UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

(Rule

14c-101)

INFORMATION

REQUIRED IN INFORMATION STATEMENT

SCHEDULE 14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check

the appropriate box:

| ☐ | Preliminary Information Statement |

| | |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| | |

| ☒ | Definitive Information Statement |

WELLNESS

CENTER USA, INC.

(Name

of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee computed on table below per Exchange Act Rules l 4c-5(g)

and 0-11 |

| (I) | Title

of each class of securities to which transaction applies: common stock, par value $.00I per

share |

| (2) | Aggregate

number of securities to which transaction applies: |

| (3) | Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-1 I (set forth the

amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed

maximum aggregate value of transaction: |

| (5) | Total

fee paid: |

| ☐ | Fee

paid previously with preliminary materials1 |

| | |

| ☐ | Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-1l(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount

Previously Paid: none. |

| (2) | Form,

Schedule or Registration Statement No.: l 4C |

| (3) | Filing

Party: Wellness Center USA, Inc. |

| (4) | Date

Filed: October 21, 2022 |

WELLNESS

CENTER USA, INC.

145

E. University Boulevard, Tucson, AZ 85705

(847) 925-1885

NOTICE

OF ACTION TAKEN BY WRITTEN CONSENT OF STOCKHOLDERS

Dear

Stockholder:

On

September 23, 2022, our Board of Directors unanimously approved, subject to stockholder approval, the execution and delivery of a proposed

Share Exchange Agreement (“Agreement”) relating to the share exchange and transfer of certain assets of the Company’s

wholly-owned subsidiary, StealthCo Inc. (“SCI”) d/b/a Stealth Mark, Inc., to Quantum Age Corporation, pursuant to the terms

and conditions the Agreement in substantially the form of the copy presented to the Board, and the related actions described in the Agreement.

As of October 15, 2022, holders of a majority of the outstanding shares of voting capital stock have executed written stockholder consents

approving these actions.

Pursuant

to the provisions of the General Corporation Law of Nevada and our Articles of Incorporation, the holders of at least a majority of the

outstanding shares of common stock are permitted to approve these actions by written consent in lieu of a meeting, provided that prompt

notice of such action is given to the other stockholders of our Company. This written consent assures that the actions will occur without

your vote.

Pursuant

to the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), an Information Statement must be sent to our holders of common stock who do

not sign the written consent at least twenty (20) days prior to the effective date of the action.

This

notice, which is being sent to all holders of common stock of record on September 30, 2022, is intended to serve as notice under Nevada

law and as the Information Statement required by the Exchange Act.

The

accompanying Information Statement is for informational purposes only and is intended to identify the terms of the Agreement, the proposed

Share Exchange Agreement, and the Amendment of our Articles of Incorporation. Please read the accompanying Information Statement carefully.

The

Information Statement is being mailed to stockholders on or about October 20, 2022.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

| Very truly yours, |

|

| |

|

| /s/

Calvin R. O’Harrow |

|

| |

|

| Chairman |

|

WELLNESS

CENTER USA, INC.

145

E. University Boulevard, Tucson, AZ 85705

(847) 925-1885

INFORMATION

STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

General

Information

On

September 23, 2022, our Board of Directors unanimously approved, subject to stockholder approval the execution and delivery of a proposed

Share Exchange Agreement (“Agreement”) relating to the share exchange and transfer of certain assets of the Company’s

wholly-owned subsidiary, StealthCo Inc. (“SCI”) d/b/a Stealth Mark, Inc., to Quantum Age Corporation, pursuant to the terms

and conditions of the Agreement in substantially the form of the copy presented to the Board and the related actions described in the

Agreement. As of October 15, 2022, holders of a majority of the outstanding shares of voting capital stock have executed written stockholder

consents approving theseactions.

Pursuant

to the provisions of the General Corporation Law of Nevada and our Articles of Incorporation, the holders of at least a majority of the

outstanding shares of common stock are permitted to approve these actions by written consent in lieu of a meeting, provided that prompt

notice of such action is given to the other stockholders of our Company. This written consent assures that the actions will occur without

your vote.

Pursuant

to the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), an Information Statement must be sent to our holders of common stock who do

not sign the written consent at least twenty (20) days prior to the effective date of the actions.

