Potash Misses Estimates in 4Q - Analyst Blog

February 04 2013 - 3:30AM

Zacks

Potash Corp of Sakatchewan Inc.’s (POT)

fourth-quarter 2012 adjusted earnings (excluding a provision for

settlement of antitrust claims) of 52 cents per share missed the

Zacks Consensus Estimate of 59 cents. Earnings, as reported, fell

to 48 cents per share from 78 cents per share a recorded a year

ago.

For full-year 2012, adjusted earnings were $2.80 per share, missing

the Zacks Consensus Estimate of $2.99. Reported earnings were $2.37

per share, down from $3.51 per share in 2011.

Sales came in at $1,642 million in the quarter, down 12% from

$1,865 million registered a year ago, missing Zacks Consensus

Estimate of $1,853 million. The year-over-year decline was due to

reduced contributions from all three nutrients arising from slack

global fertilizer markets and lower demand.

For full year, sales dipped 9% to $7,927 million and missed the

Zacks Consensus Estimate of $8,088 million.

Segment Review

Potash: Sales volumes of 1.3 million tons in the

reported quarter were down from 1.6 million tons in the year-ago

quarter. Demand for potash remained strong in North America and

drove sales but were offset by lower offshore sales volumes.

Shipments to offshore customers decreased on a year-over-year

basis. This coupled with lower realized prices led to a decline in

gross margin. Gross margin declined 42.2% year over year to $281

million.

Average realized potash price was $387 per ton, down 10.2% from the

prior-year quarter.

Phosphate: Sales volumes declined 5.8% year over

year to 0.8 million tons, due to lower production as a result of

challenging mining conditions at the company’s Aurora mine. Average

realized phosphate price was $577 per ton, down 8.6% year over year

on lower solid and liquid fertilizer prices due to weak demand.

Gross margin went down 39.3% to $99 million.

Nitrogen: Sales volumes for the segment decreased

1.3% to 1.1 million tons due to gas interruptions in Trinidad.

Gross margin decreased 14.5% to $206 million in the reported

quarter. Average realized prices for nitrogen products decreased

1.7% to $453 per ton.

Financial Condition

Cash and cash equivalents amounted to $562 million as of Dec 31,

2012, versus $430 million as of Dec 31, 2011. Long-term debt was

$3,466 million versus $3,705 million a year ago. Capital

expenditure for the fourth quarter amounted to $628 million while

operating cash flow came in at $872 million.

Outlook

The company expects earnings for the first quarter and full-year

2013 in the range of 50 cents to 65 cents per share and $2.75 to

$3.25 per share, respectively.

The company expects gross profits from its potash business in the

range of $1.9 billion to $2.4 billion in 2013. It expects shipments

in the range of 8.5-9.2 million tons. The combined phosphate and

nitrogen gross margin for full-year 2013 has been forecasted in the

range of $1.5 billion to $1.7 billion.

Capital expenditures for the year are anticipated to be about $1.5

billion, with a significant portion related to the remaining potash

expansion projects at New Brunswick and Rocanville.

Potash Corp. currently retains a Zacks Rank #4 (Sell).

Other companies having a favorable Zacks Rank in the fertilizer

industry are Agrium Inc. (AGU), Rentech

Nitrogen Partners, L.P. (RNF) and Yara

International ASA (YARIY). All these stocks carry a Zacks

Rank #2 (Buy).

AGRIUM INC (AGU): Free Stock Analysis Report

POTASH SASK (POT): Free Stock Analysis Report

RENTECH NITROGN (RNF): Free Stock Analysis Report

(YARIY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

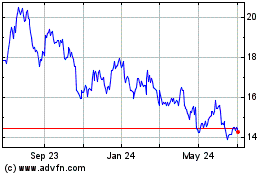

Yara International ASA (PK) (USOTC:YARIY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Yara International ASA (PK) (USOTC:YARIY)

Historical Stock Chart

From Jul 2023 to Jul 2024