Vivendi Launches Hostile Bid for Gameloft -- 3rd Update

February 19 2016 - 3:19AM

Dow Jones News

By Nick Kostov

PARIS-- Vivendi SA on Thursday launched a takeover bid for

Gameloft SE, attempting to push further into video games after

re-entering the sector last year.

The French media group said its supervisory board approved a

tender offer for the shares of Gameloft at EUR6 a share ($6.67),

valuing the company at EUR513 million. Gameloft has been trying to

fend off Vivendi's advances since it started building up its more

than 30% stake in the videogame company late last year.

"Videogames constitute content in their own right and now

represent a significant part of the entertainment and media market,

and mobile gaming is the segment expected to record the fastest

growth," Vivendi said in a statement.

The takeover is the latest chapter in a continuing battle

between Vivendi and two Paris-based videogame companies. Since

October, Vivendi has been steadily buying shares in Ubisoft

Entertainment SA, known for franchises like Assassin's Creed, and

Gameloft, a smaller company with successes in making games for

mobile phones. But the founding Guillemot family, which still owns

stakes in both videogame companies, argues that Vivendi doesn't

know the business.

Gameloft describe Vivendi's offer as "hostile," saying it first

learned about it when its shares were suspended on Thursday. The

company has called a board meeting next week to discuss its

options.

A spokesman for Vivendi said: "The bid is not hostile. It is

unsolicited but friendly."

On Thursday, Ubisoft, in which Vivendi has built up a 15% stake,

unveiled a three-year growth plan in an attempt to remain

independent. Ubisoft has been rallying investors in recent weeks to

its stand-alone strategy, saying there are no synergies with

Vivendi and a takeover would be bad for the company.

Ubisoft Chief Financial Officer Alain Martinez said on a call

with reporters that there were no clear answers on what benefits

Vivendi could bring to his company.

Vivendi, controlled by Chairman Vincent Bollore, has recently

taken minority stakes in a number of companies as it looks to put

its multi-billion euro cash pile to work. Investments include a

more than 20% stake in Telecom Italia SpA as the company looks to

build a media empire with a focus on Southern Europe.

Key to Vivendi's long-term plans is Canal Plus, the group's

struggling pay-TV unit that accounts for almost half of the group's

sales. On Thursday, Vivendi said Canal Plus was in talks to become

the exclusive distributor of beIN Sports in France, its arch rival

in sports content.

For Canal Plus, the agreement will allow it to replenish a

dwindling library of exclusive sports rights.

The Qatari-owned beIN Sports entered the French market in 2012,

spending millions of euros on sports rights including the UEFA

Champions League and the soccer World Cup. It quickly built up a

base of some 2.5 million subscribers, becoming a formidable

competitor to Canal Plus.

"We have one major challenge to address today: our pay TV

operations in France," said Vivendi Chief Executive Arnaud de

Puyfontaine on a call with analysts. "There is an urgent need to

stop losses and to commit to a transformation plan."

Vivendi, which also owns Universal Music Group, Thursday

reported profit, excluding some items, of EUR196 million for the

fourth quarter on sales of EUR3.1 billion. Analysts had predicted

adjusted net income of EUR168 million.

Vivendi said its turnaround plan for Canal Plus France could

lead to a "significant decline" in the unit's operating results in

2016, but the aim was to hit a break even point in 2018.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

February 19, 2016 03:04 ET (08:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

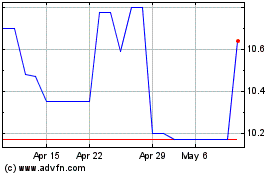

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From May 2024 to Jun 2024

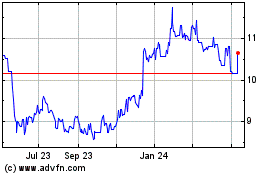

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jun 2023 to Jun 2024