This

notice, which is being sent to all holders of common stock of record on September 30, 2022, is intended to serve as notice under Nevada

law and as the Information Statement required by the Exchange Act. The Information Statement is being mailed to stockholders on or about

October 20, 2022.

We

are not aware of any substantial interest, direct or indirect, by security holders or otherwise, that is in opposition to the above actions.

In addition, pursuant to the laws of the State of Nevada, the actions taken by majority written consent in lieu of a special stockholder

meeting do not create appraisal or dissenters’ rights.

Our

Board of Directors determined to pursue stockholder actions by majority written consent of our outstanding shares of stock entitled to

vote in an effort to reduce the costs and management time required to hold a special meeting of stockholders and to implement the above

actions to our stockholders in a timely manner. Additionally, our Board believed that implementing the above actions in a timely manner

would be in the best interests of our Company and our stockholders so that we can pursue a new proposed strategic direction, assuming

the transaction is consummated, as soon as possible.

The

above actions will become effective twenty (20) days following the filing of the Definitive Information Statement, or as soon thereafter

as is practicable.

Action

by Written Consent, Record Date, Outstanding Shares and Required Vote

Pursuant

to the provisions of the General Corporation Law of Nevada and our Articles of Incorporation, the holders of at least a majority of the

outstanding common stock in the Company are permitted to approve the exchange of all issued shares of SCI, by written consent in lieu

of a meeting, provided that prompt notice of such action is given to our other stockholders.

Our

Board of Directors fixed the close of business on September 30, 2022, as the record date for the determination of holders of common stock

entitled to receive notice of said exchange of SCI shares by written stockholder consent. As of the record date, the Company had 115,598,144

shares of common stock outstanding. Each outstanding share of Company common stock is entitled to one vote per share. The affirmative

vote of a majority of the outstanding shares of Company common stock was required to approve said exchange of SCI shares.

Summary

of the Terms of the Exchange Agreement

On

September 23, 2022, our Board of Directors unanimously approved, subject to stockholder approval, the execution and delivery of a proposed

Share Exchange Agreement (“Agreement”) relating to the share exchange and transfer of certain assets of the Company’s

wholly-owned subsidiary, StealthCo Inc. (“SCI”) d/b/a Stealth Mark, Inc., to Quantum Age Corporation, pursuant to the terms

and conditions of the Agreement in substantially the form of the copy presented to the Board.

The

Agreement provides, among other things, as follows:

| ● | Quantum

Age will pay $10,000 to the Company’s wholly-owned subsidiary, SMI-DTI Holdings, LLC

(“SMI-DTI”), upon execution of the Agreement. |

| ● | Quantum

Age will pay $90,000 to the Company’s wholly-owned subsidiary, SMI-DTI Holdings, LLC

(“SMI-DTI”), upon Closing. |

| ● | Quantum

Age will issue 5,500,000 shares of Class A common stock of Quantum Age Corporation to SMI-

DTI at Closing. |

| ● | Quantum

Age will assign the assets transferred by SCI, including trademarks, intellectual properties,

and patents, to its subsidiary, Femtobitz, Inc., a Delaware corporation. |

| ● | Upon

Closing of theshare exchange, the Company’s Chairman will be appointed an advisory

board member of Quantum Age and a board member of Femtobitz, Inc. |

The

5,500,000 shares of Class A common shares of Quantum Age Corporation to be issued in exchange for all of the outstanding shares of SCI

common stock will represent a minority of the issued and outstanding shares of Quantum Age common stock as of the date of issuance. The

Quantum Age shares will be issued in reliance upon the exemption from registration requirements under the Securities Act of 1933, as

amended (the “Securities Act”), pursuant to Section 4(2) thereof and Regulation D thereunder. As such, such shares may not

be offered or sold by us unless they are registered under the Securities Act or qualify for an exemption from the registration requirements

under the Securities Act.

The

Agreement is included as Exhibit A to this Information Statement and is the legal document that governs the terms of the share exchange

described therein and the other actions contemplated thereby. The discussion of the Agreement, and the proposed Share Exchange Agreement,

as set forth herein is qualified in its entirety by reference thereto.

Summary

Information in Question and Answer Format

The

following information in question and answer format, summarizes many of the material terms of the Company’s actions described here.

What

Vote Is Required to Approve the Actions Described Herein?

