Definitive Materials Filed by Investment Companies. (497)

March 14 2014 - 5:06PM

Edgar (US Regulatory)

IMPORTANT INFORMATION REGARDING A CHANGE TO THE INVESTMENT OBJECTIVE AND INVESTMENT POLICY FOR ING SMID CAP EQUITY FUND

ING SERIES FUND, INC.

ING SMID Cap Equity Fund

(“Fund”)

Supplement dated March 14, 2014

to the Fund’s Class A, Class B, Class C, Class I, Class O, Class R

and Class W Prospectus and Summary Prospectus,

each dated September 30, 2013

(each a “Prospectus” and collectively “Prospectuses”)

On March 6, 2014, the Fund’s Board of Directors (“Board”) approved a change, effective on or about May 23, 2014, with respect to the Fund’s name, investment objective, principal investment strategies, benchmark and portfolio managers.

In addition, as disclosed in a supplement previously filed on November 29, 2013, in early 2013 ING U.S. announced plans to rebrand as Voya Financial following its initial public offering, which occurred in May 2013. Effective May 1, 2014, ING Series Fund, Inc., will be renamed Voya Series Fund, Inc.; the Fund will be renamed Voya SMID Cap Equity Fund; ING Investments, LLC, the adviser to the Fund, will be renamed Voya Investments, LLC; and ING Investment Management Co. LLC, the sub-adviser to the Fund, will be renamed Voya Investment Management Co. LLC.

Effective on or about May 23, 2014, the Fund’s Prospectuses are hereby revised as follows:

a.

All references to “Voya SMID Cap Equity Fund” are deleted and replaced with “Voya Mid Cap Value Advantage Fund.”

b.

The Fund’s investment objective is deleted and replaced with the following:

The Fund seeks long-term capital growth and current income.

c.

The section entitled “Principal Investment Strategies” is deleted and replaced with the following:

PRINCIPAL INVESTMENT STRATEGIES

Under normal market conditions, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in equity securities of mid-capitalization companies. The Fund will provide shareholders with at least 60 days’ prior notice of any change in this investment policy. Equity securities include common and preferred stocks, warrants, and convertible securities.

The sub-adviser (“Sub-Adviser”) will generally consider mid-capitalization companies as companies that are included in the Russell MidCap

®

Value Index, at the time of purchase, or if not included in the index, have total market capitalizations within the market capitalization range of the Russell MidCap

®

Value Index. The market capitalization range will vary with market conditions as the range of companies in the Russell MidCap

®

Value Index change. As of December 31, 2013, the smallest company in the Russell MidCap

®

Value Index had a market capitalization of $1.14 billion and the largest company had a market capitalization of $26.4 billion.

The Fund may invest in foreign securities, including companies located in countries with emerging securities markets, when the Sub-Adviser believes they present attractive investment opportunities.

The Fund may invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder (“1940 Act”).

The Sub-Adviser seeks to construct a portfolio of securities with a sustainable high dividend yield and dividend growth potential. In constructing the Fund’s portfolio, the Sub-Adviser uses a three-stage investment process. Stage I eliminates non-dividend paying stocks, low dividend stocks and stocks where yield is at risk to produce a universe of stocks with an attractive risk/reward profile. Stage II identifies unrecognized value using fundamental research, including proprietary sector valuation frameworks. In Stage III, the portfolio is constructed focusing substantially all risk on bottom-up stock selection. From time to time, the Sub-Adviser may select securities that do not meet all of these criteria.

The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others.

The Fund may lend portfolio securities on a short-term or long-term basis, up to 331/3% of its total assets.

d.

The section entitled “Principal Risks” is deleted and replaced with the following:

PRINCIPAL RISKS

You could lose money on an investment in the Fund. Any of the following risks, among others, could affect Portfolio performance or cause the Fund to lose money or to underperform market averages of other funds.

Company

The price of a given company’s stock could decline or underperform for many reasons including, among others, poor management, financial problems, or business challenges. If a company declares bankruptcy or becomes insolvent, its stock could become worthless.

Convertible Securities

Convertible securities are securities that are convertible into or exercisable for common stocks at a stated price or rate. Convertible securities are subject to the usual risks associated with debt securities, such as interest rate and credit risk. In addition, because convertible securities react to changes in the value of the stocks into which they convert, they are subject to market risk.

Credit

Prices of bonds and other debt instruments can fall if the issuer’s actual or perceived financial health deteriorates, whether because of broad economic or issuer-specific reasons. In certain cases, the issuer could be late in paying interest or principal, or could fail to pay altogether.

