Swire Pacific Prices $500 Million 10-Year 4.50% Bond At 99.021

February 21 2012 - 9:54AM

Dow Jones News

Swire Pacific Ltd. (0019.HK) has priced its $500 million,

10-year at 260 basis points over comparable Treasurys, according to

a term sheet seen by Dow Jones Newswires Tuesday.

HSBC and JP Morgan were joint bookrunners on the planned

bond.

The terms of the transaction are as follows.

Amount: $500 million

Maturity: Feb. 28, 2022

Coupon: 4.50%

Reoffer Price: 99.021

Payment Date: Feb. 28, 2012

Spread: 260 basis points over comparable Treasurys

Debt Ratings: A3 (Moody's)

A- (Standard & Poor's)

A (Fitch)

Denominations: $1,000

Listing: HKSE

-By Sarka Halas, Dow Jones Newswires; +44 (0)207 842 9236;

Sarka.Halasova@dowjones.com

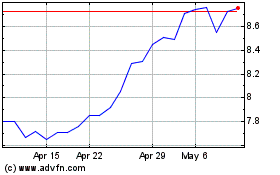

Swire Pacific (PK) (USOTC:SWRAY)

Historical Stock Chart

From May 2024 to Jun 2024

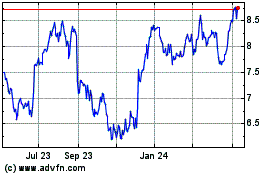

Swire Pacific (PK) (USOTC:SWRAY)

Historical Stock Chart

From Jun 2023 to Jun 2024