Current Report Filing (8-k)

October 03 2022 - 4:06PM

Edgar (US Regulatory)

0001376231

false

0001376231

2022-09-30

2022-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September

30, 2022

VPR BRANDS, LP

(Exact name of registrant as specified in its charter)

| Delaware |

|

000-54435 |

|

45-1740641 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1141 Sawgrass Corporate Parkway

Sunrise, FL 33323

(Address of principal executive offices)

(954) 715-7001

(Registrant’s telephone number, including area

code)

N/A

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 30, 2022, VPR Brands, LP (the “Company”)

entered into a Settlement Agreement (the “Settlement Agreement”) by and between the Company on the one hand, and MONQ, LLC

(“MONQ”) on the other hand. The Company previously filed a lawsuit in the United States District Court for the Middle District

of Tennessee (Civil Action No. 3:21-cv-00172) alleging patent infringement of the Company’s U.S. Patent No. 8,205,622 (the “Patent”)

by MONQ (the “Action”). Pursuant to the terms of the Settlement Agreement, the Company and MONQ agreed to settle the Action,

and MONQ agreed to pay the Company $275,000 (the “Settlement Sum”) per the following schedule (the “Payment Schedule”):

| $25,000 |

|

On or before October 10, 2022 |

| $25,000 |

|

On or before November 1, 2022 |

| $25,000 |

|

On or before December 1, 2022 |

| $25,000 |

|

On or before January 1, 2023 |

| $25,000 |

|

On or before February 1, 2023 |

| $25,000 |

|

On or before March 1, 2023 |

| $15,000 |

|

On or before April 1, 2023 |

| $15,000 |

|

On or before May 1, 2023 |

| $15,000 |

|

On or before June 1, 2023 |

| $15,000 |

|

On or before July 1, 2023 |

| $15,000 |

|

On or before August 1, 2023 |

| $15,000 |

|

On or before September 1, 2023 |

| $15,000 |

|

On or before October 1, 2023 |

| $10,000 |

|

On or before November 1, 2023 |

| $10,000 |

|

On or before December 1, 2023 |

In exchange for the Settlement Sum, the Company granted

to MONQ a non-exclusive license through and including September 30, 2022 for MONQ’s use of the Patent and all related patents and

applications. Failure to make a payment in accordance with the Payment Schedule will automatically result in a breach of the Settlement

Agreement. To retain the non-exclusive license, MONQ must pay the outstanding balance in accordance with the Payment Schedule within 10

business days. Failure to make payment after 10 business days will result in revocation of the non-exclusive license.

Subject to full receipt of the Settlement Sum, the

Company also granted to MONQ a non-exclusive and non-assignable license to the Patent to allow MONQ to continue to make, use, sell, offer

for sale, import, export, supply, lease, distribute, purchase, perform, provide, display, transmit, or otherwise practice the Patent with

respect to manufacturing, marketing and selling its devices.

The foregoing description of the Settlement Agreement

does not purport to be complete and is qualified in its entirety by reference to the Settlement Agreement, a copy of which is filed as

Exhibit 10.1 to this Current Report on Form 8-K and which is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: October 3, 2022 |

VPR BRANDS, LP |

| |

|

|

| |

By: |

/s/ Kevin Frija |

| |

|

Kevin Frija |

| |

|

Chief Executive Officer |

2

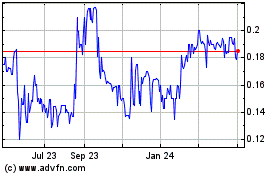

VPR Brands (QB) (USOTC:VPRB)

Historical Stock Chart

From Dec 2024 to Jan 2025

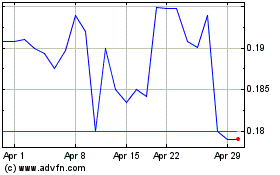

VPR Brands (QB) (USOTC:VPRB)

Historical Stock Chart

From Jan 2024 to Jan 2025