Approval

of the exchange of all of the issued shares of SCI requires the affirmative vote of the holders of not less than a majority of the Company’s

outstanding common stock.

What

Constitutes a Majority of the Company ·s Outstanding Common Stock?

On

September 30, 2022, the Company had 115,598,144 shares of common stock issued and outstanding, of which 57,799,073 constitutes a majority.

Who

Voted in Favor of the Amendment?

Stockholders

owning an aggregate of 60,099,829 shares of our common stock voted to approve the exchange of all of the issued shares of SCI by written

consent. Those shares combined represent 52.0% of the voting power of our outstanding common stock.

Will

the Stockholders that Voted in favor of the Actions Described Herein have any Special Interest in the Action Taken?

Certain

of the Company’s directors and executive officers have interests in the share exchange that may be different from, or in

addition to, the interests of the Company’s stockholders generally. Specifically, upon closing of the shareexchange, the

Company’s Chairman will be appointed an advisory board member of Quantum Age and a board member of Femtobitz, Inc. The Board

was aware of and considered these interests in reaching the determination that the proposed share exchange, and the other

transactions described in the Agreement are fair to, and in the best interests of, the Company and its stockholders, and in

approving and declaring advisable the execution and delivery of the Agreement and proposed Share Exchange Agreement, and the

transactions described therein. Except to the extent noted, the Board believes that no other stockholders that voted in favor

of the actions described herein will have any interest in the actions taken that differs from the interest of all stockholders of

the Company.

Why

isn’t the Company Holding a Stockholders Meeting to Vote on the Share Exchange Agreement and the Amendment?

Nevada

law requires that a majority of shares of common stock vote to approve the proposed Share Exchange Agreement and permits approval by

written consent in lieu of a meeting. The stockholders voting in favor of the Share Exchange Agreement represent 52.0% of the voting

power of our common stock, or a majority of the voting power of our common stock. Approving actions by the written consent of stockholders

is faster and less expensive than distributing a notice of meeting and proxy statement, and conducting a stockholders meeting; consequently,

management and the Board of Directors decided to obtain approval by written consent in lieu of a meeting.

Why

are these Actions being Undertaken?

The

Agreement and the proposed Share Exchange Agreement, and the transactions described therein, are being undertaken in an effort to enable

the Company’s stockholders to benefit from the premiere authentication technology and data intelligence services SCI has developed

to date. We believe such technology is applicable to a wide range of industries affected by counterfeiting, diversion and theft including,

but not limited to, pharmaceuticals, defense/aerospace, automotive, electronics, technology, consumer and personal care goods, designer

products, beverage/spirits, and many others. The Board believes that the Agreement and the transactions described therein, are advisable

to and in the best interests of the Company and its stockholders. The Board considered many factors in reaching its conclusion including,

without limitation, the value that stockholders might realize as a result of the execution of the Agreement and conclusion of the transactions

described therein, compared to the value likely to be realized by stockholders if we did not enter into the Agreement, and related transactions.

We currently do not possess or have access to capital, personnel, or other resources necessary to further develop and broadly market

SCI technology and services successfully. We do not expect to have or to obtain access to such capital, personnel, or resources in the

foreseeable future.

We

believe that Quantum Age may possess or have access to such capital, personnel, and resources to enable further development and broad-based

marketing of SCI technology and services successfully. We hope that we may share and realize upon the benefits of such development and

marketing through ownership of Quantum Age common shares. We also hope that funds received through the share exchange transaction including,

but not limited to, the payments to be made to the Company upon execution of the Agreement and upon closing of the share exchange, as

well as funds, if any, that may be received as a result of Company ownership of Quantum Age common shares, may be applied, at least in

part, to provide capital, personnel and other resources to continue Company operations, including the further development and marketing

of its targeted “Psoria-Light” and “Aurora” devices through its wholly-owned subsidiary, Psoria- Shield Inc.

Do

Stockholders Have Dissenters’ or Appraisal Rights regarding the Actions Described Herein?

Stockholders

do not have dissenters’ or appraisal rights under Nevada law regarding the actions described herein.

What

are the Income Tax Consequences regarding the Actions Described Herein?

There

will be no federal or state income tax consequences to our stockholders due to the actions described herein.

