Amended Current Report Filing (8-k/a)

December 13 2022 - 6:39AM

Edgar (US Regulatory)

0001506929truefalse00015069292022-01-202022-01-20iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 2)

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 20, 2022

Verde Resources, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-55276 | | 32-0457838 |

(State or other jurisdiction of | | (Commission | | (IRS Employer |

incorporation) | | File Number) | | Identification No.) |

2 Cityplace Drive, Suite 200, St. Louis, MO 63141 |

(Address of principal executive offices) |

Registrant’s telephone number, including area code (323) 538-5799

__________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Introductory Note

We are filing this Current Report on Amendment No. 2 of the Form 8-K/A to update Item 1.01 of the Report regarding the Share Sale Agreement in relation to acquisition of the entire issued and paid-up share capital of Bio Resources Limited which was originally filed on Form 8-K to SEC on May 13, 2021.

Item 1.01 Entry into a Material Definitive Agreement

On May 12, 2021, the Company, through its wholly-owned subsidiary Gold Billion Global Limited (“GBL”), entered into a Share Sale Agreement in relation to acquisition of the entire issued and paid-up share capital of Bio Resources Limited (the “Share Sale Agreement”) with Taipan International Limited, a company incorporated under the laws of the Labuan, and Borneo Resources Limited, a company incorporated under the laws of the Labuan, and other individuals.

Bio Resources Limited (“BRL”) is the beneficial and/or registered proprietor of the intellectual property known as “Catalytic Biofraction Process”, which is a slow pyrolysis process using a proprietary catalyst to depolymerise palm biomass wastes (empty fruit bunches or palm kernel shells) in temperature range of 350 degC to 500 degC to yield commercially valuable bio products: bio-oil, wood vinegar (pyroligneous acid), biochar and bio-syngas. The intellectual property is a second-generation pyrolysis process where non-food feedstock like the palm biomass wastes is used as feedstock.

Under the terms of the Share Sale Agreement, the acquisition of the entire issued and paid-up share capital of BRL, through the Company’s wholly-owned subsidiary GBL, was to be satisfied by the issuance of 321,500,000 shares of the Company’s restricted Common Stock, par value $0.001 per share (the “Common Stock”) at a price per share of $0.03, and the issuance of promissory notes to 17 lenders (the “Lenders”) each with a two-year term period for the agreed principal amount of $20,355,000 (collectively the “Notes”). The completion of the Share Sale Agreement is subject to all such acts necessary, including but not limited to stock taking, auditing and due diligence exercise to ascertain the valuation of BRL.

On January 20, 2022, the Company reached a mutual agreement with the Lenders of the Notes to enter into a Supplement to Promissory Note, with each Lender, including the Company’s President and CEO, Jack Wong, to convert the total principal loan amount of $20,355,000 into shares of the Company’s restricted Common Stock priced at $0.0611 per share, which represents the last ninety (90) days’ volume weighted average price (VWAP) as of the market closing of January 19, 2022. The Company and the Lenders further agreed that the actual date for the allotment and issue of new shares of the Company’s restricted Common Stock shall be confirmed in a subsequent written agreement. The acquisition of BRL was consummated on October 12, 2022.

On December 7, 2022, the Company entered into a Supplementary Agreement to Promissory Note with the Lenders to convert the total principal loan amount of $20,355,000 into shares of the Company’s restricted Common Stock at the agreed conversion price of $0.0611 per share on or before December 9, 2022.

Item 3.02 Unregistered Sales of Equity Securities

On December 7, 2022 the Company agreed to issue 333,142,389 shares of the Company’s restricted Common Stock, at the price of $0.0611 per share, to the 17 Lenders, including the Company’s President and CEO, Jack Wong, referenced in Item 1.01 above, in satisfaction of 17 promissory notes with an aggregate principal amount of $20,355,000. The shares were issued in reliance upon exemptions from registration pursuant to Section 4(2) of the Securities Act of 1933 (the “33 Act”) and Regulation D Section 506(b) promulgated under the ’33 Act.

Item 9.01 Financial Statements and Exhibits

The Supplementary Agreement to Promissory Note is attached hereto as Exhibit 10.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

VERDE RESOURCES, INC.

/s/ Jack Wong | |

Jack Wong | |

President and CEO | |

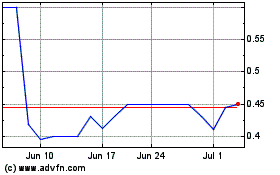

Verde Resources (QB) (USOTC:VRDR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Verde Resources (QB) (USOTC:VRDR)

Historical Stock Chart

From Jul 2023 to Jul 2024