UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(AMENDMENT

NO. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 19, 2023

TRAQIQ,

INC.

(Exact

name of registrant as specified in charter)

| California |

|

000-56148 |

|

30-0580318 |

(State

or other Jurisdiction of

Incorporation

or Organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1931

Austin Drive

Troy,

Michigan |

|

48083 |

| (Address

of Principal Executive Offices) |

|

(zip

code) |

(248)

775-7400

(Registrant’s

telephone number, including area code)

14205

SE 37th Street, Suite 100, Bellevue, WA 98006

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any

of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

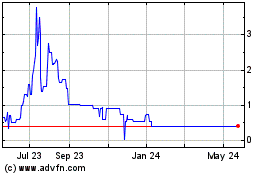

| Common

Stock, par value $.0001 per share |

|

TRIQ |

|

OTC

QB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLAINATORY

NOTE

On

May 19, 2023, TraQiQ, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Form 8-K”) to report

the consummation of its acquisition of Titan Trucking, LLC, a Michigan limited liability company (“Titan”). This Amendment

No. 1 to the Original Form 8-K amends and supplements Item 9.01 of the Original Form 8-K to provide the historical audited financial

statements of Titan and the unaudited pro form condensed combined financial information of the Company pursuant to Items 9.01(a) and

9.01(b) of Form 8-K that were excluded from the Original Form 8-K in reliance on the instructions to such items. Except as noted in this

paragraph, no other information contained in the Original Form 8-K is amended or supplemented.

| Item 9.01. |

Financial Statements and Exhibits. |

(a)

Financial Statements of Business Acquired

The

financial statements for Titan required by Item 9.01(a) of Form 8-K are attached as Exhibit 99.1 and Exhibit 99.2 to this Amendment No.1

and incorporated herein by reference.

(b)

Pro Forma Financial Information

The

unaudited pro forma condensed financial information for the Company required by Item 9.01(b) of Form 8-K is attached as Exhibit 99.3

to this Amendment No. 1 to the Original Form 8-K and incorporated herein by reference.

(c)

Not applicable.

(d)

Exhibits. The exhibits listed in the exhibit index below are being filed herewith.

EXHIBIT

INDEX

Exhibit

Number |

|

Description |

| |

|

|

| 23.1 |

|

Consent

of Freed Maxick CPAs, P.C., Independent Auditor for Titan Trucking, LLC and Subsidiary. |

| |

|

|

| 99.1 |

|

The

audited Financial Statements of Titan Trucking, LLC and Subsidiary as of and for the years ended December 31, 2022 and 2021,

and the related notes thereto. |

| |

|

|

| 99.2 |

|

The

unaudited Financial Statements of Titan Trucking, LLC and Subsidiary as of and for the three months ended March 31, 2023,

and the related notes thereto. |

| |

|

|

| 99.3 |

|

The

unaudited Pro Forma Condensed Combined Financial Information of TraQiQ, Inc. as of and for the three months ended March 31,

2023, and the year ended December 31, 2022, and the related notes thereto. |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

November 16, 2023 |

TRAQIQ,

INC. |

| |

|

|

| |

By:

|

/s/

Glen Miller |

| |

|

Glen

Miller |

| |

|

Chief

Executive Officer |

Exhibit

23.1

CONSENT

OF INDEPENDENT AUDITOR

We consent to the use in this Current Report on

Form 8-K/A of TraQiQ, Inc. of our report for Titan Trucking, LLC and Subsidiary dated September 28, 2023, which includes an explanatory

paragraph as to Titan Trucking, LLC and Subsidiary’s ability to continue as a going concern, relating to the consolidated financial

statements of Titan Trucking, LLC and Subsidiary as of and for the years ended December 31, 2022 and 2021, appearing in this Current Report

on Form 8-K/A.

/s/ Freed

Maxick CPAs, P.C.

Buffalo, New York

November 16, 2023

true

2022

0001514056

0001514056

2022-01-01

2022-12-31

0001514056

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:TitanTruckingLlcMember

us-gaap:NonrelatedPartyMember

2022-12-31

0001514056

TRIQ:TitanTruckingLlcMember

us-gaap:NonrelatedPartyMember

2021-12-31

0001514056

TRIQ:TitanTruckingLlcMember

us-gaap:RelatedPartyMember

2022-12-31

0001514056

TRIQ:TitanTruckingLlcMember

us-gaap:RelatedPartyMember

2021-12-31

0001514056

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:TitanTruckingLlcMember

2021-01-01

2021-12-31

0001514056

TRIQ:TitanTruckingLlcMember

2020-12-31

0001514056

TRIQ:TitanTruckingLlcMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

us-gaap:InvestorMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:TrailersTractorsShopEquipmentLeaseholdImprovementsAndContainerMember

srt:MinimumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:TrailersTractorsShopEquipmentLeaseholdImprovementsAndContainerMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

TRIQ:OneCustomersMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

TRIQ:TwoCustomersMember

TRIQ:TitanTruckingLlcMember

2021-01-01

2021-12-31

0001514056

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

TRIQ:ThreeCustomersMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

TRIQ:ThreeCustomersMember

TRIQ:TitanTruckingLlcMember

2021-01-01

2021-12-31

0001514056

TRIQ:TitanTruckingLlcMember

2020-01-01

2020-12-31

0001514056

us-gaap:ContainersMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

us-gaap:ContainersMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

us-gaap:TrucksMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

us-gaap:TrucksMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:TrailersMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:TrailersMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

us-gaap:OfficeEquipmentMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

us-gaap:OfficeEquipmentMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

us-gaap:LeaseholdImprovementsMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

us-gaap:LeaseholdImprovementsMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:AssetPurchaseAgreementMember

TRIQ:TitanTruckingLlcMember

2022-06-10

2022-06-10

0001514056

TRIQ:PurchaseAgreementMember

TRIQ:WTIGlobalIncMember

TRIQ:TitanTruckingLlcMember

2022-12-09

2022-12-09

0001514056

TRIQ:TitanTruckingLlcMember

2019-01-01

2019-12-31

0001514056

TRIQ:TitanTruckingLlcMember

2020-02-15

2020-02-15

0001514056

us-gaap:SubsequentEventMember

TRIQ:TitanTruckingLlcMember

2023-04-01

2023-04-01

0001514056

TRIQ:FifthThirdBankPPPMember

srt:MinimumMember

us-gaap:LoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:FifthThirdBankPPPMember

srt:MaximumMember

us-gaap:LoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:FifthThirdBankPPPMember

us-gaap:LoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:FifthThirdBankPPPMember

us-gaap:LoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:FifthThirdBankPPPMember

us-gaap:LoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:WTIGlobalIncMember

us-gaap:LoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:WTIGlobalIncMember

us-gaap:LoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:WTIGlobalIncMember

us-gaap:LoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:PeopleUnitedMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:PeopleUnitedMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:PeopleUnitedMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:MAndTBankMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:MAndTBankMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:MAndTBankMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

srt:MinimumMember

TRIQ:CollateralizedLoansMember

TRIQ:DaimlerTruckMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:DaimlerTruckMember