Currency

To the extent that the Fund invests directly in foreign (non-U.S.) currencies or in securities denominated in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those foreign (non-U.S.) currencies will decline in value relative to the U.S. dollar or, in the

2

case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged.

Foreign Investments/Developing and Emerging Markets

Investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies due to: smaller markets; differing reporting, accounting, and auditing standards; nationalization, expropriation, or confiscatory taxation; foreign currency fluctuations, currency blockage, or replacement; potential for default on sovereign debt; or political changes or diplomatic developments. Markets and economies throughout the world are becoming increasingly interconnected, and conditions or events in one market, country or region may adversely impact investments or issuers in another market, country or region. Foreign investment risks may be greater in developing and emerging markets than in developed markets.

Interest Rate

With bonds and other fixed rate debt instruments, a rise in interest rates generally causes values to fall; conversely, values generally rise as interest rates fall. The higher the credit quality of the instrument, and the longer its maturity or duration, the more sensitive it is likely to be to interest rate risk. In the case of inverse securities, the interest rate generally will decrease when the market rate of interest to which the inverse security is indexed increases. As of the date of this Prospectus, interest rates in the United States are at or near historic lows, which may increase the Fund’s exposure to risks associated with rising interest rates. For fixed income securities, an increase in interest rates may lead to increased redemptions and increased portfolio turnover, which could reduce liquidity for certain Fund investments, adversely affect values, and increase a Fund’s costs. If dealer capacity in fixed-income markets is insufficient for market conditions, it may further inhibit liquidity and increase volatility in the fixed income markets.

Investment Model

The manager’s proprietary model may not adequately allow for existing or unforeseen market factors or the interplay between such factors.

Liquidity

If a security is illiquid, the Fund might be unable to sell the security at a time when the Fund’s manager might wish to sell, and the security could have the effect of decreasing the overall level of the Fund’s liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the Fund could realize upon disposition. The Fund may make investments that become less liquid in response to market developments or adverse investor perception. The Fund could lose money if it cannot sell a security at the time and price that would be most beneficial to the Fund.

Market

Stock prices may be volatile and are affected by the real or perceived impacts of such factors as economic conditions and political events. Stock markets tend to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely impact the investment techniques available to a manager, add to Fund costs and impair the ability of the Fund to achieve its investment objectives.

Mid-Capitalization Company

Investments in mid-capitalization companies may involve greater risk than is customarily associated with larger, more established companies due to the greater business risks of smaller size, limited markets and financial resources, narrow product lines and the frequent lack of depth of management. Consequently, the securities of smaller companies may

3

have limited market stability and may be subject to more abrupt or erratic market movements than securities of larger, more established growth companies or the market averages in general.

Other Investment Companies

The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Because the Fund may invest in other investment companies, you will pay a proportionate share of the expenses of those other investment companies (including management fees, administration fees, and custodial fees) in addition to the expenses of the Fund.

Securities Lending

Securities lending involves two primary risks: “investment risk” and “borrower default risk.” Investment risk is the risk that the Fund will lose money from the investment of the cash collateral received from the borrower. Borrower default risk is the risk that the Fund will lose money due to the failure of a borrower to return a borrowed security in a timely manner.

Value Investing

Securities that appear to be undervalued may never appreciate to the extent expected. Further, because the prices of value-oriented securities tend to correlate more closely with economic cycles than growth-oriented securities, they generally are more sensitive to changing economic conditions, such as changes in interest rates, corporate earnings and industrial production.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

e.

The table in the subsection entitled “Performance Information — Average Annual Total Returns” is deleted in its entirety and replaced with the following:

Average Annual Total Returns %

(for the periods ended December 31, 2012)

|

|

|

|

1 Yr

|

|

5 Yrs

|

|

10 Yrs

(or since

inception)

|

|

Inception

Date

|

|

|

Class A

before taxes(1)

|

%

|

|

14.03

|

|

2.07

|

|

7.89

|

|

02/03/98

|

|

|

After tax on distributions

|

%

|

|

13.77

|

|

1.89

|

|

7.25

|

|

—

|

|

|

After tax on distributions with sale

|

%

|

|

9.45

|

|

1.69

|

|

6.84

|

|

—

|

|

|

Russell Mid Cap

®

Value Index (2),(3)

