Telenor Gets Favorable Court of Appeal Ruling in Unitech Wireless Tax Case

June 12 2023 - 2:35AM

Dow Jones News

By Dominic Chopping

Telenor said Monday that the Court of Appeal has for the main

part decided in the company's favor in a tax case concerning losses

under guarantees for financing in its Indian subsidiary Unitech

Wireless.

Telenor deducted the loss in its tax return for 2013 but the

Norwegian tax office disallowed the deduction and a tax expense of

2.49 billion Norwegian kroner ($231.5 million) and interest of

NOK166 million were recognized in its accounts and paid in

2019.

After an unsuccessful appeal to the tax authorities, Telenor

appealed the ruling to the Oslo District Court, which ruled in

favor of Telenor and allowed deduction for the losses which saw

Telenor reverse the tax and interest expense in its 2022

accounts.

The government appealed the district court ruling but the Court

of Appeal has ruled in favor of Telenor, but with the timing for

recognition of the loss changed from 2013 to 2015, meaning the tax

deduction will be slightly reduced due to the timing difference and

declining tax rates.

Both the Norwegian government and Telenor have a right to appeal

the ruling and the authorities aren't obliged to repay the tax and

interest before there is a final enforceable ruling from the

courts, Telenor said.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

June 12, 2023 02:20 ET (06:20 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

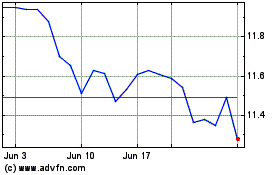

Telenor ASA (QX) (USOTC:TELNY)

Historical Stock Chart

From Oct 2024 to Nov 2024

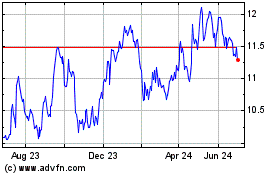

Telenor ASA (QX) (USOTC:TELNY)

Historical Stock Chart

From Nov 2023 to Nov 2024