SSE Raises Medium-Term Earnings Growth Guidance; Shares Jump -- Update

May 25 2022 - 3:37AM

Dow Jones News

By Jaime Llinares Taboada

Shares in SSE PLC climbed Wednesday in early trading after it

raised earnings growth guidance for the five years to March 2026,

reported higher profits for fiscal 2022 and said that they will

grow further this year.

The U.K. energy group now expects to deliver an adjusted

earnings per share compound annual growth rate of between 7% and

10% in that five-year period, up from previous forecasts of 5%-7%.

SSE said that this is based on its strong performance in fiscal

2022, higher inflation forecasts, higher and volatile energy

commodity prices and increased value creation potential for its

thermal, hydro and gas storage assets.

The new EPS guidance is a clear positive and should be well

received by investors, RBC Captial Markets analyst John Musk

said.

Shares at 0702 GMT were up 5.2% at 1,858 pence.

In addition, the FTSE 100 company reported a pretax profit of

3.48 billion pounds ($4.36 billion) in the year ended March 31, up

from GBP2.42 billion a year earlier.

Adjusted EPS rose 22% to 95.4 pence, within the company's

guidance range of between 92 pence and 97 pence.

Increased profitability was mainly driven by higher regulated

revenues for SSE's transmission networks and higher prices for the

power generated at its thermal plants.

Moreover, SSE forecast adjusted EPS of at least 120 pence for

fiscal 2023. Capital expenditure and investment is expected to

total more than GBP2.5 billion, which would be up from a record of

GBP2.1 billion in fiscal 2022.

The company said that it has started a sales process for a 25%

share of its SSEN Transmission business which is expected to

formally start in the summer. A decision on the timing of the sale

of a similar stake in SSEN Distribution will be made later in the

year. These disposals are meant to fund growth in the renewables

business.

"We are delivering major projects, building pipelines, and have

made inroads in Southern Europe and Japan as we export our

renewables capabilities internationally to fulfill SSE's

considerable potential," Chief Executive Alistair Phillips-Davies

said.

The group declared a final dividend of 60.2 pence a share,

bringing the full-year payment to 85.7 pence, up from 81.0 pence in

fiscal 2021. SSE's dividend is linked to inflation but will be cut

in fiscal 2024.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

May 25, 2022 03:22 ET (07:22 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

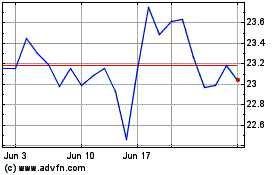

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Jun 2024 to Jul 2024

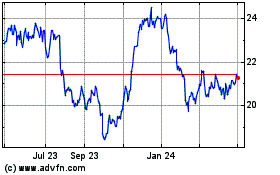

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Jul 2023 to Jul 2024