|

%

|

|

18.51

|

|

3.79

|

|

10.63

|

|

—

|

|

|

Russell 2500

™

Index (2),(3)

|

%

|

|

17.88

|

|

4.34

|

|

10.49

|

|

—

|

|

|

Class B

before taxes

|

%

|

|

11.63

|

|

1.53

|

|

7.40

|

|

03/01/99

|

|

|

Russell Mid Cap

®

Value Index(2),(3)

|

%

|

|

18.51

|

|

3.79

|

|

10.63

|

|

—

|

|

|

Russell 2500

™

Index(2),(3)

|

%

|

|

17.88

|

|

4.34

|

|

10.49

|

|

—

|

|

|

Class C

before taxes

|

%

|

|

15.99

|

|

2.16

|

|

7.67

|

|

06/30/98

|

|

|

Russell Mid Cap

®

Value Index(2),(3)

|

%

|

|

18.51

|

|

3.79

|

|

10.63

|

|

—

|

|

|

Russell 2500

™

Index(2),(3)

|

%

|

|

17.88

|

|

4.34

|

|

10.49

|

|

—

|

|

|

Class I

before taxes

|

%

|

|

17.83

|

|

2.96

|

|

8.49

|

|

02/03/98

|

|

|

Russell Mid Cap

®

Value Index(2),(3)

|

%

|

|

18.51

|

|

3.79

|

|

10.63

|

|

—

|

|

|

Russell 2500

™

Index(2),(3)

|

%

|

|

17.88

|

|

4.34

|

|

10.49

|

|

—

|

|

|

Class O

before taxes

|

%

|

|

17.55

|

|

2.69

|

|

8.22

|

|

08/01/01

|

|

|

Russell Mid Cap

®

Value Index(2),(3)

|

%

|

|

18.51

|

|

3.79

|

|

10.63

|

|

—

|

|

|

Russell 2500

™

Index(2),(3)

|

%

|

|

17.88

|

|

4.34

|

|

10.49

|

|

—

|

|

|

Class R

before taxes

|

%

|

|

17.21

|

|

2.42

|

|

6.39

|

|

10/24/03

|

|

|

Russell Mid Cap

®

Value Index(2),(3)

|

%

|

|

18.51

|

|

3.79

|

|

8.63

|

(4)

|

—

|

|

4

|

|

|

|

1 Yr

|

|

5 Yrs

|

|

10 Yrs

(or since

inception)

|

|

Inception

Date

|

|

|

Russell 2500

™

Index(2),(3)

|

%

|

|

17.88

|

|

4.34

|

|

7.71

|

(4)

|

—

|

|

|

Class W

before taxes

|

%

|

|

17.74

|

|

16.14

|

|

N/A

|

|

08/05/11

|

|

|

Russell Mid Cap

®

Value Index(2),(3)

|

%

|

|

18.51

|

|

9.36

|

(4)

|

N/A

|

|

—

|

|

|

Russell 2500

™

Index(2),(3)

|

%

|

|

17.88

|

|

16.18

|

|

N/A

|

|

—

|

|

(1)

Return calculations with starting date prior to November 15, 2012 are based on a 3.00% sales charge, while returns with a starting date on or after November 15, 2012 are based on a 5.75% sales charge.

(2)

The index returns do not reflect deductions for fees, expenses or taxes.

(3)

Beginning on May 23, 2014 the Fund changed its benchmark from the Russell 2500

™

Index to the Russell Mid Cap

®

Value Index because the Russell Mid Cap

®

Value Index is considered by the adviser to be a more appropriate benchmark, reflecting the type of securities in which the Fund invests.

(4)

Reflects index performance since the date closest to the Class’ inception for which data is available.

f.

The section entitled “Portfolio Management” of the summary section is hereby deleted and replaced with the following:

PORTFOLIO MANAGEMENT

|

Investment Adviser

|

|

Sub-Adviser

|

|

Voya Investments, LLC

|

|

Voya Investment Management Co. LLC

|

|

(formerly, ING Investments, LLC)

|

|

(formerly, ING Investment Management Co. LLC)

|

Portfolio Managers

|

Christopher F. Corapi

|

|

James Hasso

|

|

Portfolio Manager (since 05/14)

|

|

Portfolio Manager (since 07/12)

|

Brian Madonick

Portfolio Manager (since 05/14)

g.