TRIQ:CollateralizedLoansMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:DaimlerTruckMember

TRIQ:CollateralizedLoansMember

srt:MinimumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:DaimlerTruckMember

TRIQ:CollateralizedLoansMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:DaimlerTruckMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:DaimlerTruckMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

srt:MinimumMember

TRIQ:CollateralizedLoansMember

TRIQ:AscentiumCapitalMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:AscentiumCapitalMember

TRIQ:CollateralizedLoansMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:AscentiumCapitalMember

TRIQ:CollateralizedLoansMember

srt:MinimumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:AscentiumCapitalMember

TRIQ:CollateralizedLoansMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:AscentiumCapitalMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:AscentiumCapitalMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:BalboaCapitalMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:BalboaCapitalMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:BalboaCapitalMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:BlueBridgeFinancialMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:BlueBridgeFinancialMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:BlueBridgeFinancialMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:FinancialPacificMember

TRIQ:CollateralizedLoansMember

srt:MinimumMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:FinancialPacificMember

TRIQ:CollateralizedLoansMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:FinancialPacificMember

TRIQ:CollateralizedLoansMember

srt:MinimumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:FinancialPacificMember

TRIQ:CollateralizedLoansMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:FinancialPacificMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:FinancialPacificMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:M2EquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:M2EquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:M2EquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:MeridianEquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:MeridianEquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:MeridianEquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:NavitasMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:NavitasMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:NavitasMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:PawneeMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:CollateralizedLoansMember

TRIQ:PawneeMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:PawneeMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:SignatureMember

TRIQ:CollateralizedLoansMember

srt:MinimumMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:SignatureMember

TRIQ:CollateralizedLoansMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:SignatureMember

TRIQ:CollateralizedLoansMember

srt:MinimumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:SignatureMember

TRIQ:CollateralizedLoansMember

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:SignatureMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:SignatureMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:TransLeaseMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:TransLeaseMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:TransLeaseMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:VerdantMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:VerdantMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:VerdantMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:WesternEquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:WesternEquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:WesternEquipmentMember

TRIQ:CollateralizedLoansMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:TitanPropertyMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:TitanPropertyMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:TitanPropertyMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:CAndMRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:CAndMRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:CAndMRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:MRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:MRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:MRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:JRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

TRIQ:JRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2022-12-31

0001514056

TRIQ:JRizzoMember

us-gaap:RelatedPartyMember

TRIQ:TitanTruckingLlcMember

2021-12-31

0001514056

TRIQ:TitanTruckingLlcMember

2020-05-05

0001514056

TRIQ:TitanTruckingLlcMember

2021-02-01

0001514056

srt:MaximumMember

TRIQ:TitanTruckingLlcMember

2022-01-01

2022-12-31

0001514056

us-gaap:SubsequentEventMember

TRIQ:TitanTruckingLlcMember

2023-04-30

0001514056

us-gaap:SubsequentEventMember

TRIQ:TitanTruckingLlcMember

2023-04-01

2023-04-30

0001514056

TRIQ:TitanMergerAgreementMember

us-gaap:SubsequentEventMember

us-gaap:SeriesCPreferredStockMember

TRIQ:TitanTruckingLlcMember

2023-05-19

2023-05-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Exhibit

99.1

TITAN

TRUCKING, LLC, AND SUBSIDIARY

A

LIMITED LIABILTY COMPANY

AUDITED

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2022 AND 2021

C

O N T E N T S

Report

of Independent Registered Public Accounting Firm

To

the Members of Titan Trucking, LLC and Subsidiary (A Limited Liability Company):

Opinion

on the Financial Statements

We

have audited the accompanying consolidated balance sheets of Titan Trucking, LLC and Subsidiary (A Limited Liability Company) (the Company)

as of December 31, 2022 and 2021, the related consolidated statements of operations, changes in members’ equity (deficiency), and

cash flows for the years then ended, and the related notes to the consolidated financial statements (collectively, the financial statements).

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December

31, 2022 and 2021 and the results of their operations and their cash flows for the years then ended, in conformity with accounting principles

generally accepted in the United States of America.

Emphasis

of Matter – Going Concern

The

accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed

in Note 1 to the financial statements, the Company has suffered recurring losses from operations and its total current liabilities exceed

its total current assets. This raises substantial doubt about the Company’s ability to continue as a going concern. Management’s

plans in regard to these matters also are described in Note 1. The financial statements do not include any adjustments that might result

from the outcome of this uncertainty.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s

financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (PCAOB) and are required to be independent with respect to the Company in accordance with U.S. federal securities laws

and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audits in accordance with the standards of the PCAOB and in accordance with auditing standards generally accepted in the

United States of America. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the

financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were

we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an

understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the

Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our

audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error

or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding

the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits

provides a reasonable basis for our opinion.

Critical

Audit Matters

The

critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated

or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial

statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters

does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit

matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Critical

Audit Matter Description

As

described in Notes 5 and 6 to the financial statements, on June 10, 2022 and December 9, 2022, the Company completed acquisitions of

Century Waste Management and WTI Global, Inc., respectively. The transactions were accounted for as asset acquisitions (the “Acquisitions”).

The net assets acquired were recorded at fair value and included vehicles and equipment from Century Waste Management and a customer

list intangible from WTI Global, Inc.

Auditing

the Company’s accounting for these Acquisitions was complex due to the judgement involved in evaluating whether the Acquisitions

met the criteria of a business combination or an asset acquisition among other accounting considerations. The subjective considerations

included whether substantially all the fair value of the gross assets acquired was concentrated in a single identifiable asset or group

of similar identifiable assets.

How

the Critical Matter Was Addressed in the Audits

To

test the Company’s accounting for the Acquisitions, we performed the following audit procedures:

| |

● |

We

evaluated the Company’s application of the relevant accounting guidance under ASC Topic 805 – Business Combinations. |

| |

● |

We

obtained and read the relevant asset purchase agreements and assessed the completeness and accuracy of the net assets acquired. |

| |

● |

We

recalculated the fair value of the consideration paid in the Acquisitions. |

| |

● |

We

evaluated the reasonableness of the valuation methodologies used to arrive at the fair value of the acquired assets. |

| |

● |

We

assessed the appropriateness of the related disclosures in the financial statements. |

/s/ Freed Maxick CPAs, P.C.

