Amended Current Report Filing (8-k/a)

January 11 2022 - 6:05AM

Edgar (US Regulatory)

0001536089

true

Amendment No. 1

0001536089

2021-09-23

2021-09-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported): September 23, 2021

VIRTUAL

INTERACTIVE TECHNOLOGIES CORP.

(Exact

name of Registrant as specified in its charter)

|

Nevada

|

|

None

|

|

36-4752858

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File No.)

|

|

Identification No.)

|

|

|

600 17th Street, Suite 2800 South

|

|

|

|

Denver, CO 80202

|

|

|

|

(Address of principal executive offices, including Zip Code)

|

|

Registrant’s

telephone number, including area code: (303) 228-7120

(Former

name or former address if changed since last report)

Check

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below)

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-14(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13a of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

None

|

|

N/A

|

|

N/A

|

|

ITEM 2.03

|

Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

|

On

September 23, 2021, the Company borrowed $235,000 from an unrelated third party. The loan is evidenced by a promissory note. The note

is secured by all of the Company’s assets, bears interest at 12.5% per year, and is due and payable on March 23, 2022. If the note

is not paid when due, or in the event of other items at default as provided in the note, the note may be converted into shares of the

Company’s common stock. The number of shares to be issued upon any conversion will be determined by dividing the amount to be converted

by the lesser of 90% the lowest trading price of the Company’s common stock (i) during the twenty trading days preceding September

23, 2021 or (ii) during the twenty trading days preceding the date of the conversion of this Note. As further consideration for making

the loan; the Company issued 82,500 shares of its restricted common stock (the “Commitment Fee Shares”) to the note holder.

This

Note carried an original issue discount of $17,625 to cover the note holder’s costs associated with the purchase of the note. The

Company was also required to pay the note holder’s legal costs of $5,875 when the note was issued. As a result, the Company received

net proceeds of $211,500 from the note.

The

note holder may sell the Commitment Fee Shares at any time after March 23, 2022. If, the note holder has not realized net proceeds from

the sale of the Commitment Fee Shares equal to at least $200,000, then the Company will issue additional shares of common stock to the

note holder in an amount sufficient such that, when sold and the net proceeds from the sale are added to the net proceeds from the sale

of any of the previously sold Commitment Fee Shares, the note holder will have received at least $200,000. If additional shares of common

stock are issued and after the sale of such additional issued shares of common stock, the note holder still has not received net proceeds

equal to at least $200,000, then the Company will again issue additional shares of common stock to the note holder, and such additional

issuances shall continue until the note holder has received net proceeds from the sale of such common stock equal to $200,000.

If

the Note has been repaid in full on or prior to March 23, 2022, the Company has the right to redeem 41,250 of the Commitment Fee Shares

(as adjusted for stock splits, stock dividends or similar events) for $1.00. In the event of redemption, the $200,000 required to be

received from the sale of the Commitment Fee Shares will be reduced to $100,000.

If

the note is not paid when due, or in the event of other items of default, the amount to be converted and the shares issuable upon conversion

are subject to adjustment.

The

note is also subject to covenants, events of defaults, penalties, default interest and other terms and conditions customary in transactions

of this nature. The description of the terms of the note is qualified in all respects by the provisions of the note which is filed as

an exhibit to this amended 8-K report. A Securities Purchase Agreement and a Security Agreement, which relate to the note, are also filed

as exhibits to this amended 8-K report.

ITEM 3.02. Unregistered Sale of Equity Securities.

The

Company relied upon the exemption provided by Section 4(a)(2) of the Securities Act of 1933 in connection with issuance of the note and

shares of common stock described in Item 2.03 of this report. The person who acquired the note and shares of common stock was a sophisticated

investor and was provided full information regarding the Company’s business and operations. There was no general solicitation in

connection with the issuance of the note or the shares of common stock. The person who acquired the note and shares of common stock acquired

these securities for its own account.

ITEM

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

Date: January 10, 2022

|

Virtual Interactive Technologies Corp.

|

|

|

|

|

|

By:

|

/s/ Janelle Gladstone

|

|

|

|

Janelle Gladstone

|

|

|

|

Chief Financial Officer

|

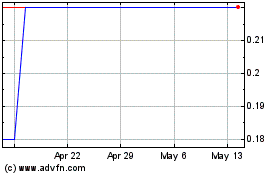

Virtual Interactive Tech... (CE) (USOTC:VRVR)

Historical Stock Chart

From Jan 2025 to Feb 2025

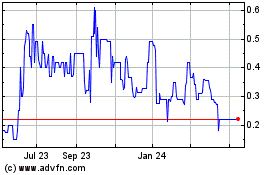

Virtual Interactive Tech... (CE) (USOTC:VRVR)

Historical Stock Chart

From Feb 2024 to Feb 2025