The subsection entitled “Management of the Funds — ING Investment Management Co. LLC” is hereby deleted and replaced with the following:

Voya Investment Management Co. LLC (formerly, ING Investment Management Co. LLC)

Voya Investment Management Co. LLC (“Voya IM” or “Sub-Adviser”), a Delaware limited liability company, was founded in 1972 and is registered with the SEC as an investment adviser. Voya IM is an indirect, wholly-owned subsidiary of Voya U.S. and is an affiliate of Voya Investments. Voya IM has acted as adviser or sub-adviser to mutual funds since 1994 and has managed institutional accounts since 1972. The principal office of Voya IM is located at 230 Park Avenue, New York, New York 10169. As of December 31, 2013, Voya IM managed approximately $81.2 billion in assets.

h.

The subsection entitled “Management of the Funds — ING SMID Cap Equity Fund” is hereby deleted and replaced with the following:

The following individuals are jointly responsible for the day-to-day management of Voya Mid Cap Value Advantage Fund.

5

Christopher F. Corapi, Portfolio Manager and Chief Investment Officer of equities, joined Voya IM in February 2004. Prior to joining Voya IM, Mr. Corapi served as global head of equity research at Federated Investors since 2002. He served as head of U.S. equities and portfolio manager at Credit Suisse Asset Management beginning in 2000 and head of emerging markets research at JPMorgan Investment Management beginning in 1998.

James Hasso, Portfolio Manager, has been with Voya IM since 2006. Prior to joining Voya IM, Mr. Hasso had been a senior research analyst with First Investors Corporation from 2004-2006. Prior to that, Mr. Hasso served as a senior research analyst and associate portfolio manager with Valenzuela Capital Partners LLC from 2001-2002.

Brian Madonick, Portfolio Manager and Senior Analyst covering the industrials sector has been with Voya IM since 2004. Prior to that, Mr. Madonick spent four years as the industrials analyst at U.S. Trust.

Historical sub-adviser/name and strategies information:

|

Effective Date

|

|

Fund Name

|

|

Adviser

|

|

05/23/14

|

|

Voya Mid Cap Value Advantage Fund***

|

|

ING Investment Management Co. LLC

|

|

07/21/12

|

|

ING SMID Cap Equity Fund*

|

|

ING Investment Management Co. LLC

|

|

03/01/02

|

|

ING Index Plus Mid Cap Fund**

|

|

ING Investment Management Co. LLC

|

|

Since Inception

|

|

Aetna Index Plus Mid Cap Fund

|

|

Pacific Investment Management Company LLC

|

*

The Fund’s name and principle investment strategies changed.

**

The Fund’s name changed.

***

The Fund’s name, investment objective and principal investment strategies changed.

i.

The following is added to the subsection entitled “Index Descriptions:”

The Russell Mid Cap

®

Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Mid Cap

®

companies with lower price-to-book ratios and lower forecasted growth values.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

6

IMPORTANT INFORMATION REGARDING A CHANGE TO THE INVESTMENT OBJECTIVE AND INVESTMENT POLICY FOR ING SMID CAP EQUITY FUND

ING SERIES FUND, INC.

ING SMID Cap Equity Fund

(“Fund”)

Supplement dated March 14, 2014

to the Fund’s Class A, Class B, Class C,

Class I, Class O, Class R and Class W

Statement of Additional Information (“SAI”)

dated September 30, 2013

On March 6, 2014, the Fund’s Board of Directors (“Board”) approved a change, effective on or about May 23, 2014, with respect to the Fund’s name, investment objective, principal investment strategies, benchmark and portfolio managers.

In addition, as disclosed in a supplement previously filed on November 29, 2013, in early 2013 ING U.S. announced plans to rebrand as Voya Financial following its initial public offering, which occurred in May 2013. Effective May 1, 2014, ING Series Fund, Inc., will be renamed Voya Series Fund, Inc.; the Fund will be renamed Voya SMID Cap Equity Fund; ING Investments, LLC, the adviser to the Fund, will be renamed Voya Investments, LLC; and ING Investment Management Co. LLC, the sub-adviser to the Fund, will be renamed Voya Investment Management Co. LLC.

Effective on or about May 23, 2014, the Fund’s SAI is hereby revised as follows:

a.

All references to “Voya SMID Cap Equity Fund” and “SMID Cap Equity Fund” are hereby deleted and replaced with “Voya Mid Cap Value Advantage Fund” and “Mid Cap Value Advantage, respectively”

b.

