Vivendi Shares Rise on Full-Year, UMG Results

February 15 2019 - 5:24AM

Dow Jones News

By Patrick Costello

Vivendi SA (VIV.FR) shares rose Friday after the company

reported a jump in revenue and pretax earnings in its 2018 results

late Thursday.

Revenue at Vivendi rose 11% on year in 2018 to 13.93 billion

euros ($15.71 billion), while its profitable Universal Music Group

subsidiary grew revenue 10% to EUR6.02 billion.

Earnings before interest and taxes increased to EUR1.18 billion

from EUR1.04 billion, Vivendi said.

At 0936 GMT, Vivendi shares were up 6.8% at EUR24.27. The share

is up 14% on year.

Analysts said that revenue growth at UMG was the highlight of

Vivendi's earnings, particularly in light of Vivendi's plans to

sell up to 50% of its stake in UMG.

While Vivendi's overall results were in line with forecasts,

UMG's revenue growth exceeded expectations and will likely "fuel

enthusiasm" around the sale of the music subsidiary, analysts at

Citi wrote.

Vivendi didn't deliver a concrete update on the sale, but "the

market is excited about the potential for this division," Citi

noted. "Even without concrete progress on the sale process, this

alone will be enough to keep investors upbeat."

Equally as reassuring for investors is Vivendi's announcement to

seek up to a 25% share buyback worth up to EUR8 billion, analysts

at Deutsche Bank said, noting this move is unrelated to the UMG

stake sale.

"Shareholders have been concerned that Vivendi's net cash and

UMG proceeds would be squandered on overpriced and questionable

deals," Deutsche Bank said. "This offers strong rebuttal."

Write to Patrick Costello at patrick.costello@dowjones.com.

(END) Dow Jones Newswires

February 15, 2019 05:09 ET (10:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

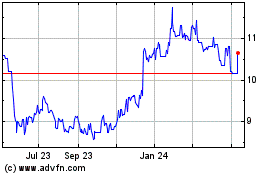

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jul 2024 to Aug 2024

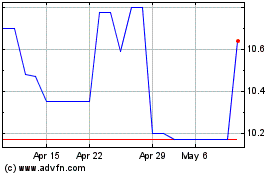

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Aug 2023 to Aug 2024