Voting

Securities of Principal Holders

The

following table presents certain information regarding the beneficial ownership of all shares of common stock at the date of this Report,

for each executive officer and director of our Company and for each person known to us who owns beneficially more than five percent (5%)

of the issued and outstanding shares of our common stock, as of the date of this Information Statement.

| Name

and Address of Beneficial Owner (l) | |

Number of

Shares | | |

Percentage (%) of Share

Ownership | |

| Calvin R. O’Harrow, Chairman, COO and Director | |

| 9,283,036 | | |

| 8.0 | % |

| Douglas W. Samuelson, CFO | |

| 2,010,000 | | |

| 1.7 | % |

| Paul D. Jones, President, Director | |

| 1,300,000 | | |

| 1.1 | % |

| Thomas E. Scott, Secretary, Director | |

| 2,176,667 | | |

| 1.9 | % |

| William E. Kingsford, Director | |

| 1,933,000 | | |

| 1.7 | % |

| Roy M. Harsch, Director, Director | |

| 1,528,254 | | |

| 1.3 | % |

| Officers and Directors as a group | |

| 18,230,957 | | |

| 15.7 | % |

| Total issued and outstanding | |

| 115,598,144 | | |

| 100.00 | % |

| |

(1) |

Except as otherwise noted below, the address of each of the

persons shown in the above table is c/o Wellness Center USA, Inc., 145 E. University Boulevard, Tucson, AZ 85705. Unless otherwise indicated,

we believe that all persons named in the table above have sole voting power and/or investment power with respect to all shares of common

stock beneficially owned by them. |

Description

of the Company’s Common Stock

Holders

of shares of common stock have full voting rights, one vote for each share held of record. Stockholders are entitled to receive dividends

as may be declared by the Board out of funds legally available therefore and share pro rata in any distributions to stockholders upon

liquidation. Stockholders have no conversion, pre-emptive or subscription rights.

Description

of Quantum Age’s Common Stock

The

shares of Quantum Age Corporation Class A common stock to be issued pursuant to the Agreement have full voting rights, one vote for each

share held of record. Holders of such shares are entitled to receive dividends as may be declared by the Quantum Age Board out of funds

legally available therefore and share pro rata in any distributions to common stockholders upon liquidation. Holders of such Class A

common shares have no pre-emptive or subscription rights.

Approval

of the Board of Directors and Stockholders

The

Board of Directors of the Company, after careful consideration, has approved the actions described herein and has recommended that the

Company’s stockholders vote in favor of its adoption. As of October 15, 2022, stockholders holding a majority of the Company’s

outstanding common stock executed written consents approving the actions described herein and in lieu of a stockholders’ meeting.

No

Dissenters’ or Appraisal Rights

Stockholders

have no dissenters’ or appraisal rights under Nevada law as to approval of the actions described herein.

Federal

Income Tax Consequences

There

will be no federal or state income tax consequences to our stockholders as a result of the actions described herein.

Where

You Can Find Additional Information

We

file annual, quarterly, and current reports, proxy and information statements and other information with the Securities and Exchange

Commission under the Securities Exchange Act of 1934, as amended. You may read and copy this information at the Public Reference Section

at the Securities and Exchange Commission at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the

Public Reference Room by calling the SEC at 1-(202) 942-8088. The SEC maintains an Internet site that contains reports, proxy and information

statements, and other information about issuers that file electronically with the SEC. The address of that site is http://wvw.sec.gov.

Our public filings are also available to the public from commercial document retrieval services.

| |

Respectfully

submitted, |

| |

|

|

| |

WELLNESS

CENTER USA, INC. |

| |

|

|

| Date:

October 15, 2022 |

By:

|

/s/

Calvin R. O’Harrow |

| |

|

Chairman |

[This

page intentionally left blank]

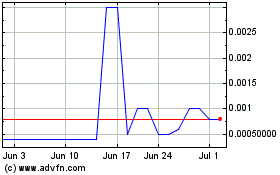

Wellness Center USA (PK) (USOTC:WCUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

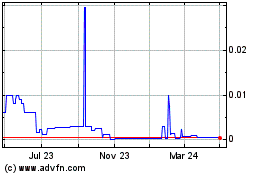

Wellness Center USA (PK) (USOTC:WCUI)

Historical Stock Chart

From Jul 2023 to Jul 2024