Orange Engages Bouygues in Telecom Merger Talks -- Update

January 05 2016 - 7:24AM

Dow Jones News

By Inti Landauro And Sam Schechner

PARIS--French telecom operator Orange SA has entered preliminary

talks to buy the telecom assets of construction-to-media

conglomerate Bouygues SA in an attempt to consolidate France's

cutthroat broadband and mobile industries.

The two companies said Tuesday they had signed a confidentiality

agreement. The move paves the way for the firms to exchange crucial

financial information to assess a possible deal, deepening

preliminary talks that have been under way since October.

"These discussions aren't limited by any particular calendar and

hold no commitment to any particular predefined outcome," Orange

said.

A deal would help France's telecom operators recover a yearslong

price war stemming from the rise of a fourth mobile operator owned

by Iliad SA.

Bouygues Telecom suffered the most from the subsequent price

war, because it had a larger staff relative to its base of

subscribers. The increased competition also affected competitor

SFR, leading then owner Vivendi SA to embark on spree of asset

sales that eventually led to SFR's purchase by cable magnate

Patrick Drahi.

Shares in France's telecom sector rose sharply early Tuesday on

hopes that an Orange-Bouygues Telecom deal would ease competition

and bolster prices. Orange and Bouygues shares rose 1.3% and 0.2%

respectively in early trading. Shares in cable and mobile-telecom

operator Numéricable-SFR SA surged 8% while Iliad rose 2.9%.

A combination of Orange, France's biggest operator, and the No.

3 operator Bouygues Telecom could require the disposal of

significant assets to receive approval from antitrust authorities,

according to analysts.

Orange and Bouygues didn't provide any estimates valuing a

potential deal. According to French weekly Le Journal du Dimanche,

Orange is preparing a 10-billion-euro ($10.08 billion) offer for

Bouygues Telecom. The former national telecom monopoly would pay

Bouygues EUR8 billion in shares and EUR2 billion in cash, the

weekly said on Sunday.

Both companies have declined to comment on the report. The

French government, which owns a 23% stake in Orange, declined to

comment Tuesday.

An Orange-Bouygues deal would give Orange, formerly known as

France Telecom, heft ahead of what European telecom executives

expect will be a winnowing of their herd in the face of stiffening

competition from international rivals. Telecom chieftains say they

need to be bigger to compete with Silicon Valley firms that

increasingly offer a free suite of communication services, from

text to video chat.

Executives at Orange have worried their company is too small and

risks becoming prey rather than predator when the industry giants

begin their hunt.

Orange had a market capitalization of roughly EUR41 billion,

compared with EUR54 billion for Telefonica SA of Spain and EUR76

billion for Germany's Deutsche Telekom AG, at the end of last

week.

If Orange takes control of Bouygues Telecom in a mostly stock

deal, the combined company could see its market capitalization grow

to as much as EUR50 billion, depending on how investors regard the

deal.

Write to Inti Landauro at inti.landauro@wsj.com

(END) Dow Jones Newswires

January 05, 2016 07:09 ET (12:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

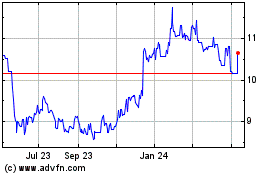

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From May 2024 to Jun 2024

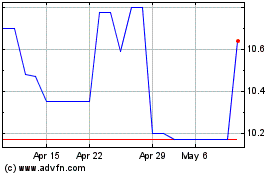

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jun 2023 to Jun 2024