The following is added to the table in the subsection entitled “Fund Name Changes:”

|

Fund

|

|

Former Name

|

|

Date of Change

|

|

Voya SMID Cap Equity Fund

|

|

ING SMID Cap Equity Fund

|

|

May 1, 2014

|

|

Voya Mid Cap Value Advantage Fund

|

|

Voya SMID Cap Equity Fund

|

|

May 23, 2014

|

c.

Footnote No. 7 to the table in the section entitled “Investments, Investment Strategies and Risks” is replaced with the following:

(7)

Except for Voya Mid Cap Value Advantage Fund, investments in emerging market equity securities will not exceed 5% of the Fund’s total assets.

d.

The second non-fundamental investment restriction in the section entitled “Non-Fundamental Investment Restrictions” is replaced with the following:

2.

except for Mid Cap Value Advantage Fund, invest more than 25% of its total assets in securities or obligations of foreign issuers, including marketable securities of, or guaranteed by, foreign governments (or any instrumentality or subdivision thereof);

e.

The subsection entitled “Non-Fundamental Investments Policies Pursuant to Rule 35d-1 of the 1940 Act — Voya SMID Cap Equity Fund” is replaced with the following:

Voya Mid Cap Value Advantage Fund

Voya Mid Cap Value Advantage Fund has adopted a non-fundamental policy as required by Rule 35d-1 under the 1940 Act to invest, under normal circumstances, at least 80% of its net assets (plus borrowings for investment purposes) in equity securities of mid-capitalization companies. The Fund has also adopted a policy to provide its shareholders with at least 60 days’ prior notice of any change in such investment policy. If, subsequent to an investment, the 80% requirement is no longer met, the Fund’s future investments will be made in a manner that will bring the Fund into compliance with this policy.

f.

The following is added to the tables in the subsections entitled “Portfolio Managers — Other Accounts Managed and Portfolio Manager Ownership of Securities”:

Other Accounts Managed

|

|

|

Registered Investment Companies

|

|

Other Pooled Investment Vehicles

|

|

Other Accounts

|

|

|

Portfolio Manager

|

|

Number of

Accounts

|

|

Total Assets

|

|

Number of

Accounts

|

|

Total Assets

|

|

Number of

Accounts

|

|

Total Assets

|

|

|

Brian Madonick(2)

|

|

1

|

|

$

|

382,876,249

|

|

0

|

|

$

|

0

|

|

0

|

|

$

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2)

As of February 28, 2014

Portfolio Manager Ownership of Securities

|

Portfolio Manager

|

|

Fund

|

|

Dollar Range of Fund Shares

Owned

|

|

Brian Madonick(1)

|

|

Mid Cap Value Advantage

|

|

None

|

(1)

As of February 28, 2014

g.

The third paragraph of the subsection entitled “Portfolio Managers — Compensation” is deleted and replaced with the following:

Voya IM has defined indices (the S&P 500

®

Index for Mr. Corapi and Mr. Costa as portfolio managers for Core Equity Research Fund; the S&P 500

®

Index for Mr. Costa, Mr. Wetter and Ms. Wong as portfolio managers for Corporate Leaders 100 Fund; the Russell 1000

®

Growth Index for Mr. Corapi, Mr. Pytosh, and Mr. Bianchi as portfolio managers for Large Cap Growth Fund; the Russell 2000

®

Index for Mr. Basset, Mr. Hasso, and Mr. Salopek as portfolio managers for Small Company Fund; and the Russell Mid Cap

®

Value Index for Mr. Corapi, Mr. Hasso, and Mr. Madonick as portfolio managers for Mid Cap Value Advantage Fund); and set performance goals to appropriately reflect requirements for the investment team. The measures for the team are outlined on a “scorecard” that is reviewed on an annual basis. These scorecards measure investment performance versus benchmark and peer groups over one-, three-, and five-year periods; and year-to-date net cash flow (changes in the accounts’ net assets not attributable to changes in the value of the accounts’ investments) and revenue growth for all accounts managed by the team. The results for overall Voya IM scorecards are typically calculated on an asset weighted performance basis of the individual team scorecards.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

2

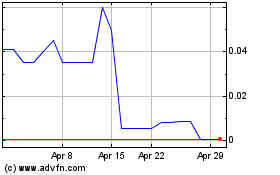

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Jun 2024 to Jul 2024

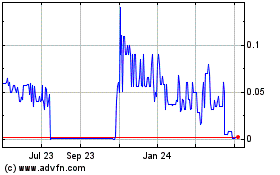

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Jul 2023 to Jul 2024