UPDATE: Tokio Marine To Buy Rest Of First Insurance Company Of Hawaii For $165 Million

August 11 2011 - 4:49AM

Dow Jones News

Tokio Marine Holdings Inc. (8766.TO) said Thursday it will

acquire the rest of First Insurance Company of Hawaii Ltd. for

about $165 million (Y12.9 billion), the latest example of a

Japanese company exploiting the strength of the yen to look for

acquisitions overseas to help secure growth in the face of limited

opportunities at home.

Japan's largest nonlife insurer by market value, which already

owns a 50% stake in the Hawaii-based insurer, will acquire the rest

of the company from the Continental Insurance Company, a unit of

CNA Financial Corp. (CNA), after getting approval from regulators

in the U.S. and Japan.

Tokio Marine, which first obtained a 40% stake in First

Insurance in 1989 and boosted its ownership to 50% ten years later,

said its brand and underwriting capacity will help the Tokyo firm

boost its profitability and market share in the U.S.

First Insurance Company of Hawaii Ltd. is the second largest

nonlife insurer by net premium revenue in Hawaii. Last year, the

U.S. firm secured net premium revenue of about $135 million.

Tokio Marine has already made significant overseas acquisitions,

buying U.K. insurer Kiln for about Y95 billion and U.S.

Philadelphia Consolidated Holding Co. for $4.7 billion in 2008.

The move underscores how the nation's life insurance companies

have been forced to look for growth opportunities abroad to offset

the headwinds of a shrinking Japan population and a sluggish

economy.

Rival property and casualty insurers have also been active in

making overseas acquisitions. Last year, MS&AD Insurance Group

Holdings Inc. (8725.TO) bought a 30% stake in Hong Leong Assurance

Bhd. in Malaysia for about Y27 billion and NKSJ Holdings (8630.TO)

acquired a majority stake in Turkey's Fiba Sigorta Anonim Sirketi

for Y27 billion.

Separately, Tokyo Marine reported Thursday a 2.2% drop in group

net profit in the April-June quarter in part due to weak revenue in

fire insurance business.

The company posted a group net profit of Y55.14 billion in the

quarter, down from Y56.41 billion in the same period a year

earlier.

For the current fiscal year ending March, the nonlife insurer

left its group net profit forecast unchanged at Y145 billion on

revenue of Y3.35 trillion.

Tokio Marine bases its earnings on Japanese accounting

standards.

-By Atsuko Fukase, Dow Jones Newswires; 813-6269-2792;

atsuko.fukase@dowjones.com

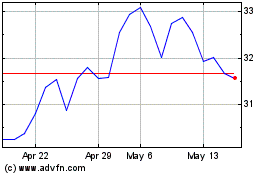

Tokio Marine (PK) (USOTC:TKOMY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tokio Marine (PK) (USOTC:TKOMY)

Historical Stock Chart

From Jul 2023 to Jul 2024