Sodali Buys Morrow, Gains Foothold in U.S.

May 11 2016 - 1:10AM

Dow Jones News

A London firm that advises companies on shareholder votes

acquired a U.S. competitor as it seeks to capitalize on the

expanding reach of activist investors.

Sodali Inc. has bought New York rival Morrow & Co., giving

the firm a foothold in the U.S., a team of proxy solicitors, and a

roster of clients that includes General Electric Co., Goldman Sachs

Group Inc. and Boeing Co., the closely held companies said. Terms

weren't disclosed.

The combined company will be named Morrow Sodali Global LLC.

Firms like Morrow and Sodali -- which counts Europe's Vivendi

SA, Renault SA and Repsol SA among its clients -- help companies

write proxy statements, the annual disclosure forms detailing

executive compensation and other matters shareholders weigh in on,

and count votes. In fights with activists, the firms solicit votes

and advise on messaging.

Pressure from shareholders on a variety of issues -- a movement

spurred by activists and fueled by big institutional investors --

has increased the importance of such campaigning and made it a

year-round process.

Directors used to focus on reviewing corporate strategy. Today,

shareholders demand more interaction with them to gauge how they

are making decisions and overseeing management. Annual meetings are

often the focal point of such interaction.

"There is no such thing as a routine annual shareholder meeting

anymore," Sodali Chairman John Wilcox said in an interview. "It

should be and is, from the point of view of shareholders, a

showcase for the board of directors instead of just a

get-together."

But the rules of play are different in every country, and

cross-border share ownership adds another layer of

complication.

For instance, companies in Europe may not fully grasp the

expectations of their U.S. investors, while U.S. shareholders may

not be familiar with the intricacies of, say, Italian corporate

governance. Those dynamics led Sodali to seek a U.S. firm to buy,

allowing it to export experience that would be hard to build, Mr.

Wilcox said.

"It's pretty clear that the market is truly global these days,

both for listed companies and the institutional investors who own

them," he said. "That's been a challenge for these companies."

Europe has long been viewed as the next target for U.S.-style

activism. Some activism has also spread to Japan in recent years,

but the U.S. remains the hotbed. Sodali's interest in Morrow

signals a belief that the brasher tactics of U.S. hedge funds will

spread across the Atlantic, and that they are here to stay in the

U.S.

Many U.S. proxy firms and others, including investment banks and

law firms, have been preparing for the spread of activism too, so

Morrow Sodali won't be alone.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

May 11, 2016 00:55 ET (04:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

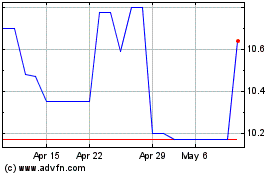

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

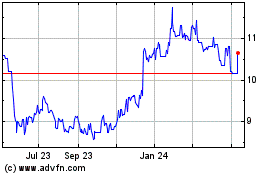

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jul 2023 to Jul 2024