2nd UPDATE: Cathay Pacific's Net Soars; Orders Widebody Jets

August 04 2010 - 7:00AM

Dow Jones News

Cathay Pacific Airways Ltd. (0293.HK) on Wednesday reported

record first-half earnings thanks to a strong recovery in demand

for its passenger and cargo services, and in a show of confidence

in the region's aviation market the company said it has placed a

multi-billion-dollar order for new widebody planes.

The Hong Kong-based airline said its capacity and services are

now close to where they were before the global financial crisis

started, and it is upbeat about its performance for the rest of the

year.

"If present trends continue, we expect our financial results to

continue to be strong in the second half of 2010," Cathay Pacific

Chairman Christopher Pratt said in a statement.

Cathay Pacific, which is controlled by conglomerate Swire

Pacific Ltd. (0019.HK), said its net profit for the six months

ended June 30 was HK$6.84 billion (US$877 million), a more than

eight-fold jump from HK$812 million a year earlier, when the global

aviation industry was hit hard by the global downturn.

The results included HK$2.17 billion worth of gains from the

sale of stakes in sister company Hong Kong Aircraft Engineering Co.

(0044.HK) and Hong Kong Air Cargo Terminals Ltd.

Revenue rose 34% to HK$41.34 billion from HK$30.92 billion. The

airline recommended a first-half dividend of HK$0.33. It didn't

recommend a first-half dividend last year.

Cathay Pacific's first-half earnings were much higher than the

average HK$4.24 billion forecast of seven analysts, mainly because

most of the analysts had expected the company to book the proceeds

from its Haeco sale in the second half. Even excluding those

proceeds, however, Cathay Pacific's results were above the average

forecast.

"The robust rebound in earnings shows that a recovery of the

industry is in place, supported not only by strong cargo demand but

a gradual comeback of premium passenger air services," said Kelvin

Lau, an analyst at Daiwa Capital Markets.

Cathay Pacific's Hong Kong shares rose 3.9% Wednesday to

HK$18.08, a two-and-a-half-year closing high, after the results

were issued during the market's midday trading break. The airline's

shares have surged nearly 25% since the start of 2010,

outperforming a 1.5% fall in the benchmark Hang Seng Index.

Jim Wong, an analyst at Nomura, said he is reviewing his

full-year earnings forecast for the airline following its

first-half figures. "I expect more earnings upgrades ahead to fuel

further buying interest," said Wong.

The financial crisis that began in late 2008 led to a sharp fall

in global export volumes and air passenger travel demand. Reacting

to the dramatic downturn in the industry, Cathay Pacific reduced

its passenger capacity by 3.7% and its cargo capacity by 13.1% in

2009.

However, its cargo and passenger business has improved markedly

since the last quarter of 2009 and Cathay's cargo traffic is now

back to its pre-crisis levels, while demand for the airline's

first- and business-class services, though not yet back to where

they were in 2008, have rebounded significantly. As such, Cathay

Pacific and its China-focused unit, Hong Kong Dragon Airlines Ltd.,

have been restoring their cut capacity.

During the first half of this year, the airline carried 12.95

million passengers, 8.5% more than a year earlier. The total cargo

it carried rose 24.4% to 871,585 metric tons.

Cathay Pacific's passenger yields--a key measure of airline

profitability calculated by dividing the airline's total revenue by

revenue passenger kilometers--rose 17.5% in the first half to 58.4

HK cents from 49.7 HK cents, reflecting higher average prices.

In a separate statement Wednesday, Cathay Pacific said it signed

a letter of intent with Airbus to buy 30 A350-900 aircraft as part

of its expansion plans. Though the planes have a list price of

US$7.82 billion, the actual purchase price will be lower, the

airline said.

Still, the order, if confirmed, will be the airline's biggest

since 2005.

Cathay Pacific said the first Airbus A350 aircraft, which will

join in 2016 at the earliest, will replace ageing Boeing 747-400

and Airbus A340 planes.

The airline said it also plans to exercise purchase rights for

six Boeing 777-300ERs from Boeing Co. (BA). Those aircraft have a

catalog price of around US$1.61 billion, it said.

"We believe that the combination of the B777-300ER and the

A350-900 aircraft makes for the best possible performance in our

existing network," Chief Executive Tony Tyler told reporters at a

news conference.

-By Joanne Chiu and Jeffrey Ng, Dow Jones Newswires;

852-2802-7002; joanne.chiu@dowjones.com

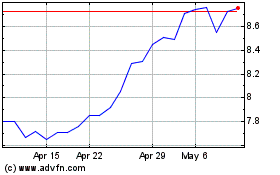

Swire Pacific (PK) (USOTC:SWRAY)

Historical Stock Chart

From May 2024 to Jun 2024

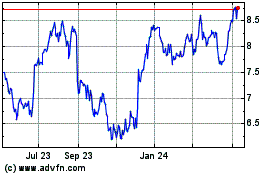

Swire Pacific (PK) (USOTC:SWRAY)

Historical Stock Chart

From Jun 2023 to Jun 2024