We

have served as the Company’s auditor since 2023.

Buffalo,

New York

September

28, 2023

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

CONSOLIDATED

BALANCE SHEETS

DECEMBER

31, 2022 AND 2021

| | |

DECEMBER 31,

2022 | | |

DECEMBER 31,

2021 | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 26,650 | | |

$ | 33,579 | |

| Accounts receivable, net | |

| 517,583 | | |

| 413,723 | |

| Subscriptions receivable | |

| 200,000 | | |

| - | |

| Other receivables | |

| 1,241 | | |

| 426,016 | |

| Prepaid expenses and other current assets | |

| 128,689 | | |

| 88,314 | |

| Total Current Assets | |

| 874,163 | | |

| 961,632 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 5,643,941 | | |

| 3,160,179 | |

| Intangible assets, net | |

| 687,500 | | |

| - | |

| Other assets | |

| 8,251 | | |

| 8,251 | |

| Operating lease right-of-use asset, net | |

| 194,112 | | |

| 276,370 | |

| Total Non-current Assets | |

| 6,533,804 | | |

| 3,444,800 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 7,407,967 | | |

$ | 4,406,432 | |

| | |

| | | |

| | |

| LIABILITIES AND MEMBERS’ EQUITY (DEFICIENCY) | |

| | | |

| | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 736,658 | | |

$ | 373,647 | |

| Accrued payroll and related taxes | |

| 50,983 | | |

| 33,039 | |

| Notes payable, net of deferred financing costs | |

| 1,098,158 | | |

| 1,244,206 | |

| Notes payable, net – related parties | |

| - | | |

| 3,660,864 | |

| Notes payable, net | |

| - | | |

| 3,660,864 | |

| Operating lease liability | |

| 95,243 | | |

| 85,303 | |

| Total Current Liabilities | |

| 1,981,042 | | |

| 5,397,059 | |

| | |

| | | |

| | |

| Long-term notes, net of deferred financing costs | |

| 2,785,531 | | |

| 837,219 | |

| Operating lease liability, net of current portion | |

| 115,290 | | |

| 210,533 | |

| Total Non-current Liabilities | |

| 2,900,821 | | |

| 1,047,752 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 4,881,863 | | |

| 6,444,811 | |

| | |

| | | |

| | |

| MEMBERS’ EQUITY (DEFICIENCY) | |

| | | |

| | |

| Members’ equity (deficiency) | |

| 2,526,104 | | |

| (2,038,379 | ) |

| | |

| | | |

| | |

| Total Members’ Equity (Deficiency) | |

| 2,526,104 | | |

| (2,038,379 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND MEMBERS’ EQUITY (DEFICIENCY) | |

$ | 7,407,967 | | |

$ | 4,406,432 | |

The

accompanying notes to the financial statements are an integral part of these statements.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

CONSOLIDATED

STATEMENTS OF OPERATIONS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

| | |

2022 | | |

2021 | |

| | |

For the Years Ended December 31, | |

| | |

2022 | | |

2021 | |

| | |

| | |

| |

| REVENUE | |

$ | 4,203,112 | | |

$ | 3,315,256 | |

| COST OF REVENUES | |

| 4,207,852 | | |

| 3,317,225 | |

| GROSS LOSS | |

| (4,740 | ) | |

| (1,969 | ) |

| | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | |

| Salaries and salary related costs | |

| 475,512 | | |

| 395,395 | |

| Professional fees | |

| 265,575 | | |

| 30,503 | |

| General and administrative expenses | |

| 359,175 | | |

| 237,243 | |

| | |

| | | |

| | |

| Total Operating Expenses | |

| 1,100,262 | | |

| 663,141 | |

| | |

| | | |

| | |

| OPERATING LOSS | |

| (1,105,002 | ) | |

| (665,110 | ) |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | |

| Interest expense, net of interest income | |

| (199,453 | ) | |

| (140,812 | ) |

| Loss on sale of assets | |

| (168,208 | ) | |

| (262,264 | ) |

| Employee Retention Credits | |

| - | | |

| 422,845 | |

| Forgiveness of Paycheck Protection Program loans | |

| 812,305 | | |

| - | |

| Other income | |

| 1,696 | | |

| 57,291 | |

| Total other income (expense) | |

| 446,340 | | |

| 77,060 | |

| | |

| | | |

| | |

| NET LOSS | |

$ | (658,663 | ) | |

$ | (588,050 | ) |

| | |

| | | |

| | |

| LOSS PER UNIT (BASIC AND DILUTED) | |

| | | |

| | |

| Weighted-average units outstanding | |

| 100 | | |

| 100 | |

| Net loss per unit | |

$ | (6,587 | ) | |

$ | (5,881 | ) |

The

accompanying notes to the financial statements are an integral part of these statements.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

CONSOLIDATED

STATEMENT OF CHANGES IN MEMBERS’ EQUITY (DEFICIENCY)

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

| | |

Members’ Equity

(Deficiency) | |

| Balance – January 1, 2021 | |

$ | (1,450,329 | ) |

| | |

| | |

| Net loss | |

| (588,050 | ) |

| | |

| | |

| Balance – December 31, 2021 | |

| (2,038,379 | ) |

| Balance | |

| (2,038,379 | ) |

| | |

| | |

| Contributions | |

| 5,223,146 | |

| | |

| | |

| Net loss | |

| (658,663 | ) |

| | |

| | |

| Balance – December 31, 2022 | |

$ | 2,526,104 | |

| Balance | |

$ | 2,526,104 | |

The

accompanying notes to the financial statements are an integral part of these statements.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

CONSOLIDATED

STATEMENTS OF CASH FLOWS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

| | |

2022 | | |

2021 | |

| | |

FOR THE YEARS ENDED DECEMBER 31, | |

| | |

2022 | | |

2021 | |

| CASH FLOW FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss | |

$ | (658,663 | ) | |

$ | (588,050 | ) |

| Adjustments to reconcile net loss to net cash (used in) operating activities: | |

| | | |

| | |

| Employee Retention Credits | |

| - | | |

| (422,845 | ) |

| Forgiveness of PPP loans | |

| (812,305 | ) | |

| - | |

| Bad debt expense | |

| 77,690 | | |

| - | |

| Depreciation and amortization | |

| 325,382 | | |

| 304,175 | |

| Loss on sale of property and equipment | |

| 168,208 | | |

| 262,264 | |

| Amortization of loan origination fees | |

| 6,663 | | |

| - | |

| Change in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (181,549 | ) | |

| (63,873 | ) |

| Prepaid expenses and other current assets | |

| (40,374 | ) | |

| (7,812 | ) |

| Other receivables | |

| 424,775 | | |

| - | |

| Other assets | |

| - | | |

| 3,800 | |

| Operating lease right-of-use asset | |

| 82,258 | | |

| 76,179 | |

| Accounts payable and accrued expenses | |

| 363,010 | | |

| (9,188 | ) |

| Accrued payroll and payroll taxes | |

| 17,944 | | |

| 14,862 | |

| Operating lease liability | |

| (85,303 | ) | |

| (76,172 | ) |

| Total adjustments | |

| 580,761 | | |

| (62,204 | ) |

| Net cash used in operating activities | |

| (312,264 | ) | |

| (506,660 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Acquisition of property and equipment | |

| (3,349,628 | ) | |

| (47,177 | ) |

| Disposal of property and equipment | |

| 371,819 | | |

| 211,965 | |

| Net cash provided by (used in) investing activities | |

| (2,977,809 | ) | |

| 164,788 | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Loan origination fees | |

| (99,950 | ) | |

| - | |

| Proceeds from notes payable | |

| 4,398,833 | | |

| 1,806,332 | |

| Repayments of notes payable | |

| (1,015,739 | ) | |

| (1,486,279 | ) |

| Net cash provided by financing activities | |

| 3,283,144 | | |

| 320,053 | |

| | |

| | | |

| | |

| NET DECREASE IN CASH | |

| (6,929 | ) | |

| (21,819 | ) |

| | |

| | | |

| | |

| CASH – BEGINNING OF YEAR | |

| 33,579 | | |

| 55,398 | |

| | |

| | | |

| | |

| CASH – END OF YEAR | |

$ | 26,650 | | |

$ | 33,579 | |

| | |

| | | |

| | |

| CASH PAID DURING THE YEAR FOR: | |

| | | |

| | |

| Interest expense | |

$ | 219,404 | | |

$ | 112,423 | |

| SUPPLEMENTAL NON-CASH DISCLOSURES OF CASH FLOW: | |

| | | |

| | |

| Member contributions in exchange for loans payable | |

$ | 4,505,646 | | |

$ | - | |

| Subscription receivable in exchange for equity | |

$ | 200,000 | | |

$ | - | |

| Member contributions in exchange for intangible asset purchase | |

$ | 517,500 | | |

$ | - | |

| Note payable in exchange for intangible asset purchase | |

$ | 170,000 | | |

$ | - | |

The

accompanying notes to the financial statements are an integral part of these statements.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

NOTE

1 – ORGANIZATION AND NATURE OF OPERATIONS

Business

Operations

Titan

Trucking, LLC (the “Company”) was incorporated in the State of Michigan on January 26, 2017. The Company was formed as a

limited liability company. The registered business address is located at 51512 Industrial Drive, New Baltimore, Michigan 48047.

The

Company is engaged in the full-service solution of waste management. The Company offers a comprehensive package of waste reduction, collection,

recycling, and technology-enabled solutions to support customer demand.

Senior

Trucking, LLC (“Senior’) was established on March 14, 2017 with 100% ownership by the single member of Titan Trucking, LLC

(“Titan”). Senior was formally acquired by Titan on April 5, 2020. Senior has operated exclusively under the management and

assets of Titan since inception.

Going

Concern

The

Company’s consolidated financial statements as of December 31, 2022 and 2021, are prepared using accounting principles generally

accepted in the United States of America (“U.S. GAAP”), which contemplates continuation of the Company as a going concern.

This contemplates the realization of assets and liquidation of liabilities in the ordinary course of business.

For

the year ended December 31, 2022, the Company had a net loss of $658,663 ($588,050 in 2021). The working capital of the Company had a

deficit of $1,106,879 for the year ended December 31, 2022 (deficit of $4,435,427 in 2021). Additionally, the Company used cash of $312,264

related to its operating activities during the year ended December 31, 2022. The Company had a cash balance of $26,650 as of December

31, 2022. These conditions raise substantial doubt about the Company’s ability to continue as a going concern for a period of time

within one year after the date that the financial statements are issued. The Company continues to shrink its working capital deficit

year-over-year and has been able to continually meet the working capital needs of the business as they come due.

Management’s

plans include raising capital through issuances of equity and debt securities and minimizing operating expenses of the business to improve

the Company’s cash burn rate, in conjunction with the TraqIQ reverse-merger (Note 13). The combined companies, subsequent to the

reverse merger, have been successful in attracting substantial capital from investors interested in the current public status of the

Company, which has been used to support its ongoing cash outlays. In the second half of the year ended 2023, TraqIQ, its new legal parent

company, obtained approximately $1 million in cash from private investors and believes, but cannot guarantee, it will continue to be

able to attract capital from outside sources as it pursues a move to a national exchange. The Company has engaged a qualified investment

bank to assist in its uplifting and simultaneous raise of capital. Additionally, the Company’s revenues continue to grow, and management

expects the Company to shrink its net losses over the upcoming quarters through organic and acquisitive growth.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

NOTE

2 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of Presentation

The

accompanying consolidated financial statements have been prepared in accordance with U.S. GAAP and the regulations of the United States

Securities and Exchange Commission. The Company adopted a December 31 fiscal year-end for financial statement reporting purposes.

The

consolidated financial statements and accompanying notes are the representations of the Company’s management, who are responsible

for their integrity and objectivity. In their opinion, such financial information is presented fairly and for all periods represented.

Principles

of Consolidation

The

consolidated financial statements include the accounts of Titan Trucking LLC and Senior Trucking LLC, its wholly owned affiliate. All

material inter-company accounts and transactions have been eliminated.

Basis

of Accounting

The

Company’s policy is to prepare its combined financial statements on the accrual basis of accounting, whereby revenue is recognized

when earned and expenses are recognized when incurred.

Accounting

Estimates

The

preparation of consolidated financial statements in conformity with U.S. GAAP in the United States of America requires management to

make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosures of contingent assets and

liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting

period. Actual results could differ from these estimates.

Business

Combinations

Under

the guidance enumerated in FASB Accounting Standards Codification (“ASC”) 805, if substantially all of the fair value of

the gross assets acquired is concentrated in a single identifiable asst or group of similar identifiable assets, the set is not considered

a business and is accounted for as an asset acquisition at which point, the acquirer measures the assts acquired based on their cost,

which is allocated on a relative fair value basis.

Business

combinations are accounted for utilizing the fair value of consideration determined by the Company’s management and external specialists.

The Company recognizes estimated fair values of the tangible and intangible assets acquired and liabilities assumed as of the acquisition

date. Goodwill is recognized as any excess in fair value over the net value of assets acquired and liabilities assumed.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

Cash

and cash equivalents

The

Company considers all highly liquid money market funds and certificates of deposit with original maturities of less than three months

to be cash equivalents. The Company maintains its cash balances with various banks. The balances are insured by the Federal Deposit Insurance

Corporation (“FDIC”) up to $250,000. At December 31, 2022, the Company had no amounts above this amount.

Accounts

Receivable, net

Accounts

receivables are recorded at the amount the Company expects to collect on the balance outstanding at year-end. Management closely monitors

outstanding balances during the year and allocates an allowance account if appropriate. The Company writes off bad debts as they occur

during the year. As of the year ended December 31, 2022, the Company allocated $77,690 to the allowance for doubtful accounts. There

was no allowance for the year ended December 31, 2021.

Subscriptions

Receivable

Subscription

receivable consists of members’ equity that have been issued with subscriptions that have not yet been settled. As of December

31, 2022 and 2021, there were $200,000 and nil, respectively, in subscriptions that had not yet settled. All these funds were settled

in January of 2023, prior to the filing of this report. Subscriptions receivable are carried at cost which approximates fair value.

Property

and Equipment, net

Property

and equipment are stated at cost. Depreciation is computed primarily using the straight-line method over the estimated useful lives of

the assets. Expenditures for repairs and maintenance are charged to expense as incurred. For assets sold or otherwise disposed of, the

cost and related accumulated depreciation are removed from the accounts, and any related gain or loss is reflected in the consolidated

statement of operations or the period in which the disposal occurred. The Company utilizes a useful life ranging from 5 to 25 years for

its trailers, tractors, shop equipment, leasehold improvements, and containers.

Management

regularly reviews property and equipment for possible impairment. This review occurs annually or more frequently if events or changes

in circumstances indicate the carrying amount of the asset may not be recoverable. Based on management’s assessment, there were

no indicators of impairment of the Company’s property and equipment as of December 31, 2022.

Finite

Intangible Assets, net

Finite

intangible assets are recorded at their estimated fair value at the date of acquisition. They are amortized on a straight-line basis

over their estimated useful lives. Management annually evaluates the estimated remaining useful lives of the intangible assets to determine

whether events or changes in circumstances warrant a revision to the remaining period of amortization. The Company acquired the finite

intangible asset, customer lists, as part of the asset acquisition of WTI Global, Inc. Customer lists are amortized over a remaining

useful life of 10 years as determined by management.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

Finite-lived

assets are reviewed for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be fully

recoverable. An impairment loss is recognized if the sum of the expected long-term undiscounted cash flows the asset is expected to generate

is less than its carrying amount. Any write-downs are treated as permanent reductions in the carrying amount of the respective asset.

Management assessed and concluded that no impairment write-down would be necessary for the finite-lived intangible assets as of December

31, 2022.

Fair

Value of Financial Instruments

The

Company’s financial instruments primarily consist of cash and cash equivalents, accounts receivable, accounts payable, accrued

expenses, and short-term notes payable. As of the consolidated balance sheet dates, the estimated fair values of the financial instruments

were not materially different from their carrying values as presented due to the short maturities of these instruments.

Leases

The

Company assesses whether a contract is or contains a lease at inception of the contract and recognizes right-of-use assets (“ROU”)

and corresponding lease liabilities at the lease commencement date. The lease term is used to calculate the lease liability, which includes

options to extend or terminate the lease when it is reasonably certain that the option will be exercised. The leases the Company currently

holds do not have implicit borrowing rates, therefore the Company utilizes its incremental borrowing rate to measure the ROU assets and

liabilities. Operating lease expense is generally recognized on a straight-line basis over the lease term. All leases that have lease

terms of one year or less are considered short-term leases, and therefore are not recorded through a ROU or liability.

The

Company has elected to apply the practical expedient to not separate the lease and non-lease components of a contract, which ultimately

results in a higher amount of total lease payments being included within the present value calculation of the lease liability.

Loan

Origination Fees

Loan

origination fees represent loan fees relating to notes granted to the Company and are amortized over the life of the note. Amortization

expense for the year ended December 31, 2022 was $6,663. The net amount of $93,745 was netted against the outstanding long-term debt.

Revenue

Recognition

The

Company records revenue based on a five-step model in accordance with ASC 606, Revenue from Contracts with Customers, which requires

the following:

1.

Identify the contract with a customer.

2.

Identify the performance obligations in the contract.

3.

Determine the transaction price of the contract.

4.

Allocate the transaction price to the performance obligations in the contract.

5.

Recognize revenue when the performance obligations are met or delivered.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

The

Company’s operating revenues are primarily generated from fees charged for the collection and disposal of waste. Revenues are recognized

at a point in time immediately after completion of disposal of waste at a landfill or transfer station and billed out to customers. Rates

charged for services performed are usually based on pre-negotiated amounts via contractual obligations and are billed on a performance

satisfaction basis via invoice. Invoices usually contain a payment term of net 30 days. There are no significant financing operations

with customers in relation to revenues generated and collected.

Revenues

from collection operations are influenced by factors such as collection frequency, type of collection furnished, type and volume or weight

of the waste collected, distance to the disposal facility or material recovery facility and disposal costs. Fees charged at transfer

stations are generally based on the weight or volume of waste deposited, including the cost of loading, transporting, and disposing of

the solid waste at a disposal site. The fees charged for services generally include environmental, fuel charge and regulatory recovery

fees, which are intended to pass through to customers direct and indirect costs incurred.

Concentration

Risk

The

Company performs a regular review of customer activity and associated credit risks.

During

the year ended December 31, 2022, one customer accounted for more than 63% of accounts receivable. During the year ended December 31.

2021, two customers accounted for more than 77% of total accounts receivable.

During

the year ended December 31, 2022, three customers accounted for more than 76% of total revenues generated. During the year ended December

31, 2021, three customers accounted for more than 77% of total revenues generated.

The

Company maintains positive customer relationships and continually expands its customer base, mitigating the impact of any potential concentration

risks that exist.

Basic

and Diluted Loss per Unit

The

Company presents both basic and diluted earnings per unit for the periods presented in the consolidated financial statements. Basic and

diluted loss per unit is calculated by dividing the net loss attributable to the Company by the weighted average number of units outstanding

during the periods presented.

Income

Taxes

The

Company, with consent from its members, has elected under the Internal Revenue Code to be an “S” corporation. In lieu of

corporation income taxes, the shareholders of an “S” corporation are taxed on their proportionate share of the Company’s

taxable income.

Advertising

and Marketing Costs

Costs

associated with advertising are charged to expense as occurred. For the years ended December 31, 2022 and 2021, the advertising and marketing

costs were $11,336 and $3,394, respectively.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

Recently

Issued Accounting Standards

In

June 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-13, “Financial Instruments –

Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments.” This amendment replaces the incurred methodology

in current GAAP with a methodology that reflects expected credit losses on instruments within its scope, including trade receivables.

This update is intended to provide financial statement users with more decision-useful information about the expected credit losses.

In November 2019, the FASB issued No. 2019-10, Financial Instruments – Credit Losses (Topic 326), Derivatives and Hedging (Topic

815), and Leases (Topic 842), which deferred the effective date of ASU 2016-13 for fiscal years beginning after December 15, 2022, including

interim periods within those fiscal years. The Company does not expect a material impact from the adoption of ASU 2016-13 on the consolidated

financial statements.

NOTE

4 - OTHER RECEIVABLES

SCHEDULE

OF OTHER RECEIVABLES

| | |

December 31,

2022 | | |

December 31,

2021 | |

| Employee retention credit (1) | |

$ | - | | |

$ | 422,845 | |

| Other receivables | |

| 1,241 | | |

| 3,171 | |

| Total | |

$ | 1,241 | | |

$ | 426,016 | |

NOTE

5 – PROPERTY AND EQUIPMENT, NET

Property

and equipment consists of the following as of December 31, 2022 and 2021:

SCHEDULE

OF PROPERTY AND EQUIPMENT

| | |

December 31,

2022 | | |

December 31,

2021 | |

| Containers | |

$ | 1,397,311 | | |

$ | - | |

| Trucks and tractors | |

| 4,086,968 | | |

| 2,213,265 | |

| Trailers | |

| 1,197,357 | | |

| 1,829,853 | |

| Shop equipment | |

| 40,380 | | |

| 40,380 | |

| Leasehold improvements | |

| 19,589 | | |

| 19,589 | |

| Property and equipment , gross | |

| 6,741,605 | | |

| 4,103,087 | |

| Less: accumulated depreciation | |

| (1,097,664 | ) | |

| (942,908 | ) |

| Net book value | |

$ | 5,643,941 | | |

$ | 3,160,179 | |

Depreciation

expenses for the year ended December 31, 2022 and 2021 were $325,382 and $304,175, respectively.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

On

June 10, 2022, the Company entered into an asset purchase agreement with Century Waste Management for consideration of approximately

$1,805,000. The entire purchase price agreement was allocated as fair value to the fixed assets acquired; no goodwill or intangible assets

were determined to be transferred as part of the sale. In order to fund the asset purchase from Century, the Company entered into several

private equipment financing agreements.

NOTE

6 – INTANGIBLES, NET

Intangible

assets acquired consisted of the following as of December 31, 2022 and 2021:

SCHEDULE

OF ACQUIRED INTANGIBLE ASSETS

| | |

December 31,

2022 | | |

December 31,

2021 | |

| Customer lists | |

$ | 687,500 | | |

$ | - | |

| Less: accumulated amortization | |

| - | | |

| - | |

| Net book value | |

$ | 687,500 | | |

$ | - | |

For

the years ended December 31, 2022 and 2021, there were no amortization expenses recorded. Amortization is expected to be $68,750 for

each of the next five years.

On

December 9, 2022, the Company entered into a purchase agreement with WTI Global, Inc. (the “seller”) for consideration of

approximately $687,500 in exchange for intangible assets. The entire purchase consideration was allocated as fair value to the customer

lists acquired from the seller. The $687,500 was funded through a combination of a note payable to the seller of $170,000 and an equity

infusion from a member of the Company for $517,500. See Note 9 and 10 for further details.

NOTE

7 – ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Detail

of accounts payable and accrued expenses as of December 31, 2022 and 2021 is as follows:

SCHEDULE

OF ACCOUNTS PAYABLE AND ACCRUED EXPENSES

| | |

December 31,

2022 | | |

December 31,

2021 | |

| Accounts payable | |

$ | 669,231 | | |

$ | 309,833 | |

| Credit card payable | |

| 29,454 | | |

| 28,683 | |

| Accrued interest | |

| 12,298 | | |

| 35,131 | |

| Accrued expenses and other | |

| 25,675 | | |

| - | |

| Total accounts payable and accrued expenses | |

$ | 736,658 | | |

$ | 373,647 | |

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

NOTE

8 – LEASE PAYABLE

The

Company leases both its headquarters office and operational warehouse in Troy, Michigan. Leases with an initial term of 12 months or

less or are immaterial are not included on the consolidated balance sheets. During the year ended December 31, 2019, the Company entered

into a 62-month lease which expires on January 15, 2025. The monthly payments were initiated on February 15, 2020 at $8,251

after a 2-month rent abatement period. Straight

rent was calculated at $8,479 per

month. The total remaining operating lease expenses through the expected termination date is approximately $211,963.

Total operating lease expenses for the years ended December 31, 2022 and 2021 were $112,753

and $112,198,

respectively.

SCHEDULE

OF LEASE PAYABLE

| | |

As of December 31, | |

| | |

2022 | | |

2021 | |

| Weighted average remaining lease term (in years) | |

| 2.08 | | |

| 3.08 | |

| Weighted average discount rate | |

| 7.57 | % | |

| 7.57 | % |

Future

minimum lease payments required under operating leases on an undiscounted cash flow basis as of December 31, 2022 are as follows:

SCHEDULE

OF FUTURE MINIMUM LEASE PAYMENT

| Fiscal Year | |

Operating Lease Payments | |

| 2023 | |

$ | 107,930 | |

| 2024 | |

| 111,168 | |

| 2025 | |

| 9,287 | |

| Total minimum lease payments | |

| 228,385 | |

| Less: imputed interest | |

| (17,852 | ) |

| Present value of future minimum lease payments | |

$ | 210,533 | |

| | |

| | |

| Current operating lease liabilities | |

| 95,243 | |

| Non-current operating lease liabilities | |

| 115,290 | |

On

April 1, 2023, the Company entered into a 60-month lease in Detroit, Michigan with a related party, which terminates on March 31, 2028.

The monthly payments were initiated on May 1, 2023, after a 1-month rent abatement period. Straight rent was calculated at $33,564 per

month.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

NOTES

9 – NOTES PAYABLE

The

Company borrows funds from various creditors to finance equipment and vehicles and acquisitions consisting of the following:

SCHEDULE

OF NOTES PAYABLE

| | |

| |

| | |

| | |

December 31, 2022 | | |

December 31, 2021 | |

| Lender | |

Maturity

Date | |

Interest

Rate | | |

Monthly Payment | | |

Short-Term | | |

Long-Term | | |

Short-Term | | |

Long-Term | |

| | |

| |

| % | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | |

| Loans | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fifth Third Bank (PPP)** | |

2/8/22 - 5/24/22 | |

| - | | |

| - | | |

| - | | |

| - | | |

| 812,304 | | |

| - | |

| WTI Global | |

On demand | |

| 7.00 | | |

| - | | |

| 170,000 | | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Collateralized Loans | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Peoples United | |

11/10/23 | |

| 5.75 | | |

| 16,614 | | |

| 177,539 | | |

| - | | |

| 165,337 | | |

| 177,539 | |

| M&T Bank | |

2/23/25 | |

| 8.78 | | |

| 13,000 | | |

| 121,927 | | |

| 321,192 | | |

| 128,191 | | |

| 443,120 | |

| Daimler Truck | |

5/14/23 - 9/29/23 | |

| 4.95 - 6.00 | | |

| 2,487 - 2,762 | | |

| 74,873 | | |

| 53,429 | | |

| 138,374 | | |

| 216,560 | |

| Ascentium Capital | |

5/5/27 - 6/5/27 | |

| 3.75 - 5.82 | | |

| 4,812 - 5,935 | | |

| 152,467 | | |

| 587,991 | | |

| - | | |

| - | |

| Balboa Capital | |

8/13/27 | |

| 9.68 | | |

| 4,860 | | |

| 38,895 | | |

| 179,433 | | |

| - | | |

| - | |

| Blue Bridge Financial | |

8/10/27 | |

| 12.18 | | |

| 1,442 | | |

| 10,394 | | |

| 50,951 | | |

| - | | |

| - | |

| Financial Pacific | |

7/15/27 - 10/15/27 | |

| 7.49 - 9.87 | | |

| 1,585 - 1,906 | | |

| 29,187 | | |

| 133,220 | | |

| - | | |

| - | |

| M2 Equipment | |

8/10/27 | |

| 8.68 | | |

| 4,739 | | |

| 39,527 | | |

| 178,039 | | |

| - | | |

| - | |

| Meridian Equipment | |

7/12/27 | |

| 9.32 | | |

| 3,118 | | |

| 25,518 | | |

| 113,606 | | |

| - | | |

| - | |

| Navitas | |

7/23/27 | |

| 7.99 | | |

| 4,257 | | |

| 36,791 | | |

| 158,723 | | |

| - | | |

| - | |

| Pawnee | |

8/15/27 | |

| 10.19 | | |

| 5,296 | | |

| 41,480 | | |

| 193,759 | | |

| - | | |

| - | |

| Signature | |

9/15/27 - 6/30/28 | |

| 6.93 - 8.25 | | |

| 3,901 - 4,842 | | |

| 73,973 | | |

| 374,921 | | |

| - | | |

| - | |

| Trans Lease | |

2/20/27 | |

| 9.75 | | |

| 4,838 | | |

| 40,524 | | |

| 157,569 | | |

| - | | |

| - | |

| Verdant | |

4/27/27 | |

| 6.25 | | |

| 4,702 | | |

| 44,324 | | |

| 169,390 | | |

| - | | |

| - | |

| Western Equipment | |

8/15/27 | |

| 8.93 | | |

| 4,989 | | |

| 41,186 | | |

| 186,605 | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Related Parties | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Titan Property | |

On demand | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,204,532 | | |

| - | |

| C. and M. Rizzo | |

On demand | |

| 3.00 | | |

| - | | |

| - | | |

| - | | |

| 500,000 | | |

| - | |

| M. Rizzo | |

On demand | |

| 1.90 | | |

| - | | |

| - | | |

| - | | |

| 1,785,451 | | |

| - | |

| J. Rizzo | |

On demand | |

| 5.00 | | |

| - | | |

| - | | |

| - | | |

| 170,881 | | |

| - | |

| | |

| |

| | | |

| | | |

| 1,118,605 | | |

| 2,858,828 | | |

| 4,905,070 | | |

| 837,219 | |

| ** |

The Company applied for and received

loans from the Paycheck Protection Program (the “PPP”) in the amounts of $406,152

and $406,153,

received on May 5, 2020 and February 1, 2021, respectively. On January 31, 2022 and March 21, 2022, the Company received notices that

the entire balances of the loans plus any accrued interest were forgiven and recorded in the consolidated statement of operations as

forgiveness of $812,305 during the year ended December 31, 2022. |

Principal

maturities for the next five years and thereafter:

SCHEDULE

OF PRINCIPAL MATURITIES PAYMENT

| | |

| | |

| 2023 | |

| 1,118,605 | |

| 2024 | |

| 806,510 | |

| 2025 | |

| 857,789 | |

| 2026 | |

| 723,597 | |

| 2027 | |

| 442,419 | |

| Thereafter | |

| 28,514 | |

| Total principal payments | |

| 3,977,434 | |

| Less: debt issuance costs | |

| (93,745 | ) |

| Total notes payable | |

| 3,883,689 | |

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

NOTES

TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED DECEMBER 31, 2022 AND 2021

NOTES

10 – RELATED PARTY TRANSACTIONS

The

Company had various related party notes payable outstanding at December 31, 2021. The notes were payable to the owner, entities related

to the owner, and family members (Note 9). During the year ended December 31, 2022, the Company conducted several related party transactions

in exchange for equity ownership in Titan Trucking LLC. As a result of the transactions, a net balance of $4,505,646 of related party

loans were converted as equity contributions and eliminated. An additional $517,500 of contributions from a member were paid directly

to the sellers for the purchase of the WTI Global Inc. customer list acquisition. These equity contribution conversions and intangible

asset purchases were utilized in the calculation of equity ownership of the members as of the year ended December 31, 2022.

As

of December 31, 2022, there was $200,000 outstanding in subscriptions receivable owed from one of the members of the Company in relation

to these equity transactions (Note 2).

NOTE

11 – BENEFIT PLAN

The

Company offers a 401(k) plan. Employees are eligible to participate in the plan on the first day of the month following the date of hire.

Employees may defer up to $22,500 per year. The Company is required to contribute on behalf of each eligible participating employee.

The Company will match 50% of the participants deferral not to exceed 3%. Employees will share in the matching contribution regardless

of the amount of service completed during the plan year. Employees will become 100% vested in the employer matching contributions after

one year of service.

Employer

contributions for the year ended December 31, 2022 and 2021 was $11,164 and $10,957, respectively.

NOTE

12 - CONTINGENCIES

From

time to time, the Company is involved in routine litigation that arises in the ordinary course of business. The Company is in an ongoing

lawsuit with Wolverine Transfer Station over a contractual dispute and property damages. Wolverine is countersuing the Company for losses

from the cancellation of contractual obligations. It is the position of the Company that net losses arising from Wolverine’s claims

are not estimable nor probable at the time of this filing.

NOTE

13 – SUBSEQUENT EVENTS

Subsequent

events were evaluated through September 28, 2023, which is the date the consolidated financial statements were issued.

In

April 30, 2023, the Company entered into a notes payable agreement with Titan Holdings 2 in the amount of $592,470, which matures on

April 30, 2028. Interest accrues at 10.5% per annum for the first twelve months and shall increase 0.5 basis points on each anniversary

of the note. The Company shall make interest-only payments for the first 60 months of the note and pay the principal in full on the fifth

anniversary of the note.

On

May 19, 2023, pursuant to the terms of the Titan Merger Agreement, the Company completed the Titan Merger. Under the terms of the Titan

Merger Agreement, the Company agreed to pay the Titan owners 630,900 shares of the Company’s Series C Preferred Stock as consideration.

The Company accounted for the Titan Merger as a reverse acquisition using acquisition accounting.

Exhibit

99.2

TITAN

TRUCKING, LLC, AND SUBSIDIARY

A

LIMITED LIABILTY COMPANY

CONSOLIDATED

FINANCIAL STATEMENTS

MARCH

31, 2023

C

O N T E N T S

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

CONSOLIDATED BALANCE SHEETS

| |

MARCH

31, 2023 | | |

DECEMBER

31, 2022 | |

| | |

| (unaudited) | | |

| | |

| ASSETS | |

| | | |

| | |

| Current

Assets: | |

| | | |

| | |

| Cash | |

$ | 52,763 | | |

$ | 26,650 | |

| Accounts

receivable, net | |

| 462,813 | | |

| 517,583 | |

| Other

receivables | |

| 3,341 | | |

| 1,241 | |

| Prepaid

expenses and other current assets | |

| 121,813 | | |

| 328,689 | |

| Total

Current Assets | |

| 640,730 | | |

| 874,163 | |

| | |

| | | |

| | |

| Property

and equipment, net | |

| 5,581,041 | | |

| 5,643,941 | |

| Intangible

assets, net | |

| 680,625 | | |

| 687,500 | |

| Other

assets | |

| 8,251 | | |

| 8,251 | |

| Operating

lease right-of-use asset, net | |

| 172,518 | | |

| 194,112 | |

| | |

| 6,442,435 | | |

| 6,533,804 | |

| | |

| | | |

| | |

| TOTAL

ASSETS | |

$ | 7,083,165 | | |

$ | 7,407,967 | |

| | |

| | | |

| | |

| LIABILITIES

AND MEMBERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Current

Liabilities: | |

| | | |

| | |

| Accounts

payable and accrued expenses | |

$ | 817,778 | | |

$ | 736,658 | |

| Accrued

payroll and related taxes | |

| 72,015 | | |

| 50,983 | |

| Notes

payable | |

| 816,694 | | |

| 1,098,158 | |

| Operating

lease liability, current | |

| 97,866 | | |

| 95,243 | |

| Total

Current Liabilities | |

| 1,804,353 | | |

| 1,981,042 | |

| | |

| | | |

| | |

| Long-term

notes, net of current portion | |

| 3,175,282 | | |

| 2,785,531 | |

| Operating

lease liability, net of current portion | |

| 89,723 | | |

| 115,290 | |

| Total

Non-current Liabilities | |

| 3,265,005 | | |

| 2,900,821 | |

| | |

| | | |

| | |

| Total

Liabilities | |

| 5,069,358 | | |

| 4,881,863 | |

| | |

| | | |

| | |

| MEMBERS’

EQUITY | |

| | | |

| | |

| Members’

equity | |

| 2,013,807 | | |

| 2,526,104 | |

| | |

| | | |

| | |

| Total

Members’ Equity | |

| 2,013,807 | | |

| 2,526,104 | |

| | |

| | | |

| | |

| TOTAL

LIABILITIES AND MEMBERS’ EQUITY | |

$ | 7,083,165 | | |

$ | 7,407,967 | |

The

accompanying notes to the financial statements are an integral part of these statements.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR

THE THREE MONTHS ENDED MARCH 31, 2023 AND 2022 (UNAUDITED)

| | |

For the three months ended

March 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| REVENUE | |

$ | 1,080,327 | | |

$ | 650,115 | |

| COST

OF REVENUES | |

| 1,161,112 | | |

| 732,836 | |

| GROSS

LOSS | |

| (80,785 | ) | |

| (82,721 | ) |

| | |

| | | |

| | |

| OPERATING

EXPENSES: | |

| | | |

| | |

| Salaries

and salary related costs | |

| 189,316 | | |

| 96,984 | |

| Professional

fees | |

| 194,779 | | |

| 15,631 | |

| Depreciation

and amortization expense | |

| 6,419 | | |

| - | |

| General

and administrative expenses | |

| 131,646 | | |

| 62,285 | |

| | |

| | | |

| | |

| Total

Operating Expenses | |

| 522,160 | | |

| 174,900 | |

| | |

| | | |

| | |

| OPERATING

LOSS | |

| (602,945 | ) | |

| (257,621 | ) |

| | |

| | | |

| | |

| OTHER

INCOME (EXPENSE): | |

| | | |

| | |

| Interest

expense, net of interest income | |

| (79,652 | ) | |

| (31,553 | ) |

| Other

income | |

| 300 | | |

| 783,301 | |

| Total

other income (expense) | |

| (79,352 | ) | |

| 751,748 | |

| | |

| | | |

| | |

| NET

INCOME (LOSS) | |

$ | (682,297 | ) | |

$ | 494,127 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| INCOME

(LOSS) PER UNIT (BASIC AND DILUTED) | |

$ | (682,297) | | |

$ | 494,127 | |

| Weighted-average

units outstanding | |

| 100 | | |

| 100 | |

| Net

income (loss) per unit | |

$ | (7,827 | ) | |

$ | 4,941 | |

The

accompanying notes to the financial statements are an integral part of these statements.

TITAN

TRUCKING, LLC AND SUBSIDIARY

A

LIMITED LIABILITY COMPANY

CONSOLIDATED STATEMENT OF CHANGES IN MEMBERS’ EQUITY (DEFICIENCY)

FOR