Common Stock to be outstanding after this offering is based on 35,758,149 shares outstanding as of November

19, 2021, and excludes:

|

|

●

|

778,125

shares of our Common Stock issuable upon the exercise of issued

and outstanding stock options outstanding at a weighted-average strike price of $0.44 per share;

|

|

|

|

|

|

|

●

|

3,825,000

shares of Common Stock issuable upon the exercise of outstanding

warrants at an weighted-average exercise price of $2.87 per share;

|

|

|

|

|

|

|

●

|

8,405,075

shares of Common Stock reserved for future issuance under our 2016

Equity Incentive Plan for employees, directors, officers, consultants and other eligible participants; and

|

|

|

|

|

|

|

●

|

958,333

shares of Common Stock issuable upon the exercise of the Representative’s

Warrants to be issued upon closing of this offering.

|

Unless

otherwise indicated, all information in this prospectus assumes:

|

|

●

|

no

exercise of the outstanding warrant or any of the outstanding stock options issued under the 2016 Equity Incentive Plan, as described

above;

|

|

|

|

|

|

|

●

|

no

exercise by the underwriters of their option to purchase up to an additional 2,500,000 shares of Common Stock from us in this

offering to cover over-allotments, if any;

|

|

|

|

|

|

|

●

|

no

exercise of the Representative’s Warrants to be issued upon consummation of this offering at an exercise price equal

to 120% of the initial offering price of the Common Stock;

|

|

|

|

|

|

|

●

|

the

Series B Preferred Stock is redeemed from the proceeds of this offering and is not converted into shares of Common Stock prior to

completion of this offering; and

|

|

|

|

|

|

|

●

|

that

the Assumed Offering Price is $0.90 per share.

|

SUMMARY

HISTORICAL CONSOLIDATED FINANCIAL DATA

The

following table summarize our financial data for the periods and as of the dates indicated. The consolidated statements of operations

data for the years ended December 31, 2020 and 2019 are derived from our audited consolidated financial statements and notes thereto

that are included elsewhere in this prospectus. The statements of operations data for the nine months ended September 30,

2021 and 2020 and the balance sheet data as of September 30, 2021 have been derived from our unaudited condensed financial statements

and related notes included elsewhere in this prospectus and have been prepared in accordance with generally accepted accounting principles

in the United States of America on the same basis as the annual audited financial statements and, in the opinion of management, the unaudited

data reflects all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of the financial

information in those statements. Our historical results are not necessarily indicative of results that may be expected in the future,

and results for the period ended September 30, 2021 are not necessarily indicative of the results to be expected for the full

year ending December 31, 2021. You should read this information together with “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in the

registration statement of which this prospectus forms a part.

|

|

|

Nine

Months Ended September 30,

|

|

|

Years

Ended December 31,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2020

|

|

|

2019

|

|

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

Consolidated

Statements of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

7,670,795

|

|

|

$

|

5,399,018

|

|

|

$

|

7,621,180

|

|

|

$

|

6,914,910

|

|

|

Cost

of revenue

|

|

|

5,982,075

|

|

|

|

3,891,307

|

|

|

|

5,263,474

|

|

|

|

4,673,870

|

|

|

Gross

profit

|

|

|

1,688,720

|

|

|

|

1,507,711

|

|

|

|

2,357,706

|

|

|

|

2,241,040

|

|

|

Operating

expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling

and marketing

|

|

|

257,129

|

|

|

|

324,546

|

|

|

|

490,403

|

|

|

|

765,441

|

|

|

Product

development

|

|

|

106,766

|

|

|

|

-

|

|

|

|

-

|

|

|

|

13,500

|

|

|

General

and administrative

|

|

|

6,151,507

|

|

|

|

3,845,768

|

|

|

|

5,288,316

|

|

|

|

4,023,921

|

|

|

Loss

on settlement of debt

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

252,900

|

|

|

Total

operating expenses

|

|

|

6,515,402

|

|

|

|

4,170,314

|

|

|

|

5,778,719

|

|

|

|

5,055,762

|

|

|

Loss

from operations

|

|

|

(4,826,682

|

)

|

|

|

(2,662,603

|

)

|

|

|

(3,421,013

|

)

|

|

|

(2,814,722

|

)

|

|

Other

income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

and financing costs

|

|

|

(6,296,524

|

)

|

|

|

(212,943

|

)

|

|

|

(265,839

|

)

|

|

|

(1,115,499

|

)

|

|

Other

income

|

|

|

83,541

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Gain

on forgiveness of debt

|

|

|

8,000

|

|

|

|

-

|

|

|

|

184,775

|

|

|

|

-

|

|

|

Total

other income (expense)

|

|

|

(6,204,983

|

)

|

|

|

(212,943

|

)

|

|

|

(81,064

|

)

|

|

|

(1,115,499

|

)

|

|

Net

loss

|

|

$

|

(11,031,665

|

)

|

|

$

|

(2,875,546

|

)

|

|

$

|

(3,502,077

|

)

|

|

$

|

(3,930,221

|

)

|

|

Loss

per share - basic and diluted

|

|

$

|

(0.32

|

)

|

|

$

|

(0.09

|

)

|

|

$

|

(0.11

|

)

|

|

$

|

(0.14

|

)

|

|

Weighted

average common shares outstanding - basic and diluted

|

|

$

|

34,819,334

|

|

|

$

|

30,828,676

|

|

|

$

|

31,118,425

|

|

|

$

|

27,112,557

|

|

|

|

|

As

of September 30, 2021

|

|

|

|

|

Actual

|

|

|

As

adjusted (1)

|

|

|

|

|

|

|

|

|

|

|

Unaudited

Consolidated Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

and cash equivalents

|

|

$

|

3,540,212

|

|

|

$

|

14,436,462

|

|

|

Working

capital

|

|

$

|

(1,314,873

|

)

|

|

$

|

11,885,127

|

|

|

Total

assets

|

|

$

|

15,541,474

|

|

|

$

|

28,741,474

|

|

|

Total

liabilities

|

|

$

|

14,737,001

|

|

|

$

|

14,737,001

|

|

|

Accumulated

deficit

|

|

$

|

(39,705,657

|

)

|

|

$

|

(39,705,657

|

)

|

|

Total

stockholders’ equity

|

|

$

|

(1,499,277

|

)

|

|

$

|

11,700,723

|

|

(1)

The pro forma as adjusted balance sheet data in the table above reflects:

the (i) the pro forma adjustments set forth above; (ii) the sale and issuance by us of 16,666,667 shares of our Common Stock in

this offering, based upon the assumed public offering price of $0.90 per share, after deducting the underwriting discounts and

commissions and estimated offering expenses payable by us; and (iii) the use of $2,303,750 of proceeds from this offering for the redemption

by us of 230,375 shares of Series B Preferred Stock.

RISK

FACTORS

An

investment in our Common Stock involves a high degree of risk. You should consider the risks, uncertainties and assumptions discussed

below as well as all of the other information contained in this prospectus. It is not possible to predict or identify all such risks.

Consequently, we could also be affected by additional factors that are not presently known to us or that we currently consider to be

immaterial to our operations. The occurrence of any of these known or unknown risks might cause you to lose all or part of your investment

in the Common Stock.

Risks

Related to Our Business and Industry

We

have generated only limited revenue to date, have incurred net losses since inception, and may continue to incur net losses for the foreseeable

future.

We

are subject to all of the risks inherent in a start-up company, including the absence of a lengthy history of successful operations.

There can be no assurance that we will be able to continue to successfully operate our business, including, without limitation, developing

and enhancing, as applicable, our technologies, products and services.

We

were initially organized in November 2016 and it was not until August 2017 that we shifted our operations into the transportation/ridesharing

industry, with a focus on developing the Rideshare Platform and growing and maintaining Distinct Cars. We therefore have a limited operating

history in the ridesharing and delivery gig industries. We generated $7,670,795 in revenue during the nine months ended

September 30, of 2021 but had a net loss of ($11,031,665) as compared to a net loss of ($2,875,546) for the nine

months ended September 30, of 2020. We generated $7,621,180 in revenue during fiscal year 2020 but had a net loss of ($3,502,077);

in the previous fiscal year, our net loss was ($3,930,221). While our current net loss decreased from the previous fiscal year, and is

significantly lower than that of two years ago, we have still not achieved profitability as yet and cannot predict with any certainty

when we will do so, if ever. Any unanticipated increase in operating expenses, or a decline in revenues such as we experienced during

the early months of the COVID-19 pandemic in 2020, or a failure by us to successfully grow our business, may result in a continuation

of net losses for the foreseeable future.

More

generally, operating results for future periods are subject to numerous uncertainties, several of which we address in this section, and

we cannot assure you that the Company will ever achieve or sustain profitability. The Company’s prospects must be considered in

light of the general risks encountered by small companies with limited operating history, particularly companies in newer and rapidly

evolving markets, as well as those risks particular to us, which we describe in this section. Operating results will depend upon many

factors, including our success in attracting and retaining motivated and qualified personnel, whether or not we can obtain needed financing

on satisfactory terms, our ability to continue to develop and market our products and services, whether or not we can control our operating

expenses, and general economic conditions. Although the Company believes that its plans to grow, expand and scale operations organically,

particularly through our transition to electric vehicles, will be successful, this may in fact not be the case. Nor can there be any

assurance that the Company’s revenue projections and marketing plans will be realized as anticipated and planned. The Company cannot

assure either its current shareholders or any prospective investors that any such failure will not have a material adverse effect on

our business.

We

have incurred a significant amount of secured indebtedness in order to finance our operations and, if we are unable to timely and adequately

service this debt, substantially all of our assets will be subject to seizure by our lender.

In

July 2021, we entered into a Term Loan, Guarantee and Security Agreement with EICF Agent LLC, as agent for the lender, and Energy Impact

Credit Fund I, LP, as lender, providing for a secured term loan facility in an aggregate principal amount of up to $15.0 million, against

which we have borrowed $7.5 million as of the closing date of the agreement. These borrowings are guaranteed by the Company’s wholly-owned

subsidiaries and are a general obligation of the Company. We have granted our lender a security interest in the right, title, and interest

in the collateral identified in the agreement, which is substantially all of the Company’s property and assets other than certain

leased vehicles. If, for whatever reason, we are unable to timely and adequately service this debt, these assets will be subject to seizure

by our lender, and we will have very limited recourse short of satisfying our debt to delay or prevent any such seizure. This contingency

would have a material adverse effect on our business, and would likely prevent us from continuing as a going concern.

We

may need but be unable to obtain additional funding on satisfactory terms, which could dilute our shareholders or impose burdensome financial

restrictions on our business.

While

we intend to rely predominantly on revenues generated from operations, as well as the capital generated from this offering, to fund all

of the cash requirements of our business for the foreseeable future, we have, in the past, relied on cash obtained from financing. If

we need to raise additional capital after this offering in order to further execute our business plan and growth, it is possible that

future financings may not be timely available, either in sufficient amounts or on terms acceptable to us, if at all. Any future debt

financing or other financing of securities senior to our Common Stock will likely include financial and other covenants that will restrict

our flexibility. Any failure to comply with these covenants would have a material adverse effect on our business, prospects, financial

condition and results of operations because we could lose our existing sources of funding and impair our ability to secure new sources

of funding.

The

ongoing COVID-19 pandemic may have an adverse effect on our business.

On

January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID-19) a “Public Health Emergency

of International Concern,” and on March 11, 2020, it characterized the outbreak as a “pandemic.” In response, numerous

states and cities ordered their residents to cease traveling to non-essential jobs and to curtail all unnecessary travel, and similar

restrictions were recommended by the federal government. Beginning in the first quarter of 2020, which saw the initial rapid spread of

COVID-19, rideshare companies were severely and negatively impacted, as demand plummeted. Consequently, the Company experienced a decline

in revenue during the first half of 2020, which had a negative impact on our cash flows, but we then saw a positive upward movement in

revenue during the second half of 2020, which has continued into the first half of 2021. As of the date of this prospectus, one vaccination

for COVID-19 has received full approval from the Food and Drug Administration, while others have received emergency-use authorization,

and many of the lockdown restrictions imposed by state and local governments have abated. Still, the pandemic has not yet ended, and

there have been multiple waves where infections, hospitalizations, and deaths have sharply increased. Most recently, variants of the

original virus have been identified, and many Americans have resisted obtaining one of the vaccinations. At this time, we cannot predict

the ultimate impact that COVID-19 may have on our business over the entirety of this year, and possibly beyond.

While

our Rideshare Platform and related software are highly technical, they do not enjoy patent protection, and are subject to inherent challenges

in measurement.

Our

Rideshare Platform and its related software are highly technical and complex. Although we have not identified any significant technical

issues to date, the Rideshare Platform could contain software bugs, hardware errors, or other vulnerabilities as yet unknown to us, which

could manifest themselves in any number of ways in our products and services, including through diminished performance or malfunctions.

Further, while we regularly review key metrics related to the operation of our Rideshare Platform business, including, but not limited

to, our monthly average users in order to evaluate growth trends, measure our performance, and make strategic decisions, it is important

to note that these metrics are calculated using internal company data and have not been validated by an independent third party. Errors

or inaccuracies in our metrics or data could result in incorrect business decisions and inefficiencies. For instance, if a significant

understatement or overstatement of Rideshare Platform users were to occur, we may expend resources to implement unnecessary business

measures or fail to take required actions to attract a sufficient number of users to satisfy our growth strategies.

Moreover,

while we developed and coded the Rideshare Platform, we did not do so using any innovative technologies or software, and therefore we

have not obtained any patents for either the Rideshare Platform or its software. Anyone who wanted to duplicate the Rideshare Platform

would not be subject to an action for patent infringement by us.

A

security breach or other disruption to the Rideshare Platform or our internal information technology systems